Concept explainers

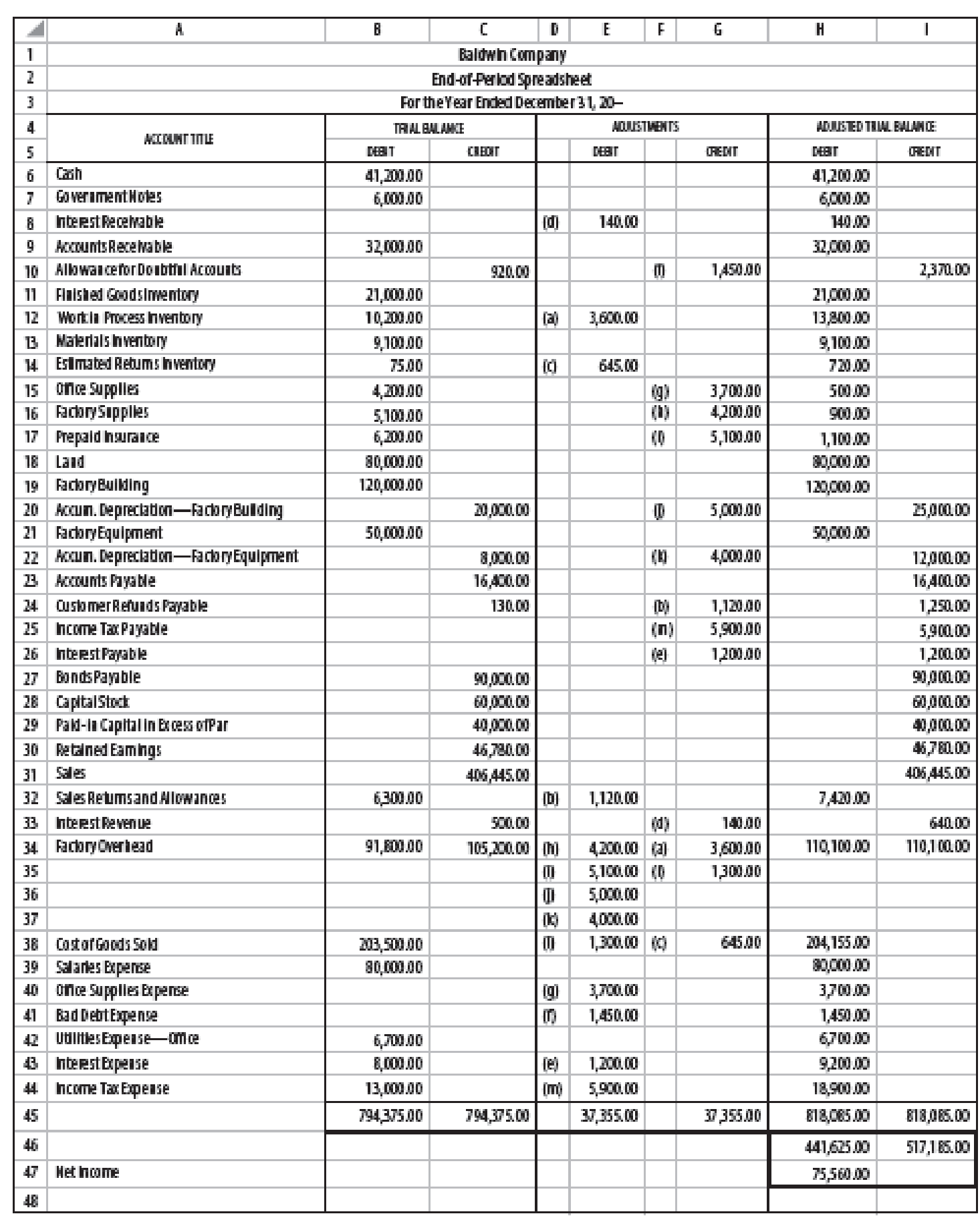

ADJUSTING. CLOSING. AND REVERSING ENTRIES A 6-column spreadsheet for Baldwin Company is shown on the next page.

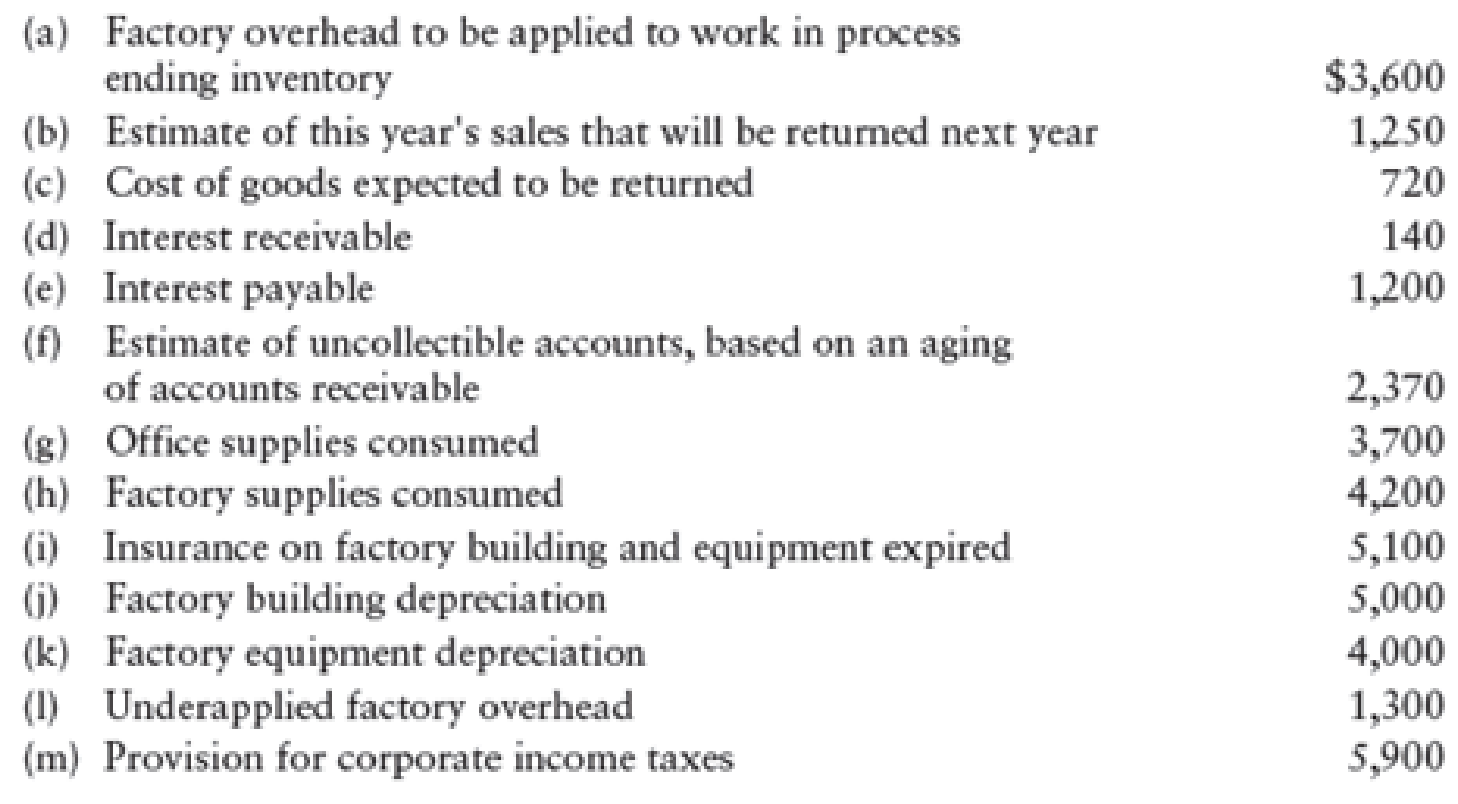

Data for adjusting the accounts are as follows:

REQUIRED

1. Prepare the December 31

2. Prepare the December 31 closing journal entries for Baldwin Company.

3. Prepare the reversing journal entries as of January 1,20-2, for Baldwin Company.

PROBLEM 27-8A

1.

Prepare adjusting entries of Company B for the year ended December 31.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Prepare adjusting entries of Company B for the year ended December 31 as follows:

| Date | Account Title and Explanation | Post ref. | Debit ($) | Credit ($) | |

| December 31 | a. | Work in process inventory account | 3,600 | ||

| Factory overhead | 3,600 | ||||

| (To record the transfer of work in process inventory account to factory overhead) | |||||

| December 31 | b. | Sales return and allowances | 1,250 | ||

| Customer refunds payable | 1,250 | ||||

| (To record the sales return from the customer) | |||||

| December 31 | c. | Estimated returns inventory | 140 | ||

| Cost of goods sold | 140 | ||||

| (To record the expected return of cost of goods sold) | |||||

| December 31 | d. | Interest receivable | 140 | ||

| Interest revenue | 140 | ||||

| (To record the interest revenue earned at the end of the accounting year) | |||||

| December 31 | e. | Interest Expense | 1,200 | ||

| Interest Payable | 1,200 | ||||

| (To record the interest expense incurred at the end of the accounting year) | |||||

| December 31 | f. | Bad Debt Expense | 1,450 | ||

| Allowance for Doubtful Accounts | 1,450 | ||||

| (To record the bad debt expense incurred at the end of the accounting year) | |||||

| December 31 | g. | Office Supplies Expense | 3,700 | ||

| Office Supplies | 3,700 | ||||

| (To record the office supplies expense incurred at the end of the accounting year) | |||||

| December 31 | h. | Factory Overhead (supplies expense) | 1,389 | ||

| Factory Supplies | 1,389 | ||||

| (To record the supplies expense incurred at the end of the accounting year) | |||||

| December 31 | i. | Factory Overhead (insurance expense) | 5,100 | ||

| Prepaid insurance | 5,100 | ||||

| (To record the insurance expense incurred at the end of the accounting year) | |||||

| December 31 | j. | Factory overhead-(depreciation expense for factory building) | 5,000 | ||

| Accumulated Depreciation-factory building | 5,000 | ||||

| (To record the depreciation expense incurred at the end of the accounting year) | |||||

| December 31 | k. | Factory Overhead (Depreciation expense-Factory Equipment) | 4,000 | ||

| Accumulated Depreciation-Factory Equipment | 4,000 | ||||

| (To record the depreciation expense incurred at the end of the accounting year) | |||||

| December 31 | l. | Cost of Goods Sold | 1,300 | ||

| Factory Overhead | 1,300 | ||||

| (To record the factory overhead transferred to the cost of goods sold) | |||||

| December 31 | m. | Income Tax Expense | 5,900 | ||

| Income Tax Payable | 5,900 | ||||

| (To record the income tax expense incurred at the end of the account) |

Table (1)

2.

Prepare closing entries of Company B for the year ended December 31.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare closing entries of Company B for the year ended December 31 as follows:

| Date | Account Title and Explanation | Post ref. | Debit ($) | Credit ($) |

| December 31 | Income Summary | 110,100 | ||

| Factory Overhead (Subsidiary ledger account) | 110,100 | |||

| (To close the subsidiary factory overheads account) | ||||

| December 31 | Factory Overhead | 110,100 | ||

| Income Summary | 110,100 | |||

| (To close the factory overhead account) | ||||

| December 31 | Sales | 406,445 | ||

| Interest revenue | 640 | |||

| Income Summary | 407,085 | |||

| (To close the sales and interest revenue account) | ||||

| December 31 | Income Summary | 331,525 | ||

| Sales returns and allowances | 7,420 | |||

| Cost of Goods Sold | 204,155 | |||

| Salaries expense | 80,000 | |||

| Office supplies expense | 3,700 | |||

| Bad debt expense | 1,450 | |||

| Utilities expense-office | 6,700 | |||

| Interest expense | 9,200 | |||

| Income tax expense | 18,900 | |||

| (To close all expenses account) | ||||

| December 31 | Income Summary | 75,560 | ||

| Retained Earnings (1) | 75,560 | |||

| (To close the income summary account) |

Table (2)

Closing entry for factory overhead:

The total debit balance of factory overhead account is transferred to the income summary account in order to bring the debit balance of factory overhead account to zero, and in the closing entry the income summary account is debited with $110,100, and the factory overhead account is credited (subsidiary ledger account) with $110,100.

The total credit balance of factory overhead account is transferred to the income summary account in order to bring the credit balance of factory overhead account to zero, and in the closing entry the factory overhead account is debited with $110,100, and the income summary account is credited with $110,100.

Closing entry for revenue account:

In this closing entry, the sales and interest revenue account is closed by transferring the amount of sales and interest revenue to the income summary account in order to bring the all revenue accounts balance to zero. Hence, debit the all revenue account for $407,085, and credit the income summary account for $407,085.

Closing entry for expenses account:

In this closing entry, all expenses are closed by transferring the amount of all expenses to the income summary account in order to bring all the expense accounts balance to zero. Hence, debit the income summary account for $331,525, and credit all the expenses account for $331,525.

Closing entry for income summary account:

In this closing entry, the income summary account is closed by transferring the amount of net income to the retained earnings account in order to bring the income summary balance to zero. Hence, debit the income summary account for $75,560, and credit the retained earnings for $75,560.

Working note (1):

Calculate the value of retained earnings.

3.

Prepare the reversing entries of Company B as of January 1, 20-2.

Explanation of Solution

Reversing entries: Reversing entries are made at the beginning of the accounting period when the accountant needs to cancel any entry made in the previous accounting period. It is done in order to eliminate any errors that might have occurred in the calculation of the revenue or expenses and henceforth increase the efficiency of the financial statements for an improved decision making.

Prepare the reversing entries of Company B as of January 1, 20-2 as follows:

Reversing entry for interest revenue:

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| January 1 | Interest revenue | 140 | ||

| Interest receivable | 140 | |||

| (To record the reversing entry for interest revenue) |

Table (3)

- ■ Interest revenue is component of shareholders’ equity, and it decreases the value of shareholders equity. Hence, debit the interest revenue with $140.

- ■ Interest receivable is an asset account, and it decreases the value of asset. Hence, credit the interest receivable account with $140.

Reversing entry for interest expense:

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| January 1 | Interest payable | 1,200 | ||

| Interest expense | 1,200 | |||

| (To record the reversing entry for interest expense) |

Table (4)

- ■ Interest payable is a liability account and it decreases in the value of liabilities. Hence, debit the interest payable with $1,200.

- ■ Interest expense is component of shareholders’ equity, and it increases the value of shareholders equity. Hence, credit the interest expense with $1,200.

Reversing entry for factory overheads:

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| January 1 | Factory Overhead | 3,600 | ||

| Work in Process Inventory | 3,600 | |||

| (To record the reversing entry for factory overhead) |

Table (5)

- ■ Factory overhead (expense) is a component of owner’s equity, and there is an increase in the value of expense. Hence, debit the factory overhead account with $3,600.

- ■ Work in process inventory is an asset account, and it decreases the value of asset. Hence, credit the work in process inventory account with $3,600.

Want to see more full solutions like this?

Chapter 27 Solutions

College Accounting, Chapters 1-27

- ADJUSTING, CLOSING, AND REVERSING ENTRIES A partial work sheet for Baldwin Company is shown on the next page. Data for adjusting the accounts are as follows: REQUIRED 1. Prepare the December 31 adjusting journal entries for Baldwin Company. 2. Prepare the December 31 closing journal entries for Baldwin Company. 3. Prepare the reversing journal entries as of January 1, 20-2, for Baldwin Company.arrow_forwardClosing entries On July 31, the close of the fiscal year, the balances of the accounts appearing in the ledger of Serbian Interiors Company, a furniture retailer, are as follows: Prepare the July 31 closing entries for Serbian Interiors Company.arrow_forwardAfter all revenue and expenses have been closed at the end of the fiscal period ended December 31, Income Summary has a debit of 45,550 and a credit of 36,520. On the same date, D. Mau, Drawing has a debit balance of 12,000 and D. Mau, Capital had a beginning credit balance of 63,410. a. Journalize the entries to close the remaining temporary accounts. b. What is the new balance of D. Mau, Capital after closing the remaining temporary accounts? Show your calculations.arrow_forward

- Reconstruction of Closing Entries The following T accounts summarize entries made to selected general ledger accounts of Cooper $ Company. Certain entries, dated December 31, are closing entries. Prepare the closing entries that were made on December 31.arrow_forwardCLOSING ENTRIES Using the spreadsheet and partially completed Income Summary Account on page 598, prepare the following: 1. Closing entries for Gimbels Gifts and Gadgets in a general journal. 2. A post-closing trial balance. EXERCISE 15-5Aarrow_forwardToms Catering Services prepared the following work sheet for the year ended December 31, 20--. Required 1. Complete the work sheet. (Skip this step if using CLGL.) 2. Prepare an income statement. 3. Prepare a statement of owners equity. Assume that there was an additional investment of 2,500 on December 1. 4. Prepare a balance sheet 5. Journalize the closing entries with the four steps in the correct sequence. 6. Prepare a post-closing trial balance. Check Figure Post-closing trial balance total, 31,665arrow_forward

- The trial balance for Wilson Financial Services on January 31 is as follows: Data for month-end adjustments are as follows: a. Expired or used-up insurance, 750. b. Depreciation expense on equipment, 300. c. Wages accrued or earned since the last payday, 1,055 (owed and to be paid on the next payday). d. Supplies used, 535. Required 1. Complete a work sheet for the month. (Skip this step if using CLGL.) 2. Journalize the adjusting entries. 3. If using CLGL, prepare an adjusted trial balance. 4. Prepare an income statement, a statement of owners equity, and a balance sheet. Assume that no additional investments were made during January.arrow_forwardThe trial balance for Benner Hair Salon on March 31 is as follows: Data for month-end adjustments are as follows: a. Expired or used-up insurance, 300. b. Depreciation expense on equipment, 500. c. Wages accrued or earned since the last payday, 235 (owed and to be paid on the next payday). d. Supplies remaining at the end of the month, 65. Required 1. Complete a work sheet for the month. (Skip this step if using CLGL.) 2. Journalize the adjusting entries. 3. Prepare an income statement, a statement of owners equity, and a balance sheet. Assume that no additional investments were made during March.arrow_forwardThe trial balance of Hadden Company as of December 31, the end of its current fiscal year, is as follows: Here are the data for the adjustments. ab.Merchandise Inventory at December 31, 64,742.80. c.Store supplies inventory (on hand), 420.20. d.Insurance expired, 738. e.Salaries accrued, 684.50. f.Depreciation of store equipment, 3,620. Required Complete the work sheet after entering the account names and balances onto the work sheet.arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub