Activity-Based Absorption Costing and Pricing LO3—5

Java Source, Inc., (JSI) buys coffee beans from around the world and roasts, blends, and packages them for resale. Some of JSI’s coffees are very popular and sell in large volumes, while a few of the newer blends sell in very low volumes. JSI prices its coffees at

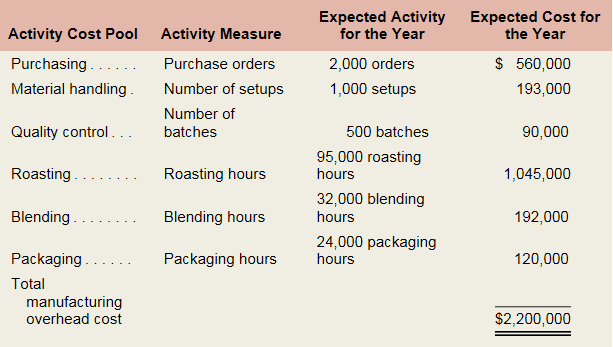

For the coming year, JSI’s budget includes estimated manufacturing overhead cost of $2,200,000. JSI assigns manufacturing overhead to products on the basis of direct labor-hours. The expected direct labor cost totals $600,000, which represents 50,000 hours of direct labor time.

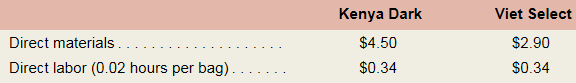

The expected costs for direct materials and direct labor for one-pound bags of two of the company’ s coffee products appear below.

JSI’s controller believes that the company s traditional costing system may be providing misleading cost information. To determine whether or not this is correct, the controller has prepared an analysis of the year’s expected manufacturing overhead costs, as shown in the following table:

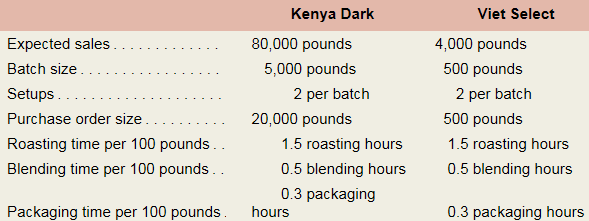

Data regarding the expected production of Kenya Dark and Viet Select coffee are presented below.

Required:

- Using direct labor-hours as the manufacturing overhead cost allocation base, do the following:

- Determine the plantwide predetermined overhead rate that will be used during the year.

- Determine the unit product cost of one pound of Kenya Dark coffee and one pound of Viet Select coffee.

- Using the activity-based absorption costing approach, do the following:

- Determine the total amount of manufacturing overhead cost assigned to Kenya Dark coffee and to Viet Select coffee for the year.

- Using the data developed in (2a) above, compute the amount of manufacturing overhead cost per pound of Kenya Dark coffee and Viet Select coffee.

- Determine the unit product cost of one pound of Kenya Dark coffee and one pound of Viet Select coffee.

- Write a brief memo to the president of ISI that explains what you found in (1) and (2) above and that discusses the implications of using direct labor-hours as the only manufacturing overhead cost allocation base.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3A Solutions

CONNECT ONLINE ACCESS F/MANAGERIAL ACC.

- Jarred Manufacturing has a valve division that manufactures and sells a standard valve.Capacity in Units 100 000 unitsSelling Price to external customers R300Variable Costs per unit R160Fixed Costs (based on capacity) R90 per unitThe company has a Pump division that could use this valve in one of its pumps. The pump division is currently purchasing 10 000 valves per year from a German supplier at a cost of R290 per valve. Required;4.1 Assuming that the Valve Division has ample idle capacity to handle all of the Pump Division needs. What is the acceptable range, if any, for the transfer price between the two divisions? 4.2 Assuming that the Valve Division is selling all of its valves that it can produce to external customers. What is the acceptable range, if any, for the transfer price between the two divisions? 4.3 Assuming that the Valve Division is selling all of its valves that it can produce to external customers and that R30 in variable costs can be avoided on inter-division…arrow_forwardCVP Analysis of Multiple Products Alo Company produces commercial printers. One is the regular model, a basic model that is designed to copy and print in black and white. Another model, the deluxe model, is a color printer-scanner-copier. For the coming year, Alo expects to sell 90,000 regular models and 18,000 deluxe models. A segmented income statement for the two products is as follows: Regular Model Deluxe Model Total Sales $14,400,000 $12,060,000 $26,460,000 Less: Variable costs 8,640,000 7,236,000 15,876,000 Contribution margin $5,760,000 $4,824,000 $10,584,000 Less: Direct fixed costs 1,200,000 960,000 2,160,000 Segment margin $4,560,000 $3,864,000 $8,424,000 Less: Common fixed costs 1,838,400 Operating income $6,585,600 Required: 1. Compute the number of regular models and deluxe models that must be sold to break even. Round your answers to the nearest whole…arrow_forwardCVP Analysis of Multiple Products Alo Company produces commercial printers. One is the regular model, a basic model that is designed to copy and print in black and white. Another model, the deluxe model, is a color printer-scanner-copier. For the coming year, Alo expects to sell 90,000 regular models and 18,000 deluxe models. A segmented income statement for the two products is as follows: Regular Model Deluxe Model Total Sales $13,500,000 $12,240,000 $25,740,000 Less: Variable costs 8,100,000 7,344,000 15,444,000 Contribution margin $5,400,000 $4,896,000 $10,296,000 Less: Direct fixed costs 1,200,000 960,000 2,160,000 Segment margin $4,200,000 $3,936,000 $8,136,000 Less: Common fixed costs 1,615,200 Operating income $6,520,800 Required: 1. Compute the number of regular models and deluxe models that must be sold to break even. Round your answers to the nearest whole unit. Regular models X units Deluxe models 6,615 x units 2. Using information only from the total column of the income…arrow_forward

- CVP Analysis of Multiple Products Steinberg Company produces commercial printers. One is the regular model, a basic model that is designed to copy and print in black and white. Another model, the deluxe model, is a color printer-scanner-copier. For the coming year, Steinberg expects to sell 90,000 regular models and 18,000 deluxe models. A segmented income statement for the two products is as follows: Regular Model Deluxe Model Total Sales $13,500,000 $12,060,000 $25,560,000 Less: Variable costs 8,100,000 7,236,000 15,336,000 Contribution margin $5,400,000 $4,824,000 $10,224,000 Less: Direct fixed costs 1,200,000 960,000 2,160,000 Segment margin $4,200,000 $3,864,000 $8,064,000 Less: Common fixed costs 1,475,200 Operating income $6,588,800 Required: 1. Compute the number of regular models and deluxe models that must be sold to break even. Round your answers to the…arrow_forwardab. ock esc ~ Microhard produces tablets, laptops and televisions. Microhard typically sells 1,000 tablets a year. The tablet information is as follows: Selling price per unit Direct material cost per unit Direct labor cost per unit Total unavoidable allocated overhead How much would Operating Income decrease if Microhard were to eliminate the tablets? DO NOT INCLUDE PARENTHESES OR NEGATIVE SIGNS IN YOUR ANSWER. Click Save and Submit to save and submit. Click Save All Answers to save all answers. ! 1 Q A @ 2 W S $60 $30 $10 $48,000 #M 3 E $ 4 D R % от оро 5 F MacBook Pro < 6 T G & of r 7 Y H * 00 つarrow_forward3G Asiacell o000. A docs.google.com A certain factory produces 2000Ton per year of its product. Th price of one kilogram is 1.8$. The annual direct production cost is 2million $ when the factory works at its whole capacity. Other fixed costs are 7X10^5 Your email address will be recorded when you submit this form. Not std22000100091@mustaqbal- college.edu.iq? Switch account * Required a) Calculate the value of fixed cost per kg of the product at the break even point. Your answer b) If the selling price increases by 10% calculate the increase in the net profit at the whole capacity assuming the taxes are 48% of the gross profit.arrow_forward

- Problem 10-09 (Algorithmic) Cress Electronic Products manufactures components used in the automotive industry. Cress purchases parts for use in its manufacturing operation from a variety of different suppliers. One particular supplier provides a part where the assumptions of the EOQ model are realistic. The annual demand is 5,500 units, the ordering cost is $80 per order, and the annual holding cost rate is 22%. If the cost of the part is $16 per unit, what is the economic order quantity? If required, round your answer to the nearest whole number.Q* = fill in the blank 1 Assume 250 days of operation per year. If the lead time for an order is 12 days, what is the reorder point? If required, round your answer up to the nearest whole number.r = fill in the blank 2 If the lead time for the part is five weeks (25 days), what is the reorder point? If required, round your answer up to the nearest whole number.r = fill in the blank 3 What is the reorder point for part (c) if the reorder…arrow_forward-/1 View Policies Current Attempt in Progress Bramble Corp. sells two types of computer hard drives. The sales mix is 30% ( Q-Drive ) and 70% (Q-Drive Plus). Q-Drive has variable costs per unit of $60 and a selling price of $120. Q-Drive Plus has variable costs per unit of $90 and a selling price of $180. The weighted-average unit contribution margin for Bramble is O $120. O $60.0. O $81. O $69.0. TAvthaalkand iadis hparrow_forwardCP Analysis of Multiple Products Steinberg Company produces commercial printers. One is the regular model, a basic model that is designed to copy and print in black and white. Another model, the deluxe model, is a color printer-scanner-copier. For the coming year, Steinberg expects to sell 80,000 regular models and 16,000 deluxe models. A segmented income statement for the two products is as follows: Regular Model Deluxe Model Total Sales $12,000,000 $10,880,000 $22,880.000 Less: Variable costs 7.200.000 6,528,000 13,728,000 Contribution margin $4,800,000 $4,352,000 $9,152,000 Less: Direct fixed costs 1,200.000 960,000 2,160,000 Segment margin $3,600,000 $3,392,000 $6,992,000 Less: Common fixed costs 1,386,400 Operating income $5,605,600 Required: 1. Compute the number of regular models and deluxe models that must be sold to break even. Round your answers to the nearest whole unit Regular models X units Deluxe models X units 2. Using information only from the total column of the income…arrow_forward

- PROBLEM 8. The Color Company manufactures and sells two products. The selling prices and variable costs of the products are as follows: Blujets Blupens P20 Selling prices Variable costs P40 8 24 The sales for 2021 were in the ratio of 3 Blujets to 1 Blupen. Sales volume for 2021 was P1 million. Fixed costs for 2020 amounted to P390,000. Requirements: 4. If the sales mix was to change to 2 units of blujets to 1 unit of Blupen, would this have any effect on the breakeven sales? If so, what would be the new breakeven sales? 5. Assuming that the sales volume would remain at P1 million, what net income would be generated using the sales mix in number (4) above? 6. What sales revenue would be required if the firm wishes to generate a net income of P328,900 if the original mix of 3:1 prevailed?arrow_forwardProblem 13-25 (Algo) Volume Trade-Off Decisions [LO13-5, LO13-6] The Walton Toy Company manufactures a line of dolls and a sewing kit. Demand for the company’s products is increasing, and management requests assistance from you in determining an economical sales and production mix for the coming year. The company has provided the following data: Product DemandNext year(units) SellingPriceper Unit DirectMaterials DirectLabor Debbie 62,000 $ 20.50 $ 5.50 $ 3.60 Trish 54,000 $ 7.00 $ 2.30 $ 1.32 Sarah 47,000 $ 34.00 $ 8.24 $ 7.20 Mike 56,000 $ 15.00 $ 3.20 $ 4.80 Sewing kit 337,000 $ 9.20 $ 4.40 $ 0.72 The following additional information is available: The company’s plant has a capacity of 84,160 direct labor-hours per year on a single-shift basis. The company’s present employees and equipment can produce all five products. The direct labor rate of $12 per hour is expected to remain unchanged during the coming year. Fixed manufacturing costs total…arrow_forwardView Policies Current Attempt in Progress Sheridan Company sells two types of computer hard drives. The sales mix is 30% (Q-Drive) and 70% (Q-Drive Plus) based upon quantity of units sold. Q-Drive has a unit variable cost of $120 and a selling price of $210. Q-Drive Plus has a unit variable cost of $100 and a selling price of $180. The weighted-average unit contribution margin for Sheridan is O $87. O $105. O $210. O $83. Save for Later Attempts: 0 of 1 used Submit Answerarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning