College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 27, Problem 1CP

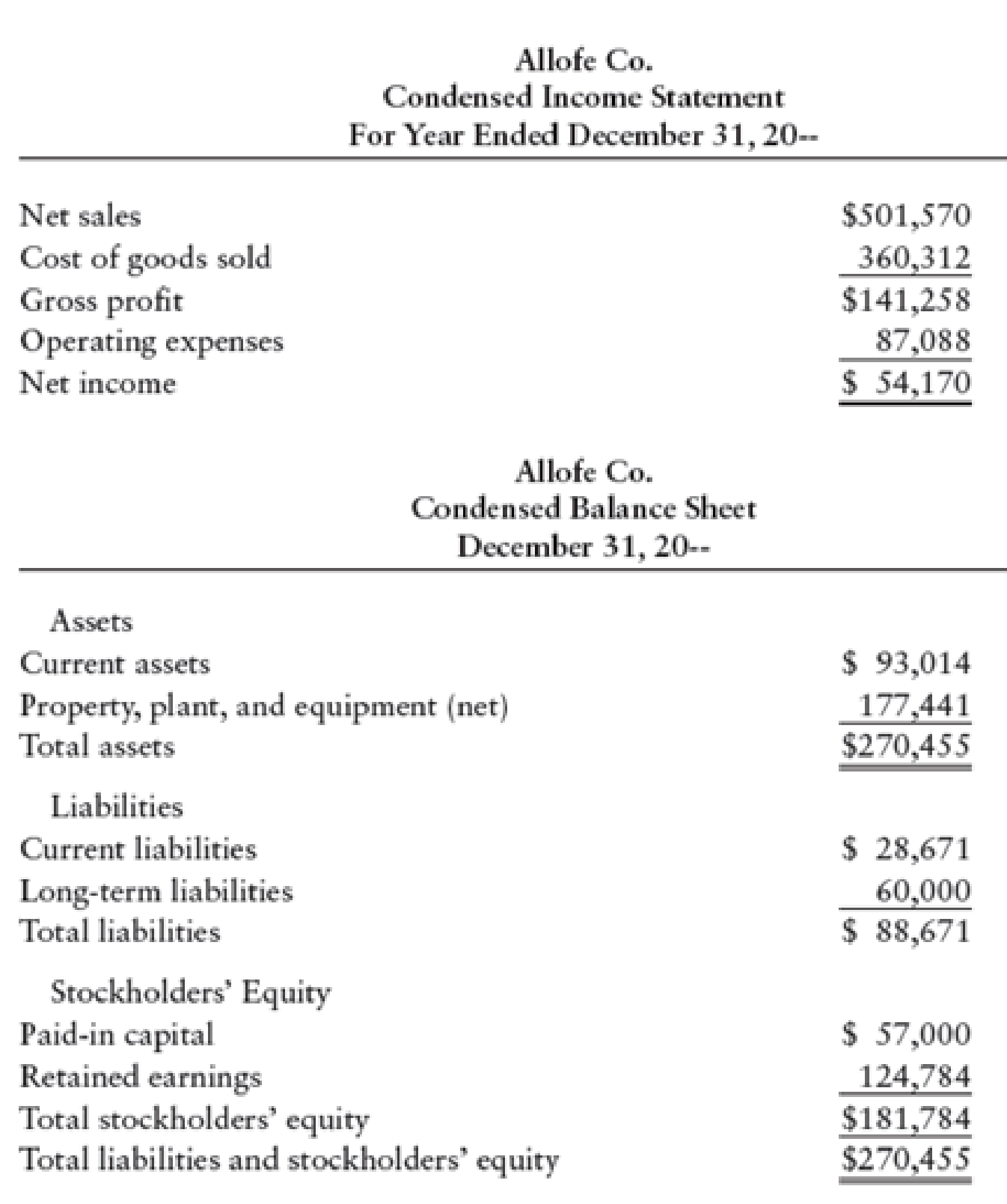

Drafts of the condensed income statement and balance sheet of Allofe Co. for the current year are shown below. Shortly after preparing these draft financial statements, Allofe discovered that an error had been made in the year-end adjustment process.

REQUIRED

- 1. Identify all adjusting and closing entries that would be affected by this error and prepare the missing portions of the entries.

- 2. Prepare a revised condensed income statement for Allofe.

(In solving this problem, assume that corporate income tax is not affected by the error.)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

At the end of the year, Metro, Inc. has an unadjusted credit balance in the Manufacturing Overhead account of $820. Which of the following is the

year−end

adjusting entry needed to adjust the account?

A.

A debit to Cost of Goods Sold of $820 and a credit to Manufacturing Overhead of $820

B.

