Concept explainers

Recording Transactions (Including Adjusting and Closing Entries), Preparing Financial Statements, and Performing Ratio Analysis

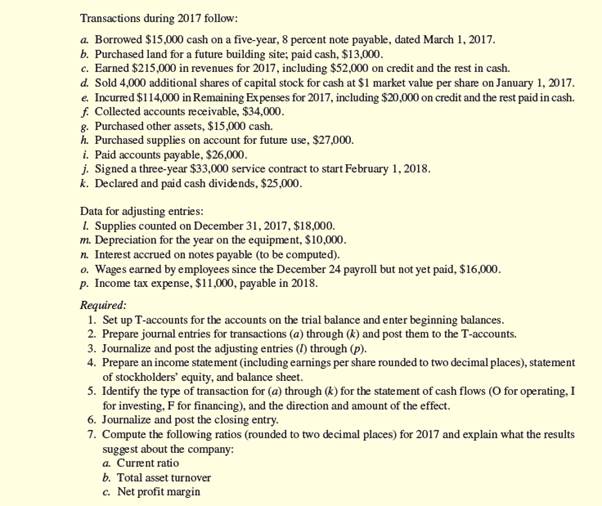

Brothers Mike and Tim Hargen began operations of their tool and the shop (H & H Tool, Inc.) on January 1, 2016. The annual reporting period ends December 31. The

| Account Titles | Debit | Credit |

| Cash | 6,000 | |

| 5,000 | ||

| Supplies | 13,000 | |

| Land | ||

| Equipment | 78,000 | |

| 8,000 | ||

| Other assets (not detailed to simplify) | 7,000 | |

| Accounts payable | ||

| Wages payable | ||

| Interest payable | ||

| Income taxes payable | ||

| Long-term notes payable | ||

| Common stock (8,000 shares, $0.50 par value) | 4,000 | |

| Additional paid-in capital | 80,000 | |

| 17,000 | ||

| Service revenue | ||

| Depreciation expense | ||

| Supplies expense | ||

| Wages expense | ||

| Interest expense | ||

| Income tax expense | ||

| Remaining expenses (not detailed to simplify) | ||

| Totals | 109,000 | 109,000 |

1, 2, 3 and 5

Prepare T-accounts for the accounts on the trial balance and enter beginning balances.

Explanation of Solution

T-account:

T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

(a)The title of the account

(b)The left or debit side

(c)The right or credit side

Prepare the T-account (amounts in thousands):

| Cash (A) account | |||

| Beginning Balance | 6 | b | 13 |

| a | 15 | e | 94 |

| c | 163 | g | 15 |

| d | 4 | i | 26 |

| f | 34 | k | 25 |

| Ending Balance | 49 | ||

| Accounts Receivable (A) account | |||||||

| Beginning Balance | 5 | ||||||

| c | 52 | f | 34 | ||||

| Ending Balance | 23 | ||||||

|

Supplies (A) account | |||||||

| Beginning Balance | 13 | ||||||

| h | 27 | l | 22 | ||||

| Ending Balance | 18 | ||||||

|

Land (A) account | |||||||

| Beginning Balance | 0 | ||||||

| b | 13 | ||||||

| Ending Balance | 13 | ||||||

|

Equipment (A) account | |||

| Beginning Balance | 78 | ||

| Ending Balance | 78 | ||

|

Accumulated depreciation (XA) account | |||

| Beginning Balance |

8 | ||

| m | 10 | ||

| Ending Balance | 18 | ||

Other assets (A) account | |||

| Beginning Balance | 7 | ||

| g | 15 | ||

| Ending Balance | 22 | ||

|

Accounts payable (L) account | |||

| Beginning Balance | 0 | ||

| e | 20 | ||

| h | 27 | ||

| Ending Balance | 21 | ||

|

Income tax payable (L) account | |||

| Beginning Balance | 0 | ||

| p | 11 | ||

| Ending Balance | 11 | ||

|

Wages payable (L) account | |||

| Beginning Balance | 0 | ||

| o | 16 | ||

| Ending Balance | 16 | ||

| Interest payable (L) account | |||

| Beginning Balance | 0 | ||

| n | 1 | ||

| Ending Balance | 1 | ||

| LT Notes payable (L) account | |||

| Beginning Balance | 0 | ||

| a | 15 | ||

| Ending Balance | 15 | ||

|

Common Stock (SE) account | |||

| Beginning Balance |

4 | ||

| d | 2 | ||

| Ending Balance | 6 | ||

|

Additional paid-in capital account | |||

| Beginning Balance |

80 | ||

| d | 2 | ||

| Ending Balance | 82 | ||

| Retained earnings (SE) account | |||

| Beginning Balance | 17 | ||

| k | 25 | ||

| Closing entry | 41 | ||

| Ending Balance | 33 | ||

| Service Revenue (R) account | |||

| Balance | 0 | ||

| Closing entry | 215 | c | 215 |

| Ending Balance | 0 | ||

| Depreciation expense (E) account | |||

| Balance | 0 | ||

| m | 10 | Closing entry | 10 |

| Ending Balance | 0 | ||

| Income Tax Expense ( E) account | |||

| Balance | 0 | ||

| p | 11 | Closing entry | 11 |

| Ending Balance | 0 | ||

| Interest Expense ( E) account | |||

| Balance | 0 | ||

| n | 1 | Closing entry | 1 |

| Ending Balance | 0 | ||

|

Supplies Expense ( E) account | |||

| Balance | 0 | ||

| l | 22 | Closing entry | 22 |

| Ending Balance | 0 | ||

| Wages Expense (E) account | |||

| Balance | 0 | ||

| o | 16 | Closing entry | 16 |

| Ending Balance | 0 | ||

| Remaining expense (E) account | |||

| Balance | 0 | ||

| e | 114 | Closing entry | 114 |

| Ending Balance | 0 | ||

2.

Record journal entries for transactions (a) to (k).

Explanation of Solution

Journal entries for the transactions (a) to (k) as follows:

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| a) | Cash (+A) | 15,000 | |

| Notes payable (Short-term) (+L) | 15,000 | ||

| (To record borrowed cash on note) | |||

| b) | Land (+A) | 13,000 | |

| Cash (-A) | 13,000 | ||

| (To record purchase of land) | |||

| c) | Cash (+A) | 163,000 | |

| Accounts Receivable (+A) | 52,000 | ||

| Service Revenue (+R, +SE) | 215,000 | ||

| (To record service revenue earned during the year 2017) | |||

| d) | Cash (+A) | 4,000 | |

| Common Stock (+SE) | 2,000 | ||

| Additional paid-in capital (+SE) | 2,000 | ||

| (To record issued common stock for cash and additional paid in capital) | |||

| e) | Remaining expenses (+A) | 114,000 | |

| Accounts payable (+L) | 20,000 | ||

| Cash (-A) | 94,000 | ||

| (To record Purchase of remaining expenses) | |||

| f) | Cash (+A) | 34,000 | |

| Accounts Receivable (-A) | 34,000 | ||

| (To record cash collected on customer’s account) | |||

| g) | Other assets (+A) | 15,000 | |

| Cash (-A) | 15,000 | ||

| (To record other assets) | |||

| h) | Supplies (+A) | 27,000 | |

| Accounts payable (+L) | 27,000 | ||

| (To record supplies purchased for future use) | |||

| i) | Accounts payable (-L) | 26,000 | |

| Cash (-A) | 26,000 | ||

| (To record cash paid to creditors) | |||

| j) | No entry required because there is no revenue earned in 2017 | ||

| k) | Retained earnings (-SE) | 25,000 | |

| Cash (-A) | 25,000 | ||

| (To record retained earnings) | |||

Table (1)

3.

Record Adjusting journal entries (l) to (p)

Explanation of Solution

Prepare adjusting journal entries (l) to (p):

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| l. | Supplies expense (+E, -SE) | 22,000 | |

| Supplies(-A) | 22,000 | ||

| (To record the use of supplies) | |||

| m. | Depreciation expense (+E, -SE) | 10,000 | |

| Accumulated depreciation – (+xA, -A) | 10,000 | ||

| (To record adjusting entry for depreciation expense) | |||

| n. | Interest expense (+E, -SE) | 1,000 | |

| Interest payable(+L) | 1,000 | ||

| (To record the adjusting entry for interest expense) | |||

| o. | Wages expense (+E, -SE) | 16,000 | |

| Wages payable (+L) | 16,000 | ||

| (To record the adjusting entry for wages expenses) | |||

| p. | Income tax expense(+E, -SE) | 11,000 | |

| Income tax payable(+L) | 11,000 | ||

| (To record the adjusting entry for income tax expense) | |||

Table (2)

l.

- Supplies expense is an expense account which is a component of stockholders equity. There is an increase in the expense which decreases the stock holders’ equity. Hence, debit supplies expense with $22,000.

- Supplies are asset. There is a decrease in the asset. Hence, credit asset with $22,000.

m.

- Depreciation expense is an expense account which is a component of stockholders’ equity. There is an increase in expense account which decreases the stockholders’ equity. Hence, debit depreciation expense with $10,000.

- Accumulated depreciation is a contra-asset. There is a decrease in the asset. Hence, credit accumulated depreciation with $10,000.

n.

- Interest expense is an expense account which is a component of stockholders’ equity. There is an increase in the expense account which decreases the stockholders’ equity. Hence, debit interest expense with $1,000.

- Interest payable is a liability. There is an increase in the liability. Hence, credit wages with $1,000.

o.

- Wages expense is an expense account which is a component of stockholders equity. There is an increase in the expense which decreases the stock holders’ equity. Hence, debit wages expense with $16,000.

- Wages payable is a liability. There is an increase in the liability. Hence, credit wages payable with $16,000.

p.

- Income tax expense is an expense account which is a component of stock holders’ equity. There is an increase in the expense account which decreases the stockholders’ equity. Hence, debit interest expense with $11,000.

- Income tax payable is a liability. There is an increase in the liability. Hence, credit, interest payable with $11,000.

4.

Prepare an income statement, Statement of stockholders’ equity and balance sheet.

Explanation of Solution

Prepare an income statement for the year ended December 31, 2017:

| Incorporation H&H | |

| Income statement | |

| For the year ended December 31, 2017 | |

| Particulars | Amount ($) |

| Revenues: | |

| Service revenue | 215,000 |

| Total revenues | 215,000 |

| Less: Expenses | |

| Depreciation expense | 10,000 |

| Supplies expense | 22,000 |

| Wages expense | 16,000 |

| Remaining expense | 114,000 |

| Total operating expenses | 162,000 |

| Operating income | 53,000 |

| Less: Other item | |

| Interest expense | 1,000 |

| Pretax income | 52,000 |

| Less: Income tax expense | 11,000 |

| Net income | 41,000 |

| Earnings per share | $3.42 |

Table (3)

Incorporation H&H’s net income is $41,000.

Prepare a statement of Stockholders’ equity:

| Incorporation H&H | ||||

| Statement of stockholders’ equity | ||||

| For the year ended December 31, 2017 | ||||

| Particulars | Common Stock | Additional Paid-in Capital | Retained earnings | Total Stockholders' Equity |

| Balance, January 1, 2017 | $4,000 | $80,000 | $17,000 | $101,000 |

| Additional stock issuance | 2,000 | 2,000 | 4,000 | |

| Net income | 41,000 | 41,000 | ||

| Dividends declared | (25,000) | (25,000) | ||

| Balance, December 31, 2017 | $6,000 | $82,000 | $33,000 | $121,000 |

Table (4)

Prepare a balance sheet for the year December 31, 2017:

| Incorporation H&H | |||

| Balance Sheet | |||

| At December 31, 2017 | |||

| Assets | Amount ($) | Liabilities and Stockholders’ Equity | Amount ($) |

| Current Assets: | Current Liabilities: | ||

| Cash | 49,000 | Accounts payable | 21,000 |

| Accounts receivable | 23,000 | Interest payable | 1,000 |

| Supplies | 18,000 | Wages payable | 16,000 |

| Total current assets | 90,000 | Income taxes payable | 11,000 |

| Land | 13,000 | Total current liabilities | 49,000 |

| Notes payable | 15,000 | ||

| Equipment | 78,000 | Total liabilities | 64,000 |

| Less: Accumulated depreciation | (18,000) | Stockholders' Equity: | |

| Net book value | 60,000 | Common stock | 6,000 |

| Other assets | 22,000 | Additional paid-in capital | 82,000 |

| Retained earnings | 33,000 | ||

| Total stockholders' equity | 1,21,000 | ||

| Total assets | 185,000 | Total liabilities and stockholders' equity | 185,000 |

Table (5)

The balance sheet agrees with the $185,000 of both assets and liabilities column.

5.

Identify the type of transaction for (a) to (k) for the statement of cash flows and the direction and the amount of the effect.

Explanation of Solution

Identify the type of transaction for (a) to (k) for the statement of cash flows and the direction and the amount of the effect:

| Transaction | Type of Effect on Cash Flows | Direction and Amount of Effect |

| a. | F | +15,000 |

| b. | I | -13,000 |

| c. | O | +163,000 |

| d. | F | +4,000 |

| e. | O | -94,000 |

| f. | O | +34,000 |

| g. | I | -15,000 |

| h. | NE | NE |

| i. | O | -26,000 |

| j. | NE | NE |

| k. | F | -25,000 |

Table (6)

Statement of cash flow:

A statement that shows the inflows and outflows of cash or cash equivalents is known as a cash flow statement. A cash flow statement includes the following three components.

- 1. Cash flows from operating activities:

These are the cash produced by the normal business operations.

The following amounts are to be adjusted from the Net Income to calculate the cash flows from the operating activities.

- Deduct increase in current assets.

- Deduct decrease in current liabilities.

- Add decrease in current assets.

- Add the increase in current liability.

- Add depreciation expense.

- Add loss on sale of plant assets.

- Less gain on sale of plant assets.

- 2. Cash flows from investing activities:

These are the amount of cash used for the purchase of any fixed assets, and any cash receives from the sale of fixed assets.

- Deduct the amount of cash used to purchase any fixed assets from cash flows from investing activities to calculate the net cash provided or used for investing activities.

- Add the amount of cash received from the sale of any fixed assets to cash flows from investing activities to calculate the net cash provided or used from investing activities.

- 3. Cash flows from financing activities:

These are the sources of finance of the business.

- Add the amount of cash received from any source of finance like amount from stockholders, debenture holders, or from any fixed liability to the cash flows from financing activities to calculate the net cash used or provided by the financing activities.

- Deduct the payment of dividend and interest from the cash flows from financing activities to calculate the net cash used or provided by the financing activities.

- Deduct the amount of cash paid to purchase the treasury stocks from the cash flows from financing activities to calculate the net cash used or provided by the financing activities.

Note:

I refer to investing activity.

F refers to financing activity.

O refers to operating activity.

NE refers to no effect.

6.

Prepare the closing entry for Incorporation H&H on December 31, 2017.

Explanation of Solution

Prepare closing entries for Incorporation H&H on December 31, 2017:

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| December 31, 2017 | Service revenue(-R) | 215,000 | |

| Retained earnings(+SE) | 41,000 | ||

| Depreciation expense(-E) | 10,000 | ||

| Interest expense (-E) | 1,000 | ||

| Supplies expense(-E) | 22,000 | ||

| Income tax expense(-E) | 11,000 | ||

| Wages expense(-E) | 16,000 | ||

| Remaining expense(-E) | 114,000 | ||

| (To record the closing entries for Incorporation H&H) |

Table (7)

For closing of temporary accounts, the balances of revenues, expenses, and dividend accounts will be transferred to retained earnings in order to bring zero balance for expenses and revenues accounts.

7.

Compute Current ratio, Total asset turnover and net profit margin and explain the results to suggest about the Company H&H.

Explanation of Solution

- (a) Calculation of current ratio:

The current ratio is 1.84:1. For Incorporation H&H, suggests that their current ratio is having sufficient current assets to pay current liabilities.

- (b) Calculation of total asset turnover:

For Incorporation H&H, suggests that the total asset turnover ratio has generated $1.50 for every dollar of assets.

- (c) Calculation of net profit margin:

For Incorporation H&H, suggests that the net profit margin earns $0.191 for every dollar in sales that it generates.

Want to see more full solutions like this?

Chapter 4 Solutions

VALUE - FINANCIAL ACCOUNTING LL+ACCESS

- Reece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services Co.s accounting clerk prepared the following unadjusted trial balance at July 31, 2016: The data needed to determine year-end adjustments are as follows: a. Depreciation of building for the year, 6,400. b. Depreciation of equipment for the year, 2,800. c. Accrued salaries and wages at July 31, 900. d. Unexpired insurance at July 31, 1,500. e. Fees earned but unbilled on July 31, 10,200. f. Supplies on hand at July 31, 615. g. Rent unearned at July 31, 300. Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation ExpenseBuilding; Depreciation ExpenseEquipment; and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries and preparean adjusted trial balance.arrow_forwardElite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 2016, follows: The following business transactions were completed by Elite Realty during April 2016: Instructions 1. Record the April 1, 2016, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for April in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of April 30, 2016. 5. Assume that the April 30 transaction for salaries and commissions should have been 19,100. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?arrow_forwardSelected accounts and related amounts for Clairemont Co. for the fiscal year ended May 31, 2016, are presented in Problem 6-5A. Instructions 1. Prepare a single-step income statement in the format shown in Exhibit 11. 2. Prepare a statement of owners equity. 3. Prepare an account form of balance sheet, assuming that the current portion of the note payable is 50,000. 4. Prepare closing entries as of May 31, 2016.arrow_forward

- Income Statement and Balance Sheet Fort Worth Corporation began business in January 2016 as a commercial carpet-cleaning and drying service. Shares of stock were issued to the owners in exchange for cash. Equipment was purchased by making a down payment in cash and signing a note payable for the balance. Services are performed for local restaurants and office buildings on open account, and customers are given 15 days to pay their accounts. Rent for office and storage facilities is paid at the beginning of each month. Salaries and wages are paid at the end of the month. The following amounts are from the records of Fort Worth Corporation at the end of its first month of operations: Required Prepare an income statement for the month ended January 31, 2016. Prepare a balance sheet at January 31, 2016. What information would you need about Notes Payable to fully assess Fort Worths longterm viability? Explain your answer.arrow_forwardSelected accounts and related amounts for Kanpur Co. for the fiscal year ended June 30, 2016, are presented in Problem 6-5B. Instructions 1. Prepare a single-step income statement in the format shown in Exhibit 11. 2. Prepare a statement of owners equity. 3. Prepare an account form of balance sheet, assuming that the current portion of the note payable is 7,000. 4. Prepare closing entries as of June 30, 2016.arrow_forwardEddie Edwards and Phil Bell own and operate The Second Hand Equipment Shop. The following transactions involving notes and interest were completed during the last three months or 20--: REQUIRED 1. Prepare general journal entries for the transactions. 2. Prepare necessary adjusting entries for the notes outstanding on December 31.arrow_forward

- Ledger accounts, adjusting entries, financial statements, and closing entries; optional spreadsheet The unadjusted trial balance of Lakota Freight Co. at March 31, 20Y4, the end of the year, follows: The data needed to determine year-end adjustments are as follows: (a) Supplies on hand at March 31 are 7,500. (b) Insurance premiums expired during year are 1,800. (c) Depreciation of equipment during year is 8,350. (d) Depreciation of trucks during year is 6,200. (e) Wages accrued but not paid at March 31 are 600. Instructions 1. For each account listed in the trial balance, enter the balance in the appropriate Balance column of a four-column account and place a check mark () in the Posting Reference column. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed. 3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following additional accounts from Lakota Freight Co.s chart of accounts should be used: Wages Payable, 22; Supplies Expense, 52; Depreciation ExpenseEquipment, 55; Depreciation ExpenseTrucks, 56; Insurance Expense, 57. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of stockholders equity, and a balance sheet. During the year ended March 31, 20Y4, additional common stock of 6,000 was issued. 6. Journalize and post the closing entries. Record the closing entries on Page 27 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 7. Prepare a post-closing trial balance.arrow_forwardEFFECTS OF TRANSACTIONS (BALANCE SHEET ACCOUNTS) Jon Wallace started a business. During the first month (March 20--), the following transactions occurred. Show the effect of each transaction on the accounting equation: Assets= Liabilities + Owners Equity. After each transaction, show the new account totals. (a) Invested cash in the business, 30,000. (b) Bought office equipment on account, 4,500. (c) Bought office equipment for cash, 1,600. (d) Paid cash on account to supplier in transaction (b), 2,000. EFFECTS OF TRANSACTIONS (REVENUE, EXPENSE, WITHDRAWALS) This exercise is an extension of Exercise 2-3B. Lets assume Jon Wallace completed the following additional transactions during March. Show the effect of each transaction on the basic elements of the expanded accounting equation: Assets = Liabilities + Owners Equity (Capital Drawing + Revenues Expenses). After transaction (k), report the totals for each element. Demonstrate that the accounting equation has remained in balance. (e) Performed services and received cash, 3,000. (f) Paid rent for March, 1,000. (g) Paid March phone bill, 68. (h) Jon Wallace withdrew cash for personal use, 800. (i) Performed services for clients on account, 900. (j) Paid wages to part-time employee, 500. (k) Received cash for services performed on account in transaction (i), 500.arrow_forwardToms Catering Services prepared the following work sheet for the year ended December 31, 20--. Required 1. Complete the work sheet. (Skip this step if using CLGL.) 2. Prepare an income statement. 3. Prepare a statement of owners equity. Assume that there was an additional investment of 2,500 on December 1. 4. Prepare a balance sheet 5. Journalize the closing entries with the four steps in the correct sequence. 6. Prepare a post-closing trial balance. Check Figure Post-closing trial balance total, 31,665arrow_forward

- The unadjusted trial balance of La Mesa Laundry at August 31, 2016, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: a. Wages accrued but not paid at August 31 are 2,200. b. Depreciation of equipment during the year is 8,150. c. Laundry supplies on hand at August 31 are 2,000. d. Insurance premiums expired during the year are 5,300. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as Aug. 31 Bal. In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, Insurance Expense, and Income Summary. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed. 3. Journalize and post the adjusting entries. Identify the adjustments by Adj. and the new balances as Adj. Bal. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of owners equity (no additional investments were made during the year), and a balance sheet. 6. Journalize and post the closing entries. Identify the closing entries by Clos. 7. Prepare a post-closing trial balance.arrow_forwardJournal entries and trial balance On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: a. Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 17,500. b. Purchased supplies on account, 2,300. c. Earned sales commissions, receiving cash, 13,300. d. Paid rent on office and equipment for the month, 3,000. e. Paid creditor on account, 1,150. f. Paid dividends, 1,800. g. Paid automobile expenses (including rental charge) for month, 1,500, and miscellaneous expenses, 400. h. Paid office salaries, 2,800. i. Determined that the cost of supplies used was 1,050. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Journal entry explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of August 31, 20Y7. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for August. 5. Determine the increase or decrease in retained earnings for August.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage