Concept explainers

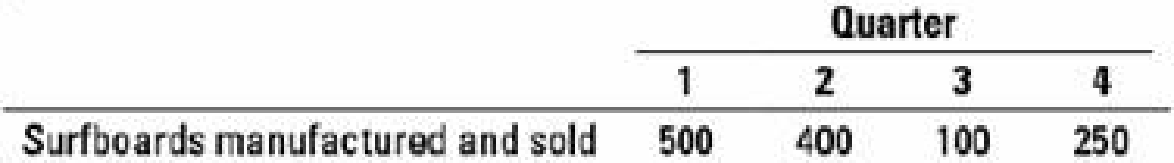

Time period used to compute indirect cost rates. Capitola Manufacturing produces surfboards. The company uses a normal-costing system and allocates manufacturing overhead on the basis of direct manufacturing labor-hours. Most of the company’s production and sales occur in the first and second quarters of the year. The company is in danger of losing one of its larger customers, Pacific Wholesale, due to large fluctuations in price. The owner of Capitola has requested an analysis of the

It takes 2 direct manufacturing labor-hours to make each board. The actual direct material cost is $65.00 per board. The actual direct manufacturing labor rate is $20 per hour. The budgeted variable manufacturing overhead rate is $16 per direct manufacturing labor-hour. Budgeted fixed manufacturing overhead costs are $20,000 each quarter.

- 1. Calculate the total manufacturing cost per unit for the second and third quarter assuming the company allocates manufacturing overhead costs based on the budgeted manufacturing overhead rate determined for each quarter.

Required

- 2. Calculate the total manufacturing cost per unit for the second and third quarter assuming the company allocates manufacturing overhead costs based on an annual budgeted manufacturing overhead rate.

- 3. Capitola Manufacturing prices its surfboards at manufacturing cost plus 20%. Why might Pacific Wholesale be seeing large fluctuations in the prices of boards? Which of the methods described in requirements 1 and 2 would you recommend Capitola use? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

COST ACCOUNTING

- Kimball Company has developed the following cost formulas: Materialusage:Ym=80X;r=0.95Laborusage(direct):Yl=20X;r=0.96Overheadactivity:Yo=350,000+100X;r=0.75Sellingactivity:Ys=50,000+10X;r=0.93 where X=Directlaborhours The company has a policy of producing on demand and keeps very little, if any, finished goods inventory (thus, units produced equals units sold). Each unit uses one direct labor hour for production. The president of Kimball Company has recently implemented a policy that any special orders will be accepted if they cover the costs that the orders cause. This policy was implemented because Kimballs industry is in a recession and the company is producing well below capacity (and expects to continue doing so for the coming year). The president is willing to accept orders that minimally cover their variable costs so that the company can keep its employees and avoid layoffs. Also, any orders above variable costs will increase overall profitability of the company. Required: 1. Compute the total unit variable cost. Suppose that Kimball has an opportunity to accept an order for 20,000 units at 220 per unit. Should Kimball accept the order? (The order would not displace any of Kimballs regular orders.) 2. Explain the significance of the coefficient of correlation measures for the cost formulas. Did these measures have a bearing on your answer in Requirement 1? Should they have a bearing? Why or why not? 3. Suppose that a multiple regression equation is developed for overhead costs: Y = 100,000 + 100X1 + 5,000X2 + 300X3, where X1 = direct labor hours, X2 = number of setups, and X3 = engineering hours. The coefficient of determination for the equation is 0.94. Assume that the order of 20,000 units requires 12 setups and 600 engineering hours. Given this new information, should the company accept the special order referred to in Requirement 1? Is there any other information about cost behavior that you would like to have? Explain.arrow_forwardBoston Executive. Inc., produces executive limousines and currently manufactures the mini-bar inset at these costs: The company received an offer from Elite Mini-Bars to produce the insets for $2,100 per Unit and supply 1,000 mini-bars for the coming years estimated production. If the company accepts this offer and shuts down production of this part of the business, production workers and supervisors will be reassigned to other areas. Assume that for the short-term decision-making process demonstrated in this problem, the companys total labor costs (direct labor and supervisor salaries) will remain the same if the bar inserts are purchased. The specialized equipment cannot be used and has no market value. However, the space occupied by the mini bar production can be used by a different production group that will lease it for $55,000 per year. Should the company make or buy the mini-bar insert?arrow_forwardSardi Inc. is considering whether to continue to make a component or to buy it from an outside supplier. The company uses 13,100 of the components each year. The unit product cost of the component according to the company's cost accounting system is given as follows: Direct materials $ 8.90 Direct labor 5.90 Variable manufacturing overhead 1.70 Fixed manufacturing overhead 3.70 Unit product cost $ 20.20 Assume that direct labor is a variable cost. Of the fixed manufacturing overhead, 20% is avoidable if the component were bought from the outside supplier. In addition, making the component uses 2 minutes on the machine that is the company's current constraint. If the component were bought, time would be freed up for use on another product that requires 4 minutes on this machine and that has a contribution margin of $5.30 per unit. When deciding whether to make or buy the component, what cost of making the component should be compared to the…arrow_forward

- National Co. produces small electric engines. It incurs the following costs for the year. Which of the following costs is not a variable product cost? Wages of the assembly-line workers Machine lubricant used in production activities Commissions paid to salespeople Engine casings used in production activitiesarrow_forwardHawkins Audio Video, Inc. manufactures digital cameras. Hawkins is considering whether it should outsource production of a part used in the manufacturing of its cameras. 60,000 units of the part were made by Hawkins last year. At this production level, the company incurred the following direct product costs: Direct Materials $250,000 Direct Labor $104,000 Manufacturing Overhead incurred during the same period for production of the part is represented by the following cost behavior equation: y = $0.10x + $50,000. If the part were purchased from an outside supplier, 80% of the total fixed manufacturing overhead cost would continue, and the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional income from this other product would be $12,600 per year. A supplier has been identified who can sell the part to Hawkins at a price of $7.80 per unit. Which of…arrow_forwardLiu Incorporated is considering whether to continue to make a component or to buy it from an outside supplier. The company uses 13,000 of the components each year. The unit product cost of the component according to the company's cost accounting system is given as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit product cost Assume that direct labor is a variable cost. Of the fixed manufacturing overhead, 40% is avoidable if the components were bought from the outside supplier. In addition, making one component uses 1 minute on the machine that is the company's current constraint. If the components were bought, this machine time would be freed up for use on another product that requires 2 minutes on the constraining machine and that has a contribution margin of $5.10 per unit. When deciding whether to make or buy the component, what cost of making the component should be compared to the price of buying the component? (CMA adapted)…arrow_forward

- Zett Company has been using FIFO process costing for tracking the costs of its manufacturing activities. But, in recent months, the system has become somewhat bogged down with details. It seems that, when the company purchased ABB Electronics last year, its product lines increased six-fold. This has caused both the accountants and the suppliers of the information, the line managers, great difficulty in keeping the costs of each product line separate. Likewise, the estimation of the completion of ending work-in-process inventories and the associated costs has become very cumbersome. The CFO of the company is looking for ways to improve the reporting system of product costs. What can you recommend to improve the situation?arrow_forwardDecorative Doors Ltd produces two types of doors: interior and exterior. The company’s costing system has two direct-cost categories (materials and labour) and one indirect-cost pool. The costing system allocates indirect costs on the basis of machine-hours. Recently, the owners of Decorative Doors have been concerned about a decline in the market share for their interior doors, usually their biggest seller. Information related to Decorative Doors production for the most recent year is as follows: Particulars Interior Exterior Units sold 3200 1800 Selling price $125 $200 Direct material cost per unit $30 $45 Direct production labour cost per hour5 $16 $16 Direct production labour-hours per unit 1.50 2.25 Production runs 40 85 Material moves 72 168 Machine set-ups 45 155 Machine-hours 5500 4500 Number of inspections 250 150 The owners have heard of other companies in the industry that are now…arrow_forwardEaston Company makes and sells scooters. Easton incurred the following costs in its most recent fiscal year: Cost Items Appearing on the Income Statement Materials cost ($10 per unit) Company president's salary Depreciation on manufacturing equipment Salaries of administrative personnel Labor cost ($4 per unit) Advertising costs (150,000 per year) Shipping and handling ($500 per year) Research and development costs Real estate taxes on factory Inspection costs Easton can currently purchase the scooters it makes from Weston Company. If the company purchases the scooters, Easton would still continue to use its own logo, sales staff, and advertising programs. If Easton outsources the scooters to Weston, which of the following costs would be relevant to the outsourcing decision? Multiple Choice X Materials cost Shipping and handling Inspection costs All of these answers are correct.arrow_forward

- Futura Company purchases 69,000 starters from a supplier at $12.40 per unit that it installs in farm tractors. Due to a reduction in output, the company now has enough idle capacity to produce the starters rather than buying them from the supplier. However, the company's chief engineer is opposed to making the starters because the production cost per unit is $13.90, as shown below: Direct materials Direct labor Supervision Depreciation Variable manufacturing overhead Rent Total product cost Per Unit $ 7.00 2.20 2.00 1.40 Financial advantage 0.70 0.60 $ 13.90 = Total If Futura decides to make the starters, a supervisor would be hired (at a salary of $138,000) to oversee production. However, the company has sufficient idle tools and machinery such that no new equipment would have to be purchased. The rent charge above is based on space utilized in the plant. The total rent on the plant is $89,000 per period. $ 138,000 $ 96,600 $ 41,400 Required: What is the financial advantage…arrow_forwardJorgansen Lighting, Inc., manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports to shareholders, creditors, and the government. The company has provided the following data: The company’s fixed manufacturing overhead per unit was constant at $560 for all three years.Required:1. Calculate each year’s absorption costing net operating income. Present your answer in the form of a reconciliation report.2. Assume in Year 4 that the company’s variable costing net operating income was $984,400 and its absorption costing net operating income was $1,012,400.a. Did inventories increase or decrease during Year 4?b. How much fixed manufacturing overhead cost was deferred or released from inventory during Year 4?arrow_forwardTool Time manufactures carpenter-grade screwdrivers. The company is trying to decide whether to continue to make the case in which the screwdrivers are sold, or to outsource the case to another company. The direct material and direct labor cost to produce the cases total $2.40 per case. The overhead cost is $1.00 per case which consists of $0.40 in variable overhead that would be eliminated if the cases are bought from the outside supplier. The $0.60 of fixed overhead is based on expected production of 400,000 cases per year and consists of the salary of the case production manager of $80,000 per year, along with the remainder consisting of rent, insurance, and depreciation on equipment that will have no resale value. The manager will be laid off if the cases were bought externally. The outside supplier has offered to supply the cases for $3.40 each. How much will Tool Time save or lose if the cases are bought externally? Save $0.40 per case Lose $0.20 per case…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning