College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666160

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 25, Problem 1SEA

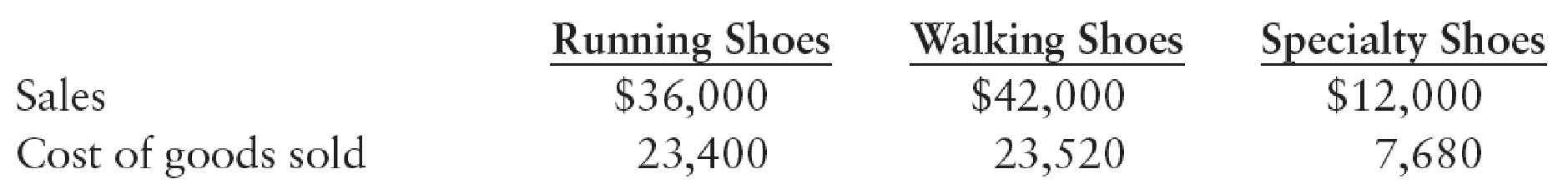

GROSS PROFIT SECTION OF DE PART MENT AL INCO ME ST ATE MENT Bill Walters and Alice Jennings are partners in a business called Walters and Jennings Sportswear that sells athletic footwear. They have organized the business on a departmental basis as follows: running shoes, walking shoes, and specialty shoes. At the end of the first year of operation, the sales and cost of goods sold for the three departments are as follows:

Prepare the gross profit section of a departmental income statement for the year ended December 31, 20--. Show the gross profit for each department and for the business in total.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Profit Center Responsibility Reporting

Glades Sporting Goods Co. operates two divisions—the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 20Y8, the end of the fiscal year, after all adjustments, including those for inventories, were recorded and posted:

Sales—Winter Sports Division

$31,920,000

Sales—Summer Sports Division

35,264,000

Cost of Goods Sold—Winter Sports Division

19,152,000

Cost of Goods Sold—Summer Sports Division

20,368,000

Sales Expense—Winter Sports Division

5,472,000

Sales Expense—Summer Sports Division

4,864,000

Administrative Expense—Winter Sports Division

3,192,000

Administrative Expense—Summer Sports Division

3,131,200

Advertising Expense

1,025,000

Transportation Expense

400,400

Accounts Receivable Collection Expense

245,700

Warehouse Expense

3,040,000

The bases to be used in allocating expenses, together with other essential…

Profit Center Responsibility Reporting

Championship Sports Inc. operates two divisions—the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 20Y9, the end of the fiscal year, after all adjustments, including those for inventories, were recorded and posted:

Sales—Winter Sports Division

$8,900,000

Sales—Summer Sports Division

16,400,000

Cost of Goods Sold—Winter Sports Division

5,000,000

Cost of Goods Sold—Summer Sports Division

9,000,000

Sales Expense—Winter Sports Division

650,000

Sales Expense—Summer Sports Division

1,200,000

Administrative Expense—Winter Sports Division

800,000

Administrative Expense—Summer Sports Division

1,450,000

Advertising Expense

1,090,000

Transportation Expense

192,000

Accounts Receivable Collection Expense

68,000

Warehouse Expense

1,800,000

The bases to be used in allocating expenses, together with other information, are as…

Profit Center Responsibility Reporting

Glades Sporting Goods Co. operates two divisions—the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 20Y8, the end of the fiscal year, after all adjustments, including those for inventories, were recorded and posted:

Sales—Winter Sports Division

$12,600,000

Sales—Summer Sports Division

16,300,000

Cost of Goods Sold—Winter Sports Division

7,560,000

Cost of Goods Sold—Summer Sports Division

9,454,000

Sales Expense—Winter Sports Division

2,016,000

Sales Expense—Summer Sports Division

2,282,000

Administrative Expense—Winter Sports Division

1,260,000

Administrative Expense—Summer Sports Division

1,450,700

Advertising Expense

578,000

Transportation Expense

265,660

Accounts Receivable Collection Expense

174,000

Warehouse Expense

1,540,000

The bases to be used in allocating expenses, together with other essential…

Chapter 25 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

Ch. 25 - A department that incurs costs and generates...Ch. 25 - Departmental gross profit is the difference...Ch. 25 - Prob. 3TFCh. 25 - Direct expenses are operating expenses incurred...Ch. 25 - Departmental direct operating margin is the...Ch. 25 - Prob. 1MCCh. 25 - The difference between a departments net sales and...Ch. 25 - Prob. 3MCCh. 25 - The difference between a departments gross profit...Ch. 25 - The difference between a departments gross profit...

Ch. 25 - Prob. 1CECh. 25 - Prob. 2CECh. 25 - Prob. 3CECh. 25 - Prob. 1RQCh. 25 - Prob. 2RQCh. 25 - Prob. 3RQCh. 25 - Prob. 4RQCh. 25 - Prob. 5RQCh. 25 - Prob. 6RQCh. 25 - Prob. 7RQCh. 25 - Prob. 8RQCh. 25 - Distinguish between departmental gross profit,...Ch. 25 - Prob. 10RQCh. 25 - GROSS PROFIT SECTION OF DE PART MENT AL INCO ME ST...Ch. 25 - ALLOCATING OPERATING EXPENSESQUARE FEET Weaverling...Ch. 25 - ALLOCATING OPERATING EXPENSERELATIVE NET SALES...Ch. 25 - ALLOCATING OPERATING EXPENSEMILES DRIVEN Mercado...Ch. 25 - COMPUTING OPERATING INCOME The sales, cost of...Ch. 25 - Prob. 6SEACh. 25 - INCOME STATEMENT WITH DEPART MENTAL GROSS PROFIT...Ch. 25 - INCOME STATE MENT WITH DEPARTMENTAL OPERATING...Ch. 25 - INCOME STATEMENT WITH DEPART MENTAL DIRECT...Ch. 25 - Prob. 10SPACh. 25 - GROSS PROFIT SECTION OF DEPART MENTAL INCOME...Ch. 25 - Prob. 2SEBCh. 25 - ALLOCATING OPERATING EXPENSERELATIVE NET SALES...Ch. 25 - ALLOCATING OPERATING EXPENSEMILES DRIVEN Herbert...Ch. 25 - Prob. 5SEBCh. 25 - Prob. 6SEBCh. 25 - INCOME STATEMENT WITH DEPART MENTAL GROSS PROFIT...Ch. 25 - Prob. 8SPBCh. 25 - Prob. 9SPBCh. 25 - Prob. 10SPBCh. 25 - Prob. 1MYWCh. 25 - Prob. 1ECCh. 25 - MASTERY PROBLEM Bobs Acme Supermarket has been in...Ch. 25 - CHALLENGE PROBLEM This problem challenges you to...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- GROSS PROFIT SECTION OF DEPART MENTAL INCOME STATEMENT Nicole Lawrence and Josh Doyle are partners in a business that sells cheerleading uniforms. They have organized the business, called L and D Uniforms, on a departmental basis as follows: letters, sweaters, and skirts. At the end of the first year of operation, the sales and cost of goods sold for the three departments are as follows: Prepare the gross profit section of a departmental income statement for the year ended December 31, 20--. Show the gross profit for each department and for the business in total.arrow_forwardINCOME STATEMENT WITH DEPART MENTAL GROSS PROFIT AND OPERATING INCOME Bacon and Hand Distributors has divided its business into two departments: retail sales and wholesale sales. The following information is provided for the year ended December 31, 20--: REQUIRED 1. Prepare an income statement showing departmental gross profit and total operating income. 2. Calculate departmental gross profit percentages.arrow_forwardINCOME STATEMENT WITH DEPART MENTAL DIRECT OPERATING MARGIN AND TOTAL OPERATING INCOME Durwood Thomas operates the business Thomas Security that sells security equipment for commercial property and residential homes. The following information is provided for the year ended December 31, 20--: REQUIRED 1. Prepare an income statement showing departmental direct operating margin and total operating income. 2. Calculate departmental direct operating margin percentages.arrow_forward

- INCOME STATE MENT WITH DEPARTMENTAL OPERATING INCOME AND TOTAL OPERATING INCOME Alexa Cole owns a business called Alexas Bakery. She has divided her business into two departments: breads and pastries. The following information is provided for the fiscal year ended June 30, 20--: REQUIRED 1. Prepare an income statement showing departmental operating income and total operating income. 2. Calculate departmental operating expense and operating income percentages.arrow_forwardUse the following information for Exercises 2-47 through 2-49. Jasper Company provided the following information for last year: Last year, beginning and ending inventories of work in process and finished goods equaled zero. Exercise 2-49 Income Statement Refer to the information for Jasper Company on the previous page. Required: 1. Prepare an income statement for Jasper for last year. Calculate the percentage of sales for each line item on the income statement. (Note: Round percentages to the nearest tenth of a percent.) 2. CONCEPTUAL CONNECTION Briefly explain how a manager could use the income statement created for Requirement 1 to better control costs.arrow_forwardThe general merchandise retail industry has a number of segments represented by the following companies: For a recent year, the following cost of goods sold and beginning and ending inventories are provided from corporate annual reports (in millions) for these three companies: a. Determine the inventory turnover ratio for all three companies. Round all calculations to one decimal place. b. Determine the number of days sales in inventory for all three companies. Use 365 days and round all calculations to one decimal place. c. Interpret these results based on each companys merchandising concept.arrow_forward

- Salespersons report and analysis Pachec Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended June 30 are as follows: Instructions 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. 2. Which salesperson generated the highest contribution margin ratio for the year and why? 3. Briefly list factors other than contribution margin that should be considered in evaluating the performance of salespersons.arrow_forwardSalespersons report and analysis Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows: Instructions 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. (Round whole percent to one digit after decimal point.) 2. Which salesperson generated the highest contribution margin ratio for the year and why? 3. Briefly list factors other than contribution margin that should be considered in evaluating the performance of salespersons.arrow_forwardMASTERY PROBLEM Bobs Acme Supermarket has been in operation for many years, offering high-quality groceries, produce, and meat at reasonable prices. Accounting records are maintained on a departmental basis with assignment of direct expenses and allocation of indirect expenses through the use of various procedures. Selected operating information for the year ended December 31, 20--, is as follows: REQUIRED 1. (a) Prepare an income statement showing departmental operating income. (b) Compute the gross profit percentage and operating income percentage for each department (round to the nearest tenth of a percent). 2. (a) Prepare an income statement showing departmental and total direct operating margins. (b) Compute the departmental direct operating margin percentage for each department (round to the nearest tenth of a percent). 3. Should Bob be concerned about the profitability of the three departments? Should any of the departments be discontinued?arrow_forward

- Profit Center Responsibility Reporting Glades Sporting Goods Co. operates two divisions—the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 20Y8, the end of the fiscal year, after all adjustments, including those for inventories, were recorded and posted: Sales—Winter Sports Division $12,600,000 Sales—Summer Sports Division 16,300,000 Cost of Goods Sold—Winter Sports Division 7,560,000 Cost of Goods Sold—Summer Sports Division 9,454,000 Sales Expense—Winter Sports Division 2,016,000 Sales Expense—Summer Sports Division 2,282,000 Administrative Expense—Winter Sports Division 1,260,000 Administrative Expense—Summer Sports Division 1,450,700 Advertising Expense 578,000 Transportation Expense 265,660 Accounts Receivable Collection Expense 174,000 Warehouse Expense 1,540,000 The bases to be used in allocating expenses, together with other essential…arrow_forwardProfit Center Responsibility Reporting Glades Sporting Goods Co. operates two divisions—the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 20Y8, the end of the fiscal year, after all adjustments, including those for inventories, were recorded and posted: Sales—Winter Sports Division $24,255,000 Sales—Summer Sports Division 26,796,000 Cost of Goods Sold—Winter Sports Division 14,553,000 Cost of Goods Sold—Summer Sports Division 15,477,000 Sales Expense—Winter Sports Division 4,158,000 Sales Expense—Summer Sports Division 3,696,000 Administrative Expense—Winter Sports Division 2,425,500 Administrative Expense—Summer Sports Division 2,379,300 Advertising Expense 1,037,000 Transportation Expense 522,000 Accounts Receivable Collection Expense 250,200 Warehouse Expense 2,310,000 The bases to be used in allocating expenses, together with other essential…arrow_forwardProfit Center Responsibility Reporting XSport Sporting Goods Co. operates two divisions—the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 20Y9, the end of the fiscal year, after all adjustments, including those for inventories, were recorded and posted: Sales—Winter Sports Division $29,295,000 Sales—Summer Sports Division 32,364,000 Cost of Goods Sold—Winter Sports Division 17,577,000 Cost of Goods Sold—Summer Sports Division 18,693,000 Sales Expense—Winter Sports Division 5,022,000 Sales Expense—Summer Sports Division 4,464,000 Administrative Expense—Winter Sports Division 2,929,500 Administrative Expense—Summer Sports Division 2,873,700 Advertising Expense 1,012,000 Transportation Expense 435,000 Accounts Receivable Collection Expense 250,200 Warehouse Expense 2,790,000 The bases to be used in allocating expenses, together with other essential…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License