Concept explainers

Rework the cash budget and short-term financial plan assuming Keafer changes to a minimum cash balance of $90,000.

KEAFER MANUFACTURING

WORKING CAPITAL MANAGEMENT

You have recently been hired by Keafer Manufacturing to work in its established treasury department. Keafer Manufacturing is a small company that produces highly customized cardboard boxes in a variety of sizes for different purchasers. Adam Keafer, the owner of the company, works primarily in the sales and production areas of the company. Currently, the company basically puts all receivables in one pile and all payables in another, and a part-lime bookkeeper periodically comes in and attacks the piles. Because of this disorganized system, the finance area needs work, and that's what you've been brought in to do.

The company currently has a cash balance of $210,000, and it plans to purchase new machinery in the third quarter at a cost of 5390,000. The purchase of the machinery will be made with cash because of the discount offered for a cash purchase. Adam wants to maintain a minimum cash balance of $135,000 to guard against unforeseen contingencies. All of Keafer’s sales to customers and purchases from suppliers are made with credit, and no discounts are offered or taken.

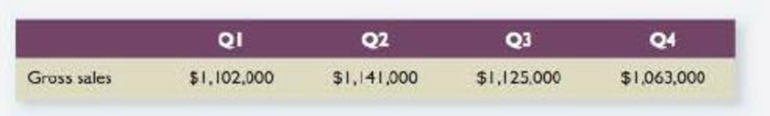

The company had the following sales each quarter of the year just ended:

After some research and discussions with customers, you’re projecting that sales will be 8 percent higher in each quarter next year. Sales for the first quarter of the following year are also expected to grow at 8 percent. You calculate that Keafer currently has an accounts receivable period of 57 days and an accounts receivable balance of $675,000. However, 10 percent of the accounts receivable balance is from a company that has just entered bankruptcy, and it is likely that this portion will never be collected.

You’ve also calculated that Keafer typically orders supplies each quarter in the amount of 50 percent of the next quarter’s projected gross sales, and suppliers are paid in 53 days on average. Wages, taxes, and other costs run about 25 percent of gross sales. The company has a quarterly interest payment of $185,000 on its long-term debt. Finally, the company uses a local bank for its short-term financial needs. It currently pays 1.2 percent per quarter on all short-term borrowing and maintains a

Adam has asked you to prepare a cash budget and short-term financial plan for the company under the current policies. He has also asked you to prepare additional plans based on changes in several inputs.

Want to see the full answer?

Check out a sample textbook solution

Chapter 26 Solutions

CORPORATE FINANCE-ACCESS >CUSTOM<

- Coral Seas Jewelry Company makes and sells costume jewelry. For the coming year, Coral Seas expects sales of 15.9 million and cost of goods sold of 8.75 million. Advertising is a key part of Coral Seas business strategy, and total marketing expense for the year is budgeted at 2.8 million. Total administrative expenses are expected to be 675,000. Coral Seas has no interest expense. Income taxes are paid at the rate of 40 percent of operating income. Required: 1. Construct a budgeted income statement for Coral Seas Jewelry Company for the coming year. 2. What if Coral Seas had interest payments of 500,000 during the year? What effect would that have on operating income? On income before taxes? On net income?arrow_forwardCASH BUDGETING Helen Bowers, owner of Helens Fashion Designs, is planning to request a line of credit from her bank. She has estimated the following sales forecasts for the firm for parts of 2019 and 2020: Estimates regarding payments obtained from the credit department are as follows: collected within the month of sale, 10%; collected the month following the sale, 75%; collected the second month following the sale, 15%. Payments for labor and raw materials are made the month after these services were provided. Here are the estimated costs of labor plus raw materials: General and administrative salaries are approximately 27,000 a month. Lease payments under long-term leases are 9,000 a month. Depreciation charges are 36,000 a month. Miscellaneous expenses are 2,700 a month. Income tax payments of 63,000 are due in September and December. A progress payment of 180,000 on a new design studio must be paid in October. Cash on hand on July 1 will be 132,000, and a minimum cash balance of 90,000 should be maintained throughout the cash budget period. a. Prepare a monthly cash budget for the last 6 months of 2019. b. Prepare monthly estimates of the required financing or excess fundsthat is, the amount of money Bowers will need to borrow or will have available to invest. c. Now suppose receipts from sales come in uniformly during the month (that is, cash receipts come in at the rate of 1/30 each day), but all outflows must be paid on the 5th. Will this affect the cash budget? That is, will the cash budget you prepared be valid under these assumptions? If not, what could be done to make a valid estimate of the peak financing requirements? No calculations are required, although if you prefer, you can use calculations to illustrate the effects. d. Bowers sales are seasonal, and her company produces on a seasonal basis, just ahead of sales. Without making any calculations, discuss how the companys current and debt ratios would vary during the year if all financial requirements were met with short-term bank loans. Could changes in these ratios affect the firms ability to obtain bank credit? Explain.arrow_forwardReview of Basic Capital Budgeting Procedures Dr. Whitley Avard, a plastic surgeon, had just returned from a conference in which she learned of a new surgical procedure for removing wrinkles around eyes, reducing the time to perform the normal procedure by 50%. Given her patient-load pressures. Dr. Avard is excited to try out the new technique. By decreasing the time spent on eye treatments or procedures, she can increase her total revenues by performing more services within a work period. In order to implement the new procedure, special equipment costing 74,000 is needed. The equipment has an expected life of 4 years, with a salvage value of 6,000. Dr. Avard estimates that her cash revenues will increase by the following amounts: She also expects additional cash expenses amounting to 3,000 per year. The cost of capital is 12%. Assume that there are no income taxes. Required: 1. Compute the payback period for the new equipment. 2. Compute the ARR. Round the percentage to two decimal places. 3. CONCEPTUAL CONNECTION Compute the NPV and IRR for the project. Use 14% as your first guess for IRR. Should Dr. Avard purchase the new equipment? Should she be concerned about payback or the ARR in making this decision? 4. CONCEPTUAL CONNECTION Before finalizing her decision. Dr. Avard decided to call two plastic surgeons who have been using the new procedure for the past 6 months. The conversations revealed a somewhat less glowing report than she received at the conference. The new procedure reduced the time required by about 25% rather than the advertised 50%. Dr. Avard estimated that the net operating cash flows of the procedure would be cut by one-third because of the extra time and cost involved (salvage value would be unaffected). Using this information, recompute the NPV of the project. What would you now recommend?arrow_forward

- Review the completed master budget and answer the following questions: Is Ranger Industries expecting to earn a profit during the next quarter? If so, how much? Does the company need to borrow cash during the quarter? Can it make any repayments? Explain. (Carefully review rows 74 through 80.)arrow_forwardFriendly Bank is attempting to determine the cost behavior of its small business lending operations. One of the major activities is the application activity. Two possible activity drivers have been mentioned: application hours (number of hours to complete the application) and number of applications. The bank controller has accumulated the following data for the setup activity: Required: 1. Estimate a regression equation with application hours as the activity driver and the only independent variable. If the bank forecasts 2,600 application hours for the next month, what will be the budgeted application cost? 2. Estimate a regression equation with number of applications as the activity driver and the only independent variable. If the bank forecasts 80 applications for the next month, what will be the budgeted application cost? 3. Which of the two regression equations do you think does a better job of predicting application costs? Explain. 4. Run a multiple regression to determine the cost equation using both activity drivers. What are the budgeted application costs for 2,600 application hours and 80 applications?arrow_forwardPreparing a financial budget—schedule of cash receipts and schedule of cash payments</b></p><p>Agua Cool is a distributor of bottled water. For each of the items, compute the number of cash receipts or payments Agua Cool will budget for September. The solution to one item may depend on the answer to an earlier item. Management expects to sell equipment that cost $14,000 at a gain of $7,000. Accumulated depreciation on this equipment is $55,000. Management expects to sell 7,100 cases of water in August and 9,000 cases in September. Each case sells for $14. Cash sales average 20% of total sales, and credit sales make up the rest. Three-fourths of credit sales are collected in the month of the sale, with the balance collected the following month. The company pays rent and property taxes of $4,500 each month. Commissions and other selling expenses average 30% of sales. Agua Cool pays one—half of the commissions and other selling expenses in the month incurred, with the…arrow_forward

- You are hired as a financial manager and your first task is to establish the cash budget of your firm.You gathered the following information. The firm receives all income from sales•Sales estimates (in millions)* Quarter1 = 1,000; Quarter2 = 1,250; Quarter3 = 1,500; Quarter4 = 2,000; Quarter1 next year = 1,200• Accounts receivable* Beginning receivables = $3000* Average collection period = 45 days• Accounts payable* Purchases = 60% of next quarter’s sales* Beginning payables = 1,200* Accounts payable period is 45 days• Other expenses*Wages, taxes, and other expense are 25% of sales*Interest and dividend payments are $100*A major capital expenditure of $500 is expected in the second quarter•The initial cash balance is $100 and the company maintains a minimum balance of $50 1) Required: establish the cash budget of the firm.arrow_forwardYou are hired as a financial manager and your first task is to establish the cash budget of your firm.You gathered the following information: The firm receives all income from sales•Sales estimates (in millions)* Quarter1 = 1,000; Quarter2 = 1,250; Quarter3 = 1,500; Quarter4 = 2,000; Quarter1 next year = 1,200• Accounts receivable* Beginning receivables = $3000* Average collection period = 45 days• Accounts payable* Purchases = 60% of next quarter’s sales* Beginning payables = 1,200* Accounts payable period is 45 days• Other expenses*Wages, taxes, and other expense are 25% of sales*Interest and dividend payments are $100*A major capital expenditure of $500 is expected in the second quarter•The initial cash balance is $100 and the company maintains a minimum balance of $50arrow_forwardEastern Enterprises is preparing a cash budget for June. Eastern has $12,000 cash at the beginning of June and anticipates $30,000 in cash receipts and $34,500 in cash disbursements during June. Eastern Enterprises has an agreement with its bank to maintain a cash balance of at least $10,000. As of May 31, Eastern owes $15,000 to the bank. To maintain the $10,000 required balance, during June Eastern must: Group of answer choices: 1)Borrow $10,000. 2)Borrow $ 2,500. 3)Repay $ 2,500. 4)Borrow $ 4,500. 5)Repay $ 7,500.arrow_forward

- Using the excel sheet Create a budget for cybersecurity based on these assumptions There are 5 members in the department: One Director that gets paid $130,000/year. One Supervisor that gets paid $95,000/year. Three Junior Staff members that get paid $65,000/year each. There are three conferences in 2021 and you will be sending 2 employees to each conference. The first two conferences cost $3,000 per person and the third conference is $5,000 per person. The conferences will be held in February, May, and September Meals will be paid for travel to the conferences mentioned above. Each person will receive $250 per day and each conference is five days. The entire department will be attending a training seminar in April and the cost is $5,000 per person During the training session for the entire department, each person will receive $250 per day for meals and the training session is for three days. Each person in the department spends $24 per month each for supplies The company always…arrow_forward(c) Upon receipt of the budget, the team manager, Damion Brownie, has now informed you that, in keeping with industry players, the management of Varsity Supplies & Things have indicated an industry requirement to maintain a minimum cash balance of $162,000 each month. He has also noted that management is very keen on keeping the gearing ratio of the business as low as possible and would therefore prefer to cushion any gaps internally using equity financing. Based on the budget prepared, will the business be achieving this desired target? Suggest three (3) internal strategies that may be employed by management to improve the organization’s monthly cash flow and militate against or reduce any possible shortfall reflected in the budget prepared. Each strategy must be fully explained.arrow_forwardUpon receipt of the budget, the team manager, Damion Brownie, has now informed you that, in keeping with industry players, the management of Varsity Supplies & Things have indicated an industry requirement to maintain a minimum cash balance of $162,000 each month. He has also noted that management is very keen on keeping the gearing ratio of the business as low as possible and would therefore prefer to cushion any gaps internally using equity financing.Based on the budget prepared, will the business be achieving this desired target? Suggest three (3) internal strategies that may be employed by management to improve the organization’s monthly cash flow and militate against or reduce any possible shortfall reflected in the budget prepared. Each strategy must be fully explained.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning