Concept explainers

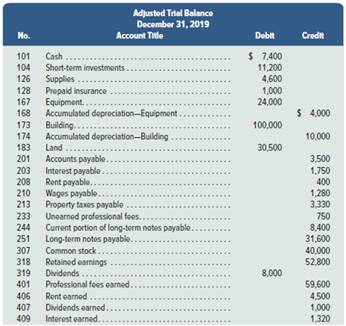

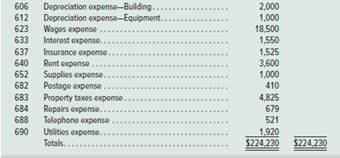

Preparing closing entries and financial statements P6 P7

The adjusted

Required

- Prepare the income statement and the statement of retained earnings for calendar-year 2019 and the classified

balance sheet at December 31, 2019. - Prepare the necessary closing entries at December 31,2019 .

1.

Introduction:

The income statement contains revenues and expense items and is prepared to determine the net income.

Statement of retained earnings is a part of total stockholders’ equity. This report shows the changes in the retained earnings during the year due to dividend declaration and net operating income or loss.

The balance sheet houses all the assets and liabilities starting with the most liquid to non-liquid assets and liabilities. The asset total must tally with the total of liabilities and equity.

To Prepare:

The income statement, statement of retained earnings and the balance sheet for the year ended December 31, 2019, of A Company.

Explanation of Solution

The income statement is prepared as follows:

| A Co. Income Statement For the Year Ended December 31, 2019 | ||

| Particular | Amount | Amount |

| Revenue: | ||

| Professional fees earned | $59,600 | |

| Rent income | $4,500 | |

| Dividend income | $1,000 | |

| Interest income | $1,320 | |

| Total income | 66,420 | |

| Expenses: | ||

| Depreciation expenses − Building | $2,000 | |

| Depreciation expense − Equipment | $1,000 | |

| Interest expense | $1,550 | |

| Wages Expenses | $18,500 | |

| Insurance Expenses | $1,525 | |

| Rent Expenses | $3,600 | |

| Supplies Expenses | $1,000 | |

| Postage Expenses | $410 | |

| Property Taxes Expense | $4,825 | |

| Repairs Expense | $679 | |

| Telephone Expenses | $521 | |

| Utilities Expense | $1,920 | |

| Total expense | $37,530 | |

| Net Income | $28,890 | |

The retained earnings statement is prepared as follows:

| A Co. Statement of Retained Earnings For the Year Ended December 31, 2019 | ||

| Particular | Amount | |

| Balance, January 1 | $52,800 | |

| Add: net income | $28,890 | |

| Less: dividends paid | ($8,000) | |

| Balance, December 31 | $73,690 | |

The balance sheet is prepared as follows:

| A Co. Balance Sheet As of December 31, 2019 | ||

| Particular | Amount | Amount |

| Assets: | ||

| Current Assets: | ||

| Cash | $7,400 | |

| Short-term Investments | $11,200 | |

| Supplies | $4,600 | |

| Prepaid Insurance | $1,000 | |

| Total Current Assets | $24,200 | |

| Non-current Assets: | ||

| Land | $30,500 | |

| Building | $100,000 | |

| Less: Accumulated Depreciation | $10,000 | |

| Building, Net | $90,000 | |

| Equipment | $24,000 | |

| Less: Accumulated Depreciation | $4,000 | |

| Equipment, Net | $20,000 | |

| Total Non-current Assets | $140,500 | |

| Total Assets | $164,700 | |

| Liabilities and Equity: | ||

| Current Liabilities: | ||

| Accounts Payable | $3,500 | |

| Interest Payable | $1,750 | |

| Rent Payable | $400 | |

| Wages Payable | $1,280 | |

| Property Taxes Payable | $3,330 | |

| Unearned Professional Fees | $750 | |

| Long-term Notes Payable - Current Portion | $8,400 | |

| Total Current Liabilities | $19,410 | |

| Non-current Liabilities | ||

| Long-term Notes Payable | $31,600 | |

| Total Non-current Liabilities | $31,600 | |

| Total Liabilities | $51,010 | |

| Equity: | ||

| Common Stock | $40,000 | |

| Retained Earnings | $73,690 | |

| Total Equity | $113,690 | |

| Total Liabilities & Equity | $164,700 | |

2.

