Concept explainers

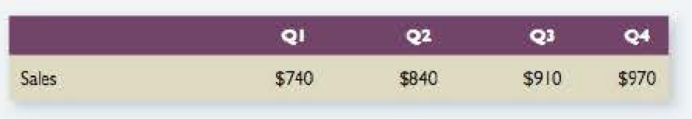

Calculating Cash Collections The Litzenberger Company has projected the following quarterly sales amounts for the coming year:

- a. Accounts receivable at the beginning of the year are $335. The company has a 45-day collection period. Calculate cash collections in each of the four quarters by completing the following:

- b. Rework (a) assuming a collection period of 60 days.

- c. Rework (a) assuming a collection period of 30 days.

a.

To compute: The cash collection in each of 4 quarters.

Cash Collection:

The receipts at the side of the cash account show the cash collection by the company. The company receives cash when there are cash sales and the collection from accounts receivable is also the cash collection of a company.

Explanation of Solution

Given,

Sales for Q1 are $740.

Sales for Q2 are $840.

Sales for Q3 are $910.

Sales for Q4 are $970.

Accounting receivables at the beginning of the year are $335.

Collection period is 45-days.

Table that shows the amount of cash collection in each quarter,

| Particulars |

Q1 ($) |

Q2 ($) |

Q3 ($) |

Q4 ($) |

| Beginning Receivable | 335 | 370 | 420 | 455 |

| Sales | 740 | 840 | 910 | 970 |

| Cash Collections | (705) | (790) | (875) | (940) |

| Ending Receivables | 370 | 420 | 455 | 485 |

Table (1)

Working notes:

Calculate the amount of ending receivable in Q1,

Calculate the cash collection in Q1,

Calculate the amount of ending receivable in Q2,

Calculate the cash collection in Q2,

Calculate the amount of ending receivable in Q3,

Calculate the cash collection in Q3,

Calculate the amount of ending receivable in Q4,

Calculate the cash collection in Q4,

Thus, the cash collection in Q1 is $705, Q2 is $790, Q3 is $875, and Q4 is $940.

b.

To compute: The cash collection in each of 4 quarters. The collection period is 60 days.

Explanation of Solution

Given,

Collection period is 60-days.

Table that shows the amount of cash collection in each quarter,

| Particulars |

Q1 ($) |

Q2 ($) |

Q3 ($) |

Q4 ($) |

| Beginning Receivable | 335 | 493 | 560 | 607 |

| Sales | 740 | 840 | 910 | 970 |

| Cash Collections | (582) | (773) | (863) | (930) |

| Ending Receivables | 493 | 560 | 607 | 647 |

Table (2)

Working Notes:

Calculate the amount of ending receivable in Q1,

Calculate the cash collection in Q1,

Calculate the amount of ending receivable in Q2,

Calculate the cash collection in Q2,

Calculate the amount of ending receivable in Q3,

Calculate the cash collection in Q3,

Calculate the amount of ending receivable in Q4,

Calculate the cash collection in Q4,

Thus, the cash collection in Q1 is $582, Q2 is $773, Q3 is $863, and Q4 is $930.

c.

To compute: The cash collection in each of 4 quarters. The collection period is 30days.

Explanation of Solution

Given,

Collection period is 30-days.

Table that shows the amount of cash collection in each quarter,

| Particulars |

Q1 ($) |

Q2 ($) |

Q3 ($) |

Q4 ($) |

| Beginning Receivable | 335 | 247 | 280 | 303 |

| Sales | 740 | 840 | 910 | 970 |

| Cash Collections | (828) | (807) | (887) | (950) |

| Ending Receivables | 247 | 280 | 303 | 323 |

Table (3)

Working notes:

Calculate the amount of ending receivable in Q1,

Calculate the cash collection in Q1,

Calculate the amount of ending receivable in Q2,

Calculate the cash collection in Q2,

Calculate the amount of ending receivable in Q3,

Calculate the cash collection in Q3,

Calculate the amount of ending receivable in Q4,

Calculate the cash collection in Q4,

Thus, the cash collection in Q1 is $828, Q2 is $807, Q3 is $887, and Q4 is $950.

Want to see more full solutions like this?

Chapter 26 Solutions

CORPORATE FINANCE (LL)-W/ACCESS

- My Aunts Closet Store collects 60% of its accounts receivable in the month of sale and 35% in the month after the sale. Given the following sales, how much cash will be collected in March?arrow_forwardNonnas Re-Appliance Store collects 55% of its accounts receivable in the month of sale and 40% in the month after the sale. Given the following sales, how much cash will be collected in February?arrow_forwardSchedule of cash payments for service company Horizon Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: Depreciation, insurance, and property taxes represent 9,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. Seventy percent of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule of cash payments for selling and administrative expenses for March, April, and May.arrow_forward

- The following four suggestions have been made to improve the company’s cash position. Evaluate the effect on cash flow for each of the four suggestions. After evaluating each suggestion, enter the projected cash balances in the spaces provided. Consider each suggestion separately. Reset cells to their initial values after each new suggestion. Seek agreement with suppliers to extend the credit period to 30 days. This would mean that all current monthly purchases would be paid for in the following month. Raise the unit price from $28 to $30. A price increase will reduce unit sales by 10% each month. Unit purchases will also be reduced by 10%. Put the company’s two salespeople on straight commission. This would reduce fixed marketing and administrative costs to $1,500 per month and raise variable marketing and administrative costs to $7 per unit. Increase the cash discount from 5% to 10%. It is anticipated that this would increase the percentage of customers paying within the discount period to 85%, and those paying the month after the discount period would drop to 8%. Five percent would pay in the following month and 2% would still be uncollectible. What are your recommendations for Sweet Pleasures, Inc.? Consider potential impact on profits as well as cash balances.arrow_forwardAssume that it is now July of Year 1 and that the brothers are developing projected financial statements for the following year. Further, assume that sales and collections in the first half-year matched the predicted levels. Use the Year-2 sales forecasts shown in the following table to estimate next year’s receivables levels for the end of March and for the end of June.arrow_forwardHistorically, Ragman Company has had no significant bad debt experience with its customers. Cash sales have accounted for 20 percent of total sales, and payments for credit sales have been received as follows: 40 percent of credit sales in the month of the sale 35 percent of credit sales in the first subsequent month 20 percent of credit sales in the second subsequent month 5 percent of credit sales in the third subsequent month The forecast for both cash and credit sales is as follows. Required: 1. What is the forecasted cash inflow for Ragman Company for May? 2. Due to deteriorating economic conditions, Ragman Company has now decided that its cash forecast should include a bad debt adjustment of 2 percent of credit sales, beginning with sales for the month of April. Because of this policy change, what will happen to the total expected cash inflow related to sales made in April? (CMA adapted)arrow_forward

- Gear Up Co. pays 65% of its purchases in the month of purchase, 30% in the month after the purchase, and 5% in the second month following the purchase. What are the cash payments if it made the following purchases in 2018?arrow_forwardWhat is the amount of budgeted cash payments if purchases are budgeted for $420,000 and the beginning and ending balances of accounts payable are $95,000 and $92,000, respectively?arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning