Concept explainers

T accounts,

The unadjusted

| La Mesa Laundry Unadjusted Trial Balance August 31,2019 |

||

| Debit Balances |

Credit Balances | |

| Cash | 3,800 | |

| Laundry Supplies | 9,000 | |

| Prepaid Insurance | 6,000 | |

| Laundry Equipment | 180,800 | |

| 49,200 | ||

| Accounts Payable | 7,800 | |

| Bobbi Downey. Capital | 95,000 | |

| Bobbi Downey. Drawing | 2,400 | |

| Laundry Revenue | 248,000 | |

| Wages Expense | 135,800 | |

| Rent Expense | 43,200 | |

| Utilities Expense | 16,000 | |

| Miscellaneous Expense | 3,000 | |

| 400,000 | 400,000 | |

The data needed to determine year-end adjustments are as follows:

a. Wages accrued but not paid at August 31 are $2,200.

b. Depreciation of equipment during the year is $8,150.

c. Laundry supplies on hand at August 31 are $2,000.

d. Insurance premiums expired during the year are $5,300.

Instructions

1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identity the balance as "Aug. 31 Bal." In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, and Insurance Expense.

2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed.

3. Journalize and post the adjusting entries. Identity the adjustments as "Adj." and the new balances as "Adj. Bal."

4. Prepare an adjusted trial balance.

5. Prepare an income statement, a statement of owner's equity (no additional investments were made during the year), and a balance sheet.

6. Journalize and

7. Prepare a post-closing trial balance.

1, 3, and 6:

Journal:

Journal is the book of original entry. Journal consists of the day-to-day financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

T-Accounts:

T-accounts are referred as T-account because its format represents the letter “T”. The T-accounts consists of the following:

Ø The title of accounts.

Ø The debit side (Dr) and,

Ø The credit side (Cr).

Adjusted trial balance:

The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting journal entries.

Adjusting entries:

An adjusting entry is prepared when the trial balance is not up-to-date, and complete, and they are usually prepared at the end of the accounting period. This adjusting entry is essential for preparing the financial statements of the business.

Spreadsheet:

A spreadsheet is a worksheet. It is used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Statement of owners’ equity:

This statement reports the beginning owner’s equity and all the changes, which led to ending owners’ equity. Additional capital, net income from income statement is added to and drawing is deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Income statement:

An income statement is one of the financial statements which shows the revenues, and expenses of the company. The income statement is prepared to ascertain the net income/loss of the company, by deducting the expenses from the revenues.

Balance sheet:

A balance sheet is a financial statement consists of the assets, liabilities, and the stockholder’s equity of the company. The balance of the assets account must be equal to that of the liabilities and the stockholder’s equity account.

Closing entries:

Closing entries are recorded in order to close the temporary accounts such as incomes and expenses by transferring them to the permanent accounts. It is passed at the end of the accounting period, to transfer the final balance.

Post-Closing Trial Balance:

After passing all the journal entries and the closing entries of the permanent accounts and then further posting them to each of the respective accounts, a post-closing trial balance is prepared which consists of a list of all the permanent accounts. A post-closing trial balance serves as an evidence to prove that the balance of the permanent accounts is equal.

To prepare: The T-accounts.

Explanation of Solution

Record the transactions directly in their respective T-accounts, and determine their balances.

| Cash | |||||||||||

| August 31 | Balance | 3,800 | |||||||||

| Laundry Supplies | |||||||||||

| August 31 | Balance | 9,000 | August 31 | Adjusted | 7,000 | ||||||

| August 31 | Adjusted balance | 2,000 | |||||||||

| Prepaid Insurance | |||||||||||

| August 31 | Balance | 6,000 | August 31 | Adjusted | 5,300 | ||||||

| Adjusted balance | 700 | ||||||||||

| Laundry Equipment | |||||||||||

| August 31 | Balance | 180,800 | |||||||||

| Accumulated Depreciation | |||||||||||

| August 31 | Balance | 49,200 | |||||||||

| August 31 | Adjusted | 8,150 | |||||||||

| August 31 | Adjusted balance | 57,350 | |||||||||

| Accounts Payable | |||||||||||

| August 31 | Balance | 7,800 | |||||||||

| Wages Payable | |||||||||||

| August 31 | Adjusted | 2,200 | |||||||||

| BD, Capital | |||||||||||

| August 31 | Closing | 2,400 | August 31 | Balance | 95,000 | ||||||

| August 31 | Closing | 27,350 | |||||||||

| August 31 | Balance | 119,950 | |||||||||

| BD, Drawing | |||||||||||

| August 31 | Balance | 2,400 | August 31 | Closing | 2,400 | ||||||

| Laundry Revenue | |||||||||||

| August 31 | Closing | 248,000 | August 31 | Balance | 248,000 | ||||||

| Wages Expense | |||||||||||

| August 31 | Balance | 135,800 | August 31 | Closing | 138,000 | ||||||

| August 31 | Adjusted | 2,200 | |||||||||

| August 31 | Adjusted balance | 138,000 | |||||||||

| Rent Expense | |||||||||||

| August 31 | Balance | 43,200 | August 31 | Closing | 43,200 | ||||||

| Utilities Expense | |||||||||||

| August 31 | Balance | 16,000 | August 31 | Closing | 16,000 | ||||||

| Depreciation Expense | |||||||||||

| August 31 | Adjusted | 8,150 | August 31 | Closing | 8,150 | ||||||

| Laundry Supplies Expense | |||||||||||

| August 31 | Adjusted | 7,000 | August 31 | Closing | 7,000 | ||||||

| Insurance Expense | |||||||||||

| August 31 | Adjusted | 5,300 | August 31 | Closing | 5,300 | ||||||

| Miscellaneous Expense | |||||||||||

| August 31 | Balance | 3,000 | August 31 | Closing | 3,000 | ||||||

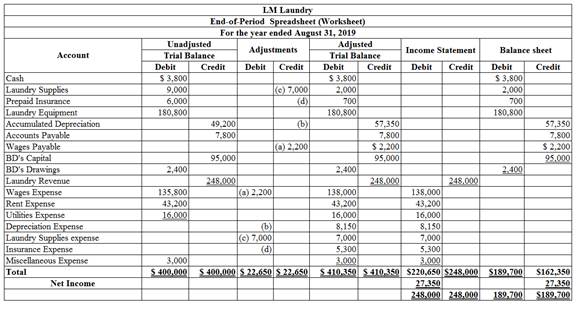

2.

To enter: The unadjusted trial balance on an end-of-period spreadsheet, and complete the spreadsheet.

Explanation of Solution

Table (1)

Hence, the unadjusted trial balance on an end-of-period spreadsheet is prepared and completed.

3.

To Journalize and post: The adjusting entries.

Explanation of Solution

| Date | Description | Debit ($) | Credit ($) | |

| 2019 | Wages expense | 2,200 | ||

| August | 31 | Wages payable | 2,200 | |

| (To record the wages accrued) | ||||

Table (2)

Explanation:

- Wages expense is an expense account, and it is increased. Hence, debit the wages expense account by $2,200.

- Wages payable is a liability account, and it is increased. Hence, credit the wages payable account by $2,200.

| Date | Description | Debit ($) | Credit ($) | |

| 2019 | Depreciation expense | 8,150 | ||

| August | 31 | Accumulated depreciation | 8,150 | |

| (To record the equipment depreciation) | ||||

Table (3)

Explanation:

- Depreciation expense is an expense account, and it is increased. Hence, debit the wages expense account by $8,150.

- Accumulated depreciation is a contra asset account, and it is increased. Hence, credit the accumulated depreciation account by $8,150.

| Date | Description | Debit ($) | Credit ($) | |

| 2019 | Laundry supplies expense | 7,000 | ||

| August | 31 |

Laundry supplies

| 7,000 | |

| (To record the equipment depreciation) | ||||

Table (4)

Explanation:

- Laundry supplies expense is an expense account, and it is increased. Hence, debit the laundry supplies expense account by $7,000.

- Laundry supplies are the asset account, and it is increased. Hence, credit the laundry supplies account by $7,000.

| Date | Description | Debit ($) | Credit ($) | |

| 2019 | Insurance expense | 5,300 | ||

| August | 31 |

Prepaid insurance

| 5,300 | |

| (To record the equipment depreciation) | ||||

Table (5)

Explanation:

- Insurance expense is an expense account, and it is increased. Hence, debit the insurance expense account by $5,300.

- Prepaid insurance is anasset account, and it is decreased. Hence, credit the prepaid insurance account by $5,300.

4.

To prepare: An unadjusted trial balance for Laundry LM, as of August 31, 2019.

Explanation of Solution

Prepare an unadjusted trial balance for Laundry LM, as of August 31, 2019.

| Laundry LM | ||

| Unadjusted Trial Balance | ||

| August 31, 2019 | ||

| Accounts | Debit Balances | Credit Balances |

| Cash | 3,800 | |

| Laundry Supplies | 2,000 | |

| Prepaid Insurance | 700 | |

| Laundry Equipment | 180,800 | |

| Accumulated depreciation | 57,350 | |

| Accounts payable | 7,800 | |

| Wages Payable | 2,200 | |

| BD, Capital | 95,000 | |

| BD, Drawing | 2,400 | |

| Laundry revenue | 248,000 | |

| Wages expense | 138,000 | |

| Rent expense | 43,200 | |

| Utilities Expense | 16,000 | |

| Depreciation Expense | 8,150 | |

| Laundry supplies expense | 7,000 | |

| Insurance Expense | 5,300 | |

| Miscellaneous Expense | 3,000 | |

| 410,350 | 410,350 | |

Table (6)

5.

Explanation of Solution

The net income of Laundry LM for the month of August r is $27,350.

| LM Laundry | ||

| Income Statement | ||

| For the year ended August 31, 2019 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenue: | ||

| Laundry revenue | $248,000 | |

| Expenses: | ||

| Wages Expense | $138,000 | |

| Rent Expense | 43,200 | |

| Utilities Expense | 16,000 | |

| Depreciation Expense | 8,150 | |

| Laundry supplies Expense | 7,000 | |

| Insurance Expense | 5,300 | |

| Miscellaneous Expense | 3,000 | |

| Total Expenses | 220,650 | |

| Net Income | $27,350 | |

Table (7)

Hence, owners’ equity for the year ended August 31, 2019 is $119,950.

6.

To Journalize: The closing entries for LM Laundry.

Explanation of Solution

Closing entry for revenue and expense accounts:

| Date | Accounts title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| August 31, 2019 | Laundry Revenue | 248,000 | ||

| WagesExpense | 138,000 | |||

| Rent Expense | 43,200 | |||

| Utilities Expense | 16,000 | |||

| Depreciation Expense | 8,150 | |||

| Laundry supplies Expense | 7,000 | |||

| Insurance Expense | 5,300 | |||

| Miscellaneous Expense | 3,000 | |||

| BD, Capital | 27,350 | |||

| (To close the revenues and expenses account. Then the balance amount are transferred to owners’ capital account) | ||||

| August 31 | BD’s Capital | 2,400 | ||

| BD’ Drawing | 2,400 | |||

| (To Close the capital and drawings account) | ||||

Table (4)

Explanation:

- Laundry revenue is revenue account. Since the amount of revenue is closed, and transferred to BD’s capital account. Here, LM Laundry earned an income of $248,000. Therefore, it is debited.

- Wages Expense, Rent Expense, Insurance Expense, Utilities Expense, Laundry Supplies Expense, Depreciation Expense, BD Capital,and Miscellaneous Expense are expense accounts. Since the amount of expenses are closed to Income Summary account. Therefore, it is credited.

- Owner’s capital is a component of owner’s equity. Thus, owners ‘equity is debited since the capital is decreased on owners’ drawings.

- Owner’s drawings are a component of owner’s equity. It is credited because the balance of owners’ drawing account is transferred to owners ‘capital account

7.

To prepare: The post–closing trial balance of LM Laundryfor the month ended August 31, 2019.

Explanation of Solution

Prepare apost–closing trial balance of LM Laundry for the month ended August 31, 2019 as follows:

|

Laundry LM Post-closing Trial Balance August 31, 2019 | ||

| Particulars | Debit $ | Credit $ |

| Cash | 3,800 | |

| Laundry Supplies | 2,000 | |

| Prepaid insurance | 700 | |

| Laundry Equipment | 180,800 | |

| Accumulated depreciation | 57,350 | |

| Accounts payable | 7,800 | |

| Wages payable | 2,200 | |

| BD’s Capital | 119,950 | |

| Total | 187,300 | 187,300 |

Table (5)

The debit column and credit column of the post–closing trial balance are agreed, both having balance of $187,300.

Want to see more full solutions like this?

Chapter 4 Solutions

Bundle: Accounting, 27th Edition, Loose-leaf Version + Cengagenowv2, 1 Term Printed Access

- T accounts, adjusting entries, financial statements, and closing entries; optional end-of-period spreadsheet The unadjusted trial balance of La Mesa Laundry at August 31, 20Y5, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: (a) Wages accrued but not paid at August 31 are 2,200. (b) Depreciation of equipment during the year is 8,150. (c) Laundry supplies on hand at August 31 are 2,000. (d) Insurance premiums expired during the year are 5,300. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as Aug. 31 Bal. In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, and Insurance Expense. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed. 3. Journalize and post the adjusting entries. Identify the adjustments by Adj. and the new balances as Adj. Bal. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of stockholders equity, and a balance sheet. During the year ended August 31, 20Y5, common stock of 3,000 was issued. 6. Journalize and post the closing entries. Identify the closing entries by Clos. 7. Prepare a post-closing trial balance.arrow_forwardT accounts, adjusting entries, financial statements, and closing entries; optional end-of-period spreadsheet The unadjusted trial balance of Epicenter Laundry at June 30, 20Y6, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: (a) Laundry supplies on hand at June 30 are 8,600. (b) Insurance premiums expired during the year are 5,700. (c) Depreciation of laundry equipment during the year is 6,500. (d) Wages accrued but not paid at June 30 are 1,100. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as June 30 Bal. In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, and Insurance Expense. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed. 3. Journalize and post the adjusting entries. Identify the adjustments by Adj. and the new balances as Adj. Bal. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of stockholders equity, and a balance sheet. During the year ended June 30, 20Y6, additional common stock of 7,500 was issued. 6. Journalize and post the closing entries. Identify the closing entries by Clos. 7. Prepare a post-closing trial balance.arrow_forwardThe unadjusted trial balance of PS Music as of July 31, 2018, along with the adjustment data for the two months ended July 31, 2018, are shown in Chapter 3. Based upon the adjustment data, the following adjusted trial balance was prepared: PS Music Adjusted Trial Balance July 31, 2018 Account No. Debit Balances Credit Balances Cash................................................. 11 9,945 Accounts Receivable................................... 12 4,150 Supplies.............................................. 14 275 Prepaid Insurance..................................... 15 2,475 Office Equipment..................................... 17 7,500 Accumulated DepreciationOffice Equipment.......... 18 50 Accounts Payable..................................... 21 8,350 Wages Payable........................................ 22 140 Unearned Revenue.................................... 23 3,600 Common Stock....................................... 31 9,000 Dividends............................................ 33 1,750 Fees Earned........................................... 41 21,200 Music Expense........................................ 54 3,610 Wages Expense....................................... 50 2,940 Office Rent Expense................................... 51 2,550 Advertising Expense................................... 55 1,500 Equipment Rent Expense.............................. 52 1,375 Utilities Expense...................................... 53 1,215 Supplies Expense...................................... 56 925 Insurance Expense.................................... 57 225 Depreciation Expense................................. 58 50 Miscellaneous Expense................................ 59 1,855 42,340 42,340 Instructions 1. (Optional) Using the data from Chapter 3, prepare an end-of-period spreadsheet. 2. Prepare an income statement, a retained earnings statement, and a balance sheet. 3. Journalize and post the closing entries. The retained earnings account is #33 and the income summary account is #34 in the ledger of PS Music. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 4. Prepare a post-dosing trial balance.arrow_forward

- Prepare journal entries to record the business transaction and related adjusting entry for the following: A. March 1, paid cash for one year premium on insurance contract, $18,000 B. December 31, remaining unexpired balance of insurance, $3,000arrow_forwardWorksheet Victoria Company has the following account balances on December 31, 2019, prior to any adjustments: Additional adjustment information: (a) depreciation on buildings, 1,100; on equipment, 600; (b) bad debts expense, 240; (c) interest accumulated but not paid: on note payable, 50; on mortgage payable, 530 (this interest is due during the next accounting period); (d) insurance expired, 175; (e) salaries accrued but not paid 370; (f) rent was collected in advance and the performance obligation is now satisfied, 800; (g) office supplies cm hand at year-end, 230 (expensed when originally purchased earlier in the year); and (h) the income tax rate is 30% on current income and is payable in the first quarter of 2020. Required: 1. Transfer the account balances to a 10-column worksheet and prepare a trial balance. 2. Prepare the adjusting entries in the general journal and complete the worksheet. 3. Prepare the companys income statement, retained earnings statement, and balance sheet. 4. Prepare closing entries in the general journal.arrow_forwardPrepare journal entries to record the following business transaction and related adjusting entry. A. January 12, purchased supplies for cash, to be used all year, $3,850 B. December 31, physical count of remaining supplies, $800arrow_forward

- Ledger accounts, adjusting entries, financial statements, and closing entries; optional end-of-period spreadsheet The unadjusted trial balance of Recessive Interiors at January 31, 20Y2, the end of the year, follows: The data needed to determine year-end adjustments are as follows: (a) Supplies on hand at January 31 are 2,850. (b) Insurance premiums expired during the year are 3,150. (c) Depreciation of equipment during the year is 5,250. (d) Depreciation of trucks during the year is 4,000. (e) Wages accrued but not paid at January 31 are 900. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in the appropriate Balance column of a four-column account and place a check mark () in the Posting Reference column. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed. 3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following additional accounts from Recessive Interiors chart of accounts should be used: Wages Payable, 22; Depreciation Expense Equipment, 54; Supplies Expense, 55; Depreciation ExpenseTrucks, 56; Insurance Expense, 57. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of stockholders equity, and a balance sheet. During the year ended January 31, 20Y2, additional common stock of 7,500 was issued. 6. Journalize and post the closing entries. Record the closing entries on Page 27 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 7. Prepare a post-closing trial balance.arrow_forwardValley Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on July 31, 2019, follows: The following business transactions were completed by Valley Realty during August 2019: Aug. 1. Purchased office supplies on account, 3,150. 2.Paid rent on office for month, 7,200. 3.Received cash from clients on account, 83,900. 5.Paid insurance premiums, 12,000. 9.Returned a portion of the office supplies purchased on August 1, receiving full credit for their cost, 400. Analyzing Transactions Aug. 17. Paid advertising expense, 8,000. 23.Paid creditors on account, 13,750. Enter the following transactions on Page 19 of the two-column journal: 29.Paid miscellaneous expenses, 1,700. 30.Paid automobile expense (including rental charges for an automobile), 2,500. 31.Discovered an error in computing a commission during July; received cash from the salesperson for the overpayment, 2,000. 31.Paid salaries and commissions for the month, 53,000. 31.Recorded revenue earned and billed to clients during the month, 183,500. 31.Purchased land for a future building site for 75,000, paying 7,500 in cash and giving a note payable for the remainder. 31.Withdrew cash for personal use, 1,000. 31.Rented land purchased on August 31 to a local university for use as a parking lot during football season (September, October, and November); received advance payment of 5,000. Instructions 1. Record the August 1 balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for August in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of August 31, 2019. 5. Assume that the August 31 transaction for Cindy Getmans cash withdrawal should have been 10,000. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?arrow_forwardThe unadjusted trial balance of Recessive Interiors at January 31, 2019, the end of the year, follows: The data needed to determine year-end adjustments are as follows: a. Supplies on hand at January 31 are 2,850. b. Insurance premiums expired during the year are 3,150. c. Depreciation of equipment during the year is 5,250. d. Depreciation of trucks during the year is 4,000. e. Wages accrued but not paid at January 31 are 900. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in the appropriate Balance column of a four-column account and place a check mark () in the Posting Reference column. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed. 3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following additional accounts from Recessive Interiors chart of accounts should be used: Wages Payable, 22; Depreciation ExpenseEquipment, 54; Supplies Expense, 55; Depreciation ExpenseTrucks, 56; Insurance Expense, 57. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of owners equity (no additional investments were made during the year), and a balance sheet. 6. Journalize and post the closing entries. Record the closing entries on Page 27 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 7. Prepare a post-closing trial balance.arrow_forward

- EXPENSE METHOD OF ACCOUNTING FOR PREPAID EXPENSES Ryans Fish House purchased supplies costing 3,000 for cash. This amount was debited to the supplies expense account. At the end of the year, December 31, 20--, an inventory showed that supplies costing 500 remained. Prepare the adjusting entry.arrow_forwardElite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 2019, follows: The following business transactions were completed by Elite Realty during April 2019: Apr. 1. Paid rent on office for month, 6,500. 2.Purchased office supplies on account, 2,300. 5.Paid insurance premiums, 6,000. 10.Received cash from clients on account, 52,300. 15.Purchased land for a future building site for 200,000, paying 30,000 in cash and giving a note payable for the remainder. 17.Paid creditors on account, 6,450. 20.Returned a portion of the office supplies purchased on April 2, receiving full credit for their cost, 325. 23.Paid advertising expense, 4,300. Enter the following transactions on Page 19 of the two-column journal: 27.Discovered an error in computing a commission; received cash from the salesperson for the overpayment, 2,500. 28.Paid automobile expense (including rental charges for an automobile), 1,500. 29.Paid miscellaneous expenses, 1,400. 30.Recorded revenue earned and billed to clients during the month, 57,000. 30.Paid salaries and commissions for the month, 11,900. 30.Withdrew cash for personal use, 4,000. 30.Rented land purchased on April 15 to local merchants association for use as a parking lot in May and June, during a street rebuilding program; received advance payment of 10,000. Instructions 1. Record the April 1, 2019, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for April in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of April 30, 2019. 5. Assume that the April 30 transaction for salaries and commissions should have been 19,100. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?arrow_forwardLedger accounts, adjusting entries, financial statements, and closing entries; optional spreadsheet The unadjusted trial balance of Lakota Freight Co. at March 31, 20Y4, the end of the year, follows: The data needed to determine year-end adjustments are as follows: (a) Supplies on hand at March 31 are 7,500. (b) Insurance premiums expired during year are 1,800. (c) Depreciation of equipment during year is 8,350. (d) Depreciation of trucks during year is 6,200. (e) Wages accrued but not paid at March 31 are 600. Instructions 1. For each account listed in the trial balance, enter the balance in the appropriate Balance column of a four-column account and place a check mark () in the Posting Reference column. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed. 3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following additional accounts from Lakota Freight Co.s chart of accounts should be used: Wages Payable, 22; Supplies Expense, 52; Depreciation ExpenseEquipment, 55; Depreciation ExpenseTrucks, 56; Insurance Expense, 57. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of stockholders equity, and a balance sheet. During the year ended March 31, 20Y4, additional common stock of 6,000 was issued. 6. Journalize and post the closing entries. Record the closing entries on Page 27 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 7. Prepare a post-closing trial balance.arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning