ACCESS IN BB-ACC202

null Edition

ISBN: 9780135375587

Author: Pearson

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 4.42AP

Use ABC to compute full product costs (Learning Objective 2)

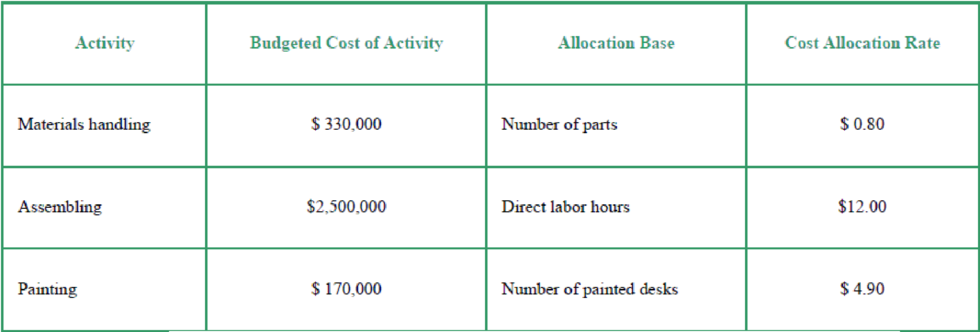

Arnett Corp. manufactures computer desks in its White Bear Lake, Minnesota, plant. The company uses activity-based costing to allocate all manufacturing conversion costs (direct labor and manufacturing

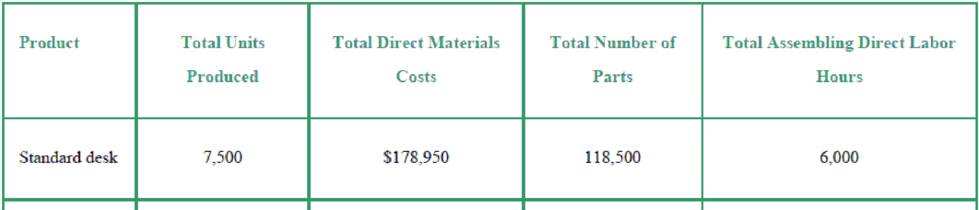

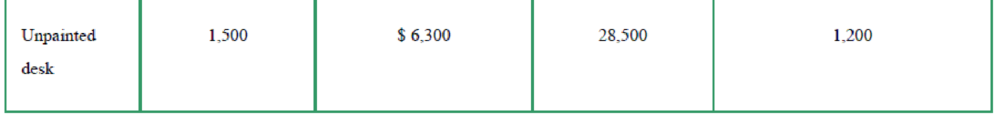

Arnett produced two styles of desks in March: the Standard desk and the Unpainted desk. Data for each follow:

Requirements

Requirements

- 1. Compute the per-unit manufacturing product cost of Standard desks and Unpainted desks.

- 2. Premanufacturing activities, such as product design, were assigned to the Standard desks at $6 each and to the Unpainted desks at $2 each. Similar analyses were conducted of post-manufacturing activities, such as distribution, marketing, and customer service. The post-

manufacturing costs were $22 per Standard and $19 per Unpainted desk. Compute the full product costs per desk. - 3. Which product costs are reported in the external financial statements? Which costs are used for management decision making? Explain the difference.

- 4. What price should Arnett’s managers set for Standard desks to earn a $42 profit per desk?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Click to watch the Tell Me More Learning Objective 1 video and then answer the questions below.

1. Which of the following manufacturers is most likely to use a process cost system?

Purse manufacturer

Sports drink manufacturer

Automobile manufacturer

Guitar manufacturer

2. Process and job order cost systems are similar in that both systems _______.

record and summarize product costs

classify product costs as direct materials, direct labor, and factory overhead

allocate factory overhead costs to products

All of these choices are correct.

Click to watch the Tell Me More Learning Objective 2 video and then answer the questions below.

1. The first step in preparing a cost of production report is to _____.

compute equivalent units of production

determine the units to be assigned costs

determine the cost per equivalent unit

allocate costs to units transferred out and partially completed units

2. The last step in preparing a cost of production report is to _____.

compute equivalent units of production

determine the units to be assigned costs

determine the cost per equivalent unit

allocate costs to units transferred out and partially completed units

Click to watch the Tell Me More Learning Objective 4 video and then answer the questions below.

1. Which of the following represents the computation of direct materials cost per equivalent unit?

Total direct cost for the period divided by total equivalent units of direct materials.

Total equivalent units of direct materials divided by total direct cost for the period.

Total direct cost for the period divided by total units of direct materials.

Total units of direct materials divided by total direct cost for the period.

2. What is the conversion cost per equivalent unit, when the total conversion cost for the period is $1,225 and the total units of packaged drinking water produced during the same period is 5,000 gallons (70 percent complete).

$0.17 per gallon

$0.35 per gallon

$2.86 per gallon

None of these choices are correct.

Chapter 4 Solutions

ACCESS IN BB-ACC202

Ch. 4 - (Learning Objective 1) Cost distortion is more...Ch. 4 - (Learning Objective 2) The first step in computing...Ch. 4 - (Learning Objective 2) Activities incurred...Ch. 4 - (Learning Objective 3) Which of the following is...Ch. 4 - (Learning Objective 3) The potential benefits of...Ch. 4 - (Learning Objective 4) Lean operations are...Ch. 4 - Prob. 7QCCh. 4 - (Learning Objective 4) Concerning lean operations,...Ch. 4 - (Learning Objective 5) Which of the following is...Ch. 4 - (Learning Objective 5) Which of the following...

Ch. 4 - Understanding key terms (Learning Objectives 1, 2,...Ch. 4 - Use departmental overhead rates to allocate...Ch. 4 - Compute departmental overhead rates (Learning...Ch. 4 - Prob. 4.4SECh. 4 - Prob. 4.5SECh. 4 - Calculate a job cost using ABC (Learning Objective...Ch. 4 - Classifying costs within the cost hierarchy...Ch. 4 - Classifying costs within the cost hierarchy...Ch. 4 - Determine the usefulness of refined costing...Ch. 4 - Prob. 4.10SECh. 4 - Identifying costs as value-added or...Ch. 4 - Identify lean production characteristics (Learning...Ch. 4 - Identify the DOWNTIME activities at a manufacturer...Ch. 4 - Prob. 4.14SECh. 4 - Classifying costs of quality (Learning Objective...Ch. 4 - Quality initiative decision (Learning Objective 5)...Ch. 4 - Assess the impact of a quality initiative...Ch. 4 - Identify ethical standards violated (Learning...Ch. 4 - Compare traditional and departmental cost...Ch. 4 - Compute activity rates and apply to jobs (Learning...Ch. 4 - Apply activity cost allocation rates (Learning...Ch. 4 - Using ABC to bill clients at a service firm...Ch. 4 - Compare traditional and ABC allocations at a...Ch. 4 - Compare traditional and ABC allocations on a job...Ch. 4 - Use ABC to allocate manufacturing overhead...Ch. 4 - Continuation of E4-25A: Determine product...Ch. 4 - Prob. 4.27AECh. 4 - Classify costs and make a quality-initiative...Ch. 4 - Prob. 4.29AECh. 4 - Compare traditional and departmental cost...Ch. 4 - Prob. 4.31BECh. 4 - Prob. 4.32BECh. 4 - Prob. 4.33BECh. 4 - Compare traditional and ABC cost allocations at a...Ch. 4 - Prob. 4.35BECh. 4 - Prob. 4.36BECh. 4 - Prob. 4.37BECh. 4 - Prob. 4.38BECh. 4 - Classify costs and make a quality-initiative...Ch. 4 - Prob. 4.40BECh. 4 - Prob. 4.41APCh. 4 - Use ABC to compute full product costs (Learning...Ch. 4 - Prob. 4.43APCh. 4 - Prob. 4.44APCh. 4 - Prob. 4.45APCh. 4 - Prob. 4.46BPCh. 4 - Prob. 4.47BPCh. 4 - Comprehensive ABC implementation (Learning...Ch. 4 - Using ABC in conjunction with quality decisions...Ch. 4 - Comprehensive ABC (Learning Objectives 2 3)...Ch. 4 - Prob. 4.51SCCh. 4 - Discussion Questions 1. Explain why departmental...Ch. 4 - ABC in Real Companies Choose a company in any of...Ch. 4 - Value-Added versus Non-Value-Added at a Restaurant...Ch. 4 - Ethics involved with ABC and hazardous waste costs...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Classify costs and make a quality-initiative decision (Learning Objective 5) Sinclair Corp. manufactures radiation-shielding glass panels . Suppose Sinclair is consider-ing spending the following amounts on a new TOM program :Strength-testing one item from each batch of panels ......................... . Training employees in TOM ................................................................. . Training suppliers in TOM .................................................................... . Identifying preferred suppliers that commit to on-time delivery ofperfect quality materials ................................................................... .Sinclair expects the new program to save costs through the following:Avoid lost profits from lost sales due to disappointed customers ....... Avoid rework and spoilage ................................................................. .. Avoid inspection of raw materials ........................................................ . Avoid…arrow_forwardAverage labor cost for the first 700 units of a product is RO 50 and the average labor cost of first 1400 units is RO 45. Average time per unit is 100 minutes. The learning ratio and the average labour cost for first 2800 units will be: a. 80% and RO 36.000 b. 90% and RO 40.500 c. 85% and RO 38.250 d. 95% and RO 42.750arrow_forwardP10-53B Determine transfer price at a manufacturer under various scenarios (Learning Objective 4) Assume the Small Components Division of Lang Manufacturing produces a video card used in the assembly of a variety of electronic products. The division's manufacturing costs, and variable selling expenses related to the video card are as follows: Cost per unit Direct materials $ 14.00 Direct labor $ 4.00 Variable manufacturing overhead $ 8.00 Fixed manufacturing overhead (at current production level) $ 9.00 Variable selling expenses $ 10.00 The Computer Division of Lang Manufacturing can use the video card produced by the Small Components Division and is interested in purchasing the video card in-house rather than buying it from an outside supplier. The Small Components Division has sufficient excess capacity with which to make the extra video cards. Because of competition, the market price for this video card is $30 regardless of whether the…arrow_forward

- Learning curve, cumulative average-time learning model. Northern Defense manufactures radar systems. It has just completed the manufacture of its first newly designed system, RS-32. Manufacturing data for the RS-32 follow: Calculate the total variable costs of producing 2, 4, and 8 units.arrow_forwardE4-23A Use ABC to allocate manufacturing overhead (Learning Objective 2) Several years after reengineering its production process, Biltmore Corporation hired a new controller, Rachael Johnson. She developed an ABC system very similar to the one used by Biltmore’s chief rival, Westriver. Part of the reason Johnson developed the ABC system was because Biltmore’s profits had been declining even though the company had shifted its product mix toward the product that had appeared most profitable under the old system. Before adopting the new ABC system, Biltmore had used a plantwide overhead rate based on direct labor hours that was developed years ago. For the upcoming year, Biltmore’s budgeted ABC manufacturing overhead allocation rates are as follows: Activity Allocation Base Activity Cost Allocation Rate Materials handling # of parts $3.84 per part Machine setup # of setups $330.00 per setup Insertion of parts # of parts $30.00 per part Finishing Finishing DL hrs $54.00 per hour The…arrow_forwardClick to watch the Tell Me More Learning Objective 3 video and then answer the questions below. 1. The journal entry to recognize depreciation on machinery is ________. a debit to Factory Overhead and a credit to Accumulated Depreciation a debit to Accumulated Depreciation and a credit to Factory Overhead a debit to Factory Overhead and a credit to Depreciation Expense a debit to Depreciation Expense and a credit to Factory Overhead 2. Process and job order cost systems are similar in ________ manner. recording and summarizing product costs classifying product costs as direct materials, direct labor, and factory overhead allocating factory overhead costs to products All of these choices are correct.arrow_forward

- MANAGEMENT ACCOUNTING & CONTROL STANDARD COSTS AND VARIANCE ANALYSIS LEARNING ACTIVITY 1 Torres Company has established standard costs for the cabinet department, in which one size of MX cabinet is made. The standard costs of producing one of these MX cabinets are shown below: Standard Cost Card – MX Cabinet Direct Material: Lumber 50 board ft at P 4 200 Direct Labor: 8 hours at P 10 80 Overhead Costs: Variable – 8 hrs at P5 40 Fixed – 8 hrs at P3 24 Total Standard Unit Cost 344 During June 2018, 500 of these cabinets were produced. The cost of operations during the month are shown below. There is no work in process at the beginning and end of the month. Direct material purchased: 30,000 bf at P4.10 123,000 Direct materials used: 24,000 board ft Direct labor: 4,200 hrs at P9.50 39,900 Overhead Costs : Variable Costs 22,000 Fixed Costs 11,000…arrow_forwardUse ABC to allocate manufacturing overhead (Learning Objective 2)Several years after reengineering its production process, King Corporation hired a new controller, Christine Erickson . She developed an ABC system very similar to the one used by King's chief rival. Part of the reason Erickson developed the ABC system was because King's profits had been declining, even though the company had shifted its product mix toward the product that had appeared most profitable under the old system . Before adopting the new ABC system, the company had used a plantwide overhead rate, based on direct labor hours developed years ago .For the upcoming year, King's budgeted ABC manufacturing overhead allocation rates are as follows :ActivityMaterials handling .......................... Machine setup ................................ Insertion of parts ............................ Finishing .........................................Allocation BaseNumber of partsNumber of setupsNumber of partsFinishing…arrow_forwardCost Identification Following is a list of cost terms described in the chapter as well as a list of brief descriptive settings for each item. Cost terms: a. Opportunity cost b. Period cost c. Product cost d. Direct labor cost e. Selling cost f. Conversion cost g. Prime cost h. Direct materials cost i. Manufacturing overhead cost j. Administrative cost Settings: 1. Marcus Armstrong, manager of Timmins Optical, estimated that the cost of plastic, wages of the technician producing the lenses, and overhead totaled 30 per pair of single-vision lenses. 2. Linda was having a hard time deciding whether to return to school. She was concerned about the salary she would have to give up for the next 4 years. 3. Randy Harris is the finished goods warehouse manager for a medium-sized manufacturing firm. He is paid a salary of 90,000 per year. As he studied the financial statements prepared by the local certified public accounting firm, he wondered how his salary was treated. 4. Jamie Young is in charge of the legal department at company headquarters. Her salary is 95,000 per year. She reports to the chief executive officer. 5. All factory costs that are not classified as direct materials or direct labor. 6. The new product required machining, assembly, and painting. The design engineer asked the accounting department to estimate the labor cost of each of the three operations. The engineer supplied the estimated labor hours for each operation. 7. After obtaining the estimate of direct labor cost, the design engineer estimated the cost of the materials that would be used for the new product. 8. The design engineer totaled the costs of materials and direct labor for the new product. 9. The design engineer also estimated the cost of converting the raw materials into their final form. 10. The auditor for a soft drink bottling plant pointed out that the depreciation on the delivery trucks had been incorrectly assigned to product cost (through overhead). Accordingly, the depreciation charge was reallocated on the income statement. Required: Match the cost terms with the settings. More than one cost classification may be associated with each setting; however, select the setting that seems to fit the item best. When you are done, each cost term will be used just once.arrow_forward

- Bordner Company manufactures HVAC (heating, ventilation, and air conditioning) systems for commercial buildings. For each new design, Bordner faces a 90 percent learning rate. On average, the first unit of a new design takes 600 hours. Direct labor is paid 25 per hour. Required: 1. Set up a table with columns showing: the cumulative number of units, cumulative average time per unit in hours, and cumulative total time in hours. Show results by row for total production of one unit, two units, four units, eight units, and sixteen units. (Round hour answers to two significant digits.) 2. What is the total labor cost if Bordner makes the following number of units: one, four, sixteen? What is the average cost per system for the following number of systems: one, four, or sixteen? (Round your answers to the nearest dollar.) 3. Using the logarithmic function, set up a table with columns showing: the cumulative number of units, cumulative average time per unit in hours, cumulative total time in hours, and the time for the last unit. Show results by row for each of units one through eight. (Round answers to two significant digits.)arrow_forwardThe following information is provided to you: Time taken to produce first 8 shock pads 640 hours Time taken to produce first 16 shock pads 1200 hours Calculate the learning curve The following information is provided to you: Direct labour needed to make first machine. 1000 hoursLearning curve. 80%Direct labour cost. R300 per hourDirect materials cost. R180000 per machine Fixed cost for machines at each cumulative production R800000 Calculate the total direct hours required to manufacture four (4) machines. ( Indicate both average time per unit as well as cumulative time per unit for all theunits) Calculate the total costs to manufacture 4 machinesarrow_forwardAssume the same information for Northern Defense as in Exercise 10-33, except that Northern Defense uses an 85% incremental unit-time learning model as a basis for predicting direct manufacturing labor-hours. (An 85% learning curve means b = -0.234465.) Q. Calculate the total variable costs of producing 2, 3, and 4 units.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY