Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 2R

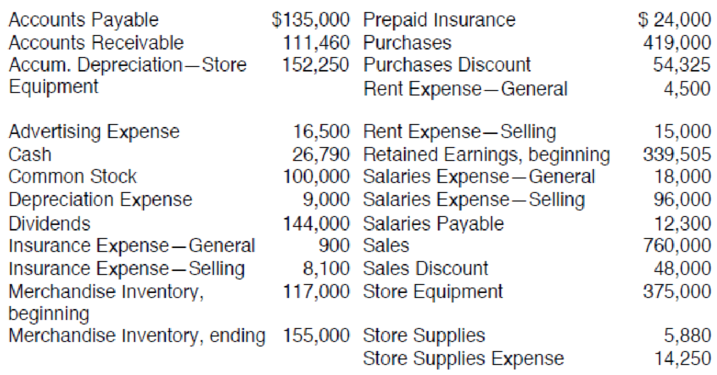

The following information is for Bonnieʼs Buds, a nursery and floral shop, for the month ended May 31, 2012:

Open the file FMERCH from the website for this book at cengagebrain.com. Enter all formulas and titles where indicated on the worksheet. For example, FORMULA2 is =G29 and TITLE A is Sales Discount. When you are finished, make sure that your balance sheet balances. Enter your name in cell A1. Save your completed file as FMERCH2. Print the worksheet. Also print your formulas. Check figure: Total assets (cell G101), $545,880.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

You will find the transactions within the spreadsheet. This additional information may be of use, as well.

Additional Info (this mainly relates to adjustments - ie. Thinking)

Because of the loan, you have to provide the bank with your financial statements at the end of the month - Feb 28, 2021. (we have to make proper FS including adjustments)

You do a quick count of your inventory and find there are 19 pairs of shoes in inventory.

On March 2nd, you receive a report from Shopify that states your credit card processing fees for the last month totalled $250. Shopify will remove the amount due from your future sales transactions.

The March 2nd report also includes notice that your next $400 monthly fee will also simply reduce the amount received from future sales transactions.

You think that your office furniture etc. will last for about 3 years.

You do a quick check and find there's still about $370 worth of office and packing supplies left.

In your wallet…

In November, Year 2, your accounting firm placed a one-time website advertisement with Today's CPA. This is your first ad with this vendor. You pay for the one-time advertising with your company's Citibank Visa credit card. Below is the transaction you completed for this purchase. If you run the report Transaction List by Vendor, for all dates, what dollar amount will appear under the vendor Today's CPA? Why?

Teacher Feedback: was the expense form completed properly?

Joanne is part of the accounts payable team at a local furniture store, responsible for recording invoices received by the business and payments made by the business. The furniture store receives an invoice for internet usage for the amount of $450. The invoice states that payment is due in 30 days, therefore Joanne records the transaction accordingly and sets a calendar reminder to pay on the due date. Based on this information, the journal entry in the furniture store's accounting system would include:

Chapter 4 Solutions

Excel Applications for Accounting Principles

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information is for Bonnies Buds, a nursery and floral shop, for the month ended May 31, 2012: Click the Chart sheet tab on the FMERCH3 file. You will see a chart depicting the five-month trend in sales, gross profit, and net income. What favorable and unfavorable trends do you see in this month-to-month comparison? Comment on any unusual changes. When the assignment is complete, close the file without saving it again. Worksheet. Your boss would prefer to have the balance sheet shown before the income statement and the statement of retained earnings. Please make this change on the FMERCH3 file. Preview the printout to make sure that the worksheet will print neatly on two or three pages, and then print the worksheet. Save the completed file as FMERCHT. Chart. Using the FMERCH3 file, prepare a 3-D pie chart that shows the amount of each of the selling expenses in June. No Chart Data Table is needed. Select A57 to A62 as one range on the worksheet to be charted and then hold down the CTRL key and select E57 to E62 as the second range. Enter your name somewhere on the chart. Save the file again as FMERCH3. Select the chart and then print it out.arrow_forwardReview the following transactions and prepare any necessary journal entries for Olinda Pet Supplies. A. On March 2, Olinda Pet Supplies receives advance cash payment from a customer for forty dog food dishes (from their Dish inventory), costing $25 each. Olinda had yet to supply the dog food bowls as of March 2. B. On April 4, Olinda provides all of the dog food bowls to the customer.arrow_forwardSage Learning Centers was established on July 20, 2016, to provide educational services. The services provided during the remainder of the month are as follows: Instructions 1. Journalize the transactions for July, using a single-column revenue journal and a two-column general journal. Post to the following customer accounts in the accounts receivable ledger, and insert the balance immediately after recording each entry: D. Chase; J. Dunlop; F. Mintz; T. Quinn; K. Tisdale. 2. Post the revenue journal and the general journal to the following accounts in the general ledger, inserting the account balances only after the last postings: 3. a. What is the sum of the balances of the customer accounts in the subsidiary ledger at July 31? b. What is the balance of the accounts receivable controlling account at July 31? 4. Assume Sage Learning Centers began using a computerized accounting system to record the sales transactions on August 1. What are some of the benefits of the computerized system over the manual system?arrow_forward

- The following information is from Dessert Dynasty. The company runs three stores and the December Income Statement for all stores is shown. A. Find the missing values for retail revenue, ingredients, and operating income. B. Comment on the financial performance of each store. C. Identify a limitation of analyzing the information provided. You may want to consider using Microsoft Excel or another spreadsheet application for the numerical data. This information will be used in a subsequent question.arrow_forwardFor each of the following, indicate if the statement reflects an input component, output component, or storage component of an accounting information system. A. A credit card scanner at a grocery store. B. A purchase order for 1,000 bottles of windshield washing fluid to be used as inventory by an auto parts store. C. A report of patients who missed appointments at a doctors office. D. A list of the days cash and credit sales. E. Electronic files containing a list of current customers.arrow_forwardPB&J Cafe has the following transactions that need to be recorded: On April 7, 2019, $250 for peanuts the cafe purchased from The Peanut Gallery to make its patented peanut butter On April 30, 2019 $375 For Rover's Sake paid for catering a corporate event How would Reha record these transactions in the general journals for these accounts? Why does she need to keep separate general journals for each account? Your answer should be at least 100 words.arrow_forward

- Make first a proper Chart of Accounts. Then make a proper Trial Balance from the following accounts and balances listed in alphabetical order for MN Company for August 31 of the current year. Put them in the correct order along with their debit and credit balances on your Trial Balance. Total the DR and CR column and make sure they balance. Make sure you have a heading. We will work on this in class. Upload here on D2L if you are not yet finished in class. Accounts Payable $2300, Accounts Receivable $1200, Accumulated Depreciation-Equipment $800, Advertising Expense $200, Cash $3400, Equipment $12,500, Furniture and Fixtures $6700, MN, Capital, $6500, MN, Drawing $500, Notes Payable $8000, Prepaid Insurance $1200, Professional Fees $10,000, Rent Expense $500, Supplies $100, Utilities Expense $300, Wages Expense $1000.arrow_forwardIn this activity, you are going to record a comprehensive transactions involving merchandising concern. Prepare the journal entries, T-accounts and trial balance of a merchandising concern. Cielo Bonita is engaged in buying and selling of novelty items. The following transactions have transpired for the month of Sept. 2020. Sept. 1 – She invested P100,500 cash and an old office equipment presently valued at P33,200 which she bought 2 years ago for P50,000. Sept. 2- Purchased MDSE from ABC Enterprise for P20,000. Terms: n/30, FOB destination. ABC paid P1,500 for the freight cost. Sept. 3- Sold MDSE for cash amounted to P10,600. Sept. 6- Purchased MDSE from Ali Commercial for P26,500. Terms: 50% down payment, balance 2/10, n/30. Sept. 7 – Sold MDSE to Jay Cesar for P12,500. Terms: 2/10, n/30, FOB Shipping point. Sept. 8 – Purchased from COVID Furniture a display counted for P6,000. Terms : 50% down payment, balance 1/10, n/30.92 Sept. 9 – Sold MDSE to Giles Anthony for P14,000. Terms:…arrow_forwardEvery March, Buddie, who owns and operates a small retail shop, takes a large box of receipts and invoices to her accountant so the accountant can file Buddie's taxes in April. Only then does Buddie know if her business has been profitable. Buddie could benefit from a(n) ________.Select one:a. concurrent control systemb. management information system c. balanced scorecard systemd. inventory control systemarrow_forward

- Before you begin this assignment, review the Tying It All Together feature in the chapter. Part of Fry’s Electronics, Inc.'s experience involves providing technical support to its customers. This includes in-home installations of electronics and also computer support at their retail store locations. Requirements Suppose Fry’s Electronics, Inc. provides $10,500 of computer support at the Dallas-Fort Worth store during the month of November. How would Fry's Electronics record this transaction? Assume all customers paid in cash. What financial statement(s) would this transaction affect? Assume Fry’s Electronics, Inc.’s Modesto, California, location received $24,000 for an annual contract to provide computer support to the local city government. How would Fry’s Electronics record this transaction? What financial statement(s) would this transaction affect? What is the difference in how revenue is recorded in requirements 1 and 2? Clearly state when revenue is recorded in each requirement.arrow_forwardIn November Year 2 your accounting firm placed a one-time website advertisement with Today’s CPA. This is your first ad with this vendor. You pay for the one-time advertising with your company’s Citibank Visa credit card. Below is the transaction you completed for this purchase. If you ran the report Transaction List by Vendor, for all dates, what dollar amount will appear under the vendor Today’s CPA? Why?arrow_forwardYou are to enter up the necessary accounts for the month of June from the following information relating to a small printing firm. Then balance off the accounts and extract a trial balance as at 30 June 2020. June 1 Started in business with capital in cash of $800 and $2200 in the bank. June 2 Bought goods on credit from the following persons: J Ward $610; P Green $214; M Taylor $174; Gemmill $345; P Tone $542 June 4 Sold goods on credit to: J Sharpe $340; G Boycott $720; F Titmus $1,152 June 6 Paid rent by cash $180 June 9 J Sharpe paid us his account by cheque $340. June 10 F Titmus paid us $1000 by cheque June 12 we paid the following by cheque: M Taylor $174; J Ward $610 June 15 Paid carriage by cash $38 June 18 Bought goods on credit from P Green $291; S Gemmill $940 June 21 Sold goods on credit to G Boycott $810 June 30 Paid rent by cheque $230arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

How JOURNAL ENTRIES Work (in Accounting); Author: Accounting Stuff;https://www.youtube.com/watch?v=Y-_Q3rANyxU;License: Standard Youtube License