Concept explainers

1.

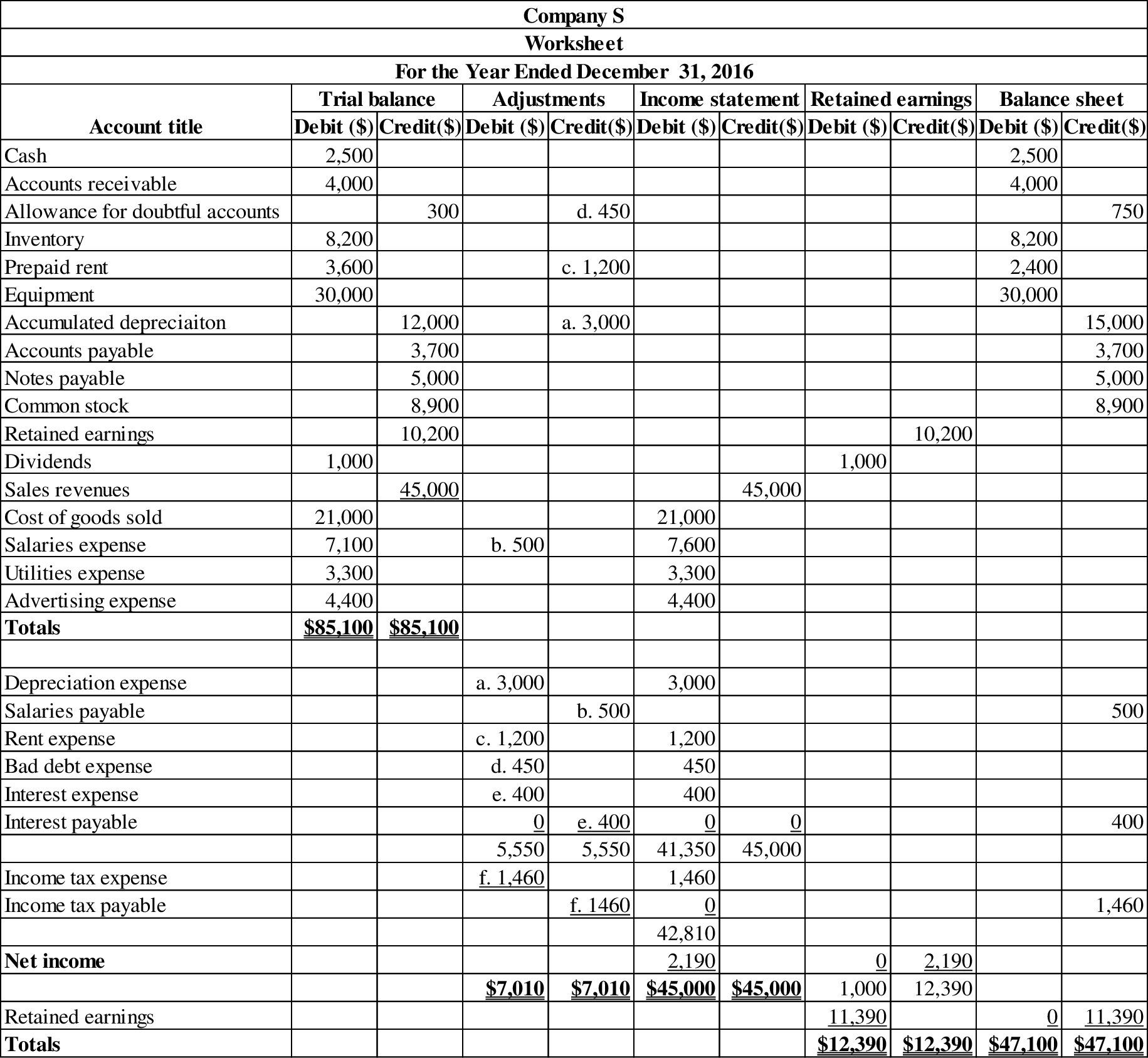

Prepare the worksheet for the year ended December 31, 2016.

1.

Explanation of Solution

Worksheet: A worksheet is a tool that is used while preparing a financial statement. It is a type of form, having multiple columns and it is used in the adjustment process.

Prepare the worksheet for the year ended December 31, 2016:

Table (1)

2.

Prepare the financial statements of Company S for the year ended December 31, 2016.

2.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare income statement of Company S for the year ended December 31, 2016:

| Company S | ||

| Income statement | ||

| For the Year Ended December 31, 2016 | ||

| Particulars | Amount($) | Amount($) |

| Sales revenue | 45,000 | |

| Less: Cost of goods sold | (21,000) | |

| Gross profit | 24,000 | |

| Less: Operating expenses: | ||

| Salaries expense | 7,600 | |

| Utilities expense | 3,300 | |

| Advertising expense | 4,400 | |

| 3,000 | ||

| Rent expense | 1,200 | |

| 450 | ||

| Total operating expense | (19,950) | |

| Income from operations | 4,050 | |

| Other items: | ||

| Interest expense | (400) | |

| Income before income taxes | 3,650 | |

| Less: Income tax expense | (1,460) | |

| Net income | $2,190 | |

| Earnings per share (1,000 shares) | $2.19 | |

Table (2)

Working notes 1: Calculate the amount of salaries expense.

Working note 2: Calculate the amount of rent expense.

Working note 3: Calculate the amount of depreciation expense.

Working note 4: Calculate the amount of income tax expense.

Working note 5: Calculate the amount of bad debt expense.

Working note 6: Calculate earnings per share.

Statement of Retained Earnings: Statement of retained earnings shows, the changes in the retained earnings, and the income left in the company after payment of the dividends, for the accounting period.

Prepare statement of retained earnings of Company S for the year ended December 31, 2016:

| Company S | ||

| Statement of Retained Earnings | ||

| For the Year Ended December 31, 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Retained earnings, January 1, 2016 | 10,200 | |

| Add: Net income | 2,190 | |

| Subtotal | 12,390 | |

| Less: Dividends | (1,000) | |

| Retained earnings at December 31, 2016 | $11,390 | |

Table (3)

Balance Sheet: Balance Sheet is one of the financial statements which summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare the balance sheet of Company S for the year ended December 31, 2016:

| Company S | ||

| Balance Sheet | ||

| As on December 31, 2016 | ||

| Assets | ||

| Current assets: | Amount ($) | Amount ($) |

| Cash | 2,500 | |

| Accounts receivable | 4,000 | |

| Less: Allowance for doubt accounts | (750) | 3,250 |

| Inventory | 8,200 | |

| Prepaid rent | 2,400 | |

| Total current assets | ||

| Property, plant and equipment: | ||

| Equipment | 30,000 | |

| Less: Accumulated depreciation | (15,000) | |

| Net property, plant and equipment | 15,000 | |

| Total assets | $31,350 | |

| Liabilities and Equity | ||

| Liabilities: | ||

| Current liabilities: | ||

| Accounts payable | 3,700 | |

| Notes payable | 5,000 | |

| Salaries payable | 500 | |

| Interest payable | 400 | |

| Income taxes payable | 1,460 | |

| Total liabilities | 11,060 | |

| Shareholders’ Equity | ||

| Contributed Capital: | ||

| Common stock | 8,900 | |

| Retained earnings | 11,390 | |

| Total shareholders’ equity | 20,290 | |

| Total liabilities and shareholders’ equity | $31,350 | |

Table (4)

3.

Prepare the closing entries for the year ended December 31, 2016 in the general journal.

3.

Explanation of Solution

Prepare the closing entries:

| Date | Accounts title and explanation | Post Ref. | Debit | Credit |

| ($) | ($) | |||

| December 31, 2016 | Sales Revenue | 45,000 | ||

| Income Summary | 45,000 | |||

| (To close the revenue accounts) | ||||

| December 31, 2016 | Income Summary | 42,810 | ||

| Cost of Goods Sold | 21,000 | |||

| Salaries Expense | 7,600 | |||

| Utilities Expense | 3,300 | |||

| Advertising Expense | 4,400 | |||

| Depreciation Expense | 3,000 | |||

| Rent Expense | 1,200 | |||

| Bad Debt Expense | 450 | |||

| Interest Expense | 400 | |||

| Income Tax Expense | 1,460 | |||

| (To close the expense accounts) | ||||

| December 31, 2016 | Income Summary | 2,190 | ||

| | 2,190 | |||

| (To close the income summary account) | ||||

| December 31, 2016 | Retained Earnings | 1,000 | ||

| Dividends | 1,000 | |||

| (To close the dividends account) | ||||

Table (5)

Want to see more full solutions like this?

Chapter 3 Solutions

Intermediate Accounting: Reporting and Analysis

- COMPLETION OF A WORK SHEET SHOWING A NET LOSS The trial balance for Cascade Bicycle Shop, a business owned by David Lamond, is shown below. Year-end adjustment information is as follows: (a and b) Merchandise inventory costing 22,000 is on hand as of December 31, 20--. (The periodic inventory system is used.) (c)Supplies remaining at the end of the year, 2,400. (d)Unexpired insurance on December 31, 1,750. (e)Depreciation expense on the building for 20--, 4,000. (f)Depreciation expense on the store equipment for 20--, 3,600. (g)Unearned storage revenue as of December 31, 1,950. (h)Wages earned but not paid as of December 31, 750. REQUIRED 1. Complete the Adjustments columns, identifying each adjustment with its corresponding letter. 2. Complete the work sheet. 3. Enter the adjustments in the general journal.arrow_forwardShannon Company began operations on January 1, 2020. The financial statement contained the following errors: YEAR 2020- Ending inventory 160,000 understated; Depreciation expense 60,000 understated; Insurance expense 100,000 overstated; Prepaid insurance 100,000 understated; YEAR 2021 - Ending inventory 150,000 overstated; Insurance expense 100,000 understated. On December 31, 2021, fully depreciation machinery was sold for P110,000 cash but the sale was not reported until 2022. No corrections have been made for any of the errors. Ignoring income tax, what amount should be reported as net effect of the errors on Working Capital on December 31, 2021?arrow_forwardA company uses straight-line depreciation (round to the nearest whole month) and adjusts its accounts annually on 31 December. On 1 January 2016, A purchased a van for $450,000 which has an estimated useful life of 9 years and no residual value. On 1 January 2021, the company incurred the following expenditure on the van: (i) $1,500 for annual maintenance and servicing (ii) $60,000 to upgrade the van with a new and more powerful engine (iii) $1,000 to paint the van after 5 years of use. On 1 January 2021, the useful life of the van was revised to 13 years with a residual value of $15,000. Required: (a) What is the book value of the van as at 31 December 2020? (b) Journalize annual depreciation of the van on 31 December 2021. Show workings.arrow_forward

