PRINCIPLES OF TAXATION F/BUS...(LL)

23rd Edition

ISBN: 9781260433197

Author: Jones

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 14AP

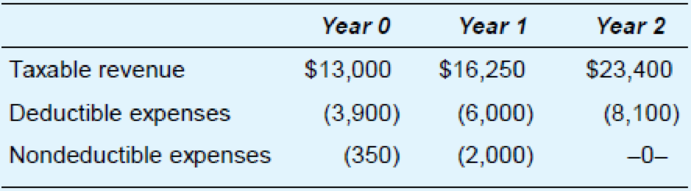

Firm Q is about to engage in a transaction with the following cash flows over a three-year period:

If the firm’s marginal tax rate over the three-year period is 30 percent and its discount rate is 6 percent, compute the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Consider a loan of $10,000 and the following pattern of cash flows. a. What is the interest rate that makes the present worth equal to $0.00? b. Using the interest rate determined in part (a), and leaving the −$10,000 at year 0 in place, determine the equal annual incomes that are equivalent to the gradient series in years 1, 2, 3, and 4?

Calculate a firm's free cash flow if it has net operating profit after taxes of P60,000, depreciation expense of P10,000, net fixed asset investment requirement of P40,000, a net current asset requirement of P30,000 and a tax rate of 30%

You invest in a company which expects to pay you the following amounts in return each year. Year 1: $1,100, Year 2: $2,100, Year 3: $1,600, Year 4: $2,100, and Year 5 $1,500. If an

annual interest rate is 5 percent, what is the present value of this uneven cash flow stream?

$7,883

$7,807

$7,563

$7,237

Chapter 3 Solutions

PRINCIPLES OF TAXATION F/BUS...(LL)

Ch. 3 - Does the NPV of future cash flows increase or...Ch. 3 - Explain the relationship between the degree of...Ch. 3 - Does the after-tax cost of a deductible expense...Ch. 3 - Prob. 4QPDCh. 3 - Prob. 5QPDCh. 3 - Prob. 6QPDCh. 3 - Prob. 7QPDCh. 3 - Which type of tax law provision should be more...Ch. 3 - In the U.S. system of criminal justice, a person...Ch. 3 - Identify two reasons why a firms actual marginal...

Ch. 3 - Prob. 11QPDCh. 3 - Prob. 12QPDCh. 3 - Prob. 1APCh. 3 - Prob. 2APCh. 3 - Prob. 3APCh. 3 - Use a 5 percent discount rate to compute the NPV...Ch. 3 - Consider the following opportunities: Opportunity...Ch. 3 - Prob. 6APCh. 3 - Refer to the income tax rate structure in the...Ch. 3 - Prob. 8APCh. 3 - Company N will receive 100,000 of taxable revenue...Ch. 3 - Prob. 10APCh. 3 - Investor B has 100,000 in an investment paying 9...Ch. 3 - Firm E must choose between two alternative...Ch. 3 - Company J must choose between two alternate...Ch. 3 - Firm Q is about to engage in a transaction with...Ch. 3 - Corporation ABC invested in a project that will...Ch. 3 - Prob. 16APCh. 3 - Investor W has the opportunity to invest 500,000...Ch. 3 - Prob. 18APCh. 3 - Prob. 19APCh. 3 - Prob. 20APCh. 3 - Prob. 21APCh. 3 - Prob. 1IRPCh. 3 - Firm V must choose between two alternative...Ch. 3 - Prob. 3IRPCh. 3 - Refer to the facts in problem 3. Company WB is...Ch. 3 - Prob. 5IRPCh. 3 - Prob. 6IRPCh. 3 - Prob. 7IRPCh. 3 - Prob. 8IRPCh. 3 - Prob. 9IRPCh. 3 - Prob. 1TPCCh. 3 - Firm D is considering investing 400,000 cash in a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculate a firm's free cash flow if it has net operating profit after taxes of R60,000, depreciation expense of R10,000, net fixed asset investment requirement of R40,000, aarrow_forwardSuppose an investor is considering the purchase of a financial instru- ment that promises to deliver the following semiannual cash flows: four payments of $40 every six months for two years and $1,000 delivered four semiannual periods from now. Suppose the price of this financial instrument is $982.0624. What yield is being offered by this financial instrument? Please explain in detail.arrow_forward14. Suppose that you have generated the estimates listed below from a pro forma analysis for a company that had requested a three year loan. The loan is a $1.5 million term loan with the equal annual payments of principals. The P&I payments are due at the end of each year with the annual interest rate = Prime rate + 1.5%. Capital expenditure Cash dividends Cash flow from operations before interest expense a). b). c). Yr.1 250,000 140,000 750,000 Assuming the Prime rate = 7.5% each year. What will be the interest payment at year 3? 25,000 50,000 45,000 53,000 10,000 Yr. 2 125,000 140,000 780,000 Yr. 3 75,000 140,000 800,000arrow_forward

- A firm, whose cost of capital is 8 percent, may acquire equipment for $146,825 and rent it to someone for a period of five years. Note: Although payment of rent is typically considered to be an annuity due, treat it as an ordinary annuity when completing this problem in a spreadsheet or when using present value factors. If the firm charges $38,730 annually to rent the equipment, what are the net present value and the internal rate of return on the investment? Use Appendix D to answer the questions. Use a minus sign to enter negative values, if any. Round your answers for the net present value to the nearest dollar and for the internal rate of return to the nearest whole number. NPV: $ IRR: % Should the firm acquire the equipment? The firm acquire the equipment as the net present value is , and the internal rate of return the firm's cost of capital. If the equipment has no estimated residual value, what must be the minimum annual rental charge for the firm to earn the required 8…arrow_forwardBrans Co. is considering a $270,000 investment, which will provide net returns of $110,000, $140,000, and $220,000 in the second, third, and fourth yearS, respectively. The company has a payback rule of 3 years. Should the company undertake the investment? Use the following table: Cumulative Cash Flow Cash Cash Net Cash Year Outflow Inflow Flow a. No O b. Yesarrow_forwardA firm has a liability cash flow of 100 at the end of year two and a second liability cash flow of 200 at the end of year three. The firm also has asset cash flows of X at the end of years one and five. Using an annual effective interest rate of 10%, calculate the absolute value of the difference between the Macaulay durations of the asset and liability cash flows.arrow_forward

- A firm will report annual Net Income of $50 and depreciation expense of $20 forever in the future. With a tax rate of 30%, how much is the present value of all future “tax shields”? Assume r = 4%.arrow_forwardSuppose you sell a fixed asset for $115,000 when it's book value is $135,000. If your company's marginal tax rate is 21%, what will be the effect on cash flows of this sale (i.e., what will be the after-tax cash flow of this sale)?arrow_forwardKonerko, Inc., manageent expects the company to earn cash flows of $13,227, $15,611, $18,970, and $19, 114 over the next four years. If the company uses an 8 percent discount rate, what is the future value of these cash flows at the end of year 4?arrow_forward

- Suppose you sell a fixed asset for $109,000 when its book value is $129,000. If your company’s marginal tax rate is 21 percent, what will be the effect on cash flows of this sale (i.e., what will be the after-tax cash flow of this sale)? (Enter your answer as a whole number.)arrow_forwardPark Company is considering an investment of $31,500 that provides net cash flows of $13,200 annually for four years. What is the investment's payback period? Numerator: 1 1 Payback Period Denominator: II II = II = Payback Period Payback period 0arrow_forwardFind the Net Present Value (NPV) for Oman Car Company if the initial investment is 8000 OMR and the cash Inflows are as follows: Year 1 =2000 OMR; Year 2 =2500 OMR; Year 3=2800 OMR and Year 4=3000 OMR. Use discount rate as 4.004%. Select one: O a. 2174.15 OMR O b. 1407.54 OMR O c. 1307.40 OMR O d. None of the options O e. 1287.12 OMRarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License