Concept explainers

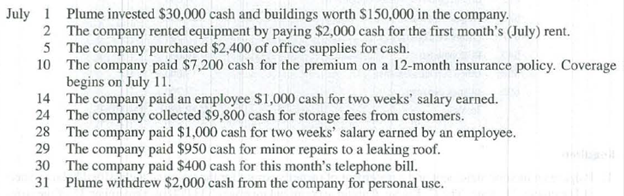

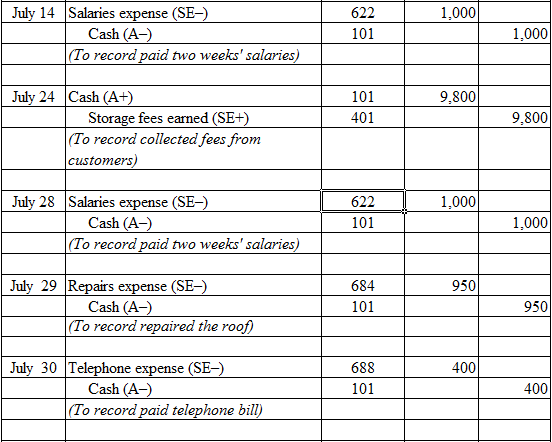

On July 1, Lula Plume created a new self-storage business, Safe Storage Co. The following transactions occurred during the company’s first month.

The company’s chart of accounts follows:

Required

- 1. Use the balance column format to set up each ledger account listed in its chart of accounts.

- 2. Prepare

journal entries to record the transactions for July and post them to the ledger accounts. Record prepaid and unearned items inbalance sheet accounts. - 3. Prepare an unadjusted

trial balance as of July 31. - 4. Use the following information to journalize and post

adjusting entries for the month:- a. Prepaid insurance of $400 has expired this month.

- b. At the end of the month, $1,525 of office supplies are still available.

- c. This month’s

depreciation on the buildings is $1,500. - d. An employee earned $100 of unpaid and unrecorded salary as of month-end.

- e. The company earned $1,150 of storage fees that are not yet billed at month-end.

- 5. Prepare the adjusted trial balance as of July 31. Prepare the income statement and the statement of owner’s equity for the month of July and the balance sheet at July 31.

- 6. Prepare journal entries to close the temporary accounts and post these entries to the ledger.

- 7. Prepare a post-closing trial balance.

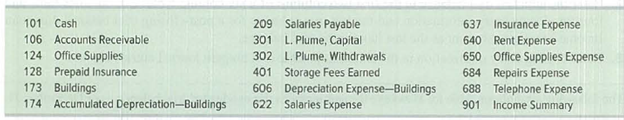

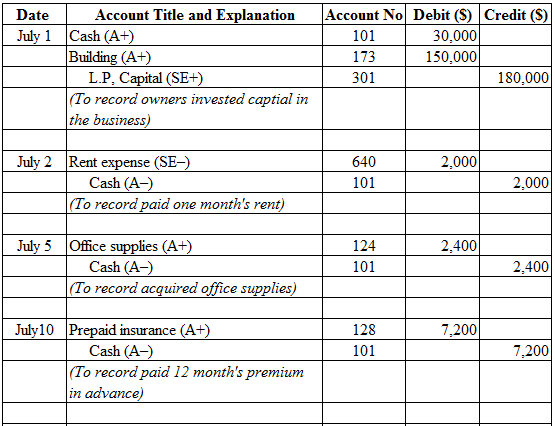

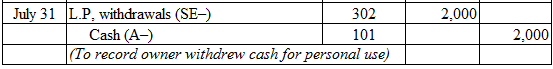

Requirement 2:

Prepare journal entries to record the transactions for July 31.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Prepare journal entries to record the transactions for July 31:

Table (1)

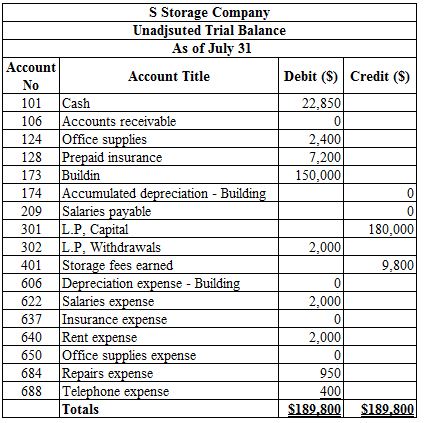

Requirement 3:

Prepare an unadjusted trial balance as of July 31.

Explanation of Solution

Unadjusted trial balance:

The unadjusted trial balance is the summary of all the ledger accounts that appear on the ledger accounts before making adjusting journal entries.

Prepare an unadjusted trial balance as of July 31:

Table (2)

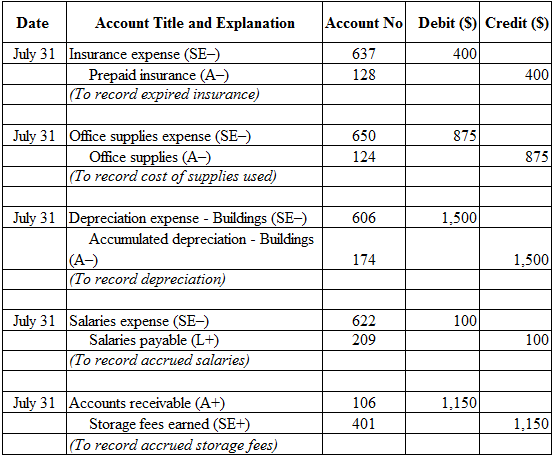

Requirement 4:

Journalize the adjusting entries.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Journalize the adjusting entries:

Table (3)

Working note:

Calculate the amount of office supplies used:

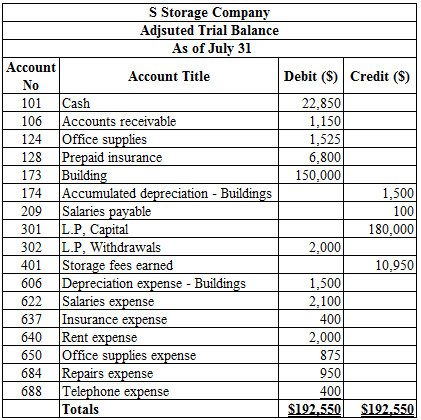

Requirement 5:

Prepare the following:

- Adjusted trial balance as of July 31.

- Income statement for the month ended July 31.

- Statement of owner’s equity for the month ended July 31.

- Balance sheet at July 31.

Explanation of Solution

Adjusted Trial Balance: Adjusted trial balance is the statement which contains complete list of accounts with their adjusted balances after all the relevant adjustments has been made. This statement is prepared at the end of every financial period.

Prepare the adjusted trial balance as of July 31:

Table (4)

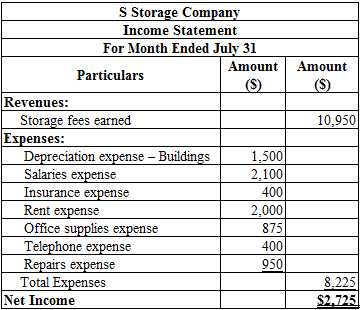

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for the month ended July 31:

Table (5)

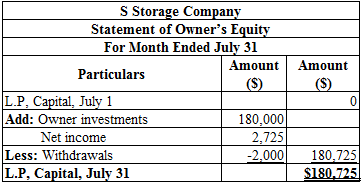

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes, which led to ending owners’ equity. Additional capital, net income from income statement is added to and a drawing is deducted from beginning owner’s equity to arrive at the result, ending owner’s equity.

Prepare the statement of owners’ equity for the month ended July 31:

Table (6)

Balance sheet: This financial statement reports about the company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Prepare the balance sheet at July 31:

Table (7)

Requirement 5:

Prepare journal entries to close the temporary accounts.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to permanent account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare the closing entries:

| Date | Accounts and Explanation |

Account Number |

Debit ($) | Credit ($) |

| July 31 | Storage fees earned (SE–) | 401 | 10,950 | |

| Income summary (SE+) | 901 | 10,950 | ||

| (To close the revenue account) | ||||

| July 31 | Income summary (SE–) | 901 | 8,225 | |

| Depreciation expense - Buildings (SE+) | 606 | 1,500 | ||

| Salaries expense (SE+) | 622 | 2,100 | ||

| Insurance expense (SE+) | 637 | 400 | ||

| Rent expense (SE+) | 640 | 2,000 | ||

| Office supplies expense (SE+) | 650 | 875 | ||

| Repairs expense (SE+) | 684 | 950 | ||

| Telephone expense (SE+) | 688 | 400 | ||

| (To close the expense accounts) | ||||

| July 31 | Income Summary (SE–) | 901 | 2,725 | |

| L.P’s Capital (SE+) | 301 | 2,725 | ||

| (To close the income summary accounts) | ||||

| July 31 | L.P’s Capital (SE–) | 301 | 2,000 | |

| L.P’s Withdrawals (SE+) | 302 | 2,000 | ||

| (To close withdrawals account.) |

Table (8)

Working Note:

Calculate the amount of L.P’s capital (transferred):

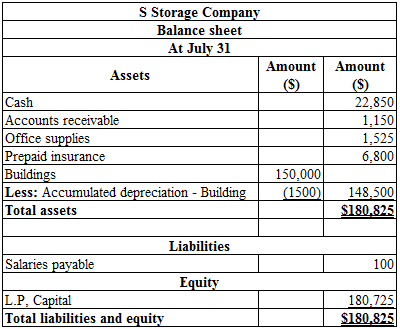

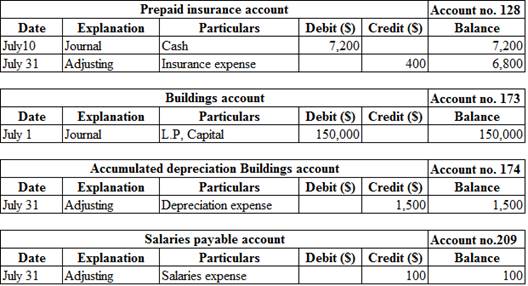

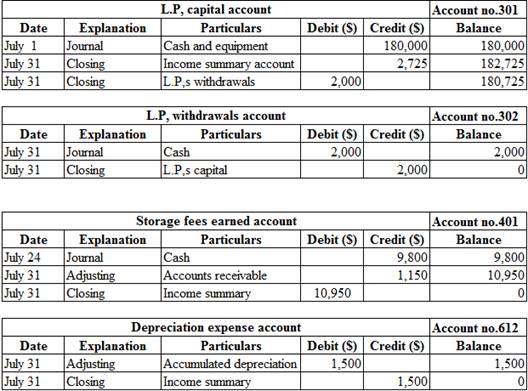

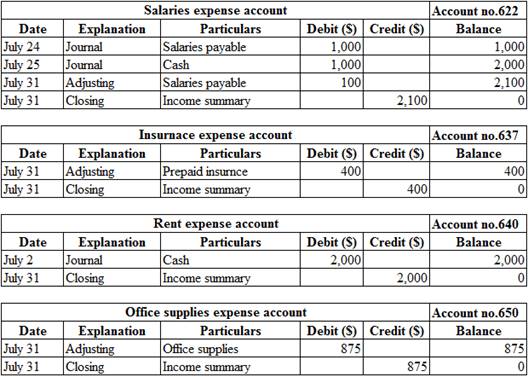

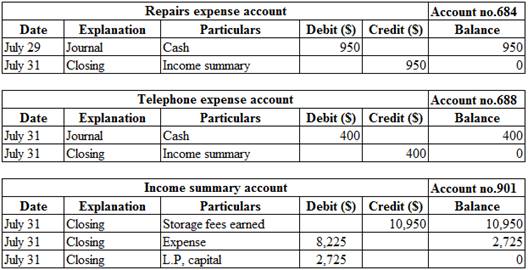

Requirement 1,2,4, and 6:

Post the journal entries, adjusting entries and closing entries to the ledger account:

Explanation of Solution

Ledger:

Ledger is the book, where the debit and credit entries recorded in the journal book are transferred to their relevant accounts. The entire accounts of the company are collectively called the ledger.

Posting the journal entries, adjusting entries and closing entries to the ledger account:

Table (9)

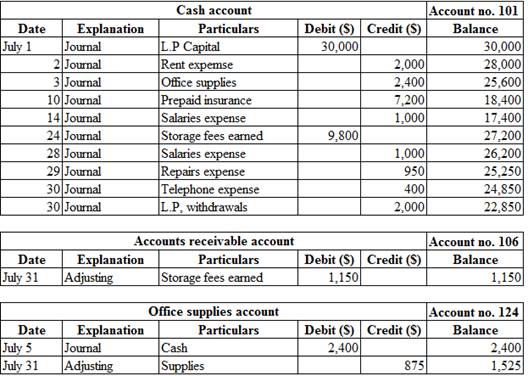

Requirement 7:

Prepare a post-closing trial balance.

Explanation of Solution

Post-closing trial balance:

The post-closing trial balance is a summary of all ledger accounts, and it shows the debit and the credit balances after the closing entries are journalized and posted. The post-closing trial balance contains only permanent (balance sheet) accounts, and the debit and the credit balances of permanent accounts should agree.

Prepare a post-closing trial balance:

| S Storage Company | ||

| Post-Closing Trial Balance | ||

| July 31 | ||

| Particulars | Debit($) | Credit ($) |

| Cash | 22,850 | |

| Accounts receivable | 1,150 | |

| Office supplies | 1,525 | |

| Prepaid insurance | 6,800 | |

| Buildings | 150,000 | |

| Accumulated depreciation – Buildings | 1,500 | |

| Salaries payable | 100 | |

| L.P’s Capital | 180,725 | |

| Totals | $182,325 | $182,325 |

Table (10)

Want to see more full solutions like this?

Chapter 4 Solutions

Principles of Financial Accounting.

- During the first month of operations, Landish Modeling Agency recorded transactions in T account form. Foot and balance the accounts. Then prepare a trial balance, an income statement, a statement of owners equity, and a balance sheet dated March 31, 20--.arrow_forwardOn July 1, K. Resser opened Ressers Business Services. Ressers accountant listed the following chart of accounts: The following transactions were completed during July: a. Resser deposited 25,000 in a bank account in the name of the business. b. Bought tables and chairs for cash, 725, Ck. No. 1200. c. Paid the rent for the current month, 1,750, Ck. No. 1201. d. Bought computers and copy machines from Ferber Equipment, 15,700, paying 4,000 in cash and placing the balance on account, Ck. No. 1202. e. Bought supplies on account from Wigginss Distributors, 535. f. Sold services for cash, 1,742. g. Bought insurance for one year, 1,375, Ck. No. 1203. h. Paid on account to Ferber Equipment, 700, Ck. No. 1204. i. Received and paid the electric bill, 438, Ck. No. 1205. j. Paid on account to Wigginss Distributors, 315, Ck. No. 1206. k. Sold services to customers for cash for the second half of the month, 820. l. Received and paid the bill for the business license, 75, Ck. No. 1207. m. Paid wages to an employee, 1,200, Ck. No. 1208. n. Resser withdrew cash for personal use, 700, Ck. No. 1209. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance as of July 31, 20--. 6. Prepare an income statement for July 31, 20--. 7. Prepare a statement of owners equity for July 31, 20--. 8. Prepare a balance sheet as of July 31, 20--. LO 1, 2, 3, 4, 5, 6arrow_forwardFollowing is the chart of accounts of Smith Financial Services: Smith completed the following transactions during June (the first month of business): Required 1. Journalize the transactions for June in the general journal. 2. Post the entries to the general ledger accounts. (Skip this step if you are using CLGL.) 3. Prepare a trial balance as of June 30, 20. 4. Prepare an income statement for the month ended June 30, 20. 5. Prepare a statement of owners equity for the month ended June 30, 20. 6. Prepare a balance sheet as of June 30, 20.arrow_forward

- In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001 (Rent Expense). e. Sold services for cash for the first half of the month, 6,927 (Service Income). f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004 (Utilities Expense). i. Received a bill for gas and oil for the truck, 218 (Gas and Oil Expense). j. Sold services on account, 3,603 (Service Income). k. Sold services for cash for the remainder of the month, 4,612 (Service Income). l. Paid wages to the employees, 3,958, Ck. Nos. 30053007 (Wages Expense). m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardThe transactions completed by AM Express Company during March, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and twocolumn general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardPiedmont Inc. has the following transactions for its first month of business: A. What are the individual account balances, and the total balance, in the accounts payable subsidiary ledger? B. What is the balance in the Accounts Payable general ledger account?arrow_forward

- In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001. e. Sold services for cash for the first half of the month, 6,927. f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004. i. Received a bill for gas and oil for the truck, 218. j. Sold services on account, 3,603. k. Sold services for cash for the remainder of the month, 4,612. l. Paid wages to the employees, 3,958, Ck. Nos. 30053007. m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. Record the transactions and the balance after each transaction 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardOn October 1, 2016, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2016. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?arrow_forwardOn November 1, 2016, Patty Cosgrove established an interior decorating business, Classic Designs. During the month, Patty completed the following transactions related to the business: Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Classic Designs as of November 30, 2016. 4. Determine the excess of revenues over expenses for November. 5. Can you think of any reason why the amount determined in (4) might not be the net income for November?arrow_forward

- Following is the chart of accounts of Sanchez Realty Company: Sanchez completed the following transactions during April (the first month of business): Required 1. Journalize the transactions for April in the general journal. 2. Post the entries to the general ledger accounts. (Skip this step if you are using CLGL.) 3. Prepare a trial balance as of April 30, 20. 4. Prepare an income statement for the month ended April 30, 20. 5. Prepare a statement of owners equity for the month ended April 30, 20. 6. Prepare a balance sheet as of April 30, 20. If you we using CLGL, use the year 2020 when preparing all reports.arrow_forwardJournal entries and trial balance On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: a. Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 17,500. b. Purchased supplies on account, 2,300. c. Earned sales commissions, receiving cash, 13,300. d. Paid rent on office and equipment for the month, 3,000. e. Paid creditor on account, 1,150. f. Paid dividends, 1,800. g. Paid automobile expenses (including rental charge) for month, 1,500, and miscellaneous expenses, 400. h. Paid office salaries, 2,800. i. Determined that the cost of supplies used was 1,050. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Journal entry explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of August 31, 20Y7. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for August. 5. Determine the increase or decrease in retained earnings for August.arrow_forwardOn March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning