Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259569562

Author: Ronald W Hilton Proffesor Prof, David Platt

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 34P

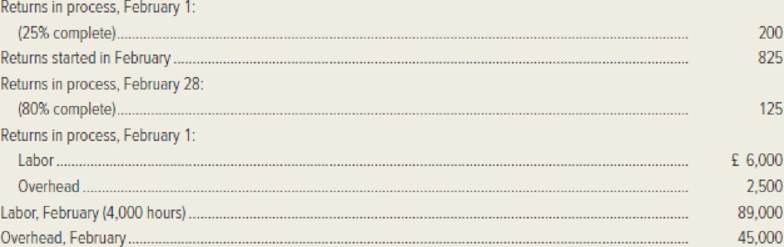

Scrooge and Zilch, a public accounting firm in London, is engaged in the preparation of income tax returns for individuals. The firm uses the weighted-average method of

*Although the euro is used in most European markets, day-to-day business in the United Kingdom continues to be conducted in pounds sterling.

Required:

- 1. Compute the following amounts for labor and for

overhead :- a. Equivalent units of activity.

- b. Cost per equivalent unit. (Remember to express your answer in terms of the British pound sterling, denoted by £.)

- 2. Compute the cost of returns in process as of February 28.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

You manage the international business for a manufacturing company. You are responsible for the overall profitability of your business unit. Your company ships your products to Malaysia. The retail stores that buy your products there pay you in their local currency, the Malaysian ringgit (MYR). All sales for the first quarter are paid on April 1st and use the exchange rate at the close of business on April 1st or the first business day after April 1st if it falls on a Saturday or Sunday. The company has sales contracts with different vendors that determine the number of units sold well in advance. The company is contractually obligated to sell 4,000 units for exactly 1.25 million MYR for the first quarter. The break-even point for each unit is $90 in U.S. dollars. Use the following foreign exchange rates:

On January 1, the daily spot rate is 3.13 MYR, and the forward rate is 0.317 U.S. dollars/MYR for April 1st of the same year.

On April 1, the daily spot rate is 3.52 MYR.

Scenario 3:…

Donovan Ramsey, the Chief Financial Officer of LevelUp Business Consulting, has advised you that the company is considering closing its Calgary, Alberta office and transitioning the staff of that location to permanent work from home employees. The employees home offices would not be considered a permanent establishment of the employer.

Eight staff members currently report to the Alberta office, and the total payroll is $775,000.00.

The organization’s head office and payroll department are in Mississauga, Ontario. The current Ontario payroll is $4,750,000.00.

You have been asked to prepare an analysis showing how closing this permanent establishment in Alberta will impact the employee’s coverage for provincial healthcare and the organization’s payroll expense for provincial health taxes.

Juniper Design Ltd. of Manchester, England, is a company specializing in providing design services to residential developers. Last year the company had net operating income of £600,000 on sales of £3,000,000.The company’s average operating assets for the year were £2,800,000 and its minimum required rate ofreturn was 18%. (The currency used in England is the pound, denoted by £.)Required:Compute the company’s residual income for the year

Chapter 4 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 4 - Explain the primary differences between job-order...Ch. 4 - List five types of manufacturing in which process...Ch. 4 - Prob. 3RQCh. 4 - What are the purposes of a product-costing system?Ch. 4 - Define the term equivalent unit and explain how...Ch. 4 - List and briefly describe the purpose of each of...Ch. 4 - Show how to prepare a journal entry to enter...Ch. 4 - Prob. 8RQCh. 4 - Prob. 9RQCh. 4 - Prob. 10RQ

Ch. 4 - How does process costing differ under normal or...Ch. 4 - How would the process-costing computations differ...Ch. 4 - Explain the concept of operation costing. How does...Ch. 4 - Prob. 14RQCh. 4 - In each case below, fill in the missing amount.Ch. 4 - Rainbow Glass Company manufactures decorative...Ch. 4 - Terra Energy Company refines a variety of...Ch. 4 - The Evanston plant of Fit-for-Life Foods...Ch. 4 - Idaho Lumber Company grows, harvests, and...Ch. 4 - Otsego Glass Company manufactures window glass for...Ch. 4 - Savannah Textiles Company manufactures a variety...Ch. 4 - The following data pertain to Tulsa Paperboard...Ch. 4 - The November production of MVPs Minnesota Division...Ch. 4 - Timing Technology, Inc. manufactures timing...Ch. 4 - Piscataway Plastics Company manufactures a highly...Ch. 4 - The following data pertain to the Vesuvius Tile...Ch. 4 - Triangle Fastener Corporation accumulates costs...Ch. 4 - Moravia Company processes and packages cream...Ch. 4 - Albany Company accumulates costs for its product...Ch. 4 - Goodson Corporation assembles various components...Ch. 4 - A-1 Products manufactures wooden furniture using...Ch. 4 - The following data pertain to the Hercules Tire...Ch. 4 - Scrooge and Zilch, a public accounting firm in...Ch. 4 - GroFast Company manufactures a high-quality...Ch. 4 - Plasto Corporation manufactures a variety of...Ch. 4 - (Contributed by Roland Minch.) Glass Glow Company...Ch. 4 - Orbital Industries of Canada, Inc. manufactures a...Ch. 4 - Laredo Leather Company manufactures high-quality...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Donovan Ramsey, the Chief Financial Officer of LevelUp Business Consulting, has advised you that the company is considering closing its Calgary, Alberta office and transitioning the staff of that location to permanent work from home employees. The employees home offices would not be considered a permanent establishment of the employer. Eight staff members currently report to the Alberta office, and the total payroll is $775,000.00. The organization’s head office and payroll department are in Mississauga,arrow_forwardA U.S.-based multinational pharmaceutical firm with four plants in Europe uses traditional methods to distribute the annual business travel allocation on the basis of workforce size. Last year $500,000 in travel expenses were distributed, according to as shown, at a rate of 500,000 / 29,100 = $17.18 per employee. A switch to ABC allocates the $500,000 in travel expenses on the basis of the number of travel vouchers, categorized by travelers working on each product line. In ABC terminology, travel is the activity and a travel voucher is the cost driver. as shown details the distribution of 500 vouchers to each product line by plant. Not all products are produced at each plant. Use the ABC method to allocate travel expenses to each product line and each plant. Compare plant-by-plant allocations based on workforce size (traditional) and number of travel vouchers (ABC).arrow_forwardDonovan Ramsey, the Chief Financial Officer of LevelUp Business Consulting, has advised you that the company is considering closing its Calgary, Alberta office at the beginning of the next calendar year and transitioning the staff of that location to permanent work from home employees. The employees home offices would not be considered a permanent establishment of the employer. Eight staff members currently report to the Alberta office, and the total payroll is $775,000.00. The organization’s head office and payroll department are in Mississauga, Ontario. The current Ontario payroll is $4,750,000.00. You have been asked to prepare an analysis showing how closing this permanent establishment in Alberta will impact the employee’s coverage for provincial healthcare and the organization’s payroll expense for provincial health taxes. Be specific in your analysis by providing a comparison of current versus projected costs that may result from this change.arrow_forward

- Europa Publications, Inc. specializes in reference books that keep abreast of the rapidly changing political and economic issues in Europe. The results of the company’s operations during the prior year are given in the following table. All units produced during the year were sold. (Ignore income taxes.) Required:1. Prepare a traditional income statement and a contribution income statement for the company.2. What is the firm’s operating leverage for the sales volume generated during the prior year?3. Suppose sales revenue increases by 10 percent. What will be the percentage increase in net income?4. Which income statement would an operating manager use to answer requirement (3)? Why?arrow_forwardHigado Confectionery Corporation has a number of store locations throughout North America. In income statements segmented by store, which of the following would be considered a common fixed cost with respect to the stores? Multiple Choice cost of goods sold at each store store manager salaries store building depreciation expense the cost of corporate advertising aired during the Super Bowlarrow_forwardElysees Ltd is a company that imports and retails luxury goods from France. Theyhave retail outlets at various high-end shopping centres throughout South Africa.As the financial accountant for Elysees Limited, you have been tasked withestablishing the correct carrying amount of the inventory for the financial yearended 31 August 2018.InventoryDue to the recent economic recession and in a bid to boost sales in the localenvironment, Elysees Limited began manufacturing faux leather handbags andshoes for resale to middle income consumers. The following information isavailable for the financial year ended 31 August 2018:DetailsRaw material purchased for the year (in metres) 75 000Raw material issued to production during the year (in metres) 52 500Raw material per unit produced (in metres) 1Direct labour per hour (Rands) R8Actual production hours for the year 138 000Variable manufacturing overheads R127 500Budgeted fixed manufacturing overheads R900 000Normal production capacity (hours per…arrow_forward

