Concept explainers

1 and 2

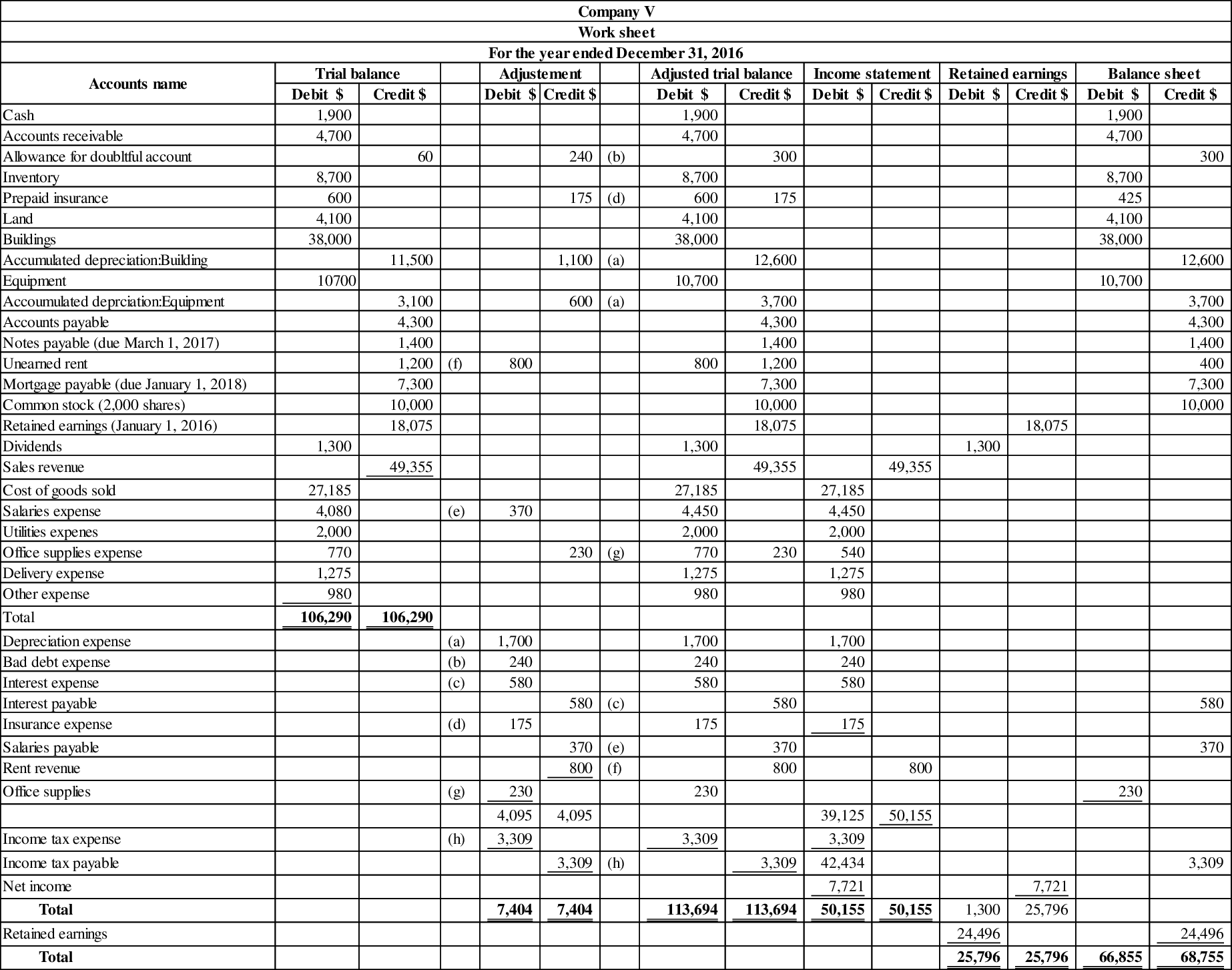

Prepare a 10 column worksheet for the given account balances, and prepare the

1 and 2

Explanation of Solution

Worksheet:

A spreadsheet is a worksheet. It is used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Prepare 10 column worksheet for the given account balances, and trial balance as follows:

Figure (1)

Adjusting entry:

| Date | Account Title & Explanation | Debit ($) | Credit($) |

| December 31, 2016 | 1,700 | ||

| Accumulated depreciation - Buildings | 1,100 | ||

| Accumulated depreciation - Equipment | 600 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| December 31, 2016 | 240 | ||

| Allowance for doubtful accounts | 240 | ||

| (To record the bad debts expense estimated at the end of the accounting year) | |||

| December 31, 2016 | Interest expense | 580 | |

| Interest payable | 580 | ||

| (To record the interest expense incurred at the end of the accounting year) | |||

| December 31, 2016 | Insurance expense | 175 | |

| Prepaid insurance | 175 | ||

| (To record the insurance expense incurred at the end of the accounting year) | |||

| December 31, 2016 | Salaries expense | 370 | |

| Salaries payable | 370 | ||

| (To record the salaries expense accrued at the end of the accounting year) | |||

| December 31, 2016 | Unearned rent | 800 | |

| Rent revenue | 800 | ||

| (To record the rent revenue recognized) | |||

| December 31, 2016 | Office supplies expense | 230 | |

| Office supplies | 230 | ||

| (To record the supplies used during the year) | |||

| December 31, 2016 | Income tax expense (1) | 3,309 | |

| Income tax payable | 3,309 | ||

| (To record the income tax expense incurred at the end of the accounting year) |

Table (1)

Working note (1):

Calculate the value of income tax expense.

3.

Prepare income statement,

3.

Explanation of Solution

Financial statements: Financial statements are condensed summary of transactions communicated in the form of reports for the purpose of decision making. The financial statements are balance sheet, income statement, statement of retained earnings, and the cash flow statement.

Prepare income statement, retained earnings, and balance sheet of Company V as follows:

| Company V | ||

| Income statement | ||

| For the year ended December 31, 2016 | ||

| Particulars | Amount($) | Amount ($) |

| Service revenue | 49,355 | |

| Less: Cost of goods sold | (27,185) | |

| Gross profit | 22,170 | |

| Less: Operating expense | ||

| Salaries expense | 4,450 | |

| Utilities expense | 2,000 | |

| Office supplies expense | 540 | |

| Delivery expense | 1,275 | |

| Depreciation expense | 1,700 | |

| Bad debt expense | 240 | |

| Insurance expense | 175 | |

| Other expense | 980 | |

| Total operating expense | 11,360 | |

| Income from operations | 10,810 | |

| Other items: | ||

| Rent revenue | 800 | |

| Interest expense | (580) | 220 |

| Income before income taxes | 11,030 | |

| Income tax expense | (3,309) | |

| Net income (A) | 14,339 | |

| Number of shares (B) | 2,000 shares | |

| Earnings per share | $3.86 | |

Table (2)

| Company V | |

| Statement of retained earnings | |

| For the year end December 31, 2016 | |

| Particulars | Amount ($) |

| Retained earnings on January 1, 2016 | 18,075 |

| Add: Net income | 7,721 |

| 25,796 | |

| Less: Dividend for 2016 | (1,300) |

| Retained earnings on December 31, 2016 | 24,496 |

Table (3)

| Company V | ||

| Balance sheet | ||

| As at December 31, 2016 | ||

| Assets | Amount ($) | Amount ($) |

| Current assets: | ||

| Cash | 1,900 | |

| 4,700 | ||

| Less: Allowance for doubtful accounts | (300) | 4,400 |

| Inventory | 8,700 | |

| Prepaid insurance | 425 | |

| Office supplies | 230 | |

| Total current assets (C) | 15,655 | |

| Property, plant and equipment: | ||

| Land | 4,100 | |

| Buildings | 38,000 | |

| Less: Accumulated depreciation | (12,600) | 25,400 |

| Equipment | 10,700 | |

| Less: Accumulated depreciation | (3,700) | 7,000 |

| Total property, plant and equipment (D) | 36,500 | |

| Total assets | 52,155 | |

| Liabilities | ||

| Current liabilities: | ||

| Accounts payable | 4,300 | |

| Notes payable (due March 1, 2017) | 1,400 | |

| Interest payable | 580 | |

| Salaries payable | 370 | |

| Unearned rent | 400 | |

| Income tax payable | 3,309 | |

| Total current liabilities | 10,359 | |

| Long-term liabilities: | ||

| Mortgage payable (due January 1, 2018) | 7,300 | |

| Total liabilities | 17,659 | |

| Shareholders' equity | ||

| Contributed capital: | ||

| Common stock | 10,000 | |

| Retained earnings | 24,496 | 34,496 |

| Total shareholder's equity | 52,155 | |

Table (4)

4.

Prepare closing entries of Company V for the current year.

4.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare closing entries of Company V for the current year as follows:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| December 31, 2016 | Sales revenue | 49,355 | |

| Rent revenue | 800 | ||

| Income summary | 50,155 | ||

| (To close the sales revenue and rent revenue account) | |||

| December 31, 2016 | Income summary | 42,434 | |

| Cost of goods sold | 27,185 | ||

| Salaries expense | 4,450 | ||

| Utilities expense | 2,000 | ||

| Office supplies expense | 540 | ||

| Delivery expense | 1,275 | ||

| Other expense | 980 | ||

| Depreciation expense | 1,700 | ||

| Bad debt expense | 240 | ||

| Interest expense | 580 | ||

| Insurance expense | 175 | ||

| Income tax expense | 3,309 | ||

| (To close all expenses account) | |||

| December 31, 2016 | Income summary | 7,721 | |

| Retained earnings (2) | 7,721 | ||

| (To close the income summary account) | |||

| December 31, 2016 | Retained Earnings | 1,300 | |

| Dividends | 1,300 | ||

| (To close the dividends account.) |

Table (5)

Closing entry for revenue account:

In this closing entry, the sales revenue and rent revenue account is closed by transferring the amount of revenue to the income summary account in order to bring the revenue accounts balance to zero. Hence, debit all revenue account for $50,155, and credit the income summary account for $50,155.

Closing entry for expenses account:

In this closing entry, cost of goods sold, operating expense, and income tax expense are closed by transferring the amount of all expenses to the income summary account in order to bring all the expense accounts balance to zero. Hence, debit the income summary account for $42,434, and credit all the expenses account for $42,434.

Closing entry for income summary account:

In this closing entry, the income summary account is closed by transferring the amount of net income to the retained earnings account in order to bring the income summary balance to zero. Hence, debit the income summary account for $7,721, and credit the retained earnings for $7,721.

Closing entry for dividends account:

The dividends are paid to the shareholders out of the retained earnings. Thus, retained earnings are debited since the earnings are decreased on payment of dividend. Dividends are a component of shareholders’ equity account. It is credited because dividends are transferred to retained earnings account.

Working note (2):

Calculate the value of retained earnings.

Want to see more full solutions like this?

Chapter 3 Solutions

Intermediate Accounting: Reporting and Analysis

- Reece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services Co.s accounting clerk prepared the following unadjusted trial balance at July 31, 2016: The data needed to determine year-end adjustments are as follows: a. Depreciation of building for the year, 6,400. b. Depreciation of equipment for the year, 2,800. c. Accrued salaries and wages at July 31, 900. d. Unexpired insurance at July 31, 1,500. e. Fees earned but unbilled on July 31, 10,200. f. Supplies on hand at July 31, 615. g. Rent unearned at July 31, 300. Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation ExpenseBuilding; Depreciation ExpenseEquipment; and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries and preparean adjusted trial balance.arrow_forwardReece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services accounting clerk prepared the following unadjusted trial balance at July 31, 2019: The data needed to determine year-end adjustments are as follows: Depreciation of building for the year, 6,400. Depreciation of equipment for the year, 2,800. Accrued salaries and wages at July 31, 900. Unexpired insurance at July 31, 1,500. Fees earned but unbilled on July 31, 10,200. Supplies on hand at July 31, 615. Rent unearned at July 31, 300. Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable, Rent Revenue, Insurance Expense, Depreciation ExpenseBuilding, Depreciation ExpenseEquipment, and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted trial balance.arrow_forwardAt the beginning of 2020, Tanham Company discovered the following errors made in the preceding 2 years: Reported net income was 27,000 in 2018 and 35,000 in 2019. The allowance for doubtful accounts had a zero balance at the beginning of 2018. No accounts were written off during 2018 or 2019. Ignore income taxes. Required: 1. What is the correct net income for 2018 and 2019? 2. Prepare the adjusting journal entry in 2020 to correct the errors.arrow_forward

- A review of Anderson Corporations books indicates that the errors and omissions pertaining to the balance sheet accounts shown as follows had not been corrected during the applicable years. The net income per the books is: 2017, 10,000; 2018, 12,000; 2019, 15,000; and 2020, 20,000. No dividends were declared during these years and no adjustments were made to retained earnings. The Retained Earnings balance on December 31, 2020, is 50,000. Omissions Required: Determine the correct net income for the years 2017, 2018, 2019, and 2020, and the adjusted balance sheet accounts as of December 31, 2020. Ignore possible income tax effects.arrow_forwardThe unadjusted trial balance of La Mesa Laundry at August 31, 2016, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: a. Wages accrued but not paid at August 31 are 2,200. b. Depreciation of equipment during the year is 8,150. c. Laundry supplies on hand at August 31 are 2,000. d. Insurance premiums expired during the year are 5,300. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as Aug. 31 Bal. In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, Insurance Expense, and Income Summary. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed. 3. Journalize and post the adjusting entries. Identify the adjustments by Adj. and the new balances as Adj. Bal. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of owners equity (no additional investments were made during the year), and a balance sheet. 6. Journalize and post the closing entries. Identify the closing entries by Clos. 7. Prepare a post-closing trial balance.arrow_forwardHardys Landscape Services total revenue on account for 2018 amounted to 273,205. The company, which uses the allowance method, estimates bad debts at percent of total revenue on account. Required Journalize the following selected entries: 2012 Dec. 12Record services performed on account for E. E. Morton, 245. 31Record the adjusting entry for Bad Debts Expense. 31Record the closing entry for Bad Debts Expense. 2013 Feb. 18Write off the account of E. E. Morton as uncollectible, 245. Check Figure Adjusting entry amount, 1,366.03arrow_forward

- Shannon Corporation began operations on January 1, 2019. Financial statements for the years ended December 31, 2019 and 2020, contained the following errors: In addition, on December 31, 2020, fully depreciated machinery was sold for 10,800 cash, but the sale was not recorded until 2021. There were no other errors during 2019 or 2020, and no corrections have been made for any of the errors. Refer to the information for Shannon Corporation above. Ignoring income taxes, what is the total effect of the errors on the amount of working capital (current assets minus current liabilities) at December 31, 2020? a. working capital overstated by 4,200 b. working capital understated by 5,800 c. working capital understated by 6,000 d. working capital understated by 9,800arrow_forwardThe balances of the ledger accounts of Pelango Furniture as of December 31, the end of its fiscal year, are as follows: Data for the adjustments are as follows: ab. Merchandise Inventory at December 31, 104,565. c. Wages accrued at December 31, 934. d. Supplies inventory (on hand) at December 31, 755. e. Depreciation of store equipment, 4,982. f. Depreciation of office equipment, 1,531. g. Insurance expired during the year, 935. h. Rent earned, 2,450. Required 1. Complete the work sheet after entering the account names and balances onto the work sheet. Ignore this step if using CLGL. 2. Journalize the adjusting entries. If using manual working papers, record adjusting entries on journal page 16.arrow_forwardAt the end of 2019, Framber Company received 8,000 as a prepayment for renting a building to a tenant during 2020. The company erroneously recorded the transaction by debiting Cash and crediting Rent Revenue in 2019 instead of 2020. Upon discovery of this error in 2020, what correcting journal entry will Framber make? Ignore income taxes.arrow_forward

- Prepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. depreciation on buildings and equipment, $17,500 B. advertising still prepaid at year end, $2,200 C. interest due on notes payable, $4,300 D. unearned rental revenue, $6,900 E. interest receivable on notes receivable, $1,200arrow_forwardThe following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. Required 1. Prepare a work sheet for the fiscal year ended June 30. Ignore this step if using CLGL. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. Check Figure Net income, 14,066arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. supplies actual count at year end, $6,500 B. remaining unexpired insurance, $6,000 C. remaining unearned service revenue, $1,200 D. salaries owed to employees, $2,400 E. depreciation on property plant and equipment, $18,000arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning