Sub part (a):

Consumption schedule and marginal propensity to consume.

Sub part (a):

Explanation of Solution

Table -1 shows the consumption schedule:

Table -1

| Consumption | |

| 100 | 120 |

| 200 | 200 |

| 300 | 280 |

| 400 | 360 |

| 500 | 440 |

| 600 | 520 |

| 700 | 600 |

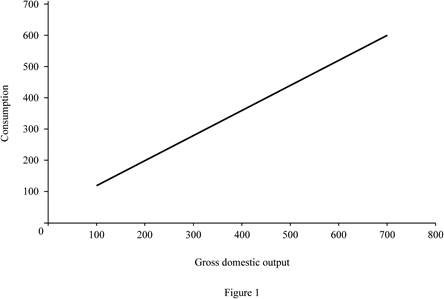

Figure 1 illustrates the level of consumption at different level of gross domestic product (GDP).

In Figure 1, the horizontal axis measures the gross domestic output and the vertical axis measures the consumption level.

Size of marginal propensity to consume (MPC) can be calculated as follows.

The size of marginal propensity to consume is 0.8.

Concept introduction:

Consumption schedule: Consumption schedule refers to the quantity of consumption at different levels of income.

Marginal propensity to consume (MPS): Marginal propensity to consume refers to the sensitivity of change in the consumption level due to the changes occurred in the income level.

Sub part (b):

Disposable income, tax rate, consumption schedule, marginal propensity to consume and multiplier.

Sub part (b):

Explanation of Solution

Disposable income (DI) can be calculated by using the following formula.

Substitute the respective values in Equation (1) to calculate the disposable income at the level of GDP $100.

Disposable income at the level of GDP $100 is $90.

Tax rate can be calculated by using the following formula.

Substitute the respective values in Equation (2) to calculate the tax rate at the level of GDP $100.

Tax rate at the level of GDP is 10%.

New consumption level can be calculated by using the following formula.

Substitute the respective values in Equation (3) to calculate the disposable income at the level of GDP $100. Since, the tax payment is equal amount of decrease in consumption for all the levels of GDP. The decreasing consumption for increasing $10 is assumed to be $8.

New consumption is $112.

Table -2 shows the values of disposable income, new consumption level after tax and the tax rate that are obtained by using Equations (1), (2) and (3).

Table -2

| Gross domestic product | Tax | DI | New consumption | Tax rate |

| 100 | 10 | 90 | 112 | 10% |

| 200 | 10 | 190 | 192 | 5% |

| 300 | 10 | 290 | 272 | 3.33% |

| 400 | 10 | 390 | 352 | 2.5% |

| 500 | 10 | 490 | 432 | 2% |

| 600 | 10 | 590 | 512 | 1.67% |

| 700 | 10 | 690 | 592 | 1.43% |

Size of marginal propensity to consume (MPC) can be calculated as follows.

The size of marginal propensity to consume is 0.8.

Multiplier: Multiplier refers to the ratio of change in the real GDP to the change in initial consumption, at a constant price rate. Multiplier is positively related to the marginal propensity to consumer and negatively related with the marginal propensity to save. Multiplier can be evaluated using the following formula:

Since the value of MPC remains the same for part (a) and part (b), there is no change in the value of multiplier. The value of multiplier is 5

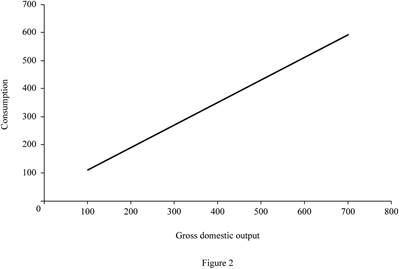

Figure -2 illustrates the level of consumption at different level of gross domestic product (GDP) for lump sum tax (Regressive tax).

In Figure -2, the horizontal axis measures the gross domestic output and the vertical axis measures the consumption level.

Concept introduction:

Consumption schedule: Consumption schedule refers to the quantity of consumption at different levels of income.

Marginal propensity to consume (MPS): Marginal propensity to consume refers to the sensitivity of change in the consumption level due to the changes occurred in the income level.

Multiplier: Multiplier refers to the ratio of change in the real GDP to the change in initial consumption at constant price rate. Multiplier is positively related to the marginal propensity to consumer and negatively related with the marginal propensity to save.

Sub part (c):

Tax amount, consumption schedule, marginal propensity to consume and multiplier.

Sub part (c):

Explanation of Solution

Tax amount can be calculated by using the following formula.

Substitute the respective values in Equation (4) to calculate the tax amount at $100 GDP.

Tax amount is $10.

Table -3 shows the values of disposable income, new consumption level after tax and the tax rate that are obtained by using Equations (1), (2), (3) and (4). The change in tax amount is differing for different levels of GDP. The decreasing consumption for increasing each $10 is assumed to be $8 (Thus, if the tax payment is $30, then the consumption decreases by $24

Table -3

| Gross domestic product | Tax | DI | New consumption | Tax rate |

| 100 | 10 | 90 | 112 | 10% |

| 200 | 20 | 180 | 184 | 10% |

| 300 | 30 | 270 | 256 | 10% |

| 400 | 40 | 360 | 328 | 10% |

| 500 | 50 | 450 | 400 | 10% |

| 600 | 60 | 540 | 472 | 10% |

| 700 | 70 | 630 | 544 | 10% |

Multiplier: Multiplier refers to the ratio of change in the real GDP to the change in initial consumption, at a constant price rate. Multiplier is positively related to the marginal propensity to consumer and negatively related with the marginal propensity to save. Multiplier can be evaluated using the following formula:

Since the value of MPC different for part (a) and part (c), the value of multiplier for both the part is different. The value of multiplier is 3.57

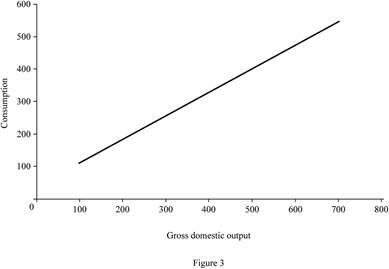

Figure -3 illustrates the level of consumption at different level of gross domestic product (GDP) for proportional tax.

In Figure -3, the horizontal axis measures the gross domestic output and the vertical axis measures the consumption level.

Concept introduction:

Consumption schedule: Consumption schedule refers to the quantity of consumption at different levels of income.

Marginal propensity to consume (MPS): Marginal propensity to consume refers to the sensitivity of change in the consumption level due to the changes occurred in the income level.

Multiplier: Multiplier refers to the ratio of change in the real GDP to the change in initial consumption at constant price rate. Multiplier is positively related to the marginal propensity to consumer and negatively related with the marginal propensity to save.

Sub part (d):

consumption schedule, marginal propensity to consume and multiplier.

Sub part (d):

Explanation of Solution

Marginal propensity to consume can be calculated by using the following formula.

Substitute the respective values in Equation (5) to calculate the MPC at $100 GDP.

The value of MPC is 0.72.

Table -4 shows the values of disposable income, new consumption level after tax and the tax rate that are obtained by using Equations (1), (2), (3), (4) and (5). The change in tax amount is differing for different levels of GDP. The decreasing consumption for increasing each $10 is assumed to be $8 (Thus, if the tax payment is $20, then the consumption decreases by $16

Table -3

| Gross domestic product | Tax | DI | New consumption | Tax rate | MPC |

| 100 | 0 | 100 | 120 | 0% | |

| 200 | 10 | 190 | 192 | 5% | 0.8 |

| 300 | 30 | 270 | 256 | 10% | 0.64 |

| 400 | 60 | 340 | 312 | 15% | 0.56 |

| 500 | 100 | 400 | 360 | 20% | 0.48 |

| 600 | 150 | 450 | 400 | 25% | 0.4 |

| 700 | 210 | 490 | 432 | 30% | 0.32 |

Multiplier: Multiplier refers to the ratio of change in the real GDP to the change in initial consumption, at a constant price rate. Multiplier is positively related to the marginal propensity to consumer and negatively related with the marginal propensity to save.

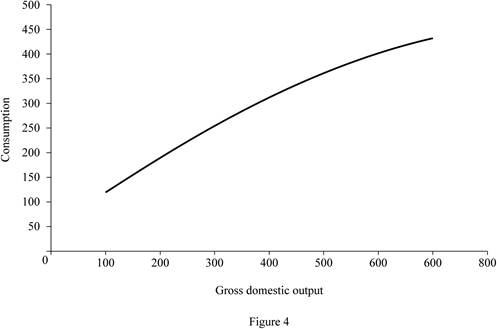

Multiplier value is differing for each level of GDP. When the tax rate increases, it reduces the value of MPC. Since the value of MPC decreases, the value of multiplier will also decrease.

Figure 4 illustrates the level of consumption at different level of gross domestic product (GDP) for progressive tax.

In Figure 4, the horizontal axis measures the gross domestic output and the vertical axis measures the consumption level.

Concept introduction:

Consumption schedule: Consumption schedule refers to the quantity of consumption at different levels of income.

Marginal propensity to consume (MPS): Marginal propensity to consume refers to the sensitivity of change in the consumption level due to the changes occurred in the income level.

Multiplier: Multiplier refers to the ratio of change in the real GDP to the change in initial consumption at constant price rate. Multiplier is positively related to the marginal propensity to consumer and negatively related with the marginal propensity to save.

Sup part (e):

Marginal propensity to consume and multiplier.

Sup part (e):

Explanation of Solution

Figure 1, Figure 2, Figure 3 and Figure 4 reveals that the proportional and progressive tax system reduces the value of MPC, so that the value of multiplier also decreases. The regressive tax system (Lump sum tax) does not alter the MPC. Since there is no change in the MPC, the multiplier remains the same.

Concept introduction:

Marginal propensity to consume (MPS): Marginal propensity to consume refers to the sensitivity of change in the consumption level due to the changes occurred in the income level.

Progressive tax: Progressive tax refers to the higher income people paying higher tax amount than the lower income people.

Proportional tax: Proportional tax rate refers to the fixed tax rate regardless of income and the tax rate and is the same for all levels of income.

Regressive tax: Regressive tax refers to the higher income people paying lower percentage of tax amount and lower income people paying higher percentage of tax amount.

Multiplier: Multiplier refers to the ratio of change in the real GDP to the change in initial consumption at constant price rate. Multiplier is positively related to the marginal propensity to consumer and negatively related with the marginal propensity to save.

Want to see more full solutions like this?

Chapter 31 Solutions

ECONOMICS W/CONNECTPLUS PKG>IC<

- 7 Suppose that the government increases its expenditure on goods and services by $100 billion and pays for these goods and services by raising autonomous taxes by $100 billion. What is the effect on aggregate demand and real GDP of each change individually and of the two combinedarrow_forward#wk4-10 Suppose that the investment demand curve in a certain economy is such that investment declines by $120 billion for every 1 percentage point increase in the real interest rate. Also, suppose that the investment demand curve shifts rightward by $170 billion at each real interest rate for every 1 percentage point increase in the expected rate of return from investment.If stimulus spending (an expansionary fiscal policy) by government increases the real interest rate by 2 percentage points, but also raises the expected rate of return on investment by 1 percentage point, how much investment, if any, will be crowded out?$ billionarrow_forward6 Suppose a closed economy with no government spending or taxing initially. Suppose also that intended investment is equal to 100 and the aggregate consumption function is given by C = 250 + 0.75Y. And suppose that, if at full employment, the economy would produce an output and income of 3500 By how much would the government need to raise spending (G) to bring the economy to full employment? (round your answer to the nearest whole value)arrow_forward

- 7 Suppose a closed economy with no government spending which in equilibrium is producing an output and income of 1100. Suppose also that the marginal propensity to consume is 0.80, and that, if at full employment, the economy would produce an output and income of 3850 By how much would the government need to cut taxes (T) to bring the economy to full employment? (round your answer to the nearest whole value)arrow_forwardSuppose that consumer spending initially rises by $5 billion for every 1 percent rise in household wealth and that investment spending initially rises by $20 billion for every 1 percentage point fall in the real interest rate. Also assume that the economy�s multiplier is 3. If household wealth falls by 6 percent because of declining house values, and the real interest rate falls by 2 percentage points, in what direction and by how much will the aggregate demand curve initially shift at each price level? The aggregate demand curve will shift_____ by $____ billion. In what direction and by how much will it eventually shift? The aggregate demand curve will shift_____ by $____ billion..arrow_forward1.) Suppose a closed economy with no government spending or taxing is capable of producing an output of $2050 at full employment. Suppose also that autonomous consumption is $150, intended investment is $60, and the mpc is 0.50. How much additional autonomous spending (for instance, from the government) is needed to move the economy to full employment? 2.)Suppose a closed economy with no government spending or taxing is capable of producing an output of $1200 at full employment. Suppose also that autonomous consumption is $120, intended investment is $70, and the mpc is 0.50. What is the value of output (Y) in equilibrium? 3.)Suppose output and income is equal to 24400, the marginal propensity to consume is 0.80, and autonomous consumption is 650. Calculate total saving for this economy, assuming no public or foreign sector. (Round your answer to the nearest whole number.) 4. According to the lectures, which of the following ideas are representative of (neo)classical…arrow_forward

- 2. In macroeconomic theory, total or aggregate spending is denoted by A and total or aggregateproduction of income by Y. Which one of the following statements is incorrect? A When A is greater than Y, there is disequilibrium and Y will tend to increase.B When A is equal to Y, there is equilibrium and Y will remain unchanged.C When A is less than Y, there is disequilibrium and Y will decrease.D When A is greater than Y, there is disequilibrium and A will decrease.arrow_forward4) Suppose an economy is producing real GDP of $600 billion. Potential GDP is equal to $540 billion, and the MPC is equal to 0.6. i)What kind of a gap (or problem) is this country experiencing? ii) What policy action do you suggest the government to take to eliminate the gap? State both the specific type of policy action and its size. Show your work for partial credit.arrow_forward9)Calculate how much output would expand by if the government increased spending by $500 billion and financed this spending by increasing lump-sum taxes by the same amount.arrow_forward

- - If an economy is in equilibrium when national income is $1000, and the level of autonomous expenditure is $600, what is the value of the marginal propensity to withdraw? - Imagine an economy where autonomous expenditure is $50, and the equilibrium level of national income is $125. How much would autonomous expenditure have to increase by to achieve full employment output of $150 ?arrow_forward12. Given this diagram of Consumption and Savings functions, What will be the level of savings at an income level of 60? 6. Given this diagram of Consumption and Savings functions, What will be the level of savings at an income level of 20? 07. Given this diagram of Consumption and Savings functions, What is the level of total desired consumption at income level of 80? 8. Given this diagram of Consumption and Savings functions, What is the level of "induced consumption" at income level of 40arrow_forward5 Suppose that the MPC is 0.60 and there are no crowding-out effects. If government expenditures increase by $250 billion, then aggregate demand؟ a. shifts rightward by $62.5 billion. b. shifts rightward by $50.0 billion. c. shifts rightward by $32.5 billion. d. shifts rightward by $625 billionarrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education