Concept explainers

Darren Dillard, majority stockholder and president of Dillard, Inc., is working with his top managers on future plans for the company. As the company’s

Requirements

- 1. Division A of Dillard, Inc. has $5,250,000 in assets. Its yearly fixed costs are $557,000, and the variable costs of its product line are $1.90 per unit. The division’s volume is currently 500,000 units. Competitors offer a similar product, at the same quality, to retailers for $4.25 each. Dillard’s management team wants to earn a 12% return on investment on the division’s assets.

- a. What is Division A’s target full product cost?

- b. Given the division’s current costs, will Division A be able to achieve its target profit?

- c. Assume Division A has identified ways to cut its variable costs to $1.75 per unit. What is its new target fixed cost? Will this decrease in variable costs allow the division to achieve its target profit?

- d. Division A is considering an aggressive advertising campaign strategy to differentiate its product from its competitors. The division does not expect volume to be affected, but it hopes to gain more control over pricing. If Division A has to spend $120,000 next year to advertise and its variable costs continue to be $1.75 per unit, what will its cost-plus price be? Do you think Division A will be able to sell its product at the cost-plus price? Why or why not?

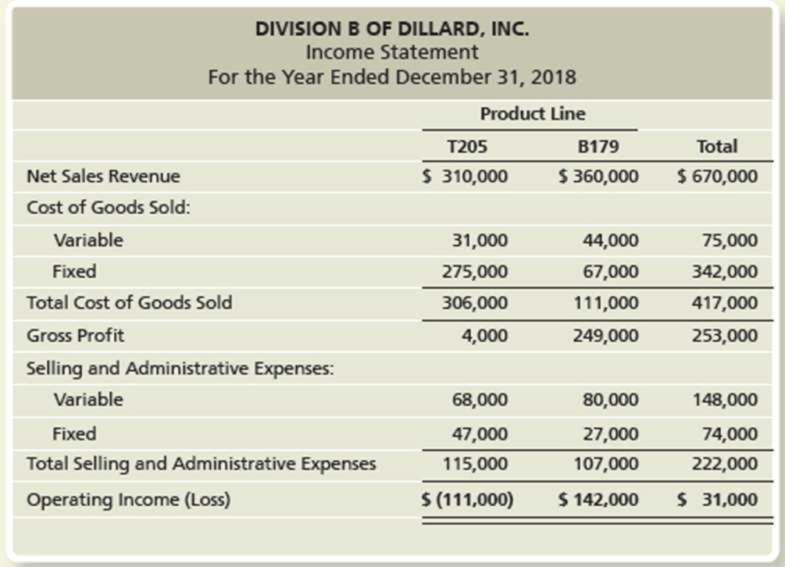

- 2. The division manager of Division B received the following operating income data for the past year:

The manager of the division is surprised that the T205 product line is not profitable. The division accountant estimates that dropping the T205 product line will decrease fixed cost of goods sold by $75,000 and decrease fixed selling and administrative expenses by $10,000.

- a. Prepare a differential analysis to show whether Division B should drop the T205 product line.

- b. What is your recommendation to the manager of Division B?

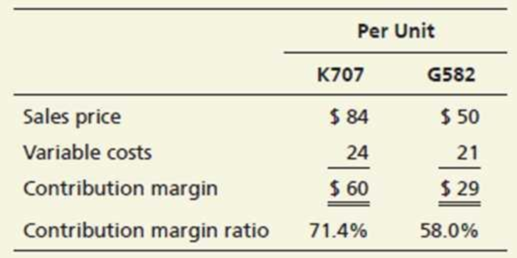

- 3. Division C also produces two product lines. Because the division can sell all of the product it can produce, Dillard is expanding the plant and needs to decide which product line to emphasize. To make this decision, the division accountant assembled the following data:

After expansion, the factory will have a production capacity of 4,700 machine hours per month. The plant can manufacture either 40 units of K707s or 62 units of G582s per machine hour.

- a. Identify the constraining factor for Division C.

- b. Prepare an analysis to show which product line to emphasize.

- 4. Division D is considering two possible expansion plans. Plan A would expand a current product line at a cost of $8,600,000. Expected annual net

cash inflows are $1,525,000, with zero residual value at the end of 10 years. Under Plan B, Division D would begin producing a new product at a cost of $8,000,000. This plan is expected to generate net cash inflows of $1,100,000 per year for 10 years, the estimated useful life of the product line. Estimated residual value for Plan B is $980,000. Division D uses straight-linedepreciation and requires an annual return of 10%.- a. Compute the payback, the ARR, the

NPV , and the profitability index for both plans. - b. Compute the estimated

IRR of Plan A. - c. Use Excel to verify the NPV calculations in Requirement 4(a) and the actual IRR for the two plans. How does the IRR of each plan compare with the company’s required

rate of return ? - d. Division D must rank the plans and make a recommendation to Dillard’s top management team for the best plan. Which expansion plan should Division D choose? Why?

- a. Compute the payback, the ARR, the

Want to see the full answer?

Check out a sample textbook solution

Chapter 26 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Cost Accounting (15th Edition)

Introduction To Managerial Accounting

Intermediate Accounting

Managerial Accounting (5th Edition)

PRINCIPLES OF TAXATION F/BUS.+INVEST.

Intermediate Accounting (2nd Edition)

- Javier Company has sales of 8 million and quality costs of 1,600,000. The company is embarking on a major quality improvement program. During the next three years, Javier intends to attack failure costs by increasing its appraisal and prevention costs. The right prevention activities will be selected, and appraisal costs will be reduced according to the results achieved. For the coming year, management is considering six specific activities: quality training, process control, product inspection, supplier evaluation, prototype testing, and redesign of two major products. To encourage managers to focus on reducing non-value-added quality costs and select the right activities, a bonus pool is established relating to reduction of quality costs. The bonus pool is equal to 10 percent of the total reduction in quality costs. Current quality costs and the costs of these six activities are given in the following table. Each activity is added sequentially so that its effect on the cost categories can be assessed. For example, after quality training is added, the control costs increase to 320,000, and the failure costs drop to 1,040,000. Even though the activities are presented sequentially, they are totally independent of each other. Thus, only beneficial activities need be selected. Required: 1. Identify the control activities that should be implemented, and calculate the total quality costs associated with this selection. Assume that an activity is selected only if it increases the bonus pool. 2. Given the activities selected in Requirement 1, calculate the following: a. The reduction in total quality costs b. The percentage distribution for control and failure costs c. The amount for this years bonus pool 3. Suppose that a quality engineer complained about the gainsharing incentive system. Basically, he argued that the bonus should be based only on reductions of failure and appraisal costs. In this way, investment in prevention activities would be encouraged, and eventually, failure and appraisal costs would be eliminated. After eliminating the non-value-added costs, focus could then be placed on the level of prevention costs. If this approach were adopted, what activities would be selected? Do you agree or disagree with this approach? Explain.arrow_forwardEach of the following scenarios requires the use of accounting information to carry out one or more of the following managerial activities: (1) planning, (2) control and evaluation, (3) continuous improvement, or (4) decision making. a. MANAGER: At the last board meeting, we established an objective of earning an after-tax profit equal to 20 percent of sales. I need to know the revenue that we need to earn in order to meet this objective, given that we have 250,000 to spend on the promotional campaign. Once I have estimated sales in units, we then need to outline a promotional campaign that conforms to our budget and that will take us where we want to be. However, to compute the targeted sales revenue, I need to know the unit sales price, the unit variable cost, and the associated fixed production and support costs. I also need to know the tax rate. b. MANAGER: We have problems with our procurement process. Our accounts payable department is spending 80 percent of its time resolving discrepancies between the purchase order, receiving order, and suppliers invoice. Incorrect part numbers on the purchase orders, incorrect quantities ordered, and wrong parts sent (or the incorrect quantity) are just a few examples of sources of discrepancies. A complete redesign of the process has been suggested, which will allow us to eliminate virtually all of the errors and, at the same time, significantly reduce the number of clerks needed in purchasing, receiving, and accounts payable. This redesign promises to significantly reduce costs, decrease lead time, and increase customer satisfaction. c. MANAGER: This overhead cost report indicates that we have spent significantly more on inspection, purchasing, and production than was budgeted. An investigation has revealed that the source of the problem is faulty components from suppliers. A supplier evaluation has revealed that by selecting five suppliers with the best quality records (out of 15 currently used), the number of defective components will be dramatically reduced, thus producing significant overhead savings by reducing the demand for inspections, reordering, and rework. d. MANAGER: A large local firm has approached me and has offered to sell us one of the components used in our small enginesa component that we are currently producing internally. I need to know costs that we would avoid if this component is purchased so that I can assess the economic merits of this offer. e. MANAGER: Currently, our deluxe lawn mower is losing money. We need to increase profits. I would like to know how much our profits would be if we reduce our variable costs by 50 per mower while maintaining our current sales volume. Also, marketing claims that if we increase advertising expenditures by 1,000,000 and cut prices by 15 percent, we can increase the number of mowers sold by 25 percent. I would like to know which approach offers the most profit, or if a combination of the approaches may be best. f. MANAGER: We are implementing a major quality improvement program. We will be increasing the investment in prevention and detection activities with the expectation of driving down both internal and external failure costs. I expect to see trend reports for all categories of quality costs. I want to see if improving quality really does reduce costs and improve profitability. g. MANAGER: Our engineering design department has proposed a new design for our product. The new design promises to reduce post-purchase costs and, as a consequence, increase market share. I need to know the cost of producing this new design because it uses some new components and requires some different manufacturing processes. I would then like to have a projected income statement based on the new market share and new production costs. The planned selling price will be the same, or maybe even 10 percent lower. Projections based on the two price scenarios would be needed. h. MANAGER: My engineers have said that by redesigning our two main production processes, we can reduce move time by 90 percent and wait time by 85 percent. This would decrease cycle time and virtually eliminate the need to carry finished goods inventories. On-time deliveries would also increase dramatically. This would produce cost savings of nearly 20,000,000 per year. Market share and revenues would also increase. Required: 1. Describe each of the four managerial responsibilities. 2. Identify the managerial activity or activities applicable for each scenario, and indicate the role of accounting information in the activity.arrow_forwardThe condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that 143,750,000 of assets have been invested in the Consumer Products Division. b. If expenses could be reduced by 3,450,000 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on investment for the Consumer Products Division?arrow_forward

- Banyan Industries has two divisions, a tax rate of 30%, and a minimum rate of return of 20%. Division A has a weighted average cost of Capital of 9.5% and is looking at a new project that will generate a profit of $1,200,000 from a machine that costs $4,000,000. Division B has a weighted average cost of capital of 9.5% and is looking at a new project that will generate a profit of $1,350,000 from a machine that costs $5,000.000. A. Calculate the EVA for each of Banyans divisions. B. Calculate the RI for each of Banyans division. C. If Banyan uses EVA to evaluate the projects, which division has the better project and by how much? D. If Banyan uses RI, which division has the better project and by how much? E. What are some of the reasons for the similarity or difference that you found in the use of EVA versus RI?arrow_forwardKatayama Company produces a variety of products. One division makes neoprene wetsuits. The divisions projected income statement for the coming year is as follows: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the contribution margin ratio. 2. The divisional manager has decided to increase the advertising budget by 140,000 and cut the average selling price to 200. These actions will increase sales revenues by 1 million. Will this improve the divisions financial situation? Prepare a new income statement to support your answer. 3. Suppose sales revenues exceed the estimated amount on the income statement by 612,000. Without preparing a new income statement, determine by how much profits are underestimated. 4. How many units must be sold to earn an after-tax profit of 1.254 million? Assume a tax rate of 34 percent. (Round your answer up to the next whole unit.) 5. Compute the margin of safety in dollars based on the given income statement. 6. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If sales revenues are 20 percent greater than expected, what is the percentage increase in profits?arrow_forwardSuppose that a company is spending 60,000 per year for inspecting, 30,000 for purchasing, and 40,000 for reworking products. A good estimate of nonvalue-added costs would be a. 70,000. b. 130,000. c. 40,000. d. 90,000. e. 100,000.arrow_forward

- Materials used by the Instrument Division of Ziegler Inc. are currently purchased from outside suppliers at a cost of 1,350 per unit. However, the same materials are available from the Components Division. The Components Division has unused capacity and can produce the materials needed by the Instrument Division at a variable cost of 900 per unit. a. If a transfer price of 1,000 per unit is established and 75,000 units of materials are transferred, with no reduction in the Components Divisions current sales, how much would Ziegler Inc.s total operating income increase? b. How much would the Instrument Divisions operating income increase? c. How much would the Components Divisions operating income increase?arrow_forwardCorazon Manufacturing Company has a purchasing department staffed by five purchasing agents. Each agent is paid 28,000 per year and is able to process 4,000 purchase orders. Last year, 17,800 purchase orders were processed by the five agents. Required: 1. Calculate the activity rate per purchase order. 2. Calculate, in terms of purchase orders, the: a. total activity availability b. unused capacity 3. Calculate the dollar cost of: a. total activity availability b. unused capacity 4. Express total activity availability in terms of activity capacity used and unused capacity. 5. What if one of the purchasing agents agreed to work half time for 14,000? How many purchase orders could be processed by four and a half purchasing agents? What would unused capacity be in purchase orders?arrow_forwardCompany A has current sales of $4,000,000 and a 45% contribution margin. Its fixed costs are $600,000. Company B is a service firm with current service revenue of $2,800,000 and a 15% contribution margin. Company Bs fixed costs are $375,000. Compute the degree of operating leverage for both companies. Which company will benefit most from a 15% increase in sales? Explain why.arrow_forward

- Forchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).arrow_forwardNico Parts, Inc., produces electronic products with short life cycles (of less than two years). Development has to be rapid, and the profitability of the products is tied strongly to the ability to find designs that will keep production and logistics costs low. Recently, management has also decided that post-purchase costs are important in design decisions. Last month, a proposal for a new product was presented to management. The total market was projected at 200,000 units (for the two-year period). The proposed selling price was 130 per unit. At this price, market share was expected to be 25 percent. The manufacturing and logistics costs were estimated to be 120 per unit. Upon reviewing the projected figures, Brian Metcalf, president of Nico, called in his chief design engineer, Mark Williams, and his marketing manager, Cathy McCourt. The following conversation was recorded: BRIAN: Mark, as you know, we agreed that a profit of 15 per unit is needed for this new product. Also, as I look at the projected market share, 25 percent isnt acceptable. Total profits need to be increased. Cathy, what suggestions do you have? CATHY: Simple. Decrease the selling price to 125 and we expand our market share to 35 percent. To increase total profits, however, we need some cost reductions as well. BRIAN: Youre right. However, keep in mind that I do not want to earn a profit that is less than 15 per unit. MARK: Does that 15 per unit factor in preproduction costs? You know we have already spent 100,000 on developing this product. To lower costs will require more expenditure on development. BRIAN: Good point. No, the projected cost of 120 does not include the 100,000 we have already spent. I do want a design that will provide a 15-per-unit profit, including consideration of preproduction costs. CATHY: I might mention that post-purchase costs are important as well. The current design will impose about 10 per unit for using, maintaining, and disposing our product. Thats about the same as our competitors. If we can reduce that cost to about 5 per unit by designing a better product, we could probably capture about 50 percent of the market. I have just completed a marketing survey at Marks request and have found out that the current design has two features not valued by potential customers. These two features have a projected cost of 6 per unit. However, the price consumers are willing to pay for the product is the same with or without the features. Required: 1. Calculate the target cost associated with the initial 25 percent market share. Does the initial design meet this target? Now calculate the total life-cycle profit that the current (initial) design offers (including preproduction costs). 2. Assume that the two features that are apparently not valued by consumers will be eliminated. Also assume that the selling price is lowered to 125. a. Calculate the target cost for the 125 price and 35 percent market share. b. How much more cost reduction is needed? c. What are the total life-cycle profits now projected for the new product? d. Describe the three general approaches that Nico can take to reduce the projected cost to this new target. Of the three approaches, which is likely to produce the most reduction? 3. Suppose that the Engineering Department has two new designs: Design A and Design B. Both designs eliminate the two nonvalued features. Both designs also reduce production and logistics costs by an additional 8 per unit. Design A, however, leaves post-purchase costs at 10 per unit, while Design B reduces post-purchase costs to 4 per unit. Developing and testing Design A costs an additional 150,000, while Design B costs an additional 300,000. Assuming a price of 125, calculate the total life-cycle profits under each design. Which would you choose? Explain. What if the design you chose cost an additional 500,000 instead of 150,000 or 300,000? Would this have changed your decision? 4. Refer to Requirement 3. For every extra dollar spent on preproduction activities, how much benefit was generated? What does this say about the importance of knowing the linkages between preproduction activities and later activities?arrow_forwardFlorentino Allers is the production manager of Electronics Manufacturer. Due to limited capacity, the company can only produce one of two possible products: An industrial motherboard with a 75% probability of making a profit of $1 million and a 25% probability of making a profit of $150,000 A regular motherboard with a 100% chance of making a profit of $710,000 Florentino will get a 20% bonus from his department. Florentino has the responsibility to choose between the two products and is more of a risk-taker, more so than most of the top management at Electronics Manufacturer. A. Which option is Florentino more likely to choose and why? B. Which option would the company be more likely to choose and why? C. What changes should the company make to Florentinos compensation to avoid unnecessary risks?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning