Corporate Financial Accounting

15th Edition

ISBN: 9781337398169

Author: Carl Warren, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 4.3MAD

Analyze and compare Foot Locker and The Finish Line

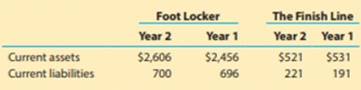

The Foot Locker, Inc. (FL) and The Finish Line, Inc. (FINL) arc two retail athletic footwear chains. The current assets and current liabilities from recent balance sheets for both companies are as follows (in millions):

a. Compute the

b. Compute the

c.  If you were a supplier to these two companies, in which company would you feel most confident about receiving payment?

If you were a supplier to these two companies, in which company would you feel most confident about receiving payment?

d.  For each company, did liquidity improve or decline between the two years?

For each company, did liquidity improve or decline between the two years?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Question 2

Alex is currently considering to invest his money in one of the companies between Company A and Company B. The summarized final accounts of the companies for their last completed financial year are as follows:

Refer to the pic attached.

Based on the pic,

Required:

Calculate the following ratios for Company A and Company B. State clearly the formulae used for each ratio:

Gross Profit Margin

Net Profit Margin

Inventory Turnover Period (days)

Receivables Collection Period (days)

Payables Payment Period (days)

Current Ratio

Quick Ratio

b. Comment on each of the ratios calculated in part (a) above.

Question 2

Alex is currently considering to invest his money in one of the companies between Company A and Company B. The summarized final accounts of the companies for their last completed financial year are as follows:

Refer to the pic attached.

Based on the pic,

Required:

Calculate the following ratios for Company A and Company B. State clearly the formulae used for each ratio:

Receivables Collection Period (days)

Payables Payment Period (days)

Current Ratio

Quick Ratio

Help me with required D,E,F,G only

The following information applies to the questions displayed below.]

You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company’s financial statements, including comparing Lydex’s performance to its major competitors. The company’s financial statements for the last two years are as follows:

Lydex CompanyComparative Balance Sheet

This Year

Last Year

Assets

Current assets:

Cash

$

940,000

$

1,180,000

Marketable securities

0

300,000

Accounts receivable, net

2,620,000

1,720,000

Inventory

3,580,000

2,300,000

Prepaid expenses

250,000

190,000

Total current assets

7,390,000

5,690,000

Plant and equipment, net

9,480,000

9,030,000

Total assets

$

16,870,000

$

14,720,000

Liabilities and Stockholders' Equity

Liabilities:

Current liabilities

$

3,990,000

$…

Chapter 4 Solutions

Corporate Financial Accounting

Ch. 4 - Prob. 1DQCh. 4 - Describe the nature of the assets that compose the...Ch. 4 - Prob. 3DQCh. 4 - Prob. 4DQCh. 4 - Why are closing entries required at the end of an...Ch. 4 - Prob. 6DQCh. 4 - What is the purpose of the post-closing trial...Ch. 4 - Prob. 8DQCh. 4 - Which step of the accounting cycle is optional?Ch. 4 - Prob. 10DQ

Ch. 4 - Flow of accounts into financial statements The...Ch. 4 - Statement of stockholders equity Scott Lockhart...Ch. 4 - Classified balance sheet The following accounts...Ch. 4 - Closing entries After the accounts have been...Ch. 4 - Accounting cycle From the following list of steps...Ch. 4 - Working capital and current ratio Current assets...Ch. 4 - Flow of accounts into financial statements The...Ch. 4 - Classifying accounts Balances for each of the...Ch. 4 - Financial statements from the end-of-period...Ch. 4 - Financial statements from the end-of-period...Ch. 4 - Income statement The following account balances...Ch. 4 - Income statement; net loss The following revenue...Ch. 4 - Income statement FedEx Corporation (FDX) had the...Ch. 4 - Statement of stockholders equity Climate Control...Ch. 4 - Statement of stockholders equity; net loss...Ch. 4 - Classifying assets Identify each of the following...Ch. 4 - Balance sheet classification At the balance sheet...Ch. 4 - Balance sheet Dynamic Weight Loss Co. offers...Ch. 4 - Balance sheet The following balance sheet was...Ch. 4 - Identifying accounts to be closed From the list...Ch. 4 - Closing entries with net income Automation...Ch. 4 - Closing entries with net loss Summit Services Co....Ch. 4 - Identifying permanent accounts Which of the...Ch. 4 - Post-closing trial balance An accountant prepared...Ch. 4 - Steps in the accounting cycle Rearrange the...Ch. 4 - Appendix 1 Completing an end-of-period spreadsheet...Ch. 4 - Appendix 1 Adjustment data on an end-of-period...Ch. 4 - Prob. 4.22EXCh. 4 - Appendix 1 Financial statements from an...Ch. 4 - Appendix 1 Adjusting entries from an end-of-period...Ch. 4 - Appendix 1 Closing entries from an end-of-period...Ch. 4 - Appendix 2 Reversing entry The following adjusting...Ch. 4 - Appendix 2 Adjusting and reversing entries On the...Ch. 4 - Appendix 2 Adjusting and reversing entries On the...Ch. 4 - Appendix 2 Entries posted to wages expense account...Ch. 4 - Appendix 2 Entries posted to wages expense account...Ch. 4 - Financial statements and closing entries 8.Net...Ch. 4 - Financial statements and closing entries Foxy...Ch. 4 - accounts, adjusting entries, financial statements,...Ch. 4 - Net Income: 51,150 Ledger accounts, adjusting...Ch. 4 - Net income: 43,475 Complete accounting cycle For...Ch. 4 - Financial statements and closing entries Last...Ch. 4 - Financial statements and closing entries The...Ch. 4 - Income: 27,350 accounts, adjusting entries,...Ch. 4 - Ledger accounts, adjusting entries, financial...Ch. 4 - Net income: 53,77S Complete accounting cycle For...Ch. 4 - Comprehensive Problem 1 8 Net income. 31,425...Ch. 4 - Working Capital and Current Ratio Analyze and...Ch. 4 - Analyze and compare Zynga, Electronic Arts, and...Ch. 4 - Analyze and compare Foot Locker and The Finish...Ch. 4 - Analyze Under Armour The following year-end data...Ch. 4 - Prob. 4.5MADCh. 4 - Analyze and compare Alphabet (Google) and...Ch. 4 - Prob. 4.1TIFCh. 4 - Prob. 4.3TIFCh. 4 - Financial statements The following is an excerpt...Ch. 4 - Prob. 4.5TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Comparing Two Companies in the Same Industry: Chipotle and Panera Bread Refer to the financial information for Chipotle and Panera Bread reproduced at the end of this book and answer the following questions: Required What is the dollar amount of inventories that each company reports on its balance sheet at the end of the most recent year? What percentage of total assets do inventories represent for each company? What does this tell you about the nature of their business? Refer to Note 1 in Chipotles annual report. What inventory valuation method does the company use? Refer to Note 2 in Panera Breads annual report. What inventory valuation method does the company use? How do both companies deal with situations in which the market value of inventory is less than its cost? Given the nature of their businesses, which inventory system, periodic or perpetual, would you expect both Chipotle and Panera Bread to use? Explain your answer.arrow_forwardAnalyze and compare Zynga, Electronic Arts, and Take-Two Data (in millions) from recent financial statements of Zynga Inc. (ZNGA), Electronic Arts Inc. (EA), and Take-Two Interactive Software, Inc. (TTWO) are as follows: a. Compute the working capital for Year 2 and Year 1 for each company. b. Which company has the largest working capital? c. Compute the current ratio for Year 2 and Year 1 for each company. Round to one decimal place. d. For Year 2, rank the companies from most liquid to least liquid based upon the current ratio.arrow_forwardAnalyze and compare Alphabet (Google) and Microsoft Alphabet Inc. (GOOG) and Microsoft Corporation (MSFT) design and distribute consumer and enterprise software, including overlaps in search, business productivity, and mobile operating systems. Alphabets primary source of revenue is from advertising, while Microsofts is from software subscription and support fees. The following year-end data (in millions) were taken from recent balance sheets for both companies: a. Compute the working capital for each company for both years. b. Which company has the larger working capital at the end of Year 2? c. Is working capital a good measure of relative liquidity in comparing the two companies? Explain. d. Compute the current ratio for both companies. Round to one decimal place. e. Which company has the larger relative liquidity based on the current ratio? f. Based on your analysis, comment on the short-term debt-paying ability of these two companies.arrow_forward

