1.

Calculate the regular earnings for the weekly payroll ended December 13, 2019.

1.

Explanation of Solution

Calculate the regular earnings for the weekly payroll ended December 13, 2019.

Step 1: Calculate the annual salary of Employee LR, Employee RB and Employee GL.

| Employee | Monthly salary (A) | Annual salary (A×12months) |

| Employee LR | $6,240 per month | $74,880.00 |

| Employee RB | $4,680 per month | $56,160.00 |

| Employee GL | $4,900 per month | $58,800.00 |

Table (1)

Step 2: Calculate the regular earnings of each employees.

| Employee | Annual salary (A) | Regular Weekly earnings |

| Employee MA | $97,240 | $1,870.00 |

| Employee BC | $91,000 | $1,750.00 |

| Employee LR | $74,880 | $1,440.00 |

| Employee RB | $56,160 | $1,080.00 |

| Employee GL | $58,800 | $1,130.77 |

| Total | $378,080 | $7,270.77 |

Table (2)

Thus, the total regular earnings for the weekly payroll ended December 13, 2019 is $7,270.77

2.

Calculate the overtime earnings if any applicable to any employee.

2.

Explanation of Solution

Calculate the overtime earnings for Employee GL.

| Employee | Weekly earnings (A) | Regular hourly rate (B) |

Overtime hourly rate (C) |

Overtime earnings (D) |

| Employee GL | $1,130.77 | $28.27 | $42.40 | $339.23 |

Table (3)

Thus, the overtime earnings for Employee GL is $339.23.

3.

Calculate the total regular, overtime earnings and bonus.

3.

Explanation of Solution

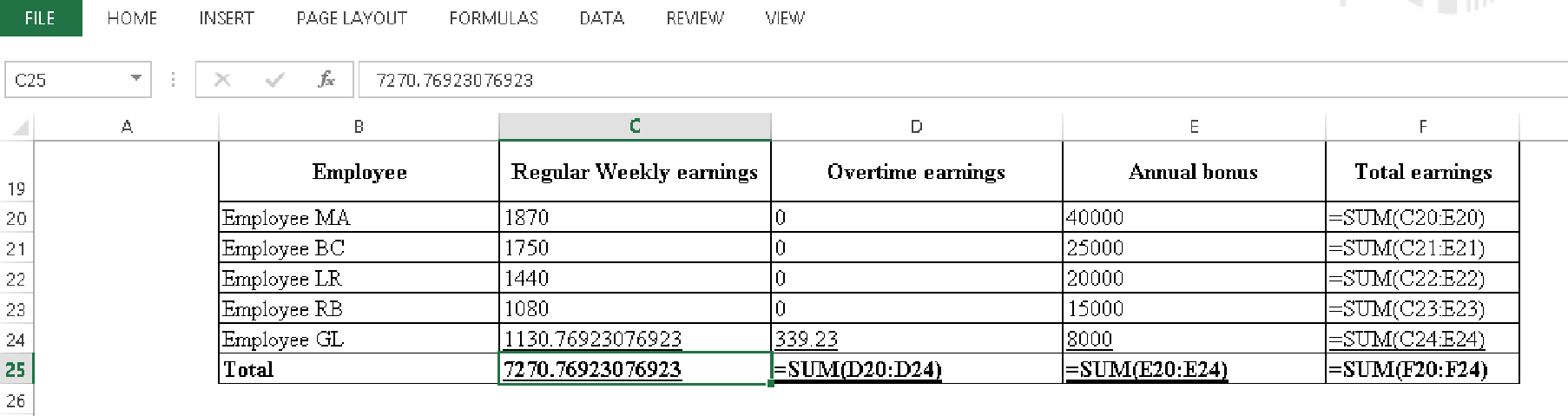

Calculate the total regular, overtime earnings and bonus.

| Employee | Regular Weekly earnings | Overtime earnings | Annual bonus | Total earnings |

| Employee MA | $1,870.00 | $0.00 | $40,000 | $41,870.00 |

| Employee BC | $1,750.00 | $0.00 | $25,000 | $26,750.00 |

| Employee LR | $1,440.00 | $0.00 | $20,000 | $21,440.00 |

| Employee RB | $1,080.00 | $0.00 | $15,000 | $16,080.00 |

| Employee GL | $1,130.77 | $339.23 | $8,000 | $9,470.00 |

| Total | $7,270.77 | $339.23 | $108,000 | $115,610.00 |

Table (4)

Calculation for total regular, overtime earnings and bonus is as follows.

Table (5)

4 and 5.

Calculate the FICA taxable wages for this period and FICA taxes to be withheld for this period.

4 and 5.

Explanation of Solution

Calculate the FICA taxable wages for this period and FICA taxes to be withheld for this period.

| Cumulative earnings as of Last Pay Period | FICA Taxable Wages This Pay Period | FICA Taxes to be Withheld | Employees | ||

| OASDI (A) | HI (B) | OASDI | HI | ||

| $91,630 | $36,770.00 | $41,870 | $2,279.74 | $607.12 | Employee MA |

| $85,750 | $26,750.00 | $26,750 | $1,658.50 | $387.88 | Employee BC |

| $70,560 | $21,440.00 | $21,440 | $1,329.28 | $310.88 | Employee LR |

| $52,920 | $16,080.00 | $16,080 | $996.96 | $233.16 | Employee RB |

| $34,890 | $9,470.00 | $9,470 | $587.14 | $137.32 | Employee GL |

| $110,510.00 | $115,610.00 | $6,851.62 | $1,676.35 | Totals | |

Table (6)

Note: Employee MA’s earnings is exceeding the taxable wage limit of $128,400. Thus, the $5,100

Step 3: Calculate the employer’s portion of the FICA taxes for the week ended.

Calculate the OASDI taxes.

Calculate the HI taxes.

Calculate the total FICA taxes.

Want to see more full solutions like this?

Chapter 3 Solutions

PAYROLL ACCOUNTING 2019

- The total wages and salaries earned by all employees of James Industries during the month of February, as shown in the labor cost summary and the schedule of fixed administrative and sales salaries, are classified as follows: a. Prepare a journal entry to distribute the wages earned during February. b. What is the total amount of payroll taxes that will be imposed on the employer for the payroll, assuming that three administrative employees with combined earnings this period of 4,500 have exceeded 8,000 in earnings prior to the period?arrow_forwardDuring the third calendar quarter of 20--, the Beechtree Inn, owned by Dawn Smedley, employed the persons listed below. Also given are the employees salaries or wages and the amount of tips reported to the owner. The tips were reported by the 10th of each month. The federal income tax and FICA tax to be withheld from the tips were estimated by the owner and withheld equally over the 13 weekly pay periods. The employers portion of FICA tax on the tips was estimated as the same amount. Employees are paid weekly on Friday. The following paydays occurred during this quarter: Taxes withheld for the 13 paydays in the third quarter follow: Based on the information given, complete Form 941 on the following pages for Dawn Smedley. Phone number: (901) 555-7959 Date filed: October 31, 20--arrow_forwardDuring the third calendar quarter of 20--, Bayview Inn, owned by Diane R. Peters, employed the persons listed below. Also given are the employees salaries or wages and the amount of tips reported to the owner. The tips were reported by the 10th of each month. The federal income tax and FICA tax to be withheld from the tips were estimated by the owner and withheld equally over the 13 weekly pay periods. The employers portion of FICA tax on the tips was estimated as the same amount. Employees are paid weekly on Friday. The following paydays occurred during this quarter: Taxes withheld for the 13 paydays in the third quarter follow: Based on the information given, complete Form 941 on the following pages for Diane R. Peters. Phone number: (901) 555-7959 Date filed: October 31, 20--arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning