Concept explainers

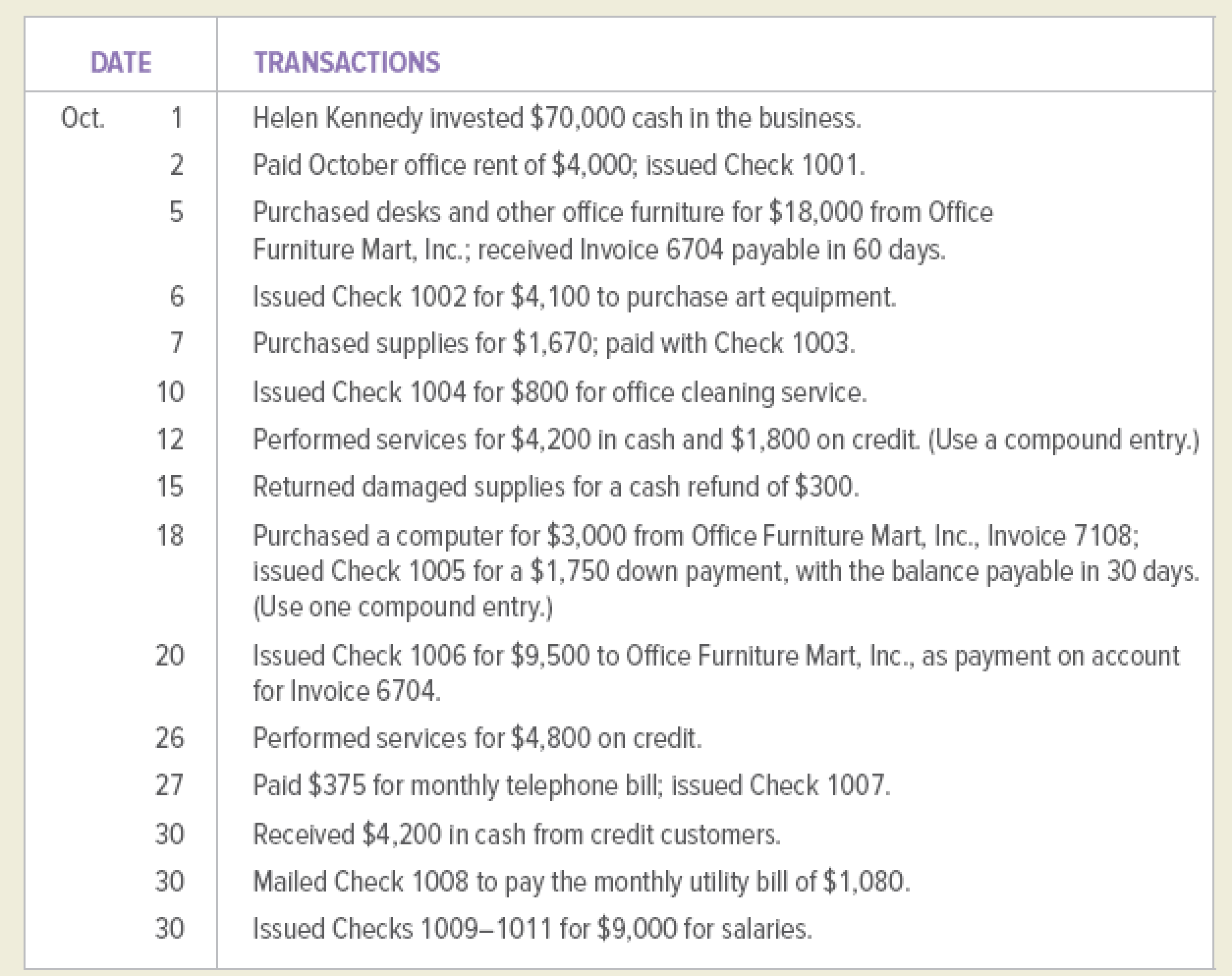

On October 1, 2019, Helen Kennedy opened an advertising agency. She plans to use the chart of accounts listed below.

INSTRUCTIONS

1. Journalize the transactions. Number the journal page 1, write the year at the top of the Date column, and include a description for each entry.

2. Post to the ledger accounts. Before you start the posting process, open accounts by entering account names and numbers in the headings. Follow the order of the accounts in the chart of accounts.

ASSETS

101 Cash

111

121 Supplies

141 Office Equipment

151 Art Equipment

LIABILITIES

202 Accounts Payable

OWNER’S EQUITY

301 Helen Kennedy, Capital

302 Helen Kennedy, Drawing

REVENUE

401 Fees Income

EXPENSES

511 Office Cleaning Expense

514 Rent Expense

517 Salaries Expense

520 Telephone Expense

523 Utilities Expense

Analyze: What is the balance of account 202 in the general ledger?

1.

Journalize the given transaction.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit: A debit, is an accounting term that refers to the left side of an account. The term debit is be denoted by (Dr). The recording amount on the left side of the account is known as debiting.

Credit: A credit, is an accounting term that refers to the right side of an account. The term credit is denoted as (Cr). The recording amount on the right side of the account is known as crediting.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all the increase in the assets, the expenses and the dividends, all the decrease in liabilities, revenues and the stockholders’ equities.

- Credit, all the increase in the liabilities, the revenues, and the stockholders’ equities, and all decreases in the assets, and the expenses.

Pass the journal entries for the given transactions:

| General Journal | Page - 1 | |||

| Date | Description | Post | Debit | Credit |

| 2019 | ||||

| October 1 | Cash | 101 | $70,000 | |

| HK Capital | 301 | $70,000 | ||

| (To record the receipt of capital) | ||||

| October 2 | Rent expense | 514 | $4,000 | |

| Cash | 101 | $4,000 | ||

| (To record the payment of rent, Check 1001) |

Table (1)

| General Journal | Page - 2 | |||

| Date | Description | Post | Debit | Credit |

| 2019 | ||||

| October 5 | Office Equipment | 141 | $18,000 | |

| Accounts payable | 202 | $18,000 | ||

| (To record the purchase of office equipment on account Invoice 6704) | ||||

| October 6 | Art Equipment | 151 | $4,100 | |

| Cash | 101 | $4,100 | ||

| (To record the purchase of art equipment for cash, Check 1002) | ||||

| October 7 | Supplies | 121 | $1,670 | |

| Cash | 101 | $1,670 | ||

| (To record the purchase of supplies for cash, Check 1003) | ||||

| October 10 | Office Cleaning Expense | 511 | $8,00 | |

| Cash | 101 | $8,00 | ||

| (To record the payment of office cleaning expense, Check 1004) | ||||

| October 12 | Cash | 101 | $4,200 | |

| Accounts receivable | 111 | $1,800 | ||

| Fees Income | 401 | $6,000 | ||

| (To record the services provided for cash and on account) | ||||

| October 15 | Cash | 101 | $300 | |

| Supplies | 121 | $300 | ||

| (To record the return of damaged supplies for cash refund) | ||||

| October 18 | Office Equipment | 141 | $3,000 | |

| Cash | 101 | $1,750 | ||

| Accounts payable | 202 | $1,250 | ||

| (To record the services provided for cash and on account) |

Table (2)

| General Journal | Page - 3 | |||

| Date | Description | Post | Debit | Credit |

| 2019 | ||||

| October 20 | Accounts payable | 202 | $9,500 | |

| Cash | 101 | $9,500 | ||

| (To record the payment for office supplies, Invoice 5103 by Check 206) | ||||

| October 26 | Accounts receivable | 111 | $4,800 | |

| Fees income | 401 | $4,800 | ||

| (To record the service provided on account) | ||||

| October 27 | Telephone expense | 520 | $375 | |

| Cash | 101 | $375 | ||

| (To record the payment of telephone bill, Check 1007) | ||||

| October 30 | Cash | 101 | $4,200 | |

| Accounts receivable | 111 | $4,200 | ||

| (To record the receipt of fees) | ||||

| Utilities expense | 523 | $1,080 | ||

| Cash | 101 | $1,080 | ||

| (To record the payment of utility bill, Check 1008) | ||||

| Salaries expense | 517 | $9,000 | ||

| Cash | 101 | $9,000 | ||

| (To record the payment of salaries, Checks 1009-1011) |

Table (3)

2.

Post the journal entries in the General Ledger and identify the balance in the Account 202.

Explanation of Solution

General ledger:

General ledger is a record of all accounts of assets, liabilities, and stockholders’ equity, necessary to prepare financial statements. In the ledger all the entries are recorded in the account order, for which the transactions actually take place.

Post the journal entries in the General Ledger:

| GENERAL LEDGER | ||||||

| ACCOUNT: Cash | Account No.: 101 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | J1 | $ 70,000 | $ 70,000 | |||

| October 2 | J1 | $ 4,000 | $ 66,000 | |||

| October 6 | J2 | $ 4,100 | $ 61,900 | |||

| October 7 | J2 | $ 1,670 | $ 60,230 | |||

| October 10 | J2 | $ 800 | $ 59,430 | |||

| October 12 | J2 | $ 4,200 | $ 63,630 | |||

| October 15 | J2 | $ 300 | $ 63,930 | |||

| October 18 | J2 | $ 1,750 | $ 62,180 | |||

| October 20 | J2 | $ 9,500 | $ 52,680 | |||

| October 27 | J3 | $ 375 | $ 52,305 | |||

| October 30 | J3 | $ 4,200 | $ 56,505 | |||

| October 30 | J3 | $ 1,080 | $ 55,425 | |||

| October 30 | J3 | $ 9,000 | $ 46,425 | |||

| ACCOUNT: Accounts receivable | Account No.: 111 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 12 | J1 | $ 1,800 | $ 1,800 | |||

| October 26 | J3 | $ 4,800 | $ 6,600 | |||

| October 30 | J3 | $ 4,200 | $ 2,400 | |||

Table (4)

| GENERAL LEDGER | ||||||

| ACCOUNT: Supplies | Account No.: 121 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 7 | J2 | $ 1,670 | $ 1,670 | |||

| October 15 | J2 | $ 300 | $1,370 | |||

| ACCOUNT: Office Equipment | Account No.: 141 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 5 | J2 | $ 18,000 | $ 18,000 | |||

| October 18 | J2 | $ 3,000 | $ 21,000 | |||

| ACCOUNT: Art Equipment | Account No.: 151 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 6 | J2 | $ 4,100 | $ 4,100 | |||

| ACCOUNT: Accounts payable | Account No.: 202 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 5 | J2 | $ 18,000 | $ 18,000 | |||

| October 18 | J2 | $ 1,250 | $ 19,250 | |||

| October 20 | J3 | $ 9,500 | $ 9,750 | |||

| ACCOUNT: HK Capital | Account No.: 301 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | J1 | $ 70,000 | $ 70,000 | |||

| ACCOUNT: HK Drawings | Account No.: 302 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

Table (5)

| GENERAL LEDGER | ||||||

| ACCOUNT: Fees Income | Account No.: 401 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 18 | J2 | $ 6,000 | $ 6,000 | |||

| October 20 | J3 | $ 4,800 | $ 10,800 | |||

| ACCOUNT: Office Cleaning Expense | Account No.: 511 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 10 | J2 | $ 800 | $ 800 | |||

| ACCOUNT: Rent Expense | Account No.: 514 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 2 | J1 | $ 4,000 | $ 4,000 | |||

| ACCOUNT: Salaries Expense | Account No.: 517 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 30 | J3 | $ 9,000 | $ 9,000 | |||

| ACCOUNT: Telephone Expense | Account No.: 520 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 27 | J3 | $ 375 | $ 375 | |||

| ACCOUNT: Utilities Expense | Account No.: 523 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 30 | J3 | $ 1,080 | $ 1,080 | |||

Table (6)

The Account 202 shows a credit balance of $9,750 at the end of the month.

Want to see more full solutions like this?

Chapter 4 Solutions

COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

- Leanders Landscaping Service maintains the following chart of accounts: The following transactions were completed by Leander: Required 1. Journalize the transactions in the general journal. Prepare a brief explanation for each entry. 2. If you are using working papers, write the name of the owner on the Capital and Drawing accounts. 3. Post the journal entries to the general ledger accounts. (Skip this step if you are using CLGL.) 4. Prepare a trial balance dated April 30, 20. If you are using CLGL, use the year 2020 when recording transactions and preparing reports.arrow_forwardKelly Pitney began her consulting business, Kelly Consulting, on April 1, 2019. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closingtrial balance as of April 30, 2019, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2019, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a twocolumn journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during May is 275. b. Supplies on hand on May 31 are 715. c. Depreciation of office equipment for May is 330. d. Accrued receptionist salary on May 31 is 325. e. Rent expired during May is 1,600. f. Unearned fees on May 31 are 3,210. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 10. Prepare a post-closing trial balance.arrow_forwardLaras Landscaping Service has the following chart of accounts: The following transactions were completed by Laras Landscaping Service: Required 1. Journalize the transactions in the general journal. Provide a brief explanation for each entry. 2. If you are using working papers, write the name of the owner on the Capital and Drawing accounts. (Skip this step if you are using CLGL.) 3. Post the journal entries to the general ledger accounts. (Skip this step if you are using CLGL.) 4. Prepare a trial balance dated March 31, 20. If you are using CLGL, use the year 2020 when recording transaction! and preparing reports.arrow_forward

- Prepare journal entries to record the following transactions. Create a T-account for Unearned Revenue, post any entries that affect the account, tally ending balance for the account (assume Unearned Revenue beginning balance of $12,500). A. May 1, collected an advance payment from client, $15,000 B. December 31, remaining unearned advances, $7,500arrow_forwardOn October 1, 2016, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2016. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?arrow_forwardOn November 1, 2016, Patty Cosgrove established an interior decorating business, Classic Designs. During the month, Patty completed the following transactions related to the business: Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Classic Designs as of November 30, 2016. 4. Determine the excess of revenues over expenses for November. 5. Can you think of any reason why the amount determined in (4) might not be the net income for November?arrow_forward

- For the past several years, Steffy Lopez has operated a part-time consulting business from his home. As of July 1, 2016, Steffy decided to move to rented quarters and to operate the business, which was to be known as Diamond Consulting, on a full-time basis. Diamond Consulting entered into the following transactions during July: Instructions 1.Journalize each transaction in a two-column journal starting on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) 2.Post the journal to a ledger of four-column accounts. 3.Prepare an unadjusted trial balance. 4.At the end of July, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during July is 375. b. Supplies on hand on July 31 are 1,525. c. Depreciation of office equipment for July is 750. d. Accrued receptionist salary on July 31 is 175. e. Rent expired during July is 2,400. f. Unearned fees on July 31 are 2,750. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 3 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owners equity, and a balance sheet. 9.Prepare and post the closing entries. (Income Summary is account #33 in the chart of accounts.) Record the closing entries on Page 4 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.arrow_forwardElite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 2016, follows: The following business transactions were completed by Elite Realty during April 2016: Instructions 1. Record the April 1, 2016, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for April in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of April 30, 2016. 5. Assume that the April 30 transaction for salaries and commissions should have been 19,100. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?arrow_forwardWhat Do You Think? You work as an accounting clerk. You have received the following information supplied by a client, S. Winston, from the clients bank statement, the clients tax returns, and a variety of other July documents. The client wants you to prepare an income statement, a statement of owners equity, and a balance sheet for the month of July for Winston Company.arrow_forward

- For the past several years, Jeff Horton has operated a part-time consulting business from his home. As of April 1, 2016, Jeff decided to move to rented quarters and to operate the business, which was to be known as Rosebud Consulting, on a full-time basis. Rosebud Consulting entered into the following transactions during April: Instructions 1.Journalize each transaction in a two-column journal starting on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) 2.Post the journal to a ledger of four-column accounts. 3.Prepare an unadjusted trial balance. 4.At the end of April, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during April is 350. b. Supplies on hand on April 30 are 1,225. c. Depreciation of office equipment for April is 400. d. Accrued receptionist salary on April 30 is 275. e. Rent expired during April is 2,000. f. Unearned fees on April 30 are 2,350. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 3 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owners equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 4 of the journal. (Income Summary is account #33 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.arrow_forwardKelly Pitney began her consulting business, Kelly Consulting, on April 1, 2016. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2016, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2016, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a two column journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6) a. Insurance expired during May is 275. b. Supplies on hand on May 31 are 715. c. Depreciation of office equipment for May is 330. d. Accrued receptionist salary on May 31 is 325. e. Rent expired during May is 1,600. f. Unearned fees on May 31 are 3,210. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owners equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. (Income Summary is account #33 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.arrow_forwardPrepare journal entries to record the following transactions. Create a T-account for Accounts Payable, post any entries that affect the account, and tally ending balance for the account. Assume an Accounts Payable beginning balance of $5,000. A. February 2, purchased an asset, merchandise inventory, on account, $30,000 B. March 10, paid creditor for part of February purchase, $12,000arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College