Concept explainers

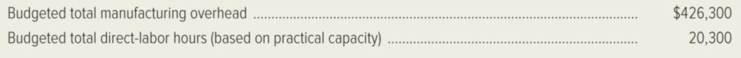

Scholastic Brass Corporation manufactures brass musical instruments for use by high school students. The company uses a normal costing system, in which manufacturing overhead is applied on the basis of direct-labor hours. The company’s budget for the current year included the following predictions.

During March, the firm worked on the following two production jobs:

Job number T81, consisting of 76 trombones

Job number C40, consisting of 110 cornets

The events of March are described as follows:

- a. One thousand square feet of rolled brass sheet metal were purchased on account for $5,000.

- b. Four hundred pounds of brass tubing were purchased on account for $4,000.

- c. The following requisitions were submitted on March 5:

Requisition number 112: 250 square feet of brass sheet metal at $5 per square foot (for job number T81)

Requisition number 113: 1,000 pounds of brass tubing, at $10 per pound (for job number C40)

Requisition number 114: 10 gallons of valve lubricant, at $10 per gallon

All brass used in production is treated as direct material. Valve lubricant is an indirect material.

- d. An analysis of labor time cards revealed the following labor usage for March.

Direct labor: Job number T81, 800 hours at $20 per hour

Direct labor: Job number C40, 900 hours at $20 per hour

Indirect labor: General factory cleanup, $4,000

Indirect labor: Factory supervisory salaries, $9,000

- e.

Depreciation of the factory building and equipment during March amounted to $12,000. - f. Rent paid in cash for warehouse space used during March was $1,200.

- g. Utility costs incurred during March amounted to $2,100. The invoices for these costs were received, but the bills were not paid in March.

- h. March property taxes on the factory were paid in cash, $2,400.

- i. The insurance cost covering factory operations for the month of March was $3,100. The insurance policy had been prepaid.

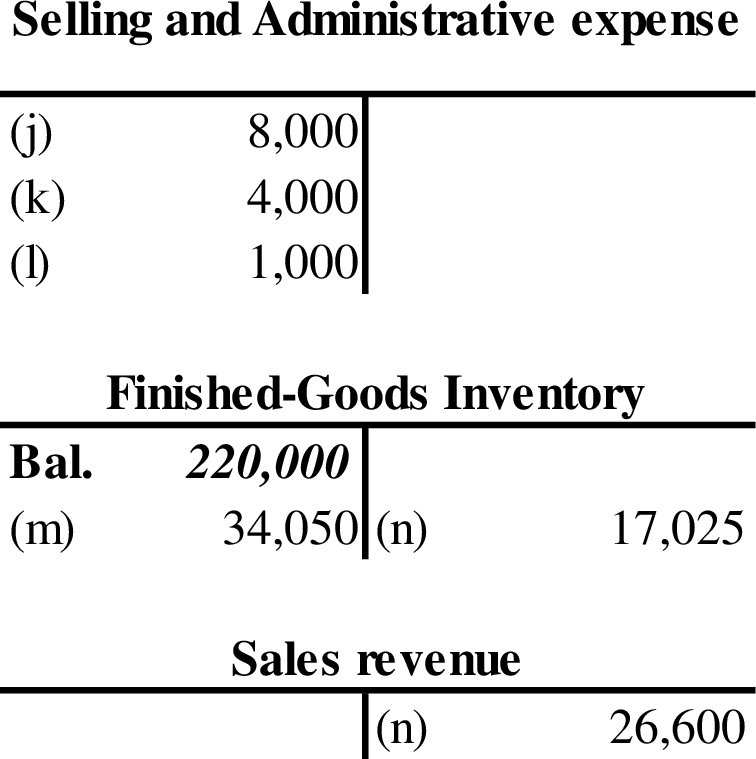

- j. The costs of salaries and

fringe benefits for sales and administrative personnel paid in cash during March amounted to $8,000. - k. Depreciation on administrative office equipment and space amounted to $4,000.

- l. Other selling and administrative expenses paid in cash during March amounted to $1,000.

- m. Job number T81 was completed on March 20.

- n. Half of the trombones in job number T81 were sold on account during March for $700 each.