- How do I do the journal entries, adjusting entries, and closing entries ( assuming FIFO for inventory) Transactions and information for the year: Jan 1st. Spent $3,500 to improve the first piece of equipment purchased in Year 1. Revised useful life is 5 more years while the new salvage value is $2,000. Jan 2nd, ordered and received 200 units of inventory purchased on account for $13 each Jan 15th, paid $100 to settle a warranty claim from a customer. Feb 3rd, ordered and received 150 units of inventory purchased on account for $12 each Feb 22nd, sold 250 units of inventory at $65 each. $10,000 was on account. The inventory came with a 1 year warranty. The company expects that providing the warranty will cost 1% of the sales made. March 1st, incurred and paid $900 of wages expense Mar 30th, collected $5000 of accounts receivable April 1st, paid $50 to settle a warranty claim from a customer. May 2nd, Paid $4000 of accounts payable. June 1st, Paid $409 of taxes payable June 30th, made…arrow_forwardThe following accounts were taken from the trial balance of Cole Company as of December 31, 2015: sales 70,000$ Inventory 23,000 Interest Revenue 3,000$ Advertising Expense 1,500 Equipment 52,000$ Selling Expense 7,500 Accumulated Depreciation - Equipment 9,600 Interest Expense 2,000 Given the information below, make the necessary adjusting entries. The equipment has an estimated useful life of 10 years and a salvage value of $4,000. Depreciation is calculated using the straight-line method. 2.Of selling expense, $1,500 has been paid in advance. 3.Interest of $800 has accrued on notes receivable. 4.Of advertising expense, $440 was incorrectly debited to Selling Expense.arrow_forwardDower Corporation prepares its financial statements according to IFRS. On March 31, 2016, the company purchased equipment for $240,000. The equipment is expected to have a six-year useful life with no residual value. Dower uses the straight-line depreciation method for all equipment. On December 31, 2016, the end of the company’s fiscal year, Dower chooses to revalue the equipment to its fair value of $220,000. Required: 1. Calculate depreciation for 2016. 2. Prepare the journal entry to record the revaluation of the equipment. Round calculations to the nearest thousand. 3. Calculate depreciation for 2017. 4. Repeat requirement 2 assuming that the fair value of the equipment at the end of 2016 is $195,000.arrow_forward

- Shannon Company began operations on January 1, 2013. The financial statements contained the following errors: 2013 2014 Ending inventory 160,000 understated 150,000 overstated Depreciation expense 60,000 understated Insurance expense 100,000 overstated 100,000 understated Prepaid insurance 100,000 understated On December 31, 2014, fully depreciated machinery was sold for P108,000 cash but the sale was not recorded until 2015. No corrections have been made for any of the errors. Ignoring income tax, what is the total effect of the errors on Working capital on December 31, 2014?arrow_forwardOn January 1, 2017, Sarah Company purchased for $60,000 a truck that had an estimated life of five years and no residual value at the end of its useful life. Sarah uses straight-line depreciation. The cost of the truck was charged to Repairs Expense when purchased in 2017. Required: a. Ignoring income taxes, prepare the journal entry to correct the error if it was discovered and corrected on January 1, 2020 (Sarah's year ends on December 31). b. When preparing the 2020 financial statements, how much depreciation expense should be reported on the comparative 2018 and 2019 income statements?arrow_forwardPeter Henning Tool Company's December 31 year-end financial statements contained the following errors. December 31, 2020 December 31, 2021 Ending inventory $9,600 understated $8,100 overstated Depreciation expense $2,300 understated — An insurance premium of $66,000 was prepaid in 2020 covering the years 2020, 2021, and 2022. The entire amount was charged to expense in 2020. In addition, on December 31, 2021, fully depreciated machinery was sold for $15,000 cash, but the entry was not recorded until 2022. There were no other errors during 2020 or 2021, and no corrections have been made for any of the errors. (Ignore income tax considerations.) Instructions a. Compute the total effect of the errors on 2021 net income. b. Compute the total effect of the errors on the amount of Henning's working capital at December 31, 2021. c. Compute the total effect of the errors on the balance of Henning's retained earnings at December 31, 2021.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning