Corporate Financial Accounting

15th Edition

ISBN: 9781337398169

Author: Carl Warren, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 4.13EX

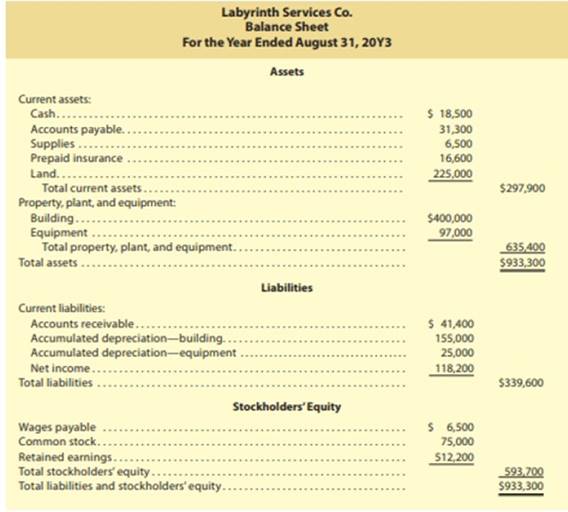

The following balance sheet was prepared by Labyrinth Services Co. for its year ended August: 20Y3.

a. List the errors in the preceding balance sheet.

b. Prepare a corrected balance sheet.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

List the title of each balance sheet account in the Accounts column.

Step 2.

For each balance sheet account, enter its balance as of December 31, 20Y7, in the first column and its balance as of December 31, 20Y8, in the last column. Place the credit balances in parentheses.

Step 3.

Add the December 31, 20Y7 and 20Y8 column totals, which should total to zero.

Step 4.

Analyze the change during the year in each noncash account to determine its net increase (decrease) and classify the change as affecting cash flows from operating activities, investing activities, financing activities, or noncash investing and financing activities.

Step 5.

Indicate the effect of the change on cash flows by making entries in the Transactions columns.

Step 6.

After all noncash accounts have been analyzed, enter the net increase (decrease) in cash during the period.

Step 7.

Add the Debit and Credit Transactions columns. The totals should be equal.

Exhibit8.

Selected account balances before adjustment for Intuit Realty at November 30, the end of the current year, follow:

Debits

Credits

Accounts Receivable

$52,310

Equipment

81,000

Accumulated Depreciation - Equipment

$8,060

Prepaid Rent

6,600

Supplies

1,570

Wages Payable

_

Unearned Fees

7,220

Fees Earned

305,490

Wages Expense

103,050

Rent Expense

_

Depreciation Expense

_

Supplies Expense

_

Data needed for year-end adjustments are as follows:

Supplies on hand at November 30, $470.

Depreciation of equipment during year, $780.

Rent expired during year, $4,810.

Wages accrued but not paid at November 30, $1,520.

Unearned fees at November 30, $3,030.

Unbilled fees at November 30, $3,610.

Required:

Question Content Area

1. Journalize the six adjusting entries required at November 30, based on the data presented.

Nov. 30

Supplies Expense

Supplies

30…

Use the following end-of-period spreadsheet to answer the question that follow.

Finley Company

End-of-Period Spreadsheet

For the Year Ended December 31

Adjusted Trial Balance

Income Statement

Balance Sheet

Account Title

Dr.

Cr.

Dr.

Cr.

Dr.

Cr.

Cash

48,000

48,000

Accounts Receivable

18,000

18,000

Supplies

6,000

6,000

Equipment

57,000

57,000

Accumulated Depreciation

18,000

18,000

Accounts Payable

25,000

25,000

Wages Payable

6,000

6,000

C. Finley, Capital

33,000

33,000

C. Finley, Drawing

3,000

3,000

Fees Earned

155,000

155,000

Wages Expense

63,000

63,000

Rent Expense

27,000

27,000

Depreciation Expense

15,000

15,000

237,000

237,000

105,000

155,000

132,000

82,000

Net income

50,000

50,000

155,000

155,000

132,000

132,000

Use the end-of-period spreadsheet…

Chapter 4 Solutions

Corporate Financial Accounting

Ch. 4 - Prob. 1DQCh. 4 - Describe the nature of the assets that compose the...Ch. 4 - Prob. 3DQCh. 4 - Prob. 4DQCh. 4 - Why are closing entries required at the end of an...Ch. 4 - Prob. 6DQCh. 4 - What is the purpose of the post-closing trial...Ch. 4 - Prob. 8DQCh. 4 - Which step of the accounting cycle is optional?Ch. 4 - Prob. 10DQ

Ch. 4 - Flow of accounts into financial statements The...Ch. 4 - Statement of stockholders equity Scott Lockhart...Ch. 4 - Classified balance sheet The following accounts...Ch. 4 - Closing entries After the accounts have been...Ch. 4 - Accounting cycle From the following list of steps...Ch. 4 - Working capital and current ratio Current assets...Ch. 4 - Flow of accounts into financial statements The...Ch. 4 - Classifying accounts Balances for each of the...Ch. 4 - Financial statements from the end-of-period...Ch. 4 - Financial statements from the end-of-period...Ch. 4 - Income statement The following account balances...Ch. 4 - Income statement; net loss The following revenue...Ch. 4 - Income statement FedEx Corporation (FDX) had the...Ch. 4 - Statement of stockholders equity Climate Control...Ch. 4 - Statement of stockholders equity; net loss...Ch. 4 - Classifying assets Identify each of the following...Ch. 4 - Balance sheet classification At the balance sheet...Ch. 4 - Balance sheet Dynamic Weight Loss Co. offers...Ch. 4 - Balance sheet The following balance sheet was...Ch. 4 - Identifying accounts to be closed From the list...Ch. 4 - Closing entries with net income Automation...Ch. 4 - Closing entries with net loss Summit Services Co....Ch. 4 - Identifying permanent accounts Which of the...Ch. 4 - Post-closing trial balance An accountant prepared...Ch. 4 - Steps in the accounting cycle Rearrange the...Ch. 4 - Appendix 1 Completing an end-of-period spreadsheet...Ch. 4 - Appendix 1 Adjustment data on an end-of-period...Ch. 4 - Prob. 4.22EXCh. 4 - Appendix 1 Financial statements from an...Ch. 4 - Appendix 1 Adjusting entries from an end-of-period...Ch. 4 - Appendix 1 Closing entries from an end-of-period...Ch. 4 - Appendix 2 Reversing entry The following adjusting...Ch. 4 - Appendix 2 Adjusting and reversing entries On the...Ch. 4 - Appendix 2 Adjusting and reversing entries On the...Ch. 4 - Appendix 2 Entries posted to wages expense account...Ch. 4 - Appendix 2 Entries posted to wages expense account...Ch. 4 - Financial statements and closing entries 8.Net...Ch. 4 - Financial statements and closing entries Foxy...Ch. 4 - accounts, adjusting entries, financial statements,...Ch. 4 - Net Income: 51,150 Ledger accounts, adjusting...Ch. 4 - Net income: 43,475 Complete accounting cycle For...Ch. 4 - Financial statements and closing entries Last...Ch. 4 - Financial statements and closing entries The...Ch. 4 - Income: 27,350 accounts, adjusting entries,...Ch. 4 - Ledger accounts, adjusting entries, financial...Ch. 4 - Net income: 53,77S Complete accounting cycle For...Ch. 4 - Comprehensive Problem 1 8 Net income. 31,425...Ch. 4 - Working Capital and Current Ratio Analyze and...Ch. 4 - Analyze and compare Zynga, Electronic Arts, and...Ch. 4 - Analyze and compare Foot Locker and The Finish...Ch. 4 - Analyze Under Armour The following year-end data...Ch. 4 - Prob. 4.5MADCh. 4 - Analyze and compare Alphabet (Google) and...Ch. 4 - Prob. 4.1TIFCh. 4 - Prob. 4.3TIFCh. 4 - Financial statements The following is an excerpt...Ch. 4 - Prob. 4.5TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Income statement; net loss The following revenue and expense account balances were taken from the ledger of Acorn Health Services Co. after the accounts had been adjusted on January 31, 20Y7, the end of the fiscal year: Prepare an income statement.arrow_forwardMissing amounts from financial statements The financial statements at the end of Atlas Realtys first month of operations follow: Instructions By analyzing the interrelationships among the four financial statements, determine the proper amounts for (a) through (r).arrow_forwardTrial Balance The following account titles, arranged in alphabetical order, are from the records of Hadley Realty Corporation. The balance in each account is the normal balance for that account. The balances are as of December 31, after adjusting entries have been made. Prepare an adjusted trial balance, listing the accounts in the following order: (1) assets; (2) liabilities; (3) stockholders equity accounts, including dividends; (4) revenues; and (5) expenses.arrow_forward

- Adjusting entries and errors At the end of August, the first month of operations, the following selected data were taken from the financial statements of Tucker Jacobs, an attorney: In preparing the financial statements, adjustments for the following data were overlooked: Unbilled fees earned at August 31, 31,900. Depreciation of equipment for August, 7,500. Accrued wages at August 31, 5,200. Supplies used during August, 3,000. Instructions 1. Journalize the entries to record the omitted adjustments. 2. Determine the correct amount of net income for August and the total assets, liabilities, and stockholders equity at August 31. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The first adjustment is presented as an example.arrow_forwardQuick ratio Gmeiner Co. had the following current assets and liabilities on December 31 of two recent years: a. Determine the quick ratio for December 31 of both years. b. Interpret the change in the quick ratio between the two balance sheet dates.arrow_forwardUse the following end-of-period spreadsheet to answer the question that follow. Finley Company End-of-Period Spreadsheet For the Year Ended December 31 Adjusted Trial Balance Income Statement Balance Sheet Account Title Dr. Cr. Dr. Cr. Dr. Cr. Cash 48,000 48,000 Accounts Receivable 18,000 18,000 Supplies 6,000 6,000 Equipment 57,000 57,000 Accumulated Depreciation 18,000 18,000 Accounts Payable 25,000 25,000 Wages Payable 6,000 6,000 C. Finley, Capital 33,000 33,000 C. Finley, Drawing 3,000 3,000 Fees Earned 155,000 155,000 Wages Expense 63,000 63,000 Rent Expense 27,000 27,000 Depreciation Expense 15,000 15,000 237,000 237,000 105,000 155,000 132,000 82,000 Net income 50,000 50,000 155,000 155,000 132,000 132,000 Use the end-of-period…arrow_forward

- State the entries in the expanded accounting equation for the year ended 31 December2020. Enter the amounts including a +/- sign to note whether each balance increases/ decreases intothe following template on Moodle.arrow_forwardUse the following end-of-period spreadsheet below to answer the question that follow. Finley CompanyEnd-of-Period SpreadsheetFor the Year Ended December 31 Adjusted Trial Balance Income Statement Balance Sheet Account Title Dr. Cr. Dr. Cr. Dr. Cr. Cash 16,000 16,000 Accounts Receivable 6,000 6,000 Supplies 2,000 2,000 Equipment 19,000 19,000 Accumulated Depreciation 6,000 6,000 Accounts Payable 10,000 10,000 Wages Payable 2,000 2,000 C. Finley, Capital 13,250 13,250 C. Finley, Drawing 1,000 1,000 Fees Earned 45,786 45,786 Wages Expense 20,595 20,595 Rent Expense 6,952 6,952 Depreciation Expense 5,489 5,489 77,036 77,036 33,036…arrow_forwardREQUIRED: a. Prepare all the double entry(T-Account) for the above transactions.b. Balance off the accounts and bring down the balances.c. Prepare a Trial Balance as at 31st March.d. Prepare Income Statement for the year ended 31st March.e. Prepare the Statement of Financial Position as at 31st March.arrow_forward

- Prepare a balance sheet (in report form) as of December 31. (Amounts to be deducted should be indicated by a minus sign. Round your final answers to the nearest whole dollar.)arrow_forwardFinancial Statements from the End-of-Period Spreadsheet Elliptical Consulting is a consulting firm owned and operated by Jayson Neese. The following end-of-period spreadsheet was prepared for the year ended June 30, 20Y6: Elliptical Consulting End-of-Period Spreadsheet For the Year Ended June 30, 20Y6 Unadjusted Adjusted Trial Balance Adjustments Trial Balance Account Title Dr. Cr. Dr. Cr. Dr. Cr. Cash 15,510 15,510 Accounts Receivable 36,920 36,920 Supplies 3,910 (a) 3,290 620 Office Equipment 29,910 29,910 Accumulated Depreciation 4,100 (b) 1,960 6,060 Accounts Payable 9,970 9,970 Salaries Payable (c) 480 480 Jayson Neese, Capital 37,660 37,660 Jayson Neese, Drawing 4,800 4,800 Fees Earned 70,330 70,330 Salary Expense 28,060 (c) 480 28,540 Supplies Expense…arrow_forwardShow all calculation notes a. Prepare the adjusting entry to account for the depreciation of the company's building and fixtures during December b. Prepare the adjusting entry to report the portion of unearned customer deposits that were earned during December c. Prepare the adjusting entry to account for income tax expense that accrued during Decemberarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License