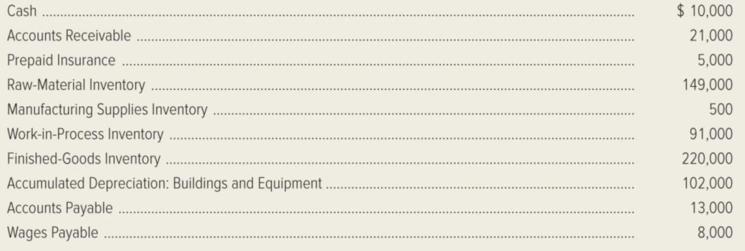

The March 1 balances in selected accounts are as follows:

Required:

- 1. Calculate the company’s predetermined overhead rate for the year.

- 2. Prepare journal entries to record the events of March.

- 3. Set up T-accounts, and

post the journal entries made in requirement (2). - 4. Calculate the over applied or under applied overhead for March. Prepare a

journal entry to close this balance into Cost of Goods Sold. - 5. Prepare a schedule of cost of goods manufactured for March.

- 6. Prepare a schedule of cost of goods sold for March.

- 7. Prepare an income statement for March.

1.

Compute the predetermined overhead rate for Corporation SB.

Explanation of Solution

Predetermined Overhead Rate: Predetermined overhead rate is a measure used to allocate the estimated manufacturing overhead cost to the products or job orders during a particular period. This is generally evaluated at the beginning of each reporting period. The evaluation takes into account the estimated manufacturing overhead cost and the estimated allocation base that includes direct labor hours, direct labor in dollars, machine hours and direct materials.

Compute the predetermined overhead rate for Corporation SB.

Thus, the predetermined overhead rate for Corporation SB is $21 per direct-labor hour.

2.

Record the events in the books of Corporation SB for the month of March.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Record the events in the books of Corporation SB for the month of March.

| Date | Account title and explanation | Debit ($) | Credit ($) |

| a) | Raw-material inventory | 5,000 | |

| Accounts payable | 5,000 | ||

| (To record the purchase of raw materials on account) | |||

| b) | Raw-material inventory | 4,000 | |

| Accounts payable | 4,000 | ||

| (To record the purchase of raw materials on account) | |||

| c) | Work-in-process inventory | 11,250 | |

| Raw-material inventory | 11,250 | ||

| (To record the raw-material inventory) | |||

| Manufacturing overhead | 100 | ||

| Wages payable | 100 | ||

| (To record the wages payable) | |||

| d) | Work-in-process inventory | 34,000 | |

| Manufacturing overhead | 13,000 | ||

| Wages payable | 47,000 | ||

| (To record the labor usage during March) | |||

| Work-in-process inventory | 35,700 | ||

| Manufacturing overhead | 35,700 | ||

| (To record the manufacturing overhead) | |||

| e) | Manufacturing overhead | 12,000 | |

| Accumulated depreciation: Building and equipment | 12,000 | ||

| (To record the depreciation expense for building and equipment) | |||

| f) | Manufacturing overhead | 1,200 | |

| Cash | 1,200 | ||

| (To record the payment of rent in cash) | |||

| g) | Manufacturing overhead | 2,100 | |

| Accounts payable | 2,100 | ||

| (To record the utilities cost incurred during March) | |||

| h) | Manufacturing overhead | 2,400 | |

| Cash | 2,400 | ||

| (To record the payment of property taxes) | |||

| i) | Manufacturing overhead | 3,100 | |

| Prepaid insurance | 3,100 | ||

| (To record the prepaid insurance) | |||

| j) | Selling and administrative expenses | 8,000 | |

| Cash | 8,000 | ||

| (To record the selling and administrative expenses) | |||

| k) | Selling and administrative expenses | 4,000 | |

| Accumulated depreciation: Buildings and equipment | 4,000 | ||

| (To record the depreciation expense for office equipment) | |||

| l) | Selling and administrative expenses | 1,000 | |

| Cash | 1,000 | ||

| (To record the payment of other selling and administrative expenses) | |||

| m) | Finished goods inventory (1) | 34,050 | |

| Work-in-process inventory | 34,050 | ||

| (To record the job completed during March 20.) | |||

| n) | Accounts receivable | 26,600 | |

| Sales revenue | 26,600 | ||

| (To record the sales revenue) | |||

| Cost of goods sold | 17,025 | ||

| Finished goods inventory | 17,025 | ||

| (To record the cost of goods sold) |

Table (1)

Working note (1):

Calculate the amount of finished goods inventory.

| Particulars | Amount ($) |

| Direct material | $1,250 |

| Direct labor | $16000 |

| Manufacturing overhead | $16,800 |

| Total cost | $34,050 |

Table (2)

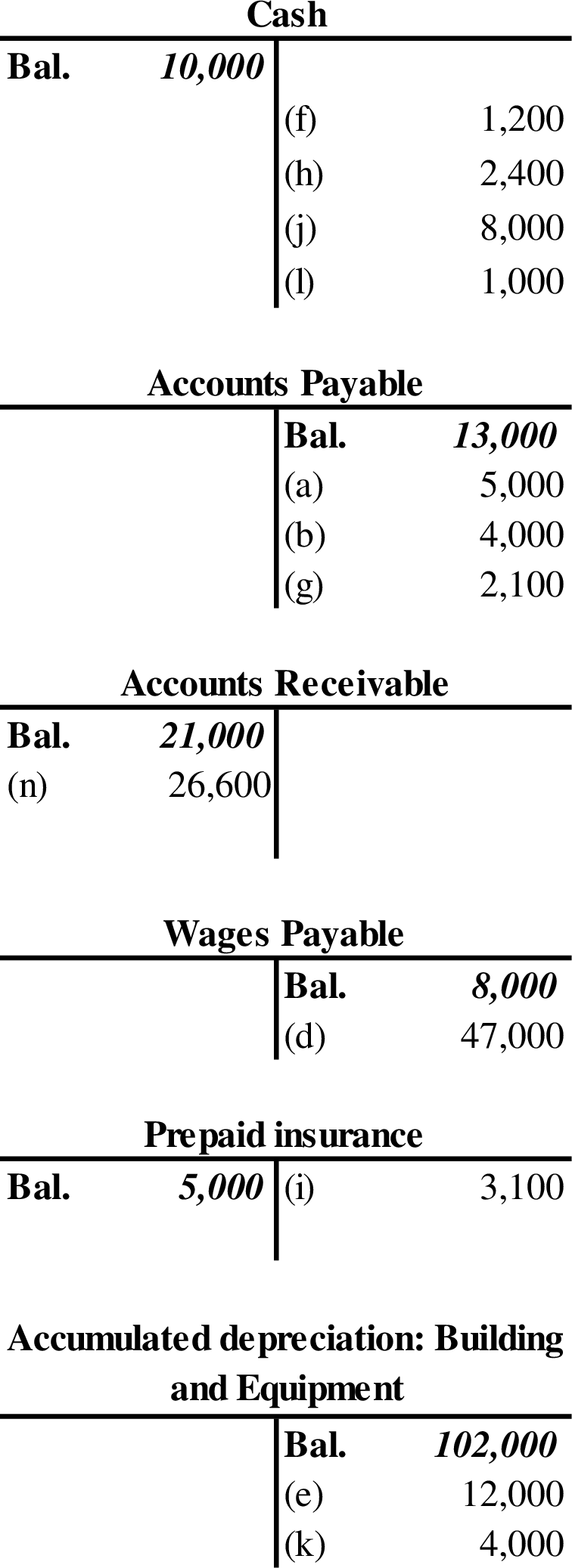

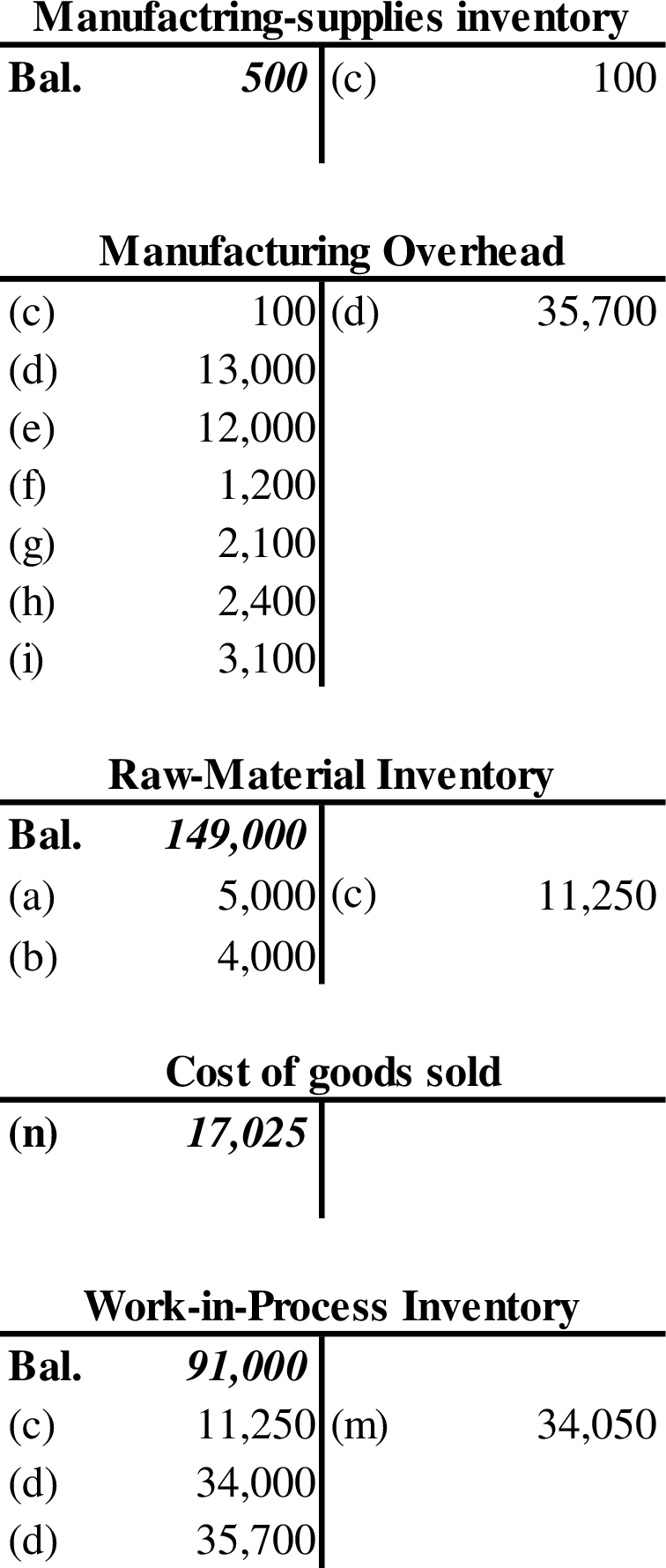

3.

Prepare the T-accounts and post the journal entries.

Explanation of Solution

T-account: The condensed form of a ledger is referred to as T-account. The left-hand side of this account is known as debit, and the right hand side is known as credit.

Prepare the T-accounts and post the journal entries.

4.

Compute the overapplied or underapplied overhead for March and close the balance into cost of goods sold.

Explanation of Solution

Step 1: Calculate the amount of actual overhead.

| Particulars | Amount ($) |

| Indirect material (valve lubricant) | $100 |

| Indirect labor | $13,000 |

| Depreciation: factory building and equipment | $12,000 |

| Rent: warehouse | $1,200 |

| Utilities | $2,100 |

| Property taxes | $2,400 |

| Insurance | $3,100 |

| Total actual overhead | $33,900 |

Table (3)

Step 2: Calculate the amount of applied manufacturing overhead.

Step 3: Calculate the overapplied or underapplied overhead.

Step 4: Prepare the journal entry to close the cost of goods sold.

| Date | Account title and explanation | Debit ($) | Credit ($) |

| Manufacturing overhead | 1,800 | ||

| Cost of goods sold | 1,800 | ||

| (To close the overapplied manufacturing overhead to cost of goods sold) |

Table (4)

5.

Prepare a schedule of cost of goods manufactured for March.

Explanation of Solution

Cost of goods manufactured: Cost of goods manufactured refers to the cost incurred for a making a product, that are available for sales at the end of the accounting period.

Prepare a schedule of cost of goods manufactured for March.

| Corporation SC | ||

| Schedule of Cost of Goods Manufactured | ||

| For the Month of March | ||

| Particulars | Amount ($) | Amount ($) |

| Direct material: | ||

| Raw-material inventory, March 1 | $149,000 | |

| Add: March purchases of raw material | $9,000 | |

| Raw material available for use | $158,000 | |

| Deduct: Raw-material inventory, March 31 | $146,750 | |

| Raw material used | $ 11,250 | |

| Direct labor | $34,000 | |

| Manufacturing overhead: | ||

| Indirect material | $100 | |

| Indirect labor | $13,000 | |

| Depreciation on factory building and equipment | $12,000 | |

| Rent: Warehouse | $1,200 | |

| Utilities | $2,100 | |

| Property taxes | $2,400 | |

| Insurance | $3,100 | |

| Total actual manufacturing overhead | $33,900 | |

| Add: overapplied overhead | $1,800 | |

| Overhead applied to work in process | $35,700 | |

| Total manufacturing costs | $80,950 | |

| Add: Work-in-process inventory, March 1 | $91,000 | |

| Subtotal | $171,950 | |

| Deduct: Work-in-process inventory, March 31 | $137,900 | |

| Cost of goods manufactured | $34,050 | |

Table (5)

Thus, the cost of goods manufactured is $34,050.

6.

Prepare the schedule of cost goods sold for March.

Explanation of Solution

Schedule of cost of goods sold: The schedule which reports all the expenses incurred by a company to sell the goods during the given period.

Prepare the schedule of cost goods sold for March.

| Corporation SC | |

| Schedule of Cost of Goods Sold | |

| For the Month of March | |

| Particulars | Amount ($) |

| Finished-goods inventory, March 1 | $220,000 |

| Add: Cost of goods manufactured | $34,050 |

| Cost of goods available for sale | $254,050 |

| Deduct: Finished-goods inventory, March 31 | $237,025 |

| Cost of goods sold | $17,025 |

| Deduct: Overapplied overhead | $1,800 |

| Cost of goods sold (adjusted for overapplied overhead) | $15,225 |

Table (6)

Thus, the cost of goods sold is $15,225.

7.

Prepare an income statement for March.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for March.

| Corporation SC | |

| Income Statement | |

| For the Month of March | |

| Particulars | Amount ($) |

| Sales revenue | $26,600 |

| Less: Cost of goods sold | $15,225 |

| Gross margin | $11,375 |

| Selling and administrative expenses | $13,000 |

| Income (loss) | ($1,625) |

Table (7)

Thus, there is a net loss for the month of March amounts to ($1,625).

Want to see more full solutions like this?

Chapter 3 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

- Salisbury Bottle Company manufactures plastic two-liter bottles for the beverage industry. The cost standards per 100 two-liter bottles are as follows: At the beginning of March, Salisburys management planned to produce 500,000 bottles. The actual number of bottles produced for March was 525,000 bottles. The actual costs for March of the current year were as follows: a. Prepare the March manufacturing standard cost budget (direct labor, direct materials, and factory overhead) for Salisbury, assuming planned production. b. Prepare a budget performance report for manufacturing costs, showing the total cost variances for direct materials, direct labor, and factory overhead for March. c. Interpret the budget performance report.arrow_forwardNaranjo Company designs industrial prototypes for outside companies. Budgeted overhead for the year was 260,000, and budgeted direct labor hours were 20,000. The average wage rate for direct labor is expected to be 25 per hour. During June, Naranjo Company worked on four jobs. Data relating to these four jobs follow: Overhead is assigned as a percentage of direct labor cost. During June, Jobs 39 and 40 were completed; Job 39 was sold at 130 percent of cost. (Naranjo had originally developed Job 40 to order for a customer; however, that customer was near bankruptcy and the chance of Naranjo being paid was growing dimmer. Naranjo decided to hold Job 40 in inventory while the customer worked out its financial difficulties. Job 40 is the only job in Finished Goods Inventory.) Jobs 41 and 42 remain unfinished at the end of the month. Required: 1. Calculate the balance in Work in Process as of June 30. 2. Calculate the balance in Finished Goods as of June 30. 3. Calculate the cost of goods sold for June. 4. Calculate the price charged for Job 39. 5. What if the customer for Job 40 was able to pay for the job by June 30? What would happen to the balance in Finished Goods? What would happen to the balance of Cost of Goods Sold?arrow_forwardBaldwin Printing Company uses a job order cost system and applies overhead based on machine hours. A total of 150,000 machine hours have been budgeted for the year. During the year, an order for 1,000 units was completed and incurred the following: The accountant computed the inventory cost of this order to be 4.30 per unit. The annual budgeted overhead in dollars was: a. 577,500. b. 600,000. c. 645,000. d. 660,000.arrow_forward

- Business Specialty, Inc., manufactures two staplers: small and regular. The standard quantities of direct labor and direct materials per unit for the year are as follows: The standard price paid per pound of direct materials is 1.60. The standard rate for labor is 8.00. Overhead is applied on the basis of direct labor hours. A plantwide rate is used. Budgeted overhead for the year is as follows: The company expects to work 12,000 direct labor hours during the year; standard overhead rates are computed using this activity level. For every small stapler produced, the company produces two regular staplers. Actual operating data for the year are as follows: a. Units produced: small staplers, 35,000; regular staplers, 70,000. b. Direct materials purchased and used: 56,000 pounds at 1.5513,000 for the small stapler and 43,000 for the regular stapler. There were no beginning or ending direct materials inventories. c. Direct labor: 14,800 hours3,600 hours for the small stapler and 11,200 hours for the regular stapler. Total cost of direct labor: 114,700. d. Variable overhead: 607,500. e. Fixed overhead: 350,000. Required: 1. Prepare a standard cost sheet showing the unit cost for each product. 2. Compute the direct materials price and usage variances for each product. Prepare journal entries to record direct materials activity. 3. Compute the direct labor rate and efficiency variances for each product. Prepare journal entries to record direct labor activity. 4. Compute the variances for fixed and variable overhead. Prepare journal entries to record overhead activity. All variances are closed to Cost of Goods Sold. 5. Assume that you know only the total direct materials used for both products and the total direct labor hours used for both products. Can you compute the total direct materials and direct labor usage variances? Explain.arrow_forwardAbbey Products Company is studying the results of applying factory overhead to production. The following data have been used: estimated factory overhead, 60,000; estimated materials costs, 50,000; estimated direct labor costs, 60,000; estimated direct labor hours, 10,000; estimated machine hours, 20,000; work in process at the beginning of the month, none. The actual factory overhead incurred for November was 80,000, and the production statistics on November 30 are as follows: Required: 1. Compute the predetermined rate, based on the following: a. Direct labor cost b. Direct labor hours c. Machine hours 2. Using each of the methods, compute the estimated total cost of each job at the end of the month. 3. Determine the under-or overapplied factory overhead, in total, at the end of the month under each of the methods. 4. Which method would you recommend? Why?arrow_forwardCardiff Inc. manufactures men’s sport shirts for large stores. It produces a single quality shirt in lots of a dozen according to each customer’s order and attaches the store’s label. The standard costs for a dozen shirts include the following: During October, Cardiff worked on three orders for shirts. Job cost records for the month disclose the following: The following information is also available: Cardiff purchased 95,000 yards of materials during October at a cost of $53,200. The materials price variance is recorded when goods are purchased, and all inventories are carried at standard cost. Direct labor incurred amounted to $112,750 during October. According to payroll records, production employees were paid $10.25 per hour. Overhead is applied on the basis of direct labor hours. Factory overhead totaling $22,800 was incurred during October. A total of $288,000 was budgeted for overhead for the year, based on estimated production at the plant’s normal capacity of 48,000 dozen shirts per year. Overhead is 60% fixed and 40% variable at this level of production. There was no work in process at October 1. During October, Lots 30 and 31 were completed, and all materials were issued for Lot 32, which was 80% completed as to labor and overhead. Required: Prepare a schedule computing the October total standard cost of Lots 30, 31, and 32. Prepare a schedule computing the materials price variance for October and indicate whether it is favorable or unfavorable. For each lot produced during October, prepare schedules computing the following (indicate whether favorable or unfavorable): Materials quantity variance in yards. Labor efficiency variance in hours. (Hint: Don’t forget the percentage of completion.) Labor rate variance in dollars. Prepare a schedule computing the total flexible-budget and production-volume overhead variances for October and indicate whether they are favorable or unfavorable. Give some reasons as to why the production-volume variance may be unfavorable and why it is important to correct the situation.arrow_forward

- The cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forwardRockford Company has four departmental accounts: Building Maintenance, General Factory Overhead, Machining, and Assembly. The direct labor hour method is used to apply factory overhead to the jobs being worked on in Machining and Assembly. The company expects each production department to use 30,000 direct labor hours during the year. The estimated overhead rates for the year include the following: During the year, both Machining and Assembly used 28,000 direct labor hours. Factory overhead costs incurred during the year follow: In determining application rates at the beginning of the year, cost allocations were made as follows, using the sequential distribution method: Building Maintenance to: General Factory Overhead, 10%; Machining, 50%; Assembly, 40%. General factory overhead was distributed according to direct labor hours. Required: Determine the under- or overapplied overhead for each production department. (Hint: First you must distribute the service department costs.)arrow_forwardDouglas Davis, controller for Marston, Inc., prepared the following budget for manufacturing costs at two different levels of activity for 20X1: During 20X1, Marston worked a total of 80,000 direct labor hours, used 250,000 machine hours, made 32,000 moves, and performed 120 batch inspections. The following actual costs were incurred: Marston applies overhead using rates based on direct labor hours, machine hours, number of moves, and number of batches. The second level of activity (the right column in the preceding table) is the practical level of activity (the available activity for resources acquired in advance of usage) and is used to compute predetermined overhead pool rates. Required: 1. Prepare a performance report for Marstons manufacturing costs in the current year. 2. Assume that one of the products produced by Marston is budgeted to use 10,000 direct labor hours, 15,000 machine hours, and 500 moves and will be produced in five batches. A total of 10,000 units will be produced during the year. Calculate the budgeted unit manufacturing cost. 3. One of Marstons managers said the following: Budgeting at the activity level makes a lot of sense. It really helps us manage costs better. But the previous budget really needs to provide more detailed information. For example, I know that the moving materials activity involves the use of forklifts and operators, and this information is lost when only the total cost of the activity for various levels of output is reported. We have four forklifts, each capable of providing 10,000 moves per year. We lease these forklifts for five years, at 10,000 per year. Furthermore, for our two shifts, we need up to eight operators if we run all four forklifts. Each operator is paid a salary of 30,000 per year. Also, I know that fuel costs about 0.25 per move. Assuming that these are the only three items, expand the detail of the flexible budget for moving materials to reveal the cost of these three resource items for 20,000 moves and 40,000 moves, respectively. Based on these comments, explain how this additional information can help Marston better manage its costs. (Especially consider how activity-based budgeting may provide useful information for non-value-added activities.)arrow_forward

- Cozy, Inc., manufactures small and large blankets. It estimates $950,000 in overhead during the manufacturing of 360,000 small blankets and 120,000 large blankets. What is the predetermined overhead rate if a small blanket takes 2 hours of direct labor and a large blanket takes 3 hours of direct labor?arrow_forwardJohnston Company cleans and applies powder coat paint to metal items on a job-order basis. Johnston has budgeted the following amounts for various overhead categories in the coming year. In the coming year, Johnston expects to powder coat 120,000 units. Each unit takes 1.3 direct labor hours. Johnston has found that supplies and gas (used to run the drying ovensall units pass through the drying ovens after powder coat paint is applied) tend to vary with the number of units produced. All other overhead categories are considered to be fixed. (Round all overhead rates to the nearest cent.) Required: 1. Calculate the number of direct labor hours Johnston must budget for the coming year. Calculate the variable overhead rate. Calculate the total fixed overhead for the coming year. 2. Prepare an overhead budget for Johnston for the coming year. Show the total variable overhead, total fixed overhead, and total overhead. Calculate the fixed overhead rate and the total overhead rate (rounded to the nearest cent). 3. What if Johnston had expected to make 118,000 units next year? Assume that the variable overhead per unit does not change and the total fixed overhead amounts do not change. Calculate the new budgeted direct labor hours and prepare a new overhead budget. Calculate the fixed overhead rate and the total overhead rate (rounded to the nearest cent).arrow_forwardThe Calhoun Textile Mill is in the process of deciding on a production schedule. It wishes to know how to weave the various fabrics it will produce during the coming quarter. The sales department has continued orders for each of the 15 fabrics produced by Calhoun. These demands are given in the following table. Also given in this table is the variable cost for each fabric. The mill operates continuously during the quarter: 13 weeks, 7 days a week, and 24 hours a day. There are two types of looms: dobbie and regular. Dobbie looms can be used to make all fabrics and are the only looms that can weave certain fabrics, such as plaids. The rate of production for each fabric on each type of loom is also given in the table. Note that if the production rate is zero, the fabric cannot be woven on that type of loom. Also, if a fabric can be woven on each type of loom, then the production rates are equal. Calhoun has 90 regular looms and 15 dobbie looms. For this problem, assume that the time requirement to change over a loom from one fabric to another is negligible. Management would like to know how to allocate the looms to the fabrics and which fabrics to buy on the market so as to minimize the cost of meeting demand.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning