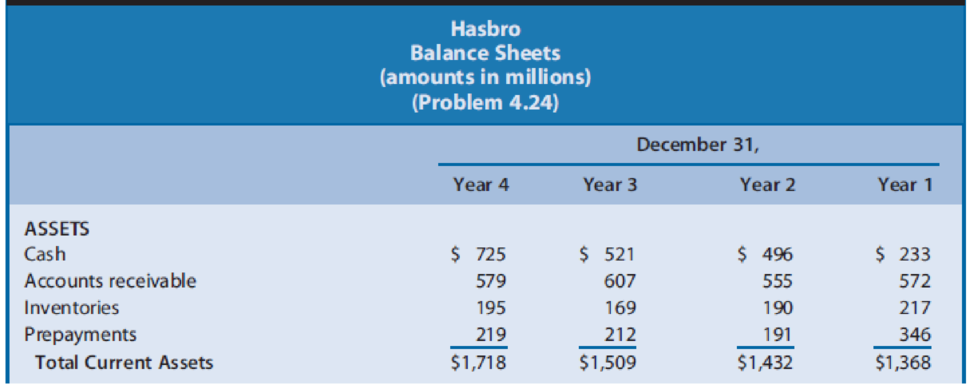

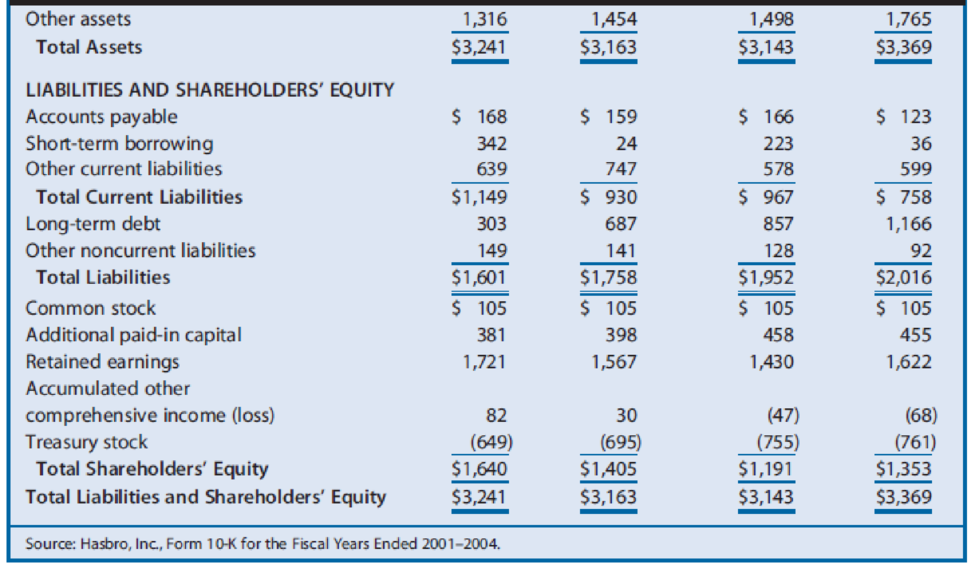

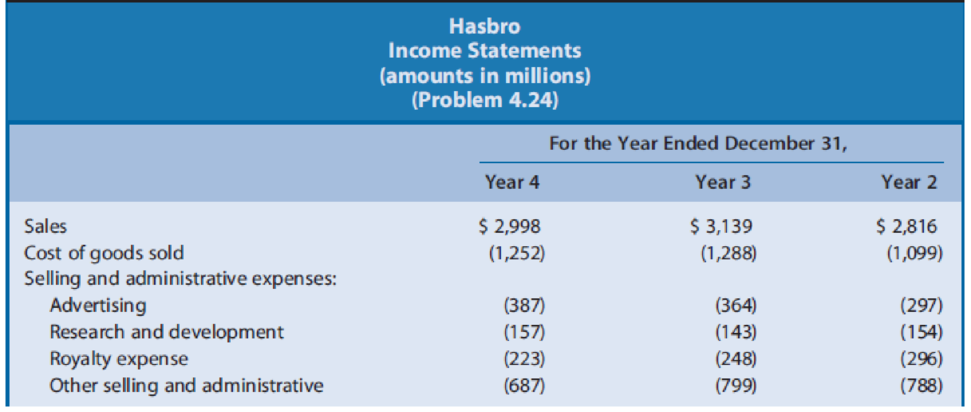

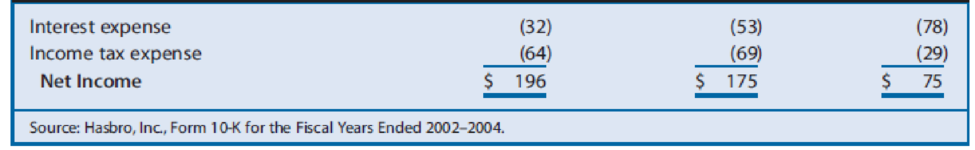

Hasbro is a leading firm in the toy, game, and amusement industry. Its promoted brands group includes products from Playskool, Tonka, Milton Bradley, Parker Brothers, Tiger, and Wizards of the Coast. Sales of toys and games are highly variable from year to year depending on whether the latest products meet consumer interests. Hasbro also faces increasing competition from electronic and online games. Hasbro develops and promotes its core brands and manufactures and distributes products created by others under license arrangements. Hasbro pays a royalty to the creator of such products. In recent years, Hasbro has attempted to reduce its reliance on license arrangements, placing more emphasis on its core brands. Hasbro also has embarked on a strategy of reducing fixed selling and administrative costs in an effort to offset the negative effects on earnings of highly variable sales. Exhibit 4.30 presents the balance sheets for Hasbro for the years ended December 31, Years 1 through 4. Exhibit 4.31 presents the income statements and Exhibit 4.32 presents the statements of cash flows for Years 2 through 4.

Exhibit 4.30

Exhibit 4.31

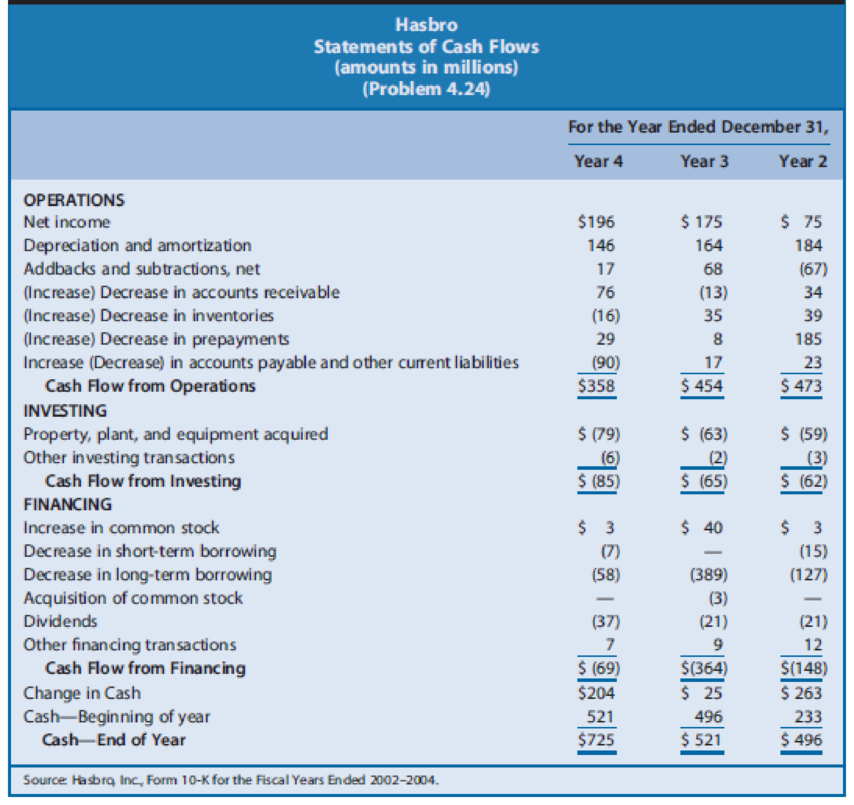

Exhibit 4.32

REQUIRED

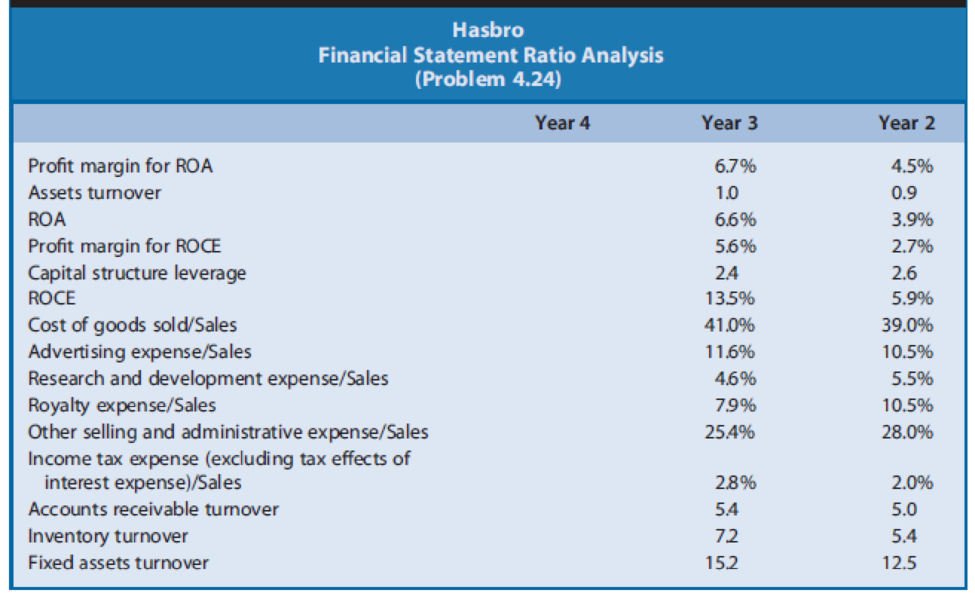

- a. Exhibit 4.33 presents profitability ratios for Hasbro for Year 2 and Year 3. Calculate each of these financial ratios for Year 4. The income tax rate is 35%.

- b. Analyze the changes in

ROA and its components for Hasbro over the three-year period, suggesting reasons for the changes observed. - c. Analyze the changes in ROCE and its components for Hasbro over the three-year period, suggesting reasons for the changes observed.

Exhibit 4.33

Trending nowThis is a popular solution!

Chapter 4 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

- Posavek is a wholesale supplier of building supplies building contractors, hardware stores, and home-improvement centers in the Boston metropolitan area. Over the years, Posavek has expanded its operations to serve customers across the nation and now employs over 200 people as technical representatives, buyers, warehouse workers, and sales and office staff. Most recently, Posavek has experienced fierce competition from the large online discount stores. In addition, the company is suffering from operational inefficiencies related to its archaic information system. Posavek revenue cycle procedures are described in the following paragraphs. Revenue Cycle Posaveks sales department representatives receive orders via traditional mail, e-mail, telephone, and the occasional walk-in customer. Because Posavek is a wholesaler, the vast majority of its business is conducted on a credit basis. The process begins in the sales department, where the sales clerk enters the customers order into the centralized computer sales order system. The computer and file server are housed in Posaveks small data processing department. If the customer has done business with Posavek in the past, his or her data are already on file. If the customer is a first-time buyer, however, the clerk creates a new record in the customer account file. The system then creates a record of the transaction in the open sales order file. When the order is entered, an electronic copy of it is sent to the customers e-mail address as confirmation. A clerk in the warehouse department periodically reviews the open sales order file from a terminal and prints two copies of a stock release document for each new sale, which he uses to pick the items sold from the shelves. The warehouse clerk sends one copy of the stock release to the sales department and the second copy, along with the goods, to the shipping department. The warehouse clerk then updates the inventory subsidiary file to reflect the items and quantities shipped. Upon receipt of the stock release document, the sales clerk accesses the open sales order file from a terminal, closes the sales order, and files the stock release document in the sales department. The sales order system automatically posts these transactions to the sales, inventory control, and cost-of-goods-sold accounts in the general ledger file. Upon receipt of the goods and the stock release, the shipping department clerk prepares the goods for shipment to the customer. The clerk prepares three copies of the bill of lading. Two of these go with the goods to the carrier and the third, along with the stock release document, is filed in the shipping department. The billing department clerk reviews the closed sales orders from a terminal and prepares two copies of the sales invoice. One copy is mailed to the customer, and the other is filed in the billing department. The clerk then creates a new record in the accounts receivable subsidiary file. The sales order system automatically updates the accounts receivable control account in the general ledger file. CASH RECEIPTS PROCEDURES Mail room clerks open customer cash receipts, reviews the check and remittance advices for completeness, and prepares two copies of a remittance list. One copy is sent with the checks to the cash receipts department. The second copy of the remittance advices are sent to the billing department. When the cash receipts clerk receives the checks and remittance list, he verifies the checks received against those on the remittance list and signs the checks For Deposit Only. Once the checks are endorsed, he records the receipts in the cash receipts journal from his terminal. The clerk then fills out a deposit slip and deposits the checks in the bank. Upon receipt of the remittances, the billing department clerk records the amounts in the accounts receivable subsidiary ledger from the department terminal. The system automatically updates the AR control account in the general ledger Posavek has hired your public accounting firm to review its sales order procedures for internal control compliance and to make recommendations for changes. Required a. Create a data flow diagram of the current system. b. Create a system flowchart of the existing system. c. Analyze the physical internal control weaknesses in the system. d. (Optional) Prepare a system flowchart of a redesigned computer-based system that resolves the control weaknesses that you identified. Explain your solution.arrow_forwardMaxwell Company produces a variety of kitchen appliances, including cooking ranges and dishwashers. Over the past several years, competition has intensified. In order to maintainand perhaps increaseits market share, Maxwells management decided that the overall quality of its products had to be increased. Furthermore, costs needed to be reduced so that the selling prices of its products could be reduced. After some investigation, Maxwell concluded that many of its problems could be traced to the unreliability of the parts that were purchased from outside suppliers. Many of these components failed to work as intended, causing performance problems. Over the years, the company had increased its inspection activity of the final products. If a problem could be detected internally, then it was usually possible to rework the appliance so that the desired performance was achieved. Management also had increased its warranty coverage; warranty work had been increasing over the years. David Haight, president of Maxwell Company, called a meeting with his executive committee. Lee Linsenmeyer, chief engineer; Kit Applegate, controller; and Jeannie Mitchell, purchasing manager, were all in attendance. How to improve the companys competitive position was the meetings topic. The conversation of the meeting was recorded as seen on the following page: DAVID: We need to find a way to improve the quality of our products and at the same time reduce costs. Lee, you said that you have done some research in this area. Would you share your findings? LEE: As you know, a major source of our quality problems relates to the poor quality of the parts we acquire from the outside. We have a lot of different parts, and this adds to the complexity of the problem. What I thought would be helpful would be to redesign our products so that they can use as many interchangeable parts as possible. This will cut down the number of different parts, make it easier to inspect, and cheaper to repair when it comes to warranty work. My engineering staff has already come up with some new designs that will do this for us. JEANNIE: I like this idea. It will simplify the purchasing activity significantly. With fewer parts, I can envision some significant savings for my area. Lee has shown me the designs so I know exactly what parts would be needed. I also have a suggestion. We need to embark on a supplier evaluation program. We have too many suppliers. By reducing the number of different parts, we will need fewer suppliers. And we really dont need to use all the suppliers that produce the parts demanded by the new designs. We should pick suppliers that will work with us and provide the quality of parts that we need. I have done some preliminary research and have identified five suppliers that seem willing to work with us and assure us of the quality we need. Lee may need to send some of his engineers into their plants to make sure that they can do what they are claiming. DAVID: This sounds promising. Kit, can you look over the proposals and their estimates and give us some idea if this approach will save us any money? And if so, how much can we expect to save? KIT: Actually, I am ahead of the game here. Lee and Jeannie have both been in contact with me and have provided me with some estimates on how these actions would affect different activities. I have prepared a handout that includes an activity table revealing what I think are the key activities affected. I have also assembled some tentative information about activity costs. The table gives the current demand and the expected demand after the changes are implemented. With this information, we should be able to assess the expected cost savings. Additionally, the following activity cost data are provided: Purchasing parts: Variable activity cost: 30 per part number; 20 salaried clerks, each earning a 45,000 annual salary. Each clerk is capable of processing orders associated with 100 part numbers. Inspecting parts: Twenty-five inspectors, each earning a salary of 40,000 per year. Each inspector is capable of 2,000 hours of inspection. Reworking products: Variable activity cost: 25 per unit reworked (labor and parts). Warranty: Twenty repair agents, each paid a salary of 35,000 per year. Each repair agent is capable of repairing 500 units per year. Variable activity costs: 15 per product repaired. Required: 1. Compute the total savings possible as reflected by Kits handout. Assume that resource spending is reduced where possible. 2. Explain how redesign and supplier evaluation are linked to the savings computed in Requirement 1. Discuss the importance of recognizing and exploiting internal and external linkages. 3. Identify the organizational and operational activities involved in the strategy being considered by Maxwell Company. What is the relationship between organizational and operational activities?arrow_forwardAhorita Company manufactures wireless transponders for satellite applications. Ahorita has recently acquired Zelltech Company, which is primarily known for its software communications development but also manufactures a specialty transponder under the trade name “Z-Tech” that competes with one of Ahorita’s products. Ahorita will now discontinue Z-Tech and projects that its own product line will see a market share increase. Nonetheless, Ahorita’s management will maintain the rights to the Z-Tech trade name as a defensive intangible asset to prevent its use by competitors, despite the fact that its high-est and best use would be to sell the trade name. Ahorita estimates that the trade name has an internal value of $1.5 million, but if sold would yield $2 million. Answer the following with supporting citations from the FASB ASC:a. How does the FASB ASC Glossary define a defensive intangible asset?b. According to ASC Topic 805, “Business Combinations,” what is the measurement principle…arrow_forward

- Sembotix Company has several divisions including a Semiconductor Division that sells semiconductors to both internal and external customers. The company’s X-ray Division uses semiconductors as a component in its final product and is evaluating whether to purchase them from the Semiconductor Division or from an external supplier. The market price for semiconductors is $100 per 100 semiconductors. Dave Bryant is the controller of the X-ray Division, and Howard Hillman is the controller of the Semiconductor Division. The following conversation took place between Dave and Howard: Dave: I hear you are having problems selling semiconductors out of your division. Maybe I can help. Howard: You’ve got that right. We’re producing and selling at about 90% of our capacity to outsiders. Last year, we were selling 100% of capacity. Would it be possible for your division to pick up some of our excess capacity? After all, we are part of the same company. Dave: What kind of price could you give…arrow_forwardSembotix Company has several divisions including a Semiconductor Division that sells semiconductors to both internal and external customers. The company's X-ray Division uses semiconductors as a component in its final product and is evaluating whether to purchase them from the Semiconductor Division or from an external supplier. The market price for semiconductors is $100 per 100 semiconductors. Dave Bryant is the controller of the X-ray Division, and Howard Hillman is the controller of the Semiconductor Division. The following conversation took place between Dave and Howard: Dave: I hear you are having problems selling semiconductors out of your division. Maybe I can help. Howard: You've got that right. We're producing and selling at about 90% of our capacity to outsiders. Last year we were selling 100% of capacity. Would it be possible for your division to pick up some of the excess capacity? After all, we are part of the same company. Dave: What kind of price can you give me?…arrow_forwardThe Baldwin Company, originally established 16 years ago to make footballs, is now a leading producer of tennis balls, baseballs, footballs, and golf balls. Recently W. C. Meadows, vice president of the Baldwin Company, identified another segment of the sports ball market that looked promising and that he felt was not adequately served by larger manufacturers. That market was for brightly colored bowling balls, and he believed many bowlers valued appearance and style above performance. As a result, the Baldwin Company investigated the marketing potential of brightly colored bowling balls. Baldwin sent a questionnaire to consumers in three markets: Philadelphia, Los Angeles, and New Haven. The results of the three questionnaires were much better than expected and supported the conclusion that the brightly colored bowling balls could achieve a 10 to 15 percent share of the market. In any case, the Baldwin Company is now considering investing in a machine to produce bowling balls. The…arrow_forward

- Phoenix Inc., a cellular communication company, has multiple business units, organized as divisions. Each division’s management is compensated based on the division’s operating income. Division A currently purchases cellular equipment from outside markets and uses it to produce communication systems. Division B produces similar cellular equipment that it sells to outside customers—but not to division A at this time. Division A’s manager approaches division B’s manager with a proposal to buy the equipment from division B. If it produces the cellular equipment that division A desires, division B will incur variable manufacturing costs of $60 per unit. Relevant Information about Division B Sells 90,000 units of equipment to outside customers at $130 per unit Operating capacity is currently 80%; the division can operate at 100% Variable manufacturing costs are $70 per unit Variable marketing costs are $8 per unit Fixed manufacturing costs are $900,000 Income per Unit for Division A…arrow_forwardMaxwell Company produces a variety of kitchen appliances, including cooking ranges and dishwashers. Over the past several years, competition has intensified. In order to maintain—and perhaps increase—its market share, Maxwell’s management decided that the overall quality of its products had to be increased. Furthermore, costs needed to be reduced so that the selling prices of its products could be reduced. After some investigation, Maxwell concluded that many of its problems could be traced to the unreliability of the parts that were purchased from outside suppliers. Many of these components failed to work as intended, causing performance problems. Over the years, the company had increased its inspection activity of the final products. If a problem could be detected internally, then it was usually possible to rework the appliance so that the desired performance was achieved. Management also had increased its warranty coverage; warranty work had been increasing over the years. DAVID…arrow_forwardGeddes Corporation is a medium- sized manufacturing company with two divisions and three subsidiaries, all located in the United States. The Metallic Division manufactures metal castings for the automotive industry, and the Plastic Division produces small plastic items for electrical products and other uses. The three subsidiaries manufacture various products for other industrial users. Geddes Corporation plans to change from the lower of first-in, first-out (FIFO)-cost-or market method of inventory valuation to the last-in, first-out (LIFO) method of inventory valuation to obtain tax benefits. To make the method acceptable for tax purposes, the change also will be made for its annual financial statements. Instructions a. Describe the establishment of and subsequent pricing procedures for each of the following LIFO inventory methods. 1. LIFO applied to units of product when the periodic inventory system is used. 2. Application of the dollar-value method to LIFO units of…arrow_forward

- Toy Creations Ltd, a small and medium enterprise, specialises in children’s toys with its products being categorised into three major groups: Plushies, Dolls and Animals. The market for Plushies is expected to expand in the future but Toy Creations is currently struggling to maintain its market share due to the intense price competition in the industry. The market for Animals is assessed to be least price-sensitive among allproducts. The company currently uses the step-down method to allocate its Material Handling and Quality Assurance (QA) costs to the three product groups, and prices all products using a cost-plus basis. The Material Handling and QA department costs are allocated based on the amount of purchases and number of labour hours respectively. The following information is available for the cost allocation exercise. Material Handling QA Plushies Dolls Animals Cost before allocation (incl. salaries) $2,500,000 $2,000,000 $1,800,000 $4,300,000 $3,250,000 Purchases…arrow_forwardFillmore Industries is a vertically integrated firm with several divisions that operate as decentralized profit centers. Fillmore's Systems Division manufactures scientific instruments and uses the products of two of Fillmore's other divisions. The Board Division manufactures printed circuit boards (PCBs). One PCB model is made exclusively for the Systems Division using proprietary designs, while less complex models are sold in outside markets. The products of the Transistor Division are sold in a well-developed competitive market; however, one transistor model is also used by the Systems Division. The costs per unit of the products used by the Systems Division are as follows: PCB Transistor Direct materials 1,85 0,40 Direct labor 4,20 0,90 Variable overhead 2,40 0,70 Fixed overhead…arrow_forwardYatta Net International has manufacturing, distribution, retail, and consulting divisions. Projects undertaken by the manufacturing and distribution divisions tend to be low-risk projects, because these divisions are well established and have predictable demand. The company started its retail and consulting divisions within the last year, and it is unknown if these divisions will be profitable. The company knew that opening these new divisions would be risky, but its management believes the divisions have the potential to be extremely profitable under favorable market conditions. The company is currently using its WACC to evaluate new projects for all divisions. If Yatta Net International does not risk-adjust its discount rate for specific projects properly, which of the following is likely to occur over time? Check all that apply. The firm will accept too many relatively risky projects. The firm will become less valuable. The firm will accept too many relatively safe…arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,