A debit to Cost of Goods Sold of $820 and a credit to Finished Goods Inventory of $820

C.

A debit to Manufacturing Overhead of $820 and a credit to Cost of Goods Sold of $820

D.

A debit to Manufacturing Overhead of $820 and a credit to Finished Goods Inventory of $820

At the end of the first year of operations, Mayberry Advertising had accounts receivable of $20,300. Management of the company estimates that 10% of the accounts will not be collected.

What adjustment would Mayberry Advertising record to establish Allowance for Uncollectible Accounts? (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

When adjusting entries were made at the end of the year, the accountant for Parker Company did not make the following adjustments.

Required:

Identify the effect on the financial statements of the adjusting entries that were omitted.

a. Wages of $2,900 had been earned by employees but were unpaid.This error will understate expenses and understate liabilities.

b. $3,750 of performance obligations had been satisfied but no cash was uncollected nor any revenue recorded.

c. $2,400 performance obligations had been satisfied. The customer had prepaid for this service and the amount was originally recorded in the Unearned Sales Revenue account.This error will understate revenues and overstate liabilities.

d. $1,200 of insurance coverage had expired. Insurance had been initially recorded in the Prepaid Insurance account.

Chapter 27 Solutions

College Accounting, Chapters 1-27

Ch. 27 - Under the perpetual inventory system, Cost of...Ch. 27 - Prob. 2TFCh. 27 - On the spreadsheet, the factory overhead account...Ch. 27 - Prob. 4TFCh. 27 - The adjustment for factory overhead applied to...Ch. 27 - LO2 The adjustment for the amount of factory...Ch. 27 - The adjustment for depreciation expense for the...Ch. 27 - At the end of the accounting period, a credit...Ch. 27 - Prob. 4MCCh. 27 - Prob. 5MC

Ch. 27 - LO2 Prepare adjusting entries at December 31 for J...Ch. 27 - Prob. 2CECh. 27 - Prob. 3CECh. 27 - Prob. 1RQCh. 27 - Prob. 2RQCh. 27 - Prob. 3RQCh. 27 - Prob. 4RQCh. 27 - Prob. 5RQCh. 27 - What are the distinctive features of ToyJoys...Ch. 27 - Prob. 7RQCh. 27 - Prob. 8RQCh. 27 - Prob. 9RQCh. 27 - ADJUSTING ENTRIES INCLUDING ADJUSTMENT FOR...Ch. 27 - Prob. 2SEACh. 27 - Prob. 3SEACh. 27 - CLOSING JOURNAL ENTRIES Prepare closing journal...Ch. 27 - REVERSING JOURNAL ENTRIES Prepare reversing...Ch. 27 - SPRE ADSHEET, ADJUSTING ENTRIES, AND FIN ANCIAL...Ch. 27 - FINANCIAL STATEMENTS The adjusted trial balance...Ch. 27 - ADJUSTING. CLOSING. AND REVERSING ENTRIES A...Ch. 27 - ADJUSTING ENTRIES INCLUDING ADJUSTMENT FOR...Ch. 27 - Prob. 2SEBCh. 27 - ADJUSTING JOURNAL ENTRIES FOR A MANUFACTURING...Ch. 27 - Prob. 4SEBCh. 27 - REVERSING ENTRIES Prepare reversing journal...Ch. 27 - SPREADSHEET, ADJUSTING ENTRIES, AND FINANCIAL...Ch. 27 - FINANCIAL STATEMENTS The adjusted trial balance...Ch. 27 - Prob. 8SPBCh. 27 - Prob. 1MYWCh. 27 - Reese Manufacturing Company manufactures and sells...Ch. 27 - Drafts of the condensed income statement and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. Required 1. Prepare a work sheet for the fiscal year ended June 30. Ignore this step if using CLGL. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. Check Figure Net income, 14,066arrow_forwardThe following accounts appear in the ledger of Sheldon Company on January 31, the end of this fiscal year. The data needed for adjustments on January 31 are as follows: ab.Merchandise inventory, January 31, 55,750. c.Insurance expired for the year, 1,285. d.Depreciation for the year, 5,482. e.Accrued wages on January 31, 1,556. f.Supplies used during the year 1,503. Required 1. Prepare a work sheet for the fiscal year ended January 31. Ignore this step if using QuickBooks or general ledger. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. Ignore this step if using CLGL. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. Check Figure Net loss, 1,737arrow_forwardAssume the following data for Oshkosh Company before its year-end adjustments: Journalize the adjusting entries for the following: a. Estimated customer refunds and allowances b. Estimated customer returnsarrow_forward

- Assume the following data for Lusk Inc. before its year-end adjustments: Journalize the adjusting entries for the following: a. Estimated customer allowances b. Estimated customer returnsarrow_forwardOlney Cleaning Company had the following items that require adjustment at year end. For one cleaning contract, $11,100 cash was received in advance. The cash was credited to Unearned Service Revenue upon receipt. At year end, $260 of the service revenue was still unearned. For another cleaning contract, $8,700 cash was received in advance and credited to Unearned Service Revenue upon receipt. At year end, $3,000 of the services had been provided. Required: 1. Prepare the adjusting journal entries needed at December 31. If an amount box does not require an entry, leave it blank. Dec. 31 Unearned Service Revenue fill in the blank 02e1a8f7d03afe9_2 fill in the blank 02e1a8f7d03afe9_3 Service Revenue fill in the blank 02e1a8f7d03afe9_5 fill in the blank 02e1a8f7d03afe9_6 Dec. 31 Unearned Service Revenue fill in the blank 02e1a8f7d03afe9_8 fill in the blank 02e1a8f7d03afe9_9 Service Revenue fill in the blank 02e1a8f7d03afe9_11 fill in the blank 02e1a8f7d03afe9_12…arrow_forwardExplain whether Colston Company correctly reported the following items in the financial statements:a. In a recent year, the company discovered a clerical error in the prior year’s accounting records. As a result, the reported net income for the previous year was overstated by $45,000. The company corrected this error by restating the prior-year financial statements.b. In a recent year, the company voluntarily changed its method of accounting for longterm construction contracts from the percentage of completion method to the completed contract method. Both methods are acceptable under generally acceptable accounting principles. The cumulative effect of this change was reported as a separate componentof income in the current period income statement.arrow_forward

- At the end of October, the ABC Company needed to make accrual adjustments to the accounts, using the following information: Depreciation for the month is £50 An inventory count on October 31 revealed that 125units were in the company’s warehouse. The cost flow assumption followed for the preparation of statements is FIFO. On September 1, ABC Company issued a 3-month, annual rate 6%, $1,000 Note Payable to Credit Bank. Capital and interest are to be paid at the end of November. Prepare a worksheet showing the October transactions and the October accrual adjustments for the ABC Company. The work sheet is attached below, which is solvevd. But I wonder how to get the lastest amount of inventory, which is 125? Can you please show me the calculation process?arrow_forwardWhen the trial balance extracted from the books of Keman Enterprises at the year-end failed to balance, the difference was placed in a Suspense account. Identify the amount that would have been placed in suspense as a result of each of the following errors; GH₵ 218,400 paid to a supplier was posted to the supplier as GH₵ 214,800arrow_forwardAt the end of the first year of operations, Gaur Manufacturing had gross accounts receivable of $300,000. Gaur's management estimates that 6% of the accounts will prove uncollectible.What journal entry should Gaur record to establish an allowance for uncollectible accounts? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forward

- The accountant for Healthy Life Company, a medical services consulting firm, mistakenly omitted adjusting entries for (a) unearned revenue earned during the year ($21,820) and (b) accrued wages ($6,770). Indicate the effect of each error, considered individually, on the income statement for the current year ended July 31. Also indicate the effect of each error on the July 31 balance sheet. Enter all amounts as positive numbers. Enter "0" in those spaces where there is no overstatement or no understatement. Error (a) The adjusting entry for unearned revenue earned during the year ($21,820) was omitted.arrow_forwardIdentify if the following changes are an accounting policy change (P), an accounting estimate change (AE), or an error (E). Item • The useful life of a piece of equipment was revised from five years to six years. • An accrued litigation liability was adjusted upwards once the lawsuit was concluded. • An item was missed in the year-end inventory count. • The method used to depreciate a factory machine was changed from straight-line to declining balance when it was determined that this better reflected the pattern of use. • A company adopted the new IFRS for revenue recognition. • The accrued pension liability was adjusted downwards as the company's actuary had not included one employee group when estimating the remaining service life. • The allowance for doubtful accounts was adjusted upwards due to current economic conditions. • The allowance for doubtful accounts was adjusted downwards because the previous estimate was based on an aged trial balance that classified some…arrow_forwardRecords showed that as of December 31, 2020, accrued salaries payable of P21,000 were not recorded in Company’s books. In addition, office supplies on hand of P9,000 at December 31, 2020 were erroneously treated as expense instead of supplies inventory. Neither of these errors was discovered nor corrected. What is the effect of these two errors? A. 2020 net income and December 31, 2020 accumulated profits are understated by P9,000 each. B. 2019 net income is overstated by P12,000 and 2020 net income is understated by P9,000 C. 2019 net income and December 31, 2019 accumulated profits are understated by P21,000 each. D. 2020 net income is understated by P30,000 and January 1, 2021 accumulated profits is understated by P9,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License