Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 16PC

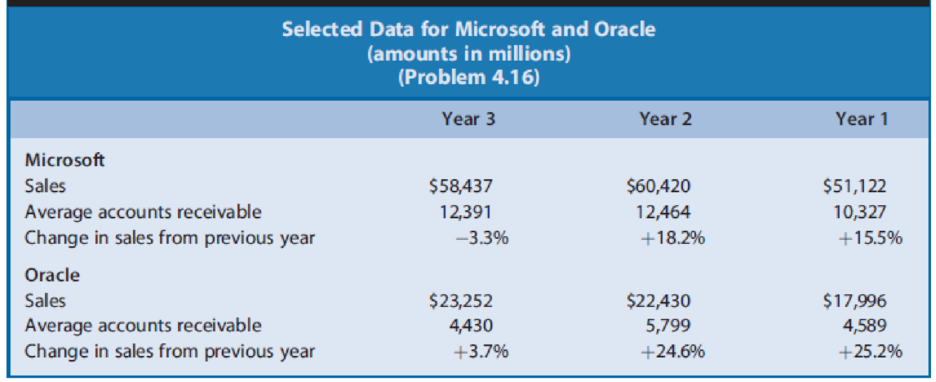

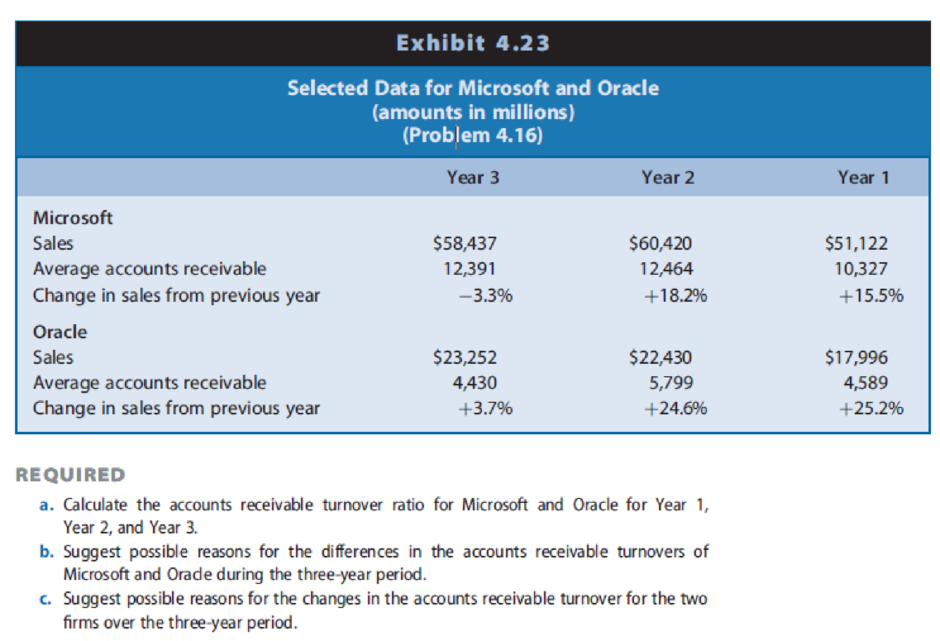

Microsoft Corporation (Microsoft) and Oracle Corporation (Oracle) engage in the design, manufacture, and sale of computer software. Microsoft sells and licenses a wide range of systems and application software to businesses, computer hardware manufacturers, and consumer retailers. Oracle sells software for information management almost exclusively to businesses. Exhibit 4.23 presents selected data for the two firms for three recent years.

Exhibit 4.23

REQUIRED

- a. Calculate the accounts receivable turnover ratio for Microsoft and Oracle for Year 1, Year 2, and Year 3.

- b. Suggest possible reasons for the differences in the accounts receivable turnovers of Microsoft and Oracle during the three-year period.

- c. Suggest possible reasons for the changes in the accounts receivable turnover for the two firms over the three-year period.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Byce Inc. and Lewis Corporation are competitors in the computer industry. Following is a table of Total revenue and R&D expenses for both companies.

Byce Inc.

Lewis Corporation

(in millions)

Year 3

Year 2

Year 1

Year 3

Year 2

Year 1

Total revenue

$215,639

$233,715

$182,795

$85,320

$93,580

$86,833

R&D expenses

10,045

8,067

6,041

11,988

12,046

11,381

Which of the following is true?

Select one:

a. Lewis Corporation is less R&D intensive in Year 3 than in Year 2.

b. Byce Inc. is the more R&D intensive company of the two.

c. Lewis Corporation is more R&D intensive in Year 3 than in Year 2.

d. None of the above

e. Byce Inc. has become less R&D intensive over the three years.

[The following information applies to the questions displayed below.]

CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below:

Sales

$

4,980,000

Net operating income

$

298,800

Average operating assets

$

830,000

The following questions are to be considered independently.

2. The entrepreneur who founded the company is convinced that sales will increase next year by 60% and that net operating income will increase by 160%, with no increase in average operating assets. What would be the company’s ROI?

Return on investment (ROI)

%

Smart Eletro plc, a public listed company, is a major supplier of electrical components to the automotive industry. Company’s key accounting ratios are set out in the following table, together with industry averages:

Smart Electro plc.

Industry Averages

Return on capital employed

21.4%

16.1%

Gross profit margin

11.5%

13.0%

Net profit margin

9.8%

11.0%

Current ratio

1.6

1.4

Inventories turnover

12

6

Trade receivables collection period

61 days

65 days

Trade payables payment period

43 days

105 days

Gearing

68.4%

37.2%

Questions:

You are working in this company and the Finance Director asked you to write a report to the Board of Directors. Write a brief report to the board of directors of Smart Eletro plc. comparing the ratios for the company with the industry averages. Identify any areas in which you think they could make improvements.

Smart Eletro plc. has operations in…

Chapter 4 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

Ch. 4 - Common-Size Analysis. Common-size analysis is a...Ch. 4 - Earnings per Share. Firm A reports an increase in...Ch. 4 - Prob. 3QECh. 4 - Profit Margin for ROA versus ROCE. Describe the...Ch. 4 - Concept and Measurement of Financial Leverage....Ch. 4 - Advantages of Financial Leverage. A company...Ch. 4 - Prob. 7QECh. 4 - Nucor, a steel manufacturer, reported net income...Ch. 4 - Phillips-Van Heusen, an apparel manufacturer,...Ch. 4 - TJX, Inc., an apparel retailer, reported net...

Ch. 4 - Boston Scientific, a medical device manufacturer,...Ch. 4 - Valero Energy, a petroleum company, reported net...Ch. 4 - Exhibit 4.22 presents selected operating data for...Ch. 4 - Microsoft Corporation (Microsoft) and Oracle...Ch. 4 - Prob. 17PCCh. 4 - Prob. 18PCCh. 4 - Texas Instruments (TI) designs and manufactures...Ch. 4 - JCPenney operates a chain of retail department...Ch. 4 - Prob. 21PCCh. 4 - Selected data for General Mills for 2007, 2008,...Ch. 4 - Prob. 23PCCh. 4 - Hasbro is a leading firm in the toy, game, and...Ch. 4 - Fitch sells casual apparel and personal care...Ch. 4 - Prob. 26PCCh. 4 - Starwood Hotels (Starwood) owns and operates many...Ch. 4 - Select data for Avis and Hertz for 2012 follow....Ch. 4 - Integrative Case 1.1 introduced the industry...Ch. 4 - Prob. 1ABICCh. 4 - Prob. 1ACICCh. 4 - Prob. 1BAICCh. 4 - Prob. 1BBICCh. 4 - Walmart and Carrefour follow similar strategies....Ch. 4 - Walmart and Carrefour follow similar strategies....

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Comparing Two Companies in the Same Industry: Chipotle and Panera Bread Refer to the financial information for Chipotle and Panera Bread reproduced at the end of this book and answer the following questions: Required What is the dollar amount of inventories that each company reports on its balance sheet at the end of the most recent year? What percentage of total assets do inventories represent for each company? What does this tell you about the nature of their business? Refer to Note 1 in Chipotles annual report. What inventory valuation method does the company use? Refer to Note 2 in Panera Breads annual report. What inventory valuation method does the company use? How do both companies deal with situations in which the market value of inventory is less than its cost? Given the nature of their businesses, which inventory system, periodic or perpetual, would you expect both Chipotle and Panera Bread to use? Explain your answer.arrow_forwardPolo Ralph Lauren Corporation designs, markets, and distributes a variety of apparel, home decor, accessory, and fragrance products. The companys products include such brands as Polo by Ralph Lauren, Ralph Lauren Purple Label, Ralph Lauren, Polo Jeans Co., and Chaps. Polo Ralph Lauren reported the following (in thousands) for two recent years: Assume that accounts receivable (in millions) were 486,200 at the beginning of Year 1. a. Compute the accounts receivable turnover for Year 2 and Year 1. Round to one decimal place. b. Compute the days sales in receivables for Year 2 and Year 1. Use 365 days and round to one decimal place. c. What conclusions can be drawn from these analyses regarding Ralph Laurens efficiency in collecting receivables?arrow_forwardPatrick Financial Services, an accounting firm, specialises in providing accounting and taxation work for dentists and doctors. You have been provided with financial information relating to the firm in appendix 1. In appendix 2, you have been provided with non-financial information which is based on the balanced scorecard format. Appendix 1: Financial information Current year Previous year Turnover (£000) 945 900 Net profit (£000) 187 180 Average cash balances (£000) 21 20…arrow_forward

- Listed below are the current Accounting Assumptions and Principles Economic Entity Assumption Monetary Unit Assumption Historical Cost Principle Going Concern Assumption Revenue Recognition Principle Full Disclosure Principle Time Period Assumption Matching Principle Required: For the following situations, identify whether the situation represents a violation or a correct application of GAAP, and which assumption/principle is applicable. d. Moss Corporation closes the books each month and prepares monthly financial statements. Violation: (Yes/No) Applicable Assumption/Principle: e. Carroll Corporation, a US company, purchased a machine from Germany for 10,000 Euros and recorded the machine on their books at $12,000 US Violation: (Yes/No) Applicable…arrow_forwardListed below are the current Accounting Assumptions and Principles Economic Entity Assumption Monetary Unit Assumption Historical Cost Principle Going Concern Assumption Revenue Recognition Principle Full Disclosure Principle Time Period Assumption Matching Principle Required: For the following situations, identify whether the situation represents a violation or a correct application of GAAP, and which assumption/principle is applicable. d. Moss Corporation closes the books each month and prepares monthly financial statements. Violation: (Yes/No) Applicable Assumption/Principle: e. Carroll Corporation, a US company, purchased a machine from Germany for 10,000 Euros and recorded the machine on their books at $12,000 US Violation: (Yes/No)…arrow_forwardCommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below: Sales $ 4,300,000 Net operating income $ 301,000 Average operating assets $ 860,000 The following questions are to be considered independently. 3. The Chief Financial Officer of the company believes a more realistic scenario would be a $1,550,000 increase in sales, requiring a $310,000 increase in average operating assets, with a resulting $444,875 increase in net operating income. What would be the company’s ROI in this scenario? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forward

- Can you help with this question plese? The accounting firm of Deloitte & Touche is the largest international accounting firm in the world as ranked by total revenues. For two recent years, Deloitte & Touche reported the following for its U.S. operations: CurrentYear PreviousYear Revenue (in billions) $19.9 $18.6 Number of professional staff (including partners) 79,347 71,212 a. For the current and previous years, determine the revenue per professional staff. Round your answers to the nearest dollar. Revenue per professional staff Current year $fill in the blank 1 Previous year $fill in the blank 2 b. Interpret the trend between the two years. Did the revenues increase or decrease? Did the revenue per professional staff increase or decrease?arrow_forwardSmart Eletro plc, a public listed company, is a major supplier of electrical components to the automotive industry. Company’s key accounting ratios are set out in the following table, together with industry averages: Smart Electro plc.Industry AveragesReturn on capital employed 21.4%16.1%Gross profit margin 11.5%13.0%Net profit margin 9.8%11.0%Current ratio 1.61.4Inventories turnover 126Trade receivables collection period 61 days65 daysTrade payables payment period 43 days105 daysGearing 68.4%37.2%Questions:b) Smart Eletro plc. has operations in the United Kingdom, Europe and the United States. The company has been looking for some time to expand its operations into the Far East and has now formulated plans for the building of two major new factories in China. Explain in detail the best possible internal and external financing options available to the company to expand its operations taking into account the company’s gearing and profitability position.arrow_forward. Ortel Telecom sells telecommunication products and services to a variety of small businesses. Two of Ortel’s key clients are Square and Cloudburst, both fast-growing technology start-ups located in New York City. Ortel has compiled information regarding its transactions with Square and Cloudburst for 2017, as well as its expectations regarding their interactions over the next 3 years: (in pic) Ortel’s transactions with Square and Cloudburst are in cash. Assume that they occur at year-end. Ortel is headquartered in the Cayman Islands and pays no income taxes. The owners of Ortel insist on a required rate of return of 12%. Q. Based on the net present value from cash flows over the next 3 years, is Cloudburst or Square a more valuable customer for Ortel?arrow_forward

- . Ortel Telecom sells telecommunication products and services to a variety of small businesses. Two of Ortel’s key clients are Square and Cloudburst, both fast-growing technology start-ups located in New York City. Ortel has compiled information regarding its transactions with Square and Cloudburst for 2017, as well as its expectations regarding their interactions over the next 3 years: (in pic) Ortel’s transactions with Square and Cloudburst are in cash. Assume that they occur at year-end. Ortel is headquartered in the Cayman Islands and pays no income taxes. The owners of Ortel insist on a required rate of return of 12%. Q. What is the expected net cash flow from Square and Cloudburst for the next 3 yearsarrow_forward. Ortel Telecom sells telecommunication products and services to a variety of small businesses. Two of Ortel’s key clients are Square and Cloudburst, both fast-growing technology start-ups located in New York City. Ortel has compiled information regarding its transactions with Square and Cloudburst for 2017, as well as its expectations regarding their interactions over the next 3 years: (in pic) Ortel’s transactions with Square and Cloudburst are in cash. Assume that they occur at year-end. Ortel is headquartered in the Cayman Islands and pays no income taxes. The owners of Ortel insist on a required rate of return of 12%. Q. Cloudburst threatens to switch to another supplier unless Ortel gives a 10% price reduction on all sales starting in 2018. Calculate the 3-year NPV of Cloudburst after incorporating the 10% discount. Should Ortel continue to transact with Cloudburst? What other factors should it consider before making its final decision?arrow_forwardAT&T and Verizon produce and market telecommunications products and are competitors. Key financial figures for these businesses for a recent year follow. Key Figures ($ millions) AT&T Verizon Sales . $126,723 $110,875 Net income . 4,184 10,198 Average assets . . . . . . . . . . . . . . . . . . . . 269,868 225,233 Required 1. Compute return on assets for (a) AT&T and (b) Verizon. 2. Which company is more successful in the total amount of sales to consumers? 3. Which company is more successful in returning net income from its assets invested?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License