a.

To determine: The net operating working capital for 2018 and 2019.

Statement of Cash Flow: It is a part of financial statements that are included in the annual report of a company. It reports the cash generated or used by the business in a specified period.

Cash Flow from Operating Activities: The cash generated over and above required business operations is called and reported as cash flow from operating activities. Statement of cash flow reports the net cash flow generated or consumed by the business.

a.

Answer to Problem 14P

The net operating working capital for 2018 is $42,000 and 2019 is $50,220.

Explanation of Solution

Determine the net operating working capital for 2018:

Therefore the net operating working capital for 2018 is $42,000.

Determine the net operating working capital for 2019:

Therefore the net operating working capital for 2019 is $50,220.

b.

To determine: The

b.

Answer to Problem 14P

The free cash flow in 2019 for Company A is $22,780.

Explanation of Solution

Determine the free cash flow in 2019 for Company A:

Therefore, the free cash flow in 2019 for Company A is $22,780.

c.

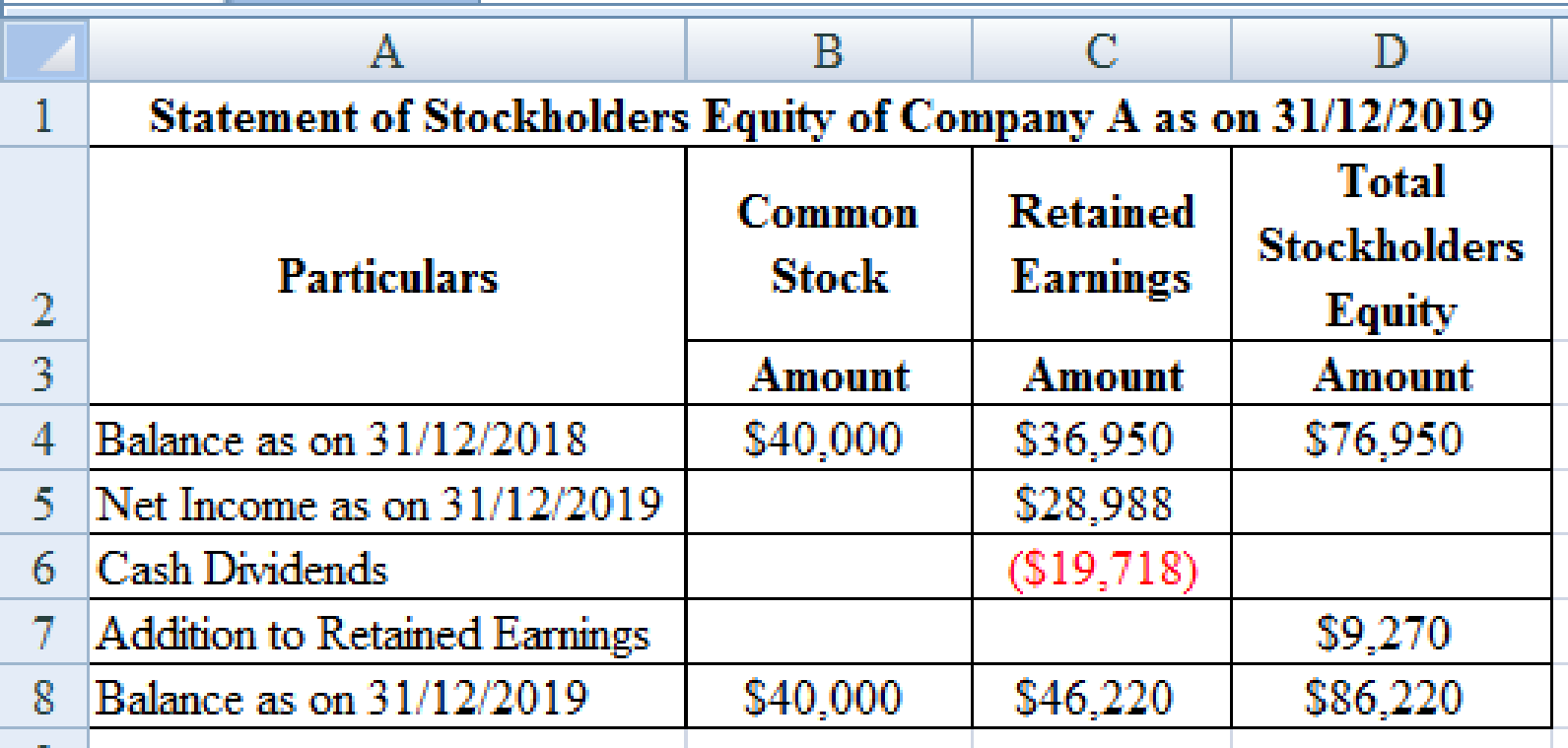

To determine: The statement of

c.

Explanation of Solution

The statement of stockholders equity for Company as on 2019 is as follows:

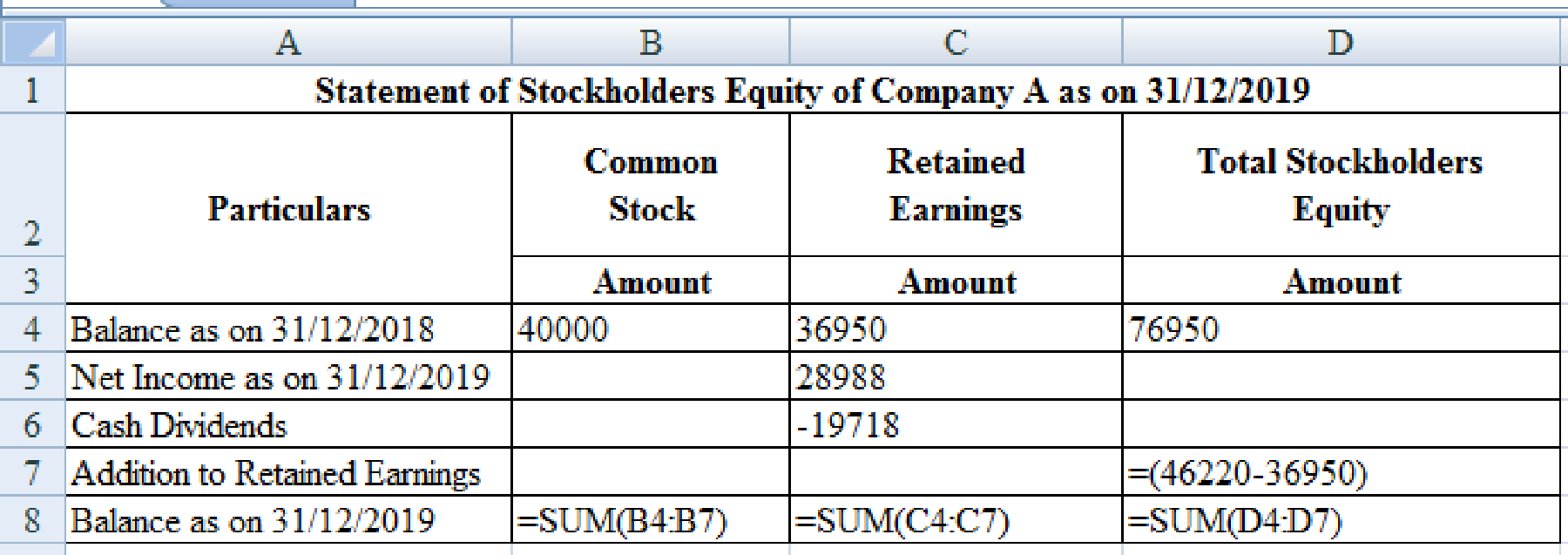

Excel Spreadsheet:

Excel Spreadsheet Workings:

d.

To determine: The EVA of Company A for 2019.

d.

Answer to Problem 14P

The EVA of Company A for 2019 is $21,678.

Explanation of Solution

Determine the EVA of Company A for 2019:

Therefore, the EVA of Company A for 2019 is $21,678.

e.

To determine: The MVA of Company A for 2019.

e.

Answer to Problem 14P

The MVA of Company A for 2019 is $13,780.

Explanation of Solution

Determine the MVA of Company A for 2019:

Therefore, the MVA of Company A for 2019 is $13,780.

Want to see more full solutions like this?

Chapter 3 Solutions

Fundamentals of Financial Management, Concise Edition

- Jordan Company recognized a 5,000 unrealized holding gain on investment in Starbuckss common stock during 2019. The company classified as equity investments. How would this information be reported in a statement of cash flows prepared using the indirect method?arrow_forwardAFN EQUATION Refer to Problem 16-1 and assume that the company had 3 million in assets at the end of 2019. However, now assume that the company pays no dividends. Under these assumptions, what additional funds would be needed for the coming year? Why is this AFN different from the one you found in Problem 16-1?arrow_forwardSelected information from Brook Corporations accounting records and financial statements for 2019 follows: On the statement of cash flows for the year ended December 31, 2019, Brook should disclose a net increase in cash in the amount of: a. 1,700,000 b. 2,400,000 c. 3,700,000 d. 4,200,000arrow_forward

- Dunn Company recognized a 5,000 unrealized holding gain on investment in Starbuckss long-term bonds during 2019. The company classified its investment as an available-for-sale security. How would this information be reported on a statement of cash flows prepared using the indirect method?arrow_forwardComprehensive: Balance Sheet from Statement of Cash Flows Mills Company prepared the following balance sheet at the beginning of 2019: Additional information related to the statement of cash flows: 1. The long-term bonds have a face value of 6,000 and were issued on December 31, 2019. 2. The building was purchased on December 30, 2019. 3. The land was sold at its original cost. 4. The common stock which was sold totaled 300 shares and had a par value of 10 per share. Required: Next Level Prepare a classified balance sheet for Mills as of December 31, 2019. (Hint. Review the information on the statement of cash flows and the balances in the beginning balance sheet accounts to determine the impact on the ending balance sheet accounts.)arrow_forwardInterest and Income Taxes Staggs Company has prepared its 2019 statement of cash flows. In conjunction with this statement, it plans to disclose the interest and income taxes it paid during 2019. The following information is available from its 2019 income statement and beginning and ending balance sheet: Required: 1. Compute the amounts of interest paid and income taxes paid by Staggs for 2019. 2. Next Level Under IFRS, how would interest paid and income taxes paid be reported?arrow_forward

- Leverage Cook Corporation issued financial statements at December 31, 2019, that include the following information: Balance sheet at December 31,2019 Assets $8,000,000 Liabilities $1,200,000 Stockholders' equity (300,000 shares) $6,800,000 Income statement for 2019: Income from operations $1,200,000 Less: Interest expense (100,000) Income before taxes $1,100,000 Less: Income taxes expense (0,30) (330,000) Net income $ 770,000 The levels of assets, liabilities, stockholders' equity, and operating income have been stable in recent years; however, Cook Corporation is planning a 51,800,000 expansion program that will increase income from operations by $350,000 to $1,550,000, Cook is planning to sell 8.5% notes at par to finance the expansion. Required: What earnings per share does Cook report before the expansion?arrow_forwardSpreadsheet and Statement The following 2019 information is available for Stewart Company: Partial additional information: The equipment that was sold for cash had cost 400 and had a book value of 300. Land that was sold brought a cash price of 530. Fifty shares of stock were issued at par. Required: Making whatever additional assumptions that are necessary, 1. Prepare a spreadsheet to support a 2019 statement of cash flows for Stewart. 2. Prepare the statement of cash flows.arrow_forwardComprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning