EBK FUNDAMENTALS OF CORPORATE FINANCE

9th Edition

ISBN: 9781260049237

Author: BREALEY

Publisher: MCGRAW HILL BOOK COMPANY

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 6QP

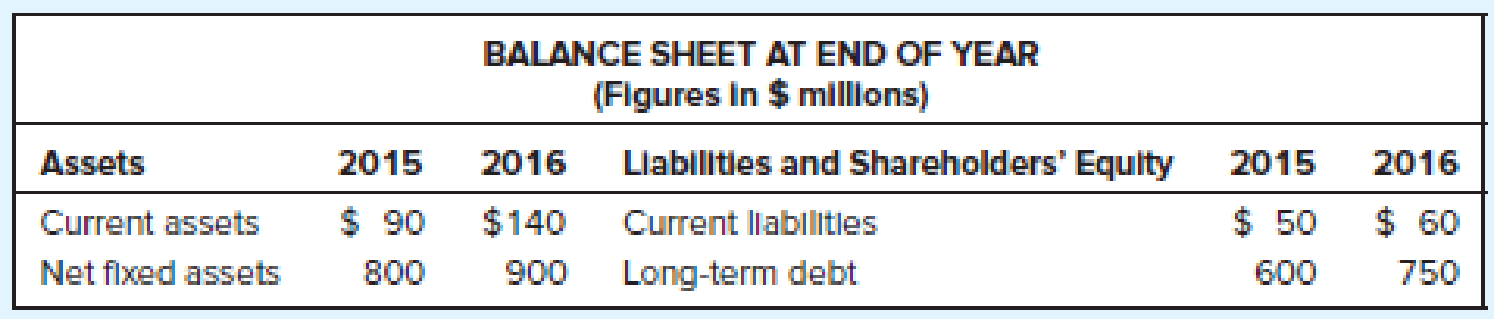

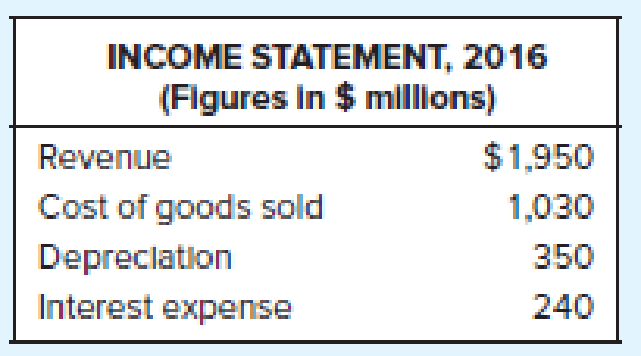

Financial Statements. South Sea Baubles has the following (incomplete)

- a. What is shareholders’ equity in 2015?

- b. What is shareholders’ equity in 2016?

- c. What is net working capital in 2015?

- d. What is net working capital in 2016?

- e. What are taxes paid in 2016? Assume the firm pays taxes equal to 35% of taxable income.

- f. What is cash provided by operations during 2016? Pay attention to changes in net working capital, using Table 3.4 as a guide.

- g. Net fixed assets increased from $800 million to $900 million during 2016. What must have been South Sea’s gross investment in fixed assets during 2016?

- h. If South Sea reduced its outstanding accounts payable by $35 million during the year, what must have happened to its other current liabilities?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Question Description

Use the table below to answer the questions.

2014

Sales

COGS

Interest

Depreciation

Cash

Accounts receivables

Current liabilities

Inventory

Long-term debt

Net fixed assets

Shareholder's equity

Taxes

$6,318

3.945

303

1,204

672

601

414

1,215

4,780

7,700

4,994

217

1. What is the change in net working capital from 2014 to 2015?

2. What is the net capital spending for 2015?

2015

$7,202

4,460

277

1,196

418

578

463

1,598

4,103

7,330

5.358

317

Cash flow to owners. Use the data from the following financial statements in the popup window,. The company

paid interest expense of $18,900 for 2017 and had an overall tax rate of 40% for 2017. Find the cash flow to owners for

2017 by parts and total, with the parts being dividends paid and increases in borrowing from owners (change in common

stock and paid-in-surplus).

The distributed earnings is $

Net new borrowing from owners is $

The cash flow to owners is $

(Round to the nearest dollar.)

(Round to the nearest dollar.)

(Round to the nearest dollar.)

Consider the balance sheets and selected data from the income statement of Keith Corporation that follow (attached)

a. Calculate the firm's net operating profit after taxes (NOPAT) for the year ended December 31, 2015.

b. Calculate the firm's operating cash flow (OCF) for the year ended December 31, 2015.

c. Calculate the firm's free cash flow (FCF) for the year ended December 31, 2015.

d. Interpret, compare and contrast your cash flow estimate in parts (b) and (c).

Chapter 3 Solutions

EBK FUNDAMENTALS OF CORPORATE FINANCE

Ch. 3 - Prob. 1QPCh. 3 - Prob. 2QPCh. 3 - Balance Sheet. Construct a balance sheet for...Ch. 3 - Income Statement. A firm’s income statement...Ch. 3 - Prob. 5QPCh. 3 - Financial Statements. South Sea Baubles has the...Ch. 3 - Prob. 8QPCh. 3 - Prob. 9QPCh. 3 - Prob. 10QPCh. 3 - Prob. 11QP

Ch. 3 - Prob. 12QPCh. 3 - Prob. 13QPCh. 3 - Prob. 14QPCh. 3 - Working Capital. QuickGrow is in an expanding...Ch. 3 - Prob. 16QPCh. 3 - Prob. 17QPCh. 3 - Prob. 18QPCh. 3 - Prob. 19QPCh. 3 - Prob. 20QPCh. 3 - Free Cash Flow. Free cash flow measures the cash...Ch. 3 - Prob. 24QPCh. 3 - Prob. 25QPCh. 3 - Prob. 26QPCh. 3 - Prob. 27QPCh. 3 - Prob. 28QPCh. 3 - Prob. 29QPCh. 3 - Prob. 31QPCh. 3 - Prob. 32QPCh. 3 - Prob. 33QPCh. 3 - Prob. 34QPCh. 3 - Prob. 35QPCh. 3 - Prob. 36QPCh. 3 - Prob. 37QPCh. 3 - Prob. 38QP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Help me pleasearrow_forwardYou are given the financial statements of a company for over the 6-year periods (2016 –2021). Considering 2016 as the base year, compute the trend index for the following items:a. Revenue, cost of goods sold, total expenses and net earnings. Comment on the trends of each of the items.b. Total assets, total liabilities and shareholders’ equity. Comment on the trends of each of the items.c. Cash flow from operation, cash flow from investing, cash flow from financing and closing cash balances. Comment on the trends of each of the items.arrow_forwardYou are a financial Manager of Chevron Corp. You need to assess the effectiveness of working capital management of the company for 2018 using the following data. What is the 2018 Receivable turnover? 2017 Account Receivable = 15,353 000 2018 Account Receivable = 15.050,00O 2017 Inventory = 5,585.000 2018 Inventory = 5 704.00O 2017 Accounts Payable= 14 565 00I 2018 Accounts Payable = 13 953 000 2017 Sales 134,674 000 2018 Sales 158.902 000. 2017 Cost of Sales = 95 114.000 2018 Cost of Sales = 113 997 000 2017 Purchases= 95 114 000 2018 PurchaSes = 123 435 000arrow_forward

- How much net income did H&M’s tool, incorporated, generate during 2021? What was the net profit margin? Is the company financed primarily by liabilities or stock holders equity? What is its current ratio?arrow_forwardThe following condensed information is reported by Beany Baby Collectibles. Income Statement Information Sales revenue Cost of goods sold Net income Balance Sheet Information Current assets Long-term assets Total assets Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and stockholders' equity Required: 1. Calculate the following profitability ratios for 2024: 2. Determine the amount of dividends paid to shareholders in 2024. 2024 $10,440,000 6,827,760 360,000 $1,200,000 1,500,000 2023 $1,600,000 $1,500,000 2,200,000 1,900,000 $3,800,000 $3,400,000 800,000 300,000 $3,800,000 $8,400,000 5,900,000 248,000 $900,000 1,500,000 800,000 200,000 $3,400,000arrow_forwardThe below tables shows Dynamic Mattress’s year-end 2016 and 2018 balance sheets, and its income statement for 2017. Dynamic MattressYear-End Balance Sheet for 2016(figures in $ millions) Assets Liabilities and Shareholders’ Equity Current Assets: Current Liabilities: Cash $ 22 Bank loans $ 22 Marketable securities 11 Accounts payable 80 Accounts receivable 111 Inventory 155 Total current assets $ 299 Total current liabilities $ 102 Fixed assets: Gross investment $ 251 Long-term debt 26 Less depreciation 71 Net worth (equity and retained earnings) 351 Net fixed assets $ 180 Total assets $ 479 Total liabilities and net worth $ 479 Dynamic MattressYear-End Balance Sheet for 2017(figures in $ millions) Assets Liabilities and Shareholders’ Equity Current Assets: Current Liabilities: Cash $ 32.0 Debt due within a year (bank…arrow_forward

- The following condensed information is reported by World of Stamp Collectibles. Income Statement Information Sales revenue Cost of goods sold Net income Balance Sheet Information Current assets Long-term assets Total assets Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and stockholders' equity Required: 1. Calculate the following profitability ratios for 2024: 2. Determine the amount of dividends paid to shareholders in 2024. Required 1 a. Gross profit ratio b. Return on assets c. Profit margin d. Asset turnover e. Return on equity % % % 2024 Complete this question by entering your answers in the tabs below. times % $7,612,000 5,031,532 321,780 Required 1 $1,530,000 2,130,000 $3,660,000 $1,130,000 1,570,000 730,000 230,000 $3,660,000 Required 2 J Calculate the following profitability ratios for 2024: (Round your answers to 1 decimal place.) Profitability Ratios 2023 Required 2 > $7,700,000 5,200,000 178,000 $1,430,000 1,830,000 $3,260,000…arrow_forwardUse the following selected financial information for Cascabel Corporation to answer questions Cascabel Corporation Balance Sheet December 31, 2015 Assets Liabilities and stockholders' equity Current assets Current liabilities Cash Accounts payable Accrued liabilities 2 36 Short-term investments 10 25 Accounts receivable 52 Total current liabilities 61 Inventory 57 Other current assets Long-term debt 102 Total current assets 129 Total liabilities 163 Long-term assets Stockholders' equity Net Plant 195 Common stock 110 Retained earnings Total stockholders' equity Total liabilities and equity 51 161 324 Total assets 324 Cascabel Corporation Income Statement For the Year Ended December 31, 2015arrow_forwardThe below tables shows Dynamic Mattress’s year-end 2016 and 2018 balance sheets, and its income statement for 2017. Dynamic MattressYear-End Balance Sheet for 2016(figures in $ millions) Assets Liabilities and Shareholders’ Equity Current Assets: Current Liabilities: Cash $ 46 Bank loans $ 46 Marketable securities 23 Accounts payable 140 Accounts receivable 123 Inventory 215 Total current assets $ 407 Total current liabilities $ 186 Fixed assets: Gross investment $ 263 Long-term debt 38 Less depreciation 83 Net worth (equity and retained earnings) 363 Net fixed assets $ 180 Total assets $ 587 Total liabilities and net worth $ 587 Dynamic MattressYear-End Balance Sheet for 2017(figures in $ millions) Assets Liabilities and Shareholders’ Equity Current Assets: Current Liabilities: Cash $ 176.0 Debt due within a year (bank…arrow_forward

- Find in the Selected Financial Data or calculate, the following data: Dividends per share declared in 2017. Capital expenditures in 2016. Year total equity grew by the greatest amount over the previous year. Change in total debt from 2013 to 2017.arrow_forwardWhat is the operating cash flow in 2015? What is the change of working capital in 2015? What is the capital spending in 2015? What is the free cash flow in 2015? What is the cash flow to creditors in 2015? What is the cash flow to stockholders in 2015?arrow_forwardCalculation and interpretation of ratios. Data for White Star Limited: Net operating profit after tax is $25 million (2018: $38 million). 1. Use the information above to calculate for 2019 and 2018: a working capital b current ratio c quick ratio d debt-to-equity ratio e return on equity ratio f earnings per share ratio. 2. Identify two warning signals that could have negative implications with respect to the company ’ s ability to generate cash flows to meet its future needs. In each case, explain why the signal you have identified could reflect a cash flow problem. 3. At the annual general meeting of White Star, the managing director, Ms Rose Dawson, made the following statement: ‘ Recently a number of articles in the financial press have questioned the financial position of our company. This criticism is totally unjustified. Net profit was $25 million and total assets have increased by $160 million. These results show that 2019 was a very successful year for White Star. ’ Comment on…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License