- Question 2 Alex is currently considering to invest his money in one of the companies between Company A and Company B. The summarized final accounts of the companies for their last completed financial year are as follows: Refer to the pic attached. Based on the pic, Part (a) Gross Profit Margin Net Profit Margin Inventory Turnover Period (days) Receivables Collection Period (days) Payables Payment Period (days) Current Ratio Quick Ratio Required: b. Comment on each of the ratios calculated in part (a) above.arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company’s financial statements, including comparing Lydex’s performance to its major competitors. The company’s financial statements for the last two years are as follows: Lydex CompanyComparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 860,000 $ 1,100,000 Marketable securities 0 300,000 Accounts receivable, net 2,300,000 1,400,000 Inventory 3,500,000 2,000,000 Prepaid expenses 240,000 180,000 Total current assets 6,900,000 4,980,000 Plant and equipment, net 9,320,000 8,950,000 Total assets $ 16,220,000 $ 13,930,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 3,910,000 $…arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company’s financial statements, including comparing Lydex’s performance to its major competitors. The company’s financial statements for the last two years are as follows: Lydex CompanyComparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 1,020,000 $ 1,260,000 Marketable securities 0 300,000 Accounts receivable, net 2,940,000 2,040,000 Inventory 3,660,000 2,100,000 Prepaid expenses 270,000 210,000 Total current assets 7,890,000 5,910,000 Plant and equipment, net 9,640,000 9,110,000 Total assets $ 17,530,000 $ 15,020,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 4,070,000…arrow_forward

- Required information Skip to question [The following information applies to the questions displayed below.] You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company’s financial statements, including comparing Lydex’s performance to its major competitors. The company’s financial statements for the last two years are as follows: Lydex CompanyComparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 1,020,000 $ 1,260,000 Marketable securities 0 300,000 Accounts receivable, net 2,940,000 2,040,000 Inventory 3,660,000 2,100,000 Prepaid expenses 270,000 210,000 Total current assets 7,890,000 5,910,000 Plant and equipment, net 9,640,000 9,110,000 Total assets $ 17,530,000 $ 15,020,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 4,070,000…arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company’s financial statements, including comparing Lydex’s performance to its major competitors. The company’s financial statements for the last two years are as follows: Lydex CompanyComparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 1,020,000 $ 1,260,000 Marketable securities 0 300,000 Accounts receivable, net 2,940,000 2,040,000 Inventory 3,660,000 2,100,000 Prepaid expenses 270,000 210,000 Total current assets 7,890,000 5,910,000 Plant and equipment, net 9,640,000 9,110,000 Total assets $ 17,530,000 $ 15,020,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 4,070,000…arrow_forwardEvaluate each of the following transactions in terms of their effect on assets, liabilities, and equity. 1. Buy $15,000 worth of manufacturing supplies on credit2. Issue $85,000 in stock3. Borrow $63,000 from a bank4. Pay $5,000 owed to a supplier What is the net change in Total Liabilities? Please don't provide answer in image format thank youarrow_forward

- Return on assets Tiffany & Co. (TIF) designs and sells jewelry including rings, watches, and necklaces throughout the world. The folk wing data (in millions) n taken from recent financial statements of Tiffany: Compute the return on assets for Tiffany using the preceding data. Round to one decimal place.arrow_forwardComparing Two Companies in the Same Industry: Chipotle and Panera Bread Refer to the financial information for Chipotle and Panera Bread reproduced at the back of the book and answer the following questions. What was the total revenue for each company for the most recent year? By what percentage did each companys revenue increase or decrease from its total amount in the prior year? What was each companys net income for the most recent year? By what percentage did each companys net income increase or decrease from its net income for the prior year? What was the total asset balance for each company at the end of its most recent year? Among its assets, what was the largest asset each company reported on its year-end balance sheet? Did either company pay its stockholders any dividends during the most recent year? Explain how you can tell.arrow_forwardFitch sells casual apparel and personal care products for men, women, and children through retail stores located primarily in shopping malls. Its fiscal year ends January 31 of each year. Financial statements for Abercrombie Fitch for fiscal years ending January 31, Year 3, Year 4, and Year 5 appear in Exhibit 4.34 (balance sheets), Exhibit 4.35 (income statements), and Exhibit 4.36 (statements of cash flows). These financial statements reflect the capitalization of operating leases in property, plant, and equipment and long-term debt, a topic discussed in Chapter 6. Exhibit 4.37 (page 312) presents financial statement ratios for Abercrombie Fitch for Years 3 and 4. Selected data for Abercrombie Fitch appear here. Exhibit 4.34 REQUIRED a. Calculate the ratios in Exhibit 4.37 for Year 5. The income tax rate is 35%. b. Analyze the changes in ROA for Abercrombie Fitch during the three-year period, suggesting possible reasons for the changes observed. c. Analyze the changes in ROCE for Abercrombie Fitch during the three-year period, suggesting possible reasons for the changes observed. Exhibit 4.35 Exhibit 4.36 Exhibit 4.37arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License