- Elysees Ltd is a company that imports and retails luxury goods from France. Theyhave retail outlets at various high-end shopping centres throughout South Africa.As the financial accountant for Elysees Limited, you have been tasked withestablishing the correct carrying amount of the inventory for the financial yearended 31 August 2018.InventoryDue to the recent economic recession and in a bid to boost sales in the localenvironment, Elysees Limited began manufacturing faux leather handbags andshoes for resale to middle income consumers. The following information isavailable for the financial year ended 31 August 2018:DetailsRaw material purchased for the year (in metres) 75 000Raw material issued to production during the year (in metres) 52 500Raw material per unit produced (in metres) 1Direct labour per hour (Rands) R8Actual production hours for the year 138 000Variable manufacturing overheads R127 500Budgeted fixed manufacturing overheads R900 000Normal production capacity (hours per…arrow_forwardMason, Durant, and Westbrook (MDW) is a tax services firm. The firm is located in Oklahoma City and employs 15 professionals and eight staff. The firm does tax work for small businesses and well-to-do individuals. The following data are provided for the last fiscal year. (The Mason, Durant, and Westbrook fiscal year runs from July 1 through June 30.) Required: 1. Prepare a statement of cost of services sold. 2. Refer to the statement prepared in Requirement 1. What is the dominant cost? Will this always be true of service organizations? If not, provide an example of an exception. 3. Assuming that the average fee for processing a return is 850, prepare an income statement for Mason, Durant, and Westbrook. 4. Discuss three differences between services and tangible products. Calculate the average cost of preparing a tax return for last year. How do the differences between services and tangible products affect the ability of MDW to use the last years average cost of preparing a tax return in budgeting the cost of tax return services to be offered next year?arrow_forwardSuppose that Demont has been given a summer job as an intern at Isaac Aircams, a company that manufactures sophisticated spy cameras for remote-controlled military reconnaissance aircraft. The company, which is privately owned, has approached a bank for a loan to help it finance its growth. The bank requires financial statements before approving such a loan. Classify each cost listed below as either product costs or period costs for the purpose of preparing the financial statements for the bank. Cost Product Cost/Period Cost 1. Factory supervisors' salaries 2. Heat, water, and power consumed in the factory 3. Materials used for boxing products for shipment overseas. Units are normally boxed. 4. Advertising costs 5. Workers' compensation insurance for factory employeearrow_forward

- Willingham Construction is in the business of building high-priced, custom, single-family homes. The company,headquartered in Anaheim, California, operates throughout the Southern California area. The construction periodfor the average home built by Willingham is six months, although some homes have taken as long as nine months.You have just been hired by Willingham as the assistant controller and one of your first tasks is to evaluate thecompany’s revenue recognition policy. The company presently recognizes revenue upon completion for all of itsprojects and management is now considering whether revenue recognition over time is appropriate.Required:Write a 1- to 2-page memo to Virginia Reynolds, company controller, describing the differences between theeffects of recognizing revenue over time and upon project completion on the income statement and balance sheet.Indicate any criteria specifying when revenue should be recognized. Be sure to include references to GAAP asthey pertain to…arrow_forwardFor each of the following items, identify which of the management accounting guidelines applies: cost-benefit approach, behavioral and technical considerations, or different costs for different purposes. Analyzing whether to keep the billing function within an organization or outsource it Deciding to give bonuses for superior performance to the employees in a Japanese subsidiary and extra vacation time to the employees in a Swedish subsidiary Including costs of all the value-chain functions before deciding to launch a new product, but including only its manufacturing costs in determining its inventory valuation Considering the desirability of hiring one more salesperson Giving each salesperson the compensation option of choosing either a low salary and a high-percentage sales commission or a high salary and a low-percentage sales commission Selecting the costlier computer system after considering two systems Installing a participatory budgeting system in which managers set…arrow_forwardYou have just been hired by Ogden Company to fill a new position that was created in response to rapidgrowth in sales. It is your responsibility to coordinate shipments of finished goods from the factory to distribution warehouses located in various parts of the United States so that goods will be available as ordersare received from customers.The company is unsure how to classify your annual salary in its cost records. The company’s costanalyst says that your salary should be classified as a manufacturing (product) cost; the controller says thatit should be classified as a selling expense; and the president says that it doesn’t matter which way yoursalary cost is classified.Required:1. Which viewpoint is correct? Why?2. From the point of view of the reported net operating income for the year, is the president correct in hisstatement that it doesn’t matter which way your salary cost is classified? Explain.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Foreign Exchange Risks; Author: Kaplan UK;https://www.youtube.com/watch?v=ne1dYl3WifM;License: Standard Youtube License