Concept explainers

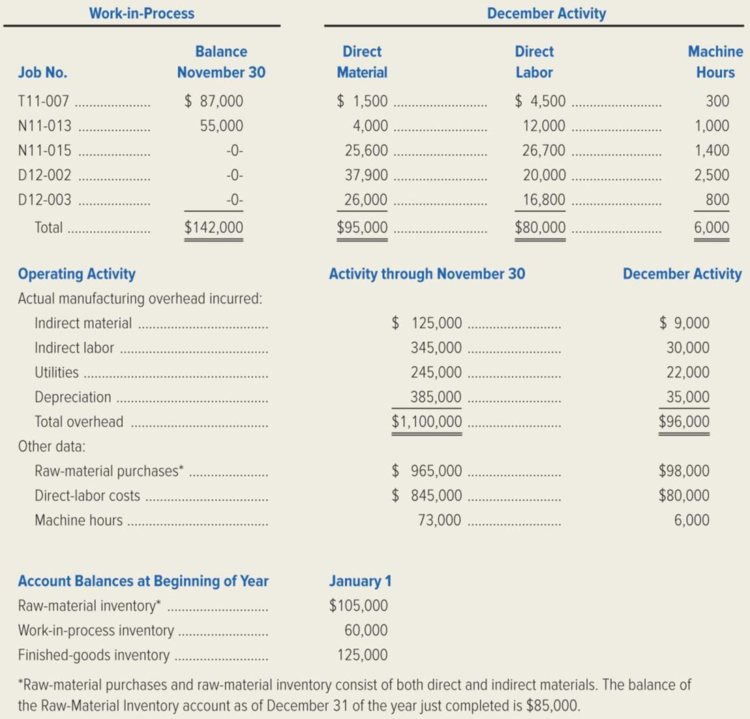

FiberCom, Inc., a manufacturer of fiber optic communications equipment, uses a

Required:

- 1. Explain why manufacturers use a predetermined overhead rate to apply manufacturing overhead to their jobs.

- 2. How much manufacturing overhead would FiberCom have applied to jobs through November 30 of the year just completed?

- 3. How much manufacturing overhead would have been applied to jobs during December of the year just completed?

- 4. Determine the amount by which manufacturing overhead is over applied or under applied as of December 31 of the year just completed.

- 5. Determine the balance in the Finished-Goods Inventory account on December 31 of the year just completed.

- 6. Prepare a Schedule of Cost of Goods Manufactured for FiberCom, Inc. for the year just completed. (Hint: In computing the cost of direct material used, remember that FiberCom includes both direct and indirect material in its Raw-Material Inventory account.)

1.

Explain the reason for using the predetermined overhead rate by the manufacturers to apply manufacturing overhead to their jobs.

Explanation of Solution

Predetermined Overhead Rate: Predetermined overhead rate is a measure used to allocate the estimated manufacturing overhead cost to the products or job orders during a particular period. This is generally evaluated at the beginning of each reporting period. The evaluation takes into account the estimated manufacturing overhead cost and the estimated allocation base that includes direct labor hours, direct labor in dollars, machine hours and direct materials.

The predetermined overhead rates are used by the manufacturers to allocate it to the production jobs the costs incurred for the production are not directly traceable to the particular job. This could result the management to have the timely and accurate job-cost information. The predetermined overhead rates are easy to apply and avoid fluctuations.

2.

Calculate the manufacturing overhead would Incorporation FC have applied to jobs through November 30 for the year just completed.

Explanation of Solution

Calculate the manufacturing overhead would Incorporation FC have applied to jobs through November 30 for the year just completed.

Thus the manufacturing overhead applied is $1,095,000.

3.

Calculate the manufacturing overhead would Incorporation FC have applied to jobs during December for the year just completed.

Explanation of Solution

Calculate the manufacturing overhead would Incorporation FC have applied to jobs during December for the year just completed.

Thus the manufacturing overhead applied is $90,000.

4.

Calculate the amount by which the manufacturing overhead is overapplied or underapplied as of December 31 for the job completed.

Explanation of Solution

Underapplied overhead:

When there is a debit balance in the manufacturing overhead account during the month end, it indicates that overheads applied to jobs are less than the actual overhead cost incurred by the business. Therefore, the debit balance in the manufacturing overhead account is referred to as underapplied overhead.

Overapplied overhead:

When there is a credit balance in the manufacturing overhead account during the month end, indicates that overheads applied to jobs is more than the actual overhead cost incurred by the business. Therefore, the credit balance in the manufacturing overhead account is referred to as over- applied overhead.

Calculate the amount by which the manufacturing overhead is overapplied or underapplied as of December 31 for the job completed.

| Particulars | Calculation | Amount ($) |

| Actual overhead | $1,196,000 | |

| Applied overhead | ($1,185,000) | |

| Underapplied overhead | $11,000 |

Table (1)

Thus, the underapplied overhead is $11,000.

5.

Calculate the balance in the finished-goods inventory account on December 31 of the year just completed.

Explanation of Solution

Calculate the balance in the finished-goods inventory account on December 31 of the year just completed.

| Particulars | Amount ($) |

| November 30 balance for Job No. N11-013 | $ 55,000 |

| December direct material | 4,000 |

| December direct labor | 12,000 |

| December overhead | 15,000 |

| Total finished-goods inventory | $ 86,000 |

Table (2)

Thus, the total finished-goods inventory is $86,000.

6.

Prepare the schedule of cost of goods manufactured for Incorporation FC for the year just completed.

Explanation of Solution

Cost of goods manufactured: Cost of goods manufactured refers to the cost incurred for a making a product, that are available for sales at the end of the accounting period.

Prepare the schedule of cost of goods manufactured for Incorporation FC for the year just completed.

| Incorporation FC | ||

| Schedule of Cost of Goods Manufactured | ||

| For the Year Ended December 31 | ||

| Particulars | Amount ($) | Amount ($) |

| Direct material: | ||

| Raw-material inventory, 1/1 | $105,000 | |

| Raw-material purchases | $1,063,000 | |

| Raw material available for use | $1,168,000 | |

| Deduct: Indirect material used | $134,000 | |

| Raw-material inventory 12/31 | $85,000 | $219,000 |

| Raw material used | $949,000 | |

| Direct labor | $925,000 | |

| Manufacturing overhead: | ||

| Indirect material | $134,000 | |

| Indirect labor | $375,000 | |

| Utilities | $267,000 | |

| Depreciation | $420,000 | |

| Total actual manufacturing overhead | $1,196,000 | |

| Less: Underapplied overhead | $11,000 | |

| Overhead applied to work in process | $1,185,000 | |

| Total manufacturing costs | $3,059,000 | |

| Add: Work-in-process inventory, 1/1 | $60,000 | |

| Subtotal | $3,119,000 | |

| Less: Work-in-process inventory, 12/31 (1) | $150,200 | |

| Cost of goods manufactured | $2,968,800 | |

Table (3)

Working note (1):

Calculate the work-in process inventory as of 12/31.

| Particulars | D12-002 | D12-003 | Total |

| Direct material | $37,900 | $26,000 | $63,900 |

| Direct labor | $20,000 | $16,800 | $36,800 |

| Applied overhead: | |||

| $37,500 | $0 | $37,500 | |

| $0 | $12,000 | $12,000 | |

| Total | $ 95,400 | $ 54,800 | $ 150,200 |

Table (4)

Want to see more full solutions like this?

Chapter 3 Solutions

MANAGERIAL ACCOUNTING-ACCESS

- Brees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide 2,600 units of a component used in its main product. The component is a track assembly that is currently produced internally. The supplier has offered to sell the track assembly for 66 per unit. Brees is currently using a traditional, unit-based costing system that assigns overhead to jobs on the basis of direct labor hours. The estimated traditional full cost of producing the track assembly is as follows: Prior to making a decision, the companys CEO commissioned a special study to see whether there would be any decrease in the fixed overhead costs. The results of the study revealed the following: 3 setups1,160 each (The setups would be avoided, and total spending could be reduced by 1,160 per setup.) One half-time inspector is needed. The company already uses part-time inspectors hired through a temporary employment agency. The yearly cost of the part-time inspectors for the track assembly operation is 12,300 and could be totally avoided if the part were purchased. Engineering work: 470 hours, 45/hour. (Although the work decreases by 470 hours, the engineer assigned to the track assembly line also spends time on other products, and there would be no reduction in his salary.) 75 fewer material moves at 30 per move. Required: 1. Ignore the special study, and determine whether the track assembly should be produced internally or purchased from the supplier. 2. Now, using the special study data, repeat the analysis. 3. Discuss the qualitative factors that would affect the decision, including strategic implications. 4. After reviewing the special study, the controller made the following remark: This study ignores the additional activity demands that purchasing would cause. For example, although the demand for inspecting the part on the production floor decreases, we may need to inspect the incoming parts in the receiving area. Will we actually save any inspection costs? Is the controller right?arrow_forwardSan Mateo Optics, Inc., specializes in manufacturing lenses for large telescopes and cameras used in space exploration. As the specifications for the lenses are determined by the customer and vary considerably, the company uses a job-order costing system. Manufacturing overhead is applied to jobs on the basis of direct labor hours, utilizing the absorption- or full-costing method. San Mateos predetermined overhead rates for 20x1 and 20x2 were based on the following estimates. Jim Cimino, San Mateos controller, would like to use variable (direct) costing for internal reporting purposes as he believes statements prepared using variable costing are more appropriate for making product decisions. In order to explain the benefits of variable costing to the other members of San Mateos management team, Cimino plans to convert the companys income statement from absorption costing to variable costing. He has gathered the following information for this purpose, along with a copy of San Mateos 20x1 and 20x2 comparative income statement. San Mateo Optics, Inc. Comparative Income Statement For the Years 20x1 and 20x2 San Mateos actual manufacturing data for the two years are as follows: The companys actual inventory balances were as follows: For both years, all administrative expenses were fixed, while a portion of the selling expenses resulting from an 8 percent commission on net sales was variable. San Mateo reports any over-or underapplied overhead as an adjustment to the cost of goods sold. Required: 1. For the year ended December 31, 20x2, prepare the revised income statement for San Mateo Optics, Inc., utilizing the variable-costing method. Be sure to include the contribution margin on the revised income statement. 2. Describe two advantages of using variable costing rather than absorption costing. (CMA adapted)arrow_forwardJohn Sheng, a cost accountant at Starlet Company, is developing departmental factory overhead application rates for the companys Tooling and Fabricating departments. The budgeted overhead for each department and the data for one job are as follows: Using the departmental overhead application rates, total overhead applied to Job 231 in the Tooling and Fabricating departments will be: a. 225. b. 303. c. 537. d. 671.arrow_forward

- Minor Co. has a job order cost system and applies overhead based on departmental rates. Service Department 1 has total budgeted costs of 168,000 for next year. Service Department 2 has total budgeted costs of 280,000 for next year. Minor allocates service department costs solely to the producing departments. Service Department 1 cost is allocated to producing departments on the basis of machine hours. Service Department 2 cost is allocated to producing departments on the basis of direct labor hours. Producing Department 1 has budgeted 8,000 machine hours and 12,000 direct labor hours. Producing Department 2 has budgeted 2,000 machine hours and 12,000 direct labor hours. What is the total cost allocation from the two service departments to Producing Department 1? a. 173,600 b. 140,000 c. 134,400 d. 274,400arrow_forwardLansing. Inc., provided the following data for its two producing departments: Machine hours are used to assign the overhead of the Molding Department, and direct labor hours are used to assign the overhead of the Polishing Department. There are 30,000 units of Form A produced and sold and 50,000 of Form B. Required: 1. Calculate the overhead rates for each department. 2. Using departmental rates, assign overhead to live two products and calculate the overhead cost per unit. How does this compare with the plantwide rate unit cost, using direct labor hours? 3. What if the machine hours in Molding were 1,200 for Form A and 3,800 for Form B and the direct labor hours used in Polishing were 5,000 and 15,000, respectively? Calculate the overhead cost per unit for each product using departmental rates, and compare with the plantwide rate unit costs calculated in Requirement 2. What can you conclude from this outcome?arrow_forwardEclipse Motor Company manufactures two types of specialty electric motors, a commercial motor and a residential motor, through two production departments, Assembly and Testing. Presently, the company uses a single plantwide factory overhead rate for allocating factory overhead to the two products. However, management is considering using the multiple production department factory overhead rate method. The following factory overhead was budgeted for Eclipse: Direct machine hours were estimated as follows: In addition, the direct machine hours (dmh) used to produce a unit of each product in each department were determined from engineering records, as follows: a. Determine the per-unit factory overhead allocated to the commercial and residential motors under the single plantwide factory overhead rate method, using direct machine hours as the allocation base. b. Determine the per-unit factory overhead allocated to the commercial and residential motors under the multiple production department factory overhead rate method, using direct machine hours as the allocation base for each department. c. Recommend to management a product costing approach, based on your analyses in (a) and (b). Support your recommendation.arrow_forward

- Rulers Company is a neon sign company that estimated overhead will be $60,000, consisting of 1,500 machine hours. The cost to make Job 416 is $95 in neon, 15 hours of labor at $13 per hour, and five machine hours. During the month, it incurs $95 in indirect material cost, $130 in administrative labor, $320 in utilities, and $350 in depreciation expense. What is the predetermined overhead rate if machine hours are considered the cost driver? What is the cost of Job 416? What is the overhead incurred during the month?arrow_forwardVargas, Inc., produces industrial machinery. Vargas has a machining department and a group of direct laborers called machinists. Each machinist is paid 25,000 and can machine up to 500 units per year. Vargas also hires supervisors to develop machine specification plans and to oversee production within the machining department. Given the planning and supervisory work, a supervisor can oversee three machinists, at most. Vargass accounting and production history reveal the following relationships between units produced and the costs of direct labor and supervision (measured on an annual basis): Required: 1. Prepare two graphs: one that illustrates the relationship between direct labor cost and units produced, and one that illustrates the relationship between the cost of supervision and units produced. Let cost be the vertical axis and units produced the horizontal axis. 2. How would you classify each cost? Why? 3. Suppose that the normal range of activity is between 2,400 and 2,450 units and that the exact number of machinists is currently hired to support this level of activity. Further suppose that production for the next year is expected to increase by an additional 400 units. How much will the cost of direct labor increase (and how will this increase be realized)? Cost of supervision?arrow_forwardFirenza Company manufactures specialty tools to customer order. Budgeted overhead for the coming year is: Previously, Sanjay Bhatt, Firenza Companys controller, had applied overhead on the basis of machine hours. Expected machine hours for the coming year are 50,000. Sanjay has been reading about activity-based costing, and he wonders whether or not it might offer some advantages to his company. He decided that appropriate drivers for overhead activities are purchase orders for purchasing, number of setups for setup cost, engineering hours for engineering cost, and machine hours for other. Budgeted amounts for these drivers are 5,000 purchase orders, 500 setups, and 2,500 engineering hours. Sanjay has been asked to prepare bids for two jobs with the following information: The typical bid price includes a 40 percent markup over full manufacturing cost. Required: 1. Calculate a plantwide rate for Firenza Company based on machine hours. What is the bid price of each job using this rate? 2. Calculate activity rates for the four overhead activities. What is the bid price of each job using these rates? 3. Which bids are more accurate? Why?arrow_forward

- Rockford Company has four departmental accounts: Building Maintenance, General Factory Overhead, Machining, and Assembly. The direct labor hour method is used to apply factory overhead to the jobs being worked on in Machining and Assembly. The company expects each production department to use 30,000 direct labor hours during the year. The estimated overhead rates for the year include the following: During the year, both Machining and Assembly used 28,000 direct labor hours. Factory overhead costs incurred during the year follow: In determining application rates at the beginning of the year, cost allocations were made as follows, using the sequential distribution method: Building Maintenance to: General Factory Overhead, 10%; Machining, 50%; Assembly, 40%. General factory overhead was distributed according to direct labor hours. Required: Determine the under- or overapplied overhead for each production department. (Hint: First you must distribute the service department costs.)arrow_forwardJohnston Company cleans and applies powder coat paint to metal items on a job-order basis. Johnston has budgeted the following amounts for various overhead categories in the coming year. In the coming year, Johnston expects to powder coat 120,000 units. Each unit takes 1.3 direct labor hours. Johnston has found that supplies and gas (used to run the drying ovensall units pass through the drying ovens after powder coat paint is applied) tend to vary with the number of units produced. All other overhead categories are considered to be fixed. (Round all overhead rates to the nearest cent.) Required: 1. Calculate the number of direct labor hours Johnston must budget for the coming year. Calculate the variable overhead rate. Calculate the total fixed overhead for the coming year. 2. Prepare an overhead budget for Johnston for the coming year. Show the total variable overhead, total fixed overhead, and total overhead. Calculate the fixed overhead rate and the total overhead rate (rounded to the nearest cent). 3. What if Johnston had expected to make 118,000 units next year? Assume that the variable overhead per unit does not change and the total fixed overhead amounts do not change. Calculate the new budgeted direct labor hours and prepare a new overhead budget. Calculate the fixed overhead rate and the total overhead rate (rounded to the nearest cent).arrow_forwardPlata Company has identified the following overhead activities, costs, and activity drivers for the coming year: Plata produces two models of microwave ovens with the following activity demands: The companys normal activity is 21,000 machine hours. Calculate the total overhead cost that would be assigned to Model X using an activity-based costing system: a. 230,000 b. 240,000 c. 280,000 d. 190,000arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College