Introduction:

As the revenue and expense accounts should not have the ending balances, they should be transferred to the temporary account called income summary to determine the net results. Finally, the net result is transferred to retained earnings. If there is profit, the retained earnings are increased and if there is a loss, then the retained earnings are decreased.

To Prepare:

Closing entries as of December 31, 2019 for A Company.

Explanation of Solution

The closing entries are prepared as follows:

| Journal | |||||

| Date | Account Titles & Explanations | Account No. | Debit | Credit | |

| 2019 | |||||

| 31-Dec | Professional fees earned | 401 | $59,600 | ||

| Rent earned | 406 | $4,500 | |||

| Dividends earned | 407 | $1,000 | |||

| Interest earned | 409 | $1,320 | |||

| Income summary | $66,420 | ||||

| (To close the revenue accounts) | |||||

| 31-Dec | Income summary | $37,530 | |||

| Depreciation expense-Building | 606 | $2,000 | |||

| Depreciation expense-Equipment | 612 | $1,000 | |||

| Wages expenses | 623 | $18,500 | |||

| Interest expense | 633 | $1,550 | |||

| Insurance expense | 637 | $1,525 | |||

| Rent expense | 640 | $3,600 | |||

| Supplies expense | 652 | $1,000 | |||

| Postage expense | 682 | $410 | |||

| Property taxes expense | 683 | $4,825 | |||

| Repairs Expense | 684 | $679 | |||

| Telephone expense | 688 | $521 | |||

| Utilities expense | 690 | $1,920 | |||

| (To close the expense accounts) | |||||

| 31-Dec | Income summary | $28,890 | |||

| Retained earnings | 318 | $28,890 | |||

| (To close the income summary account) | |||||

| 31-Dec | Retained earnings | 318 | $8,000 | ||

| Dividends | 319 | $8,000 | |||

| (To close the dividends paid) | |||||

Want to see more full solutions like this?

Chapter 3 Solutions

FINANCIAL ACCOUNTING FUNDAMENTALS

- Brief Exercise 3-36 Preparing and Analyzing Closing Entries At December 31, 2019, the ledger of Aulani Company includes the following accounts, all having normal balances: Sales Revenue, cost of Goods sold, $31,000; Retained $20,000; Interest Expense, $3,200; Dividends, $5,000, Wages Expense $5,000, and Interest Payable, $2,100. Required: Prepare the closing entries for Aulani at December 31, 2019. How does the closing process affect Aulanis retained earnings?arrow_forward(Appendix 3.1) Cash-Basis Accounting Puntarelli Contracting keep its accounting records on a cash basis during the year. At year end, it adjusts its books to the accrual basis for preparing its financial statements. At the end of 2018, Puntarelli reported the following balance sheet items. It is now the end of 2019. The companys checkbook shows a balance of 4,700, which includes cash receipts from customers of 51,300 and cash payments of 49,300. An examination of the cash payments shows that: (1) 30,600 was paid to suppliers, (2) 12,700 was paid for other operating costs (including 7,200 paid on January 1 for 2 years annual rent), and (3) 6,000 was withdrawn by T. Puntarelli. On December 51, 2019, (1) customers owed Puntarelli Contracting 55,900, (2) Puntarelli owed suppliers and employees 7,000 and 900, respectively, and (3) the ending inventory was 6,300. Puntarelli is depreciating the equipment using straight line depreciation over a 10-year life (no residual value). Required: 1. Using accrual based accounting, prepare a 2019 income statement (show supporting calculations). 2. Using accrual-based accounting, prepare a December 31, 2019, balance sheet (show supporting calculations).arrow_forwardCornerstone Exercise 1-18 Balance Sheet An analysis of the transactions of Cavernous Homes Inc. yields the following totals at December 31, 2019: cash, $3,200; accounts receivable, $4,500; notes payable, $5,000; supplies, $8,100; common stock, $7,000; and retained earnings, 9,800. Required: Prepare a balance sheet for Cavernous Homes Inc. at December 31 , 2019.arrow_forward

- Exercise 3-59 Preparation of Closing Entries Grand Rapids Consulting Inc. began 2019 with a retained earnings balance of $38,100 and has the following accounts and balances at year end: Required: 1. Prepare the closing entries made by Grand Rapids Consulting at the end of 2019. 2. Prepare Grand Rapids Consultings retained earnings statement for 2019.arrow_forwardThe transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1.Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1.Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2.Received 1,000 cash from customers on account. 3.On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 250 to creditors on account. 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart, 7,500. 8.Paid for a newspaper advertisement, 200. 11.Received 1,000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment. 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27.Paid electric bill, 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31.Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2019.arrow_forwardThe transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.arrow_forward

- Interim Reporting (Appendix 5.1) Miller Company prepares quarterly and year-to-date interim reports. The following is its interim income statement for the quarter ended March 31, 2019: On June 30, 2019, Millers accountant completed a worksheet in preparation for developing the year-to-date interim income statement. The following are the accounts and amounts listed on the income statement debit and credit columns of this worksheet: Required: Assuming 20,000 shares of common stock have been outstanding for the entire 6 months, prepare Millers: 1. Year-to-date interim income statement for the first 6 months of 2019. 2. Interim income statement for the second quarter of 2019.arrow_forwardExercise 1-53 Relationships Among the Financial Statements During 2019, Moore Corporation paid $20,000 of dividends. Moores assets, liabilities, and common stock at the end 012018 and 2019 were: Required: Using the information provided. compute Moores net income for 2019.arrow_forward(Appendix 21.1) Comprehensive The following are Adair Companys December 31, 2018, post-closing trial balance and the December 31, 2019, adjusted trial balance: A review of the accounting records reveals the following additional information for 2019: Investments in bonds to be held to maturity were purchased at year-end for 8,600. A building was purchased for 28,000. A note payable was issued for 9,000. Common stock was issued for 14,500. Dividends of 6,500 were declared and paid. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support the 2019 statement of cash flows for Adair. 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)arrow_forward

- Problem 1-60A Income Statement and Balance Sheet The following information for Rogers Enterprises is available at December 31, 2019 and includes all of Rogers financial statement amounts except retained earnings: Required: Prepare a single-step income statement and a c1assified balance sheet for the year ending December 31, 2019, for Rogers.arrow_forwardComprehensive: Income Statement and Supporting Schedules The following s a partial list of the account balances, after adjustments, of Silvoso Company on December 31, 2019: The following information is also available: 1. The company declared and paid a 0.60 per share cash dividend on its common stock. The stock was outstanding the entire year. 2. A physical count determined that the December 31, 2019, ending inventory is 34,100. 3. A tornado destroyed a warehouse, resulting in a pretax loss of 12,000. The last tornado in this area had occurred 10 years earlier. 4. On May 1, 2019, the company sold an unprofitable division (R). From January through April, Division R (a major component of the company) had incurred a pretax operating loss of 8,700. Division R was sold at a pretax gain of 10,000. 5. The company is subject to a 30% income tax rate. Its income tax expense for 2019 totals 4,230. The breakdown is as follows: 6. The company had average shareholders equity of 150,000 during 2019. Required: 1. As supporting documents for Requirement 2, prepare separate supporting schedules for cost of goods sold, selling expenses, general and administrative expenses, and depreciation expense. 2. Prepare a 2019 multiple-step income statement for Silvoso. Include any related note to the financial statements. 3. Prepare a 2019 retained earnings statement. 4. Next Level What was Silvosos return on common equity for 2019? What is your evaluation of Silvosos return on common equity if last year it was 10%?arrow_forwardBrief Exercise 3-33 Preparing an Income Statement The adjusted trial balance of Pelton Company at December 31, 2019, includes the following accounts: Wages Expense, $22,400; Service Revenue. Rent Expense, $3,200; Dividends, $4,000; Retained Earnings, $12,200; and Prepaid Rent, $1,000. Required: Prepare a single-step income Statement for Pelton for 2019.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning