Prepare a spreadsheet to support a cash flow statement of H Company for the year 2016.

Explanation of Solution

Statement of cash flows: Cash flow statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities.

Worksheet: A worksheet is a spreadsheet used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

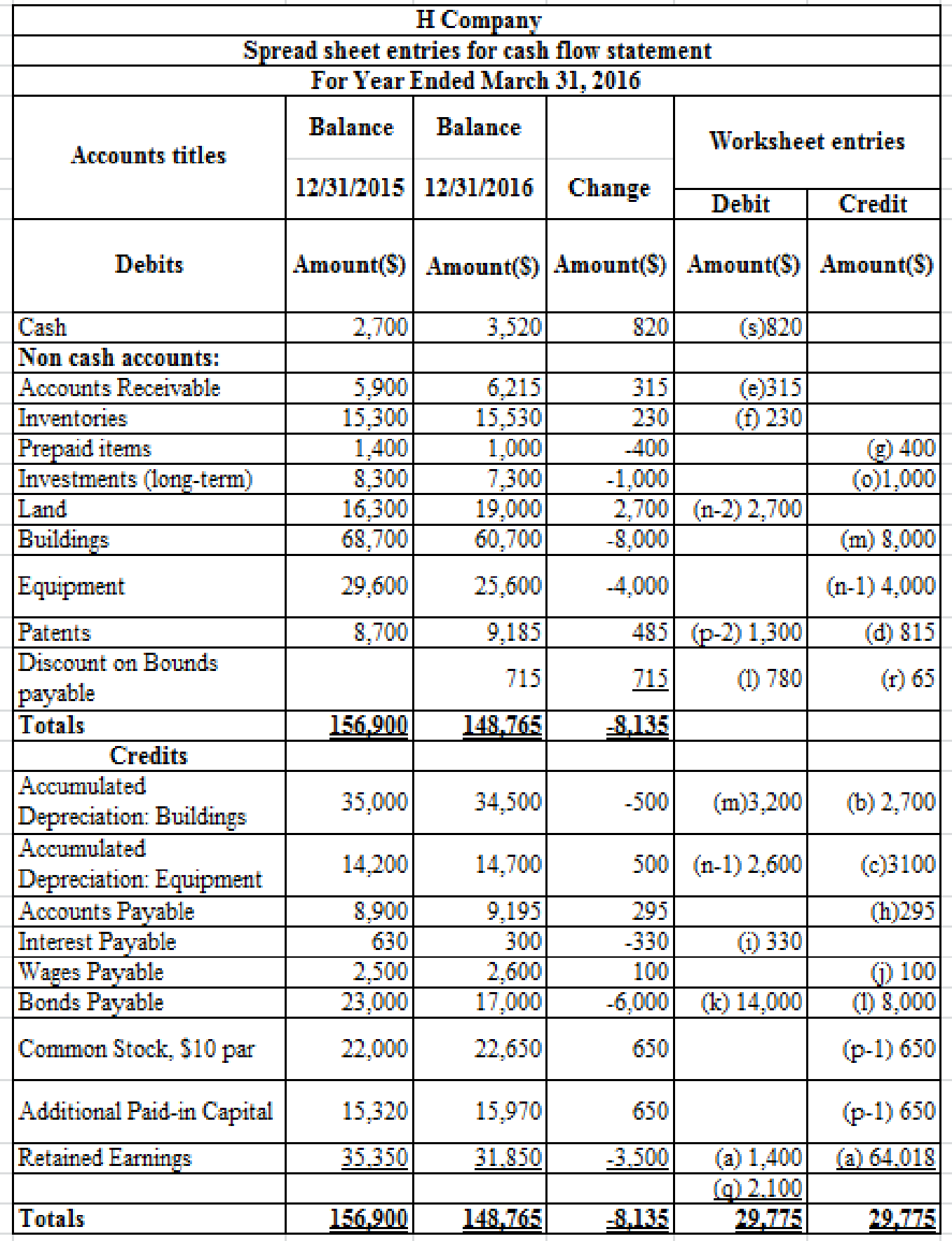

Prepare a spreadsheet to support the statement of cash flows.

Table (1)

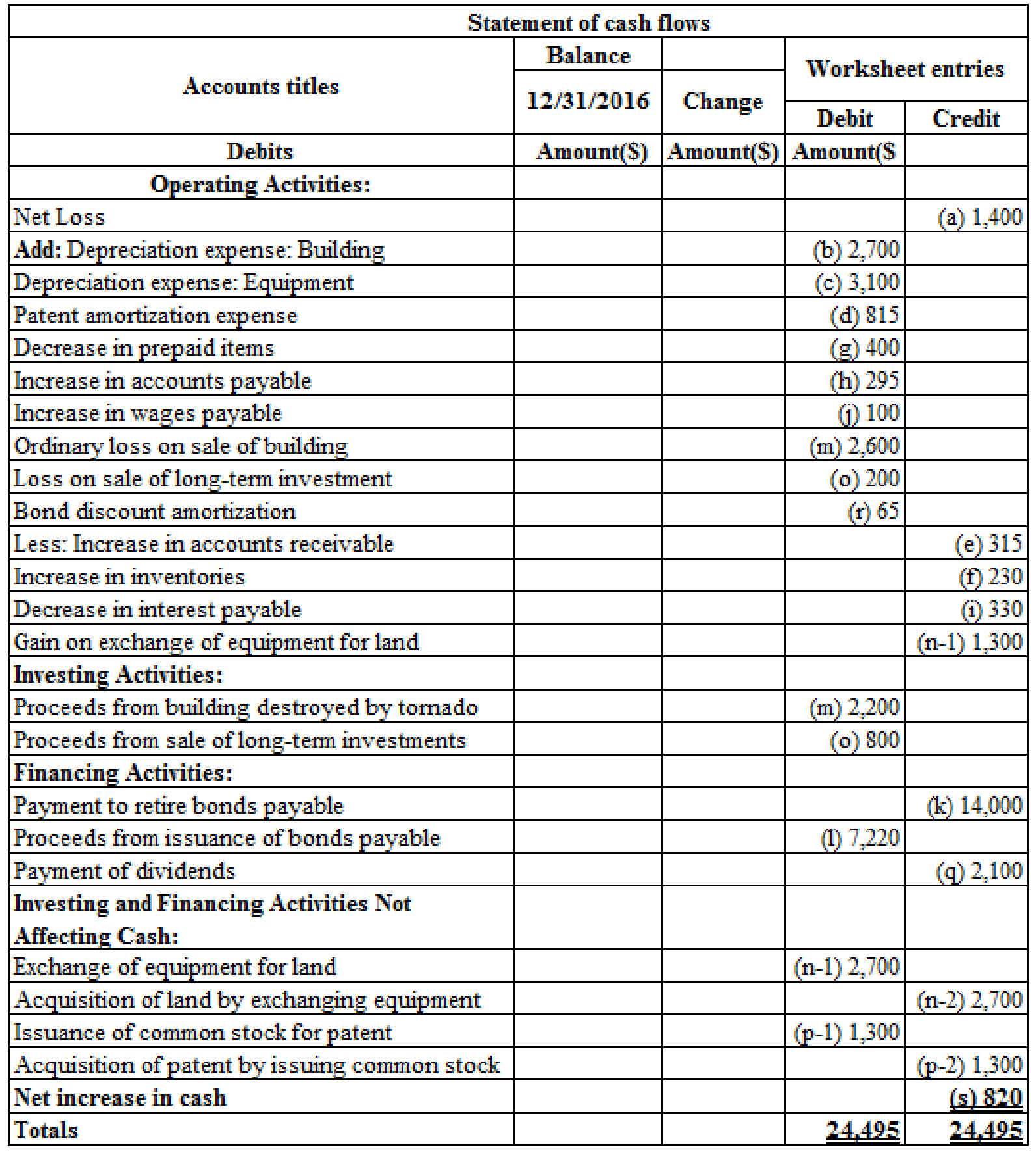

A statement of cash flows of H Company for the year 2016:

Table (2)

Working notes:

- (a) Calculate the net loss.

| Particulars | Amount($) | Amount($) |

| Revenues : | ||

| Sales | 49,550 | |

| Interest revenue | 790 | |

| Gain on exchange of assets | 1,300 | |

| Total revenue | 51,640 | |

| Expenses: | ||

| Cost of goods sold | 23,800 | |

| Wages expense | 16,510 | |

| Other operating expenses | 1,100 | |

| 2,700 | ||

| Depreciation expense: equipment | 3,100 | |

| Patent amortization | 815 | |

| Interest expense | 1,715 | |

| Loss on sale of investments | 200 | |

| Loss on sale of building | (2,600) | |

| Income tax expense | 500 | |

| Total expenses | (53,040) | |

| Net Loss | (1,400) |

Table (2)

Note: The $31,850 ending

(e) Calculate the increase in

(f) Calculate the increase in inventories.

(g) Calculate the decrease in prepaid items.

(h) Calculate the increase in accounts payable.

- (i) Calculate the decrease in interest payable.

- (j) Calculate the increase in wages payable.

- (l) Proceeds from issuance of bonds payable.

- (m) Students may have difficulty with the extraordinary loss transaction. This may be shown in journal entry form as follows:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Proceeds from sale of building | 2,200 | ||

| Accumulated Depreciation | 3,200 | ||

| Ordinary Loss(net) | 2,600 | ||

| Buildings | 8000 | ||

| (To record the sale of building) |

Table (3)

(n-1) Calculate the exchange of equipment for land.

(o)Calculate the proceeds from sale of long-term investment.

(p-1) Calculate the issuance of common stock for patent.

(p-2) Acquisition of patent by issuing common stock is $1,300,

(r) Calculate the bond discount amortization.

(s) Calculate net increase in cash.

Therefore, the net increase in cash is $820.

Want to see more full solutions like this?

Chapter 21 Solutions

Intermediate Accounting: Reporting and Analysis

- Spreadsheet from Trial Balance Heinz Companys post closing trial balance as of December 31, 2018, and the adjusted trial balance as of December 31, 2019, are shown here: A review of the accounting records reveals the following additional information: a. Bomb payable with a face value, book value, and market value of 14,000 were retired on June 30, 2019. b. Bonds payable with a face value of 8,000 were issued at 90.25 on August 1, 2019. They mature on August 1, 2024. The company uses the straight-line method to amortize the bond discount. c. The company sold a building that had an original cost of 8,000 and a book value of 4,800. The company received 2,200 in cash for the building and recorded a loss of 2,600. d. Equipment with a cost of 4,000 and a book value of 1,400 was exchanged for an acre of land valued at 2,700. No cash was exchanged. e. Long-term investments in bonds being held to maturity with a cost of 1,000 were sold for 800. f. Sixty-five shares of common stock were exchanged for a patent. The common stock was selling for 20 per share at the time of the exchange. Required: Prepare a spreadsheet to support a statement of cash flows for 2019.arrow_forwardReal-world annual report The financial statements for Nike, Inc. (NKE), are presented in Appendix E at the end of the text. The following additional information is available (in thousands): Instructions 1. Determine the following measures for the fiscal years ended May 31, 2017, and May 31, 2016. Round ratios and percentages to one decimal place. a. Working capital b. Current ratio c. Quick ratio d. Accounts receivable turnover e. Number of days sales in receivables f. Inventory turnover g. Number of days sales in inventory' h. Ratio of liabilities to stockholders equity i. Asset turnover j. Return on total assets, assuming interest expense is 82 million for the year ending May 31. 2017, and 33 million for the year ending May 31, 2016. k. k. Return on common stockholders equity l. Price-eamings ratio, assuming that the market price was 52.81 per share on May 31, 2017, and 54.35 per share on May 31, 2016. m. m. Percentage relationship of net income to sales 2. What conclusions can be drawn from these analyses?arrow_forwardMillennium Associates records bad debt using the allowance, income statement method. They recorded $299,420 in accounts receivable for the year, and $773,270 in credit sales. The uncollectible percentage is 3.2%. On February 5, Millennium Associates identifies one uncollectible account from Molar Corp in the amount of $1,330. On April 15, Molar Corp unexpectedly pays its account in full. Record journal entries for the following. A. Year-end adjusting entry for 2017 bad debt B. February 5, 2018 identification entry C. Entry for payment on April 15, 2018arrow_forward

- Adjusting Entries Kretz Corporation prepares monthly financial statements and therefore adjusts its accounts at the end of every month. The following information is available for March 2016: Kretz Corporation takes out a 90-day, 8%, $15,000 note on March 1, 2016, with interest and principal to be paid at maturity. The asset account Office Supplies on Hand has a balance of $1,280 on March 1, 2016. During March, Kretz adds $750 to the account for purchases during the period. A count of the supplies on hand at the end of March indicates a balance of $1,370. The company purchased office equipment last year for $62,600. The equipment has an estimated useful life of six years and an estimated salvage value of $5,000. The companys plant operates seven days per week with a daily payroll of $950. Wage earners are paid every Sunday. The last day of the month is Thursday, March 31. The company rented an idle warehouse to a neighboring business on February 1, 2016, at a rate of $2,500 per month. On this date, Kretz Corporation credited Rent Collected in Advance for six months rent received in advance. On March 1, 2016, Kretz Corporation credited a liability account, Customer Deposits, for $4,800. This sum represents an amount that a customer paid in advance and that Kretz will earn evenly over a four-month period. Based on its income for the month, Kretz Corporation estimates that federal income taxes for March amount to $3,900. Required For each of the preceding situations, prepare in general journal form the appropriate adjusting entry to be recorded on March 31, 2016.arrow_forwardComprehensive: Income Statement and Supporting Schedules The following s a partial list of the account balances, after adjustments, of Silvoso Company on December 31, 2019: The following information is also available: 1. The company declared and paid a 0.60 per share cash dividend on its common stock. The stock was outstanding the entire year. 2. A physical count determined that the December 31, 2019, ending inventory is 34,100. 3. A tornado destroyed a warehouse, resulting in a pretax loss of 12,000. The last tornado in this area had occurred 10 years earlier. 4. On May 1, 2019, the company sold an unprofitable division (R). From January through April, Division R (a major component of the company) had incurred a pretax operating loss of 8,700. Division R was sold at a pretax gain of 10,000. 5. The company is subject to a 30% income tax rate. Its income tax expense for 2019 totals 4,230. The breakdown is as follows: 6. The company had average shareholders equity of 150,000 during 2019. Required: 1. As supporting documents for Requirement 2, prepare separate supporting schedules for cost of goods sold, selling expenses, general and administrative expenses, and depreciation expense. 2. Prepare a 2019 multiple-step income statement for Silvoso. Include any related note to the financial statements. 3. Prepare a 2019 retained earnings statement. 4. Next Level What was Silvosos return on common equity for 2019? What is your evaluation of Silvosos return on common equity if last year it was 10%?arrow_forwardMillennium Associates records bad debt using the allowance, balance sheet method. They recorded $299,420 in accounts receivable for the year, and $773,270 in credit sales. The uncollectible percentage is 3.2%. On November 22, Millennium Associates identifies one uncollectible account from Angels Hardware in the amount of $3,650. On December 18, Angels Hardware unexpectedly pays its account in full. Record journal entries for the following. A. Year-end adjusting entry for 2017 bad debt B. November 22, 2018 identification entry C. Entry for payment on December 18, 2018arrow_forward

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: Note: Round answers to two decimal places. 1. Calculate the times-interest-earned ratio. 2. Calculate the debt ratio. 3. Calculate the debt-to-equity ratio.arrow_forwardReading 3M Companys Balance Sheet: Accounts Receivable The following current asset appears on the balance sheet in 3M Companys Form 10-K for the year ended December 31, 2013 (amounts in millions of dollars): Required What is the balance in 3M Companys Allowance for Doubtful Accounts at the end of 2013 and 2012? What is the net realizable value of 3M Companys accounts receivable at the end of each of these two years? What caused increases in the allowance account during 2013? What caused decreases? Explain what a net decrease in the account for the year means.arrow_forwardSaverin, Inc. produces and sells outdoor equipment. On July 1, 2016, Saverin, Inc. issued 62,500,000 of 10-year, 9% bonds at a market (effective) interest rate of 8%, receiving cash of 66,747,178. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Instructions 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds. 2. Journalize the entries to record the following: a. The first semiannual interest payment on December 31, 2016, and the amortization of the bond premium, using the interest method. (Round to the nearest dollar.) b. The interest payment on June 30, 2017, and the amortization of the bond premium, using the interest method. (Round to the nearest dollar.) 3. Determine the total interest expense for 2016.arrow_forward

- Allowance Method for Accounting for Bad Debts At the beginning of 2016, EZ Tech Companys Accounts Receivable balance was $140,000, and the balance in Allowance for Doubtful Accounts was $2,350 (Cr.). EZ Techs sales in 2016 were $1,050,000, 80% of which were on credit. Collections on account during the year were $670,000. The company wrote off $4,000 of uncollectible accounts during the year. Required Prepare summary journal entries related to the sale, collections, and write-offs of accounts receivable during 2016. Prepare journal entries to recognize bad debts assuming that (a) bad debts expense is 3% of credit sales and (b) amounts expected to be uncollectible are 6% of the year-end accounts receivable. What is the net realizable value of accounts receivable on December 31, 2016, under each assumption in part (2)? What effect does the recognition of bad debts expense have on the net realizable value? What effect does the write-off of accounts have on the net realizable value?arrow_forwardClick the Chart sheet tab. The stacked bar chart shows Chens equity account balances at December 31, 2013. Match the stacked bars (AG) that best describe what will happen to the equity accounts if the following transactions and events occur in 2014. Letters may be repeated or not used. Consider each case independently. When the assignment is complete, close the file without saving it again. TICKLERS (optional) Worksheet. Suppose that the 54,000 Additional paid-in capital balance at December 31, 2011, comes from two ledger accounts: 42,000 from Paid-in capital in excess of par and 12,000 from Paid-in capital from treasury stock transactions. Revise the STOCKEQ2 worksheet to show a column for each of these accounts instead of the single column for Additional paid-in capital. Then redo the 2012 transactions using the new columns. Preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Save the file as STOCKEQT. Chart. Using the STOCKEQ4 file, prepare a column chart showing the dollar amount of each of the stockholders equity account balances at December 31, 2013. Treasury stock can be shown as a negative value. Enter your name somewhere on the chart. Save the file again as STOCKEQ4. Print the chart.arrow_forwardClosing Entries for Nordstrom The following accounts appear on Nordstroms 2013 financial statements as reported in its Form 10-K for the fiscal year ended February 1, 2014. The accounts are listed in alphabetical order, and the balance in each account is the normal balance for that account. All amounts are in millions of dollars. Prepare closing entries for Nordstrom for 2013.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,