COST ACCTOUNTING LOOSE W/SOL.MANL

15th Edition

ISBN: 9781323164174

Author: Horngren

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 3.46P

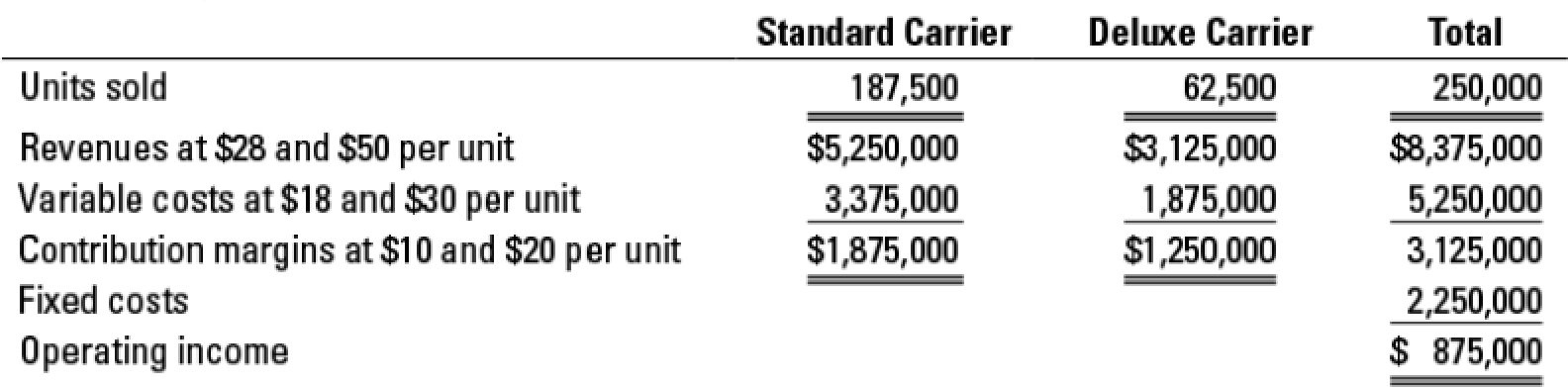

Sales mix, two products. The Stackpole Company retails two products: a standard and a deluxe version of a luggage carrier The

- 1. Compute the breakeven point in units, assuming that the company achieves its planned sales mix.

Required

- 2. Compute the breakeven point in units (a) if only standard carriers are sold and (b) if only deluxe carriers are sold.

- 3. Suppose 250,000 units are sold but only 50,000 of them are deluxe. Compute the operating income. Compute the breakeven point in units. Compare your answer with the answer to requirement 1. What is the major lesson of this problem?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The firm uses the absorption costing approach to cost-plus pricing described in the text to set prices for its products. Based on budgeted sales of 45,000 units next year, the unit product cost of a particular product is ₱15.60. The company's selling, general, and administrative expenses for this product are budgeted to be ₱1,035,000 in total for the year. The company has invested ₱280,000 in this product and expects a return on investment of 11%. The selling price for this product based on the absorption costing approach described would be closest to:

a. ₱39.28

b. ₱17.32

c. ₱97.20

d. ₱38.60

n an attempt to improve budgeting, the controller for Meliore, Inc., has developed a flexible budget for overhead costs. Meliore, Inc., makes two types of products, the standard model and the deluxe model. Meliore expects to produce 400,000 units of the standard model and 110,000 units of the deluxe model during the coming year. The standard model requires 0.10 direct labor hour per unit, and the deluxe model requires 0.16. The controller has developed the following cost formulas for each of the four overhead items:

Cost Formula

Maintenance

$34,600 + $1.25 DLH

Power

$0.50 DLH

Indirect labor

$68,200 + $2.30 DLH

Rent

$31,700

Required:

1. Prepare an overhead budget for the expected activity level for the coming year.

Meliore, Inc.Overhead BudgetFor the Year Ended December 31

Per DLH

Budgeted direct labor hours

?

Variable costs:

Maintenance

?

?

Power

?

?

Indirect labor

?

?

Total variable costs

?

Fixed costs:…

Gonzales Corp. needs to set a target price for its newly designed product EverReady. The following data relate to this product.

Per Unit Total

Direct Material $20

Direct Labor $40

Variable manufacturing Overhead $10

Fixed manufacturing overhead $1,200,000

Variable selling and administrative $5

Fixed selling and administrative $1,120,000

The costs shown above are based on a budgeted volume of 80,000 units produced and sold each year. Gonzales uses cost-plus pricing methods to set its target selling price. Because some managers prefer absorption-cost pricing and others prefer variable-cost pricing, the accounting department provides information under both approaches using a markup of 50% on absorption cost and a markup of 70% on variable cost.…

Chapter 3 Solutions

COST ACCTOUNTING LOOSE W/SOL.MANL

Ch. 3 - Define costvolumeprofit analysis.Ch. 3 - Describe the assumptions underlying CVP analysis.Ch. 3 - Distinguish between operating income and net...Ch. 3 - Prob. 3.4QCh. 3 - Prob. 3.5QCh. 3 - Why is it more accurate to describe the subject...Ch. 3 - CVP analysis is both simple and simplistic. If you...Ch. 3 - Prob. 3.8QCh. 3 - Prob. 3.9QCh. 3 - Give an example of how a manager can decrease...

Ch. 3 - Give an example of how a manager can increase...Ch. 3 - What is operating leverage? How is knowing the...Ch. 3 - There is no such thing as a fixed cost. All costs...Ch. 3 - Prob. 3.14QCh. 3 - In CVP analysis, gross margin is a less-useful...Ch. 3 - Prob. 3.16ECh. 3 - Prob. 3.17ECh. 3 - Prob. 3.18ECh. 3 - Prob. 3.19ECh. 3 - CVP exercises. The Doral Company manufactures and...Ch. 3 - Prob. 3.21ECh. 3 - Prob. 3.22ECh. 3 - Prob. 3.23ECh. 3 - Prob. 3.24ECh. 3 - Prob. 3.25ECh. 3 - Prob. 3.26ECh. 3 - Sales mix, new and upgrade customers. Chartz 1-2-3...Ch. 3 - Prob. 3.28ECh. 3 - Prob. 3.29ECh. 3 - Prob. 3.30ECh. 3 - Prob. 3.31ECh. 3 - Prob. 3.32ECh. 3 - CVP analysis, service firm. Lifetime Escapes...Ch. 3 - Prob. 3.34PCh. 3 - Prob. 3.35PCh. 3 - Prob. 3.36PCh. 3 - Prob. 3.37PCh. 3 - CVP analysis, shoe stores. The HighStep Shoe...Ch. 3 - Prob. 3.39PCh. 3 - Prob. 3.40PCh. 3 - Prob. 3.41PCh. 3 - Prob. 3.42PCh. 3 - Prob. 3.43PCh. 3 - Prob. 3.44PCh. 3 - Prob. 3.45PCh. 3 - Sales mix, two products. The Stackpole Company...Ch. 3 - Prob. 3.47PCh. 3 - Prob. 3.48PCh. 3 - Deciding where to produce. (CMA, adapted) Portal...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hammond Company runs a driving range and golf shop. The budgeted income statement for the coming year is as follows. Required: 1. What is Hammonds variable cost ratio? Its contribution margin ratio? 2. Suppose Hammonds actual revenues are 200,000 greater than budgeted. By how much will before-tax profits increase? Give the answer without preparing a new income statement. 3. How much sales revenue must Hammond earn in order to break even? What is the expected margin of safety? (Round your answers to the nearest dollar.) 4. How much sales revenue must Hammond generate to earn a before-tax profit of 130,000? An after-tax profit of 90,000? (Round your answers to the nearest dollar.) Prepare a contribution margin income statement to verify the accuracy of your last answer.arrow_forwardUse the following information for Exercises 9-50 and 9-51: Assume that Stillwater Designs produces two automotive subwoofers: S12L7 and S12L5. The S12L7 sells for 475, and the S12L5 sells for 300. Projected sales (number of speakers) for the coming 5 quarters are as follows: The vice president of sales believes that the projected sales are realistic and can be achieved by the company. Exercise 9-50 Sales Budget Refer to the information regarding Stillwater Designs above. Required: 1. Prepare a sales budget for each quarter of 20X1 and for the year in total. Show sales by product and in total for each time period. 2. CONCEPTUAL CONNECTION How will Stillwater Designs use this sales budget?arrow_forwardCaribbean Hammocks currently sells 75.000 units at $50 per unit. Its expenses are: Management believes it can increase sales by 5,000 units for every $5 decrease in sales price. It also believes the additional sales will allow a decrease in direct material of $1 for each additional 5,000 units. Prepare a flexible budgeted income statement for 75,000-, 80,000-, and 85,000-unit sales.arrow_forward

- Variable Cost Ratio, Contribution Margin Ratio Chillmax Company plans to sell 3,500 pairs of shoes at 60 each in the coming year. Unit variable cost is 21 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Fixed factory overhead is 30,000 and fixed selling and administrative expense is 48,000. Required: 1. Calculate the variable cost ratio. 2. Calculate the contribution margin ratio. 3. Prepare a contribution margin income statement based on the budgeted figures for next year. In a column next to the income statement, show the percentages based on sales for sales, total variable cost, and total contribution margin.arrow_forwardArtic Camping Gears currently sells 35,000 units at $73 per unit. Its expenses are as follows: Management believes it can increase sales by 2,000 units for every $5 decrease in sales price. It also believes the additional sales will allow a decrease in direct material of $1 for each additional 2,000 units. Prepare a flexible budgeted income statement for 35,000-, 37,000-, and 39,000-unit sales.arrow_forwardKatayama Company produces a variety of products. One division makes neoprene wetsuits. The divisions projected income statement for the coming year is as follows: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the contribution margin ratio. 2. The divisional manager has decided to increase the advertising budget by 140,000 and cut the average selling price to 200. These actions will increase sales revenues by 1 million. Will this improve the divisions financial situation? Prepare a new income statement to support your answer. 3. Suppose sales revenues exceed the estimated amount on the income statement by 612,000. Without preparing a new income statement, determine by how much profits are underestimated. 4. How many units must be sold to earn an after-tax profit of 1.254 million? Assume a tax rate of 34 percent. (Round your answer up to the next whole unit.) 5. Compute the margin of safety in dollars based on the given income statement. 6. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If sales revenues are 20 percent greater than expected, what is the percentage increase in profits?arrow_forward

- Cold X, Inc. uses this information when preparing their flexible budget: direct materials of $2 per unit, direct labor of $3 per unit, and manufacturing overhead of $1 per unit. Fixed costs are $35,000. What would be the budgeted amounts for 20,000 and 25,000 units?arrow_forwardAspen Enterprises makes award pins for various events. Budget information regarding the current period is: A fraternity with which Aspen has a long relationship approached Aspen with a special order for 6,000 pins at a price of $2.75 per pin. Variable costs will be the same as the current production, and the special order will not impact the rest of the companys orders. However, Aspen is operating at capacity and will incur an additional $5,000 in fixed manufacturing overhead if the order is accepted. Based on this information, what is the differential income (loss) associated with accepting the special order?arrow_forwardPlay-Disc makes Frisbee-type plastic discs. Each 12-inch diameter plastic disc has the following manufacturing costs: For the coming year, Play-Disc expects to make 300,000 plastic discs, and to sell 285,000 of them. Budgeted beginning inventory in units is 16,000 with unit cost of 4.75. (There are no beginning or ending inventories of work in process.) Required: 1. Prepare an ending finished goods inventory budget for Play-Disc for the coming year. 2. What if sales increased to 290,000 discs? How would that affect the ending finished goods inventory budget? Calculate the value of budgeted ending finished goods inventory.arrow_forward

- Using the following per-unit and total amounts, prepare a flexible budget at the 14,000-, 15,000-, and 16,000-unit levels of production and sales for Natural Products Inc.:arrow_forwardNovo, Inc., wants to develop an activity flexible budget for the activity of moving materials. Novo uses eight forklifts to move materials from receiving to stores. The forklifts are also used to move materials from stores to the production area. The forklifts are obtained through an operating lease that costs 18,000 per year per forklift. Novo employs 25 forklift operators who receive an average salary of 50,000 per year, including benefits. Each move requires the use of a crate. The crates are used to store the parts and are emptied only when used in production. Crates are disposed of after one cycle (two moves), where a cycle is defined as a move from receiving to stores to production. Each crate costs 1.80. Fuel for a forklift costs 3.60 per gallon. A gallon of gas is used every 20 moves. Forklifts can make three moves per hour and are available for 280 days per year, 24 hours per day (the remaining time is downtime for various reasons). Each operator works 40 hours per week and 50 weeks per year. Required: 1. Prepare a flexible budget for the activity of moving materials, using the number of cycles as the activity driver. 2. Calculate the activity capacity for moving materials. Suppose Novo works at 80 percent of activity capacity and incurs the following costs: Prepare the budget for the 80 percent level and then prepare a performance report for the moving materials activity. 3. Calculate and interpret the volume variance for moving materials. 4. Suppose that a redesign of the plant layout reduces the demand for moving materials to one-third of the original capacity. What would be the budget formula for this new activity level? What is the budgeted cost for this new activity level? Has activity performance improved? How does this activity performance evaluation differ from that described in Requirement 2? Explain.arrow_forwardBudgeted unit sales for the entire countertop oven industry were 2,500,000 (of all model types), and actual unit sales for the industry were 2,550,000. Recall from Cornerstone Exercise 18.6 that Iliff, Inc., provided the following information: Required: 1. Calculate the market share variance (take percentages out to four significant digits). 2. Calculate the market size variance. 3. What if Iliff actually sold a total of 41,000 units (in total of the two models)? How would that affect the market share variance? The market size variance?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY