Transfer pricing, perfect and imperfect markets. Letang Company has three divisions (R, S, and T), organized as decentralized profit centers. Division R produces the basic chemical Ranbax, in multiples of 1,000 pounds, and transfers it to divisions S and T. Division S processes Ranbax into the final product Syntex, and division T processes Ranbax into the final product Termix. No material is lost during processing.

Division R has no fixed costs. The variable cost per pound of Ranbax is $0.18. Division R has a capacity limit of 10,000 pounds. Divisions S and T have capacity limits of 4,000 and 6,000 pounds, respectively. Divisions S and T sell their final product in separate markets. The company keeps no inventories of any kind.

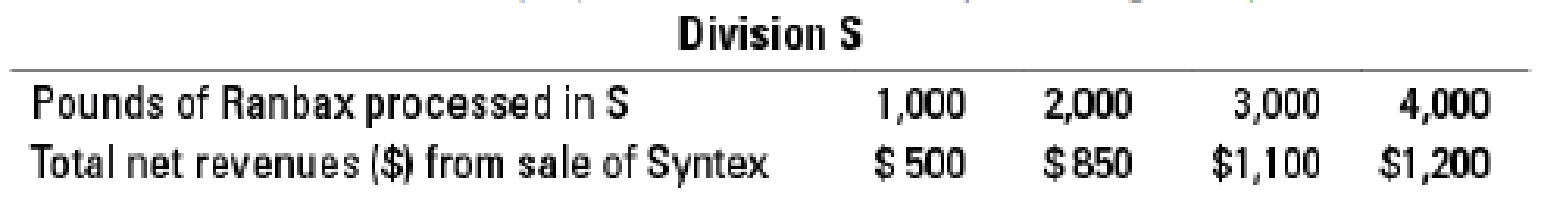

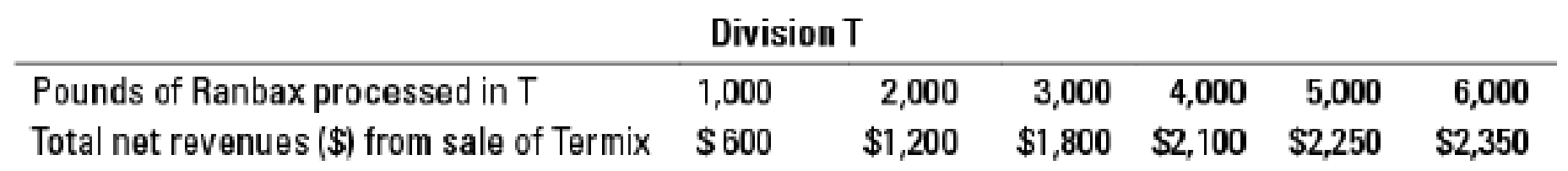

The cumulative net revenues (i.e., total revenues – total

- A. Suppose there is no external market for Ranbax. What quantity of Ranbax should the Letang Company produce to maximize overall income? How should this quantity be allocated between the two processing divisions?

- B. What range of transfer prices will motivate divisions S and T to demand the quantities that maximize overall income (as determined in requirement 1), as well as motivate division R to produce the sum of those quantities?

- C. Suppose that division R can sell any quantity of Ranbax in a

perfectly competitive market for $0.33 a pound. To maximize Letang’s income, how many pounds of Ranbax should division R transfer to divisions S and T, and how much should it sell in the external market? - D. What range of transfer prices will result in divisions R, S, and T taking the actions determined as optimal in requirement 3? Explain your answer.

Want to see the full answer?

Check out a sample textbook solution

Chapter 22 Solutions

EBK HORNGREN'S COST ACCOUNTING

- Morrisons Plastics Division, a profit center, sells its products to external customers as well as to other internal profit centers. Which one of the following circumstances would justify the Plastics Division selling a product internally to another profit center at a price that is below the market-based transfer price? a. The buying unit has excess capacity. b. The selling unit is operating at full capacity. c. Routine sales commissions and collection costs would be avoided. d. The profit centers managers are evaluated on the basis of unit operating income.arrow_forwardPerfumesLtd has two divisions: the Perfume Division and the Bottle Division. The company is decentralised and each division is evaluated as a profit centre. The Bottle Division produces bottles that can be used by the Perfume Division. The Bottle Division's variable manufacturing cost per unit is $3.00 and shipping costs are $0.20 per unit. The Bottle Division's external sales price is $4.00 per unit. No shipping costs are incurred on sales to the Perfume Division. The Perfume Division can purchase similar bottles in the external market for $3.50.The Bottle Division has sufficient capacity to meet all external market demands in addition to meeting the demands of the Perfume Division. Required: a) Using the general rule, determine the minimum transfer price. b) Assume the Bottle Division has no excess capacity and can sell everything produced externally. Would the transfer price change? c) Assume the Bottle Division has no excess capacity and can sell everything produced externally.…arrow_forwardScottsdale Manufacturing is organized into two divisions: Fabrication and Assembly. Components transferred between the two divisions are recorded at a predetermined transfer price. Standard variable manufacturing cost per unit in the Fabrication Division is $350. At the present time, this division is working to capacity. Fabrication estimates that the units it produces could be sold on the external market for $580. The product under consideration is viewed as a commodity-type product, with no differentiating features or characteristics. Required: 2. Based on the general transfer pricing rule presented in the chapter, what is the minimum transfer price between units when the Fabrication Division is working to capacity? 3. What if the Fabrication Division had excess capacity? How would this change the minimum transfer price as determined by the application of the general transfer pricing rule?arrow_forward

- Cable Network System Bhd (CNS) is a supplier of equipment to telecommunication companies such as Maxis, Celcom and Astro. It has two division, Component Division and the Equipment Division. CNS adopts a decentralized management system where managers are essentially free to determine whether goods will be transferred internally and what would be the internal transfer prices. CNS policy is that for all internal transfers between divisions, the transfer price be expressed on a full cost basis. The markup in the full cost arrangement is left to the discretion of divisional managers. The managers of the two division held a meeting to discuss on the pricing arrangement for a mini- antennae produced by the component division. Production of the mini-antennae is currently at full capacity. The Component Division can sell the mini-antennae for RM 46.50 to outside customers. The Equipment Division can also buy the mini-antennae from external sources for the same price. The manager of the…arrow_forwardScottsdale Manufacturing is organized into two divisions: Fabrication and Assembly. Components transferred between the two divisions are recorded at a predetermined transfer price. Standard variable manufacturing cost per unit in the Fabrication Division is $390. At the present time, this division is working to capacity. Fabrication estimates that the units it produces could be sold on the external market for $635. The product under consideration is viewed as a commodity-type product, with no differentiating features or characteristics. Required: 2. Based on the general transfer pricing rule presented in the chapter, what is the minimum transfer price between units when the Fabrication Division is working to capacity? 3. What if the Fabrication Division had excess capacity? How would this change the minimum transfer price as determined by the application of the general transfer pricing rule? 2. Transfer price (full capacity) 3. Transfer price (excess capacity)arrow_forwardThe Sheridan Company is a multidivisional company. Its managers have full responsibility for profits and complete autonomy to accept or reject transfers from other divisions. Division A produces a sub-assembly part for which there is a competitive market. Division B currently uses this sub-assembly for a final product that is sold outside at $1,368. Division A charges Division B the market price of $798 per unit of the part. Unit variable costs are $594 and $684 for Divisions A and B, respectively. The manager of Division B feels that Division A should transfer the part at a lower price than market because at market, Division B is unable to make a profit. (a) Your answer is correct. Calculate Division B's contribution margin if transfers are made at the market price, and calculate the company's total contribution margin. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) (b) (c) Division B's contribution margin $ Company's…arrow_forward

- Peter Division is part of the Fabric Gallery Group. It produces a basic fabric that is then converted in other divisions within the group. The fabric is also produced in other divisions within the Group and a limited quantity can be purchased from outside the group. The fabric is currently charged out by Peter Division at total cost plus 20 per cent profit mark-up.Discuss why the current transfer pricing method used by Peter Division is inappropriate.arrow_forwarderfumes Ltd has two divisions: the Perfume Division and the Bottle Division. The company is decentralised and each division is evaluated as a profit centre. The Bottle Division produces bottles that can be used by the Perfume Division. The Bottle Division's variable manufacturing cost per unit is $3.00 and shipping costs are $0.20 per unit. The Bottle Division's external sales price is $4.00 per unit. No shipping costs are incurred on sales to the Perfume Division. The Perfume Division can purchase similar bottles in the external market for $3.50. The Bottle Division has sufficient capacity to meet all external market demands in addition to meeting the demands of the Perfume Division. Required: a) Using the general rule, determine the minimum transfer price. b) Assume the Bottle Division has no excess capacity and can sell everything produced externally. Would the transfer price change? c) Assume the Bottle Division has no excess capacity and can sell everything produced externally.…arrow_forwardIllinois Metallurgy Corporation has two divisions. The Fabrication Division transfers partially completed components to the Assembly Division at a predetermined transfer price. The Fabrication Division’s standard variable production cost per unit is $300. The division has no excess capacity, and itcould sell all of its components to outside buyers at $380 per unit in a perfectly competitive market. Required:1. Determine a transfer price using the general rule.2. How would the transfer price change if the Fabrication Division had excess capacity?arrow_forward

- Effect of alternative transfer-pricing methods on division operating income. Cran Health Products is a cranberry cooperative that operates two divisions, a harvesting division and a processing division. Currently, all of harvesting’soutput is converted into cranberry juice by the processing division, and the juice is sold to large beverage companies that produce cranberry juice blends. The processing division has a yield of 500 gallons of juice per 1,000 pounds of cranberries. Cost and market price data for the two divisions are as follows:arrow_forwardThe Harris Company is decentralized, and divisions are considered investment centers. Harris has one division that manufactures oak dining room chairs with upholstered seat cushions. The Chair Division cuts, assembles, and finishes the oak chairs and then purchases and attaches the seat cushions. requirements 2. Assume the Chair Division purchases the 800 cushions needed from the Cushion Division at its current sales price. What is the total contribution margin for each division and the company? 3. Assume the Chair Division purchases the 800 cushions needed from the Cushion Division at its current variable cost. What is the total contribution margin for each division and the company? 5. Assume the Cushion Division has capacity of 1,600 cushions per quarter and can continue to supply its outside customers with 800 cushions per quarter and also supply the Chair Division with 800 cushions per quarter. What transfer price should Harris Company set? Explain your reasoning. Using the…arrow_forwardVaughn treats its divisions as profit centers and allows division managers to choose whether to sell or to buy from internal division. Corporate policy requires that all interdivisional sales and purchases be transferred at variable cost. Gamma Division of Vaughn Corp. produces electric motors. This product is currently sold to outside customers but is needed by Omega, another division of Vaughn. Gamma Division's estimated sales and standard cost data for the year ended December 31, based on practical capacity of 60,000 units are as follows: P 7,200,000 3, 300,000 P 3,900,000 1,075,000 P 2,825,000 Sales Less: Variables Cost Contribution Margin Fixed Cost Operating Income Gamma has an opportunity to sell 12,000 units to Omega. Omega can purchase the units it needs from outside supplier for P92 each. Required: Assuming that Gamma can normally sell 57,000 units to outsider customers 1. compute for the minimum transfer price acceptable to Gamma. 2. Compute for the maximum transfer price.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,