Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

12th Edition

ISBN: 9781259144387

Author: Richard A Brealey, Stewart C Myers, Franklin Allen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 28, Problem 4PS

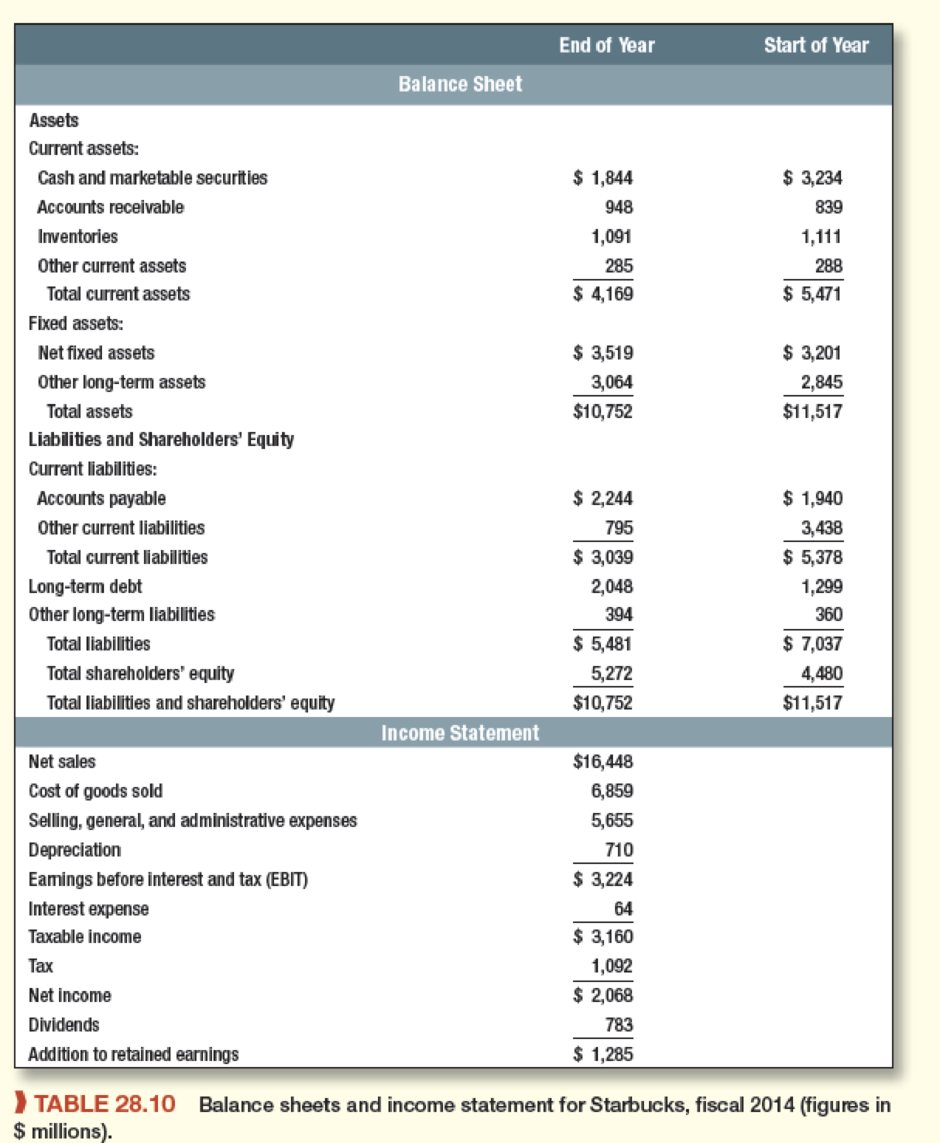

Performance measures Look again at Table 28.10. At the end of fiscal 2014, Starbucks had 748 million shares outstanding with a share price of $81.25. The company’s weighted-average cost of capital was about 9%. Calculate:

- a. Market value added.

- b. Market-to-book ratio.

- c. Economic value added.

- d. Return on start-of-the-year capital.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Firm M has a margin of 12%, turnover of 1.5, sales of $870,000, and average stockholders' equity of $360,000.

Calculate Firm M’s average total assets, net income, return on investment (ROI), and return on equity (ROE).

The most recent financial statements for Bello Co. are shown here:

Income Statement

Balance Sheet

Sales

$

18,900

Current assets

$

11,700

Debt

$

15,700

Costs

12,800

Fixed assets

26,500

Equity

22,500

Taxable income

$

6,100

Total

$

38,200

Total

$

38,200

Taxes (21%)

1,281

Net income

$

4,819

Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 30 percent dividend payout ratio.

What is the sustainable growth rate?

Suppose that Psy Ops Industries currently has the balance sheet shown below, and that sales for the year just ended were $4.4 million. The firm also has a profit margin of 20 percent, a retention ratio of 25 percent, and expects sales of $7.4 million next year.

Assets

Liabilities and Equity

Current assets

$ 1,980,000

Current liabilities

$ 1,672,000

Fixed assets

3,700,000

Long-term debt

1,800,000

Equity

2,208,000

Total assets

$ 5,680,000

Total liabilities and equity

$ 5,680,000

If fixed assets have enough capacity to cover the increase in sales and all other assets and current liabilities are expected to increase with sales, what amount of additional funds will Psy Ops need from external sources to fund the expected growth?

Note: Enter your answer in dollars not in millions. Negative amount should be indicated by a minus sign.

Chapter 28 Solutions

Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Ch. 28 - Prob. 1PSCh. 28 - Financial ratios Table 28.10 gives abbreviated...Ch. 28 - Performance measures Look again at Table 28.10. At...Ch. 28 - Prob. 5PSCh. 28 - Financial ratios True or false? a. A companys...Ch. 28 - Book rates of return Keller Cosmetics maintains an...Ch. 28 - Prob. 8PSCh. 28 - Prob. 9PSCh. 28 - Prob. 10PSCh. 28 - Prob. 11PS

Ch. 28 - Prob. 12PSCh. 28 - Prob. 13PSCh. 28 - Prob. 14PSCh. 28 - Performance measures Describe some alternative...Ch. 28 - Prob. 16PSCh. 28 - Prob. 17PSCh. 28 - Prob. 18PSCh. 28 - Financial ratios Sara Togas sells all its output...Ch. 28 - Prob. 20PSCh. 28 - Prob. 21PSCh. 28 - Prob. 22PSCh. 28 - Prob. 23PSCh. 28 - Prob. 25PSCh. 28 - Prob. 26PSCh. 28 - Prob. 27PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the market price per share for Rebert is 51.50. Required: 1. Compute the dollar amount of preferred dividends. 2. Compute the number of common shares. 3. Compute earnings per share. (Note: Round to two decimals.) 4. Compute the price-earnings ratio. (Note: Round to the nearest whole number.)arrow_forwardUsing the Value Line Investment Survey report in Exhibit 11.5, find the following information for Apple. What was the amount of revenues (i.e., sales) generated by the company in 2017? What were the latest annual dividends per share and dividend yield? What is the earnings per share (EPS) projection for 2019? How many shares of common stock were outstanding? What were the book value per share and EPS in 2017? How much long-term debt did the company have in the third quarter of 2018?arrow_forwardCompute the following profitability measures for Esplanade Enterprises for 20-2: (a) Profit margin ratio (b) Return on assets (ROA) (c) Return on common stockholders equity (ROE) (d) Earnings per share of common stock (EPS)arrow_forward

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the dividends paid to common stockholders for last year were 2,600,000 and that the market price per share of common stock is 51.50. Required: 1. Compute the dividends per share. 2. Compute the dividend yield. (Note: Round to two decimal places.) 3. Compute the dividend payout ratio. (Note: Round to two decimal places.)arrow_forwardFinancial leverage MicrosoCortrepotied (MSFT) reported the following data (in millions) for a tern year Compute the profit margin, asset turnover, and financial leverage metrics using the expandedDuPont formula. Round profit margin, asset turnover, and financial leverage to two decimalplaces.Round return on stockholders’ equity to one decimal place.arrow_forwardRebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Required: 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed...

Finance

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License