Apply activity cost allocation rates (Learning Objective 2)

SUSTAINABILITY

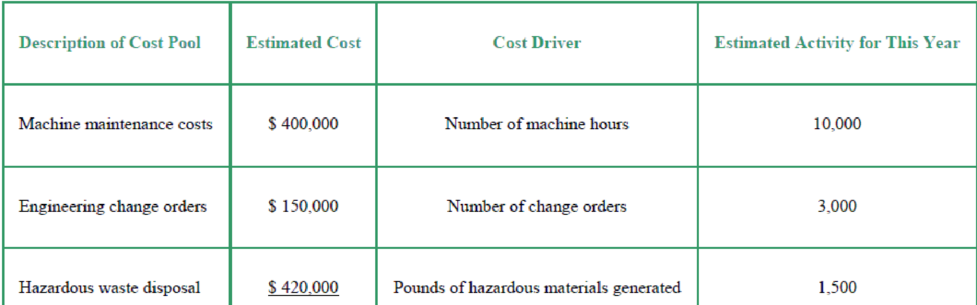

Holiday Industries manufactures a variety of custom products. The company has traditionally used a plantwide manufacturing

Up to this point, hazardous waste disposal fees have been absorbed into the plantwide manufacturing overhead rate and allocated to all products as part of the manufacturing overhead process. Recently, the company has been experiencing significantly increased waste-disposal fees for hazardous waste generated by certain products, and as a result, profit margins on all products have been negatively impacted. Company management wants to implement an activity-based costing system so that managers know the cost of each product, including its hazardous waste disposal costs.

Expected usage and

During the year, Job 356 is started and completed. Usage for this job follows:

| 290 pounds of direct materials at $35 per pound |

| 20 direct labor hours used at $20 per labor hour |

| 60 machine hours used |

| 9 change orders |

| 60 pounds of hazardous waste generated |

Requirements

- 1. Calculate the cost of Job 356 using the traditional plantwide manufacturing overhead rate based on machine hours.

- 2. Calculate the cost of Job 356 using activity-based costing.

- 3. If you were a manager, which cost estimate would provide you more useful information? How might you use this information?

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

ACCESS IN BB-ACC202

- Bordner Company manufactures HVAC (heating, ventilation, and air conditioning) systems for commercial buildings. For each new design, Bordner faces a 90 percent learning rate. On average, the first unit of a new design takes 600 hours. Direct labor is paid 25 per hour. Required: 1. Set up a table with columns showing: the cumulative number of units, cumulative average time per unit in hours, and cumulative total time in hours. Show results by row for total production of one unit, two units, four units, eight units, and sixteen units. (Round hour answers to two significant digits.) 2. What is the total labor cost if Bordner makes the following number of units: one, four, sixteen? What is the average cost per system for the following number of systems: one, four, or sixteen? (Round your answers to the nearest dollar.) 3. Using the logarithmic function, set up a table with columns showing: the cumulative number of units, cumulative average time per unit in hours, cumulative total time in hours, and the time for the last unit. Show results by row for each of units one through eight. (Round answers to two significant digits.)arrow_forwardYour company has received an order for 20 units of aproduct. Th e labor cost to produce the item is $9.50 per hour. Th esetup cost for the item is $60 and material costs are $25 per unit. Th e item is sold for $92. Th e learning rate is 80 percent. Overheadis assessed at a rate of 55 percent of unit labor cost.(a) Determine the average unit cost for the 20 units if the fi rstunit takes four hours.(b) Determine the minimum number of units that need to bemade before the selling price meets or exceeds the averageunit cost.arrow_forwardTo complete the first setup on a new machine took an employee 100 minutes. Using an 80% incremental unit-time learning model indicates that the second setup on the new machine is expected to take ________. Select one: a. 70 minutes b. 80 minutes c. 120 minutes d. 60 minutesarrow_forward

- Average labor cost for the first 700 units of a product is RO 50 and the average labor cost of first 1400 units is RO 45. Average time per unit is 100 minutes. The learning ratio and the average labour cost for first 2800 units will be: a. 80% and RO 36.000 b. 90% and RO 40.500 c. 85% and RO 38.250 d. 95% and RO 42.750arrow_forwardMANAGEMENT ACCOUNTING & CONTROL STANDARD COSTS AND VARIANCE ANALYSIS LEARNING ACTIVITY 1 Torres Company has established standard costs for the cabinet department, in which one size of MX cabinet is made. The standard costs of producing one of these MX cabinets are shown below: Standard Cost Card – MX Cabinet Direct Material: Lumber 50 board ft at P 4 200 Direct Labor: 8 hours at P 10 80 Overhead Costs: Variable – 8 hrs at P5 40 Fixed – 8 hrs at P3 24 Total Standard Unit Cost 344 During June 2018, 500 of these cabinets were produced. The cost of operations during the month are shown below. There is no work in process at the beginning and end of the month. Direct material purchased: 30,000 bf at P4.10 123,000 Direct materials used: 24,000 board ft Direct labor: 4,200 hrs at P9.50 39,900 Overhead Costs : Variable Costs 22,000 Fixed Costs 11,000…arrow_forwardC7-73 Calculate breakeven and margin of safety after hotel renovation (Learning Objective 2) Cost-Volume-Profit Analysis 437 This case is a continuation of the Caesars Entertainment Corporation serial case that began in Chapter 1. Refer to the introductory story in chapter 1 (see page 43) for additional background. (The components of the Caesars serial case can be completed in any order.) Caesars Palace® Las Vegas made headlines when it undertook a $75 million renovation. In mid-September 2015, the hotel closed its then-named Roman Tower, which was last updated in 2001, and started a major renovation of the 567 rooms housed in that tower . On January 1, 2016, the newly renamed Julius Tower reopened, replacing the Roman Tower. In addition to renovating the existing rooms and suites in the former Roman Tower, 20 guest rooms were added to the Roman Tower. With the renovation completed, Caesars expects the Julius Tower room rate to average around $149 per night. This increase, a $25 or 20…arrow_forward

- A professional division at a business school provides several development programs that have been tailored to the specific training needs of both the public and private sectors. The program director is planning to offer a one-full-day course in risk management to be sold at $2,250 plus orientation fee (5%) per participant. The division incurs a cost of $45,000 for promotion, classroom space, staff and instructor’s salary, as well as a cost of $240 per participant for refreshments, lunch, course material, a gift package, and a framed certificate of completion. How many participants need to register in the course for it to be worthwhile to offer it? Round to two decimal places. Group of answer choices 21.20 26.86 36.72arrow_forwardThe following information is provided to you: Time taken to produce first 8 shock pads 640 hours Time taken to produce first 16 shock pads 1200 hours Calculate the learning curve The following information is provided to you: Direct labour needed to make first machine. 1000 hoursLearning curve. 80%Direct labour cost. R300 per hourDirect materials cost. R180000 per machine Fixed cost for machines at each cumulative production R800000 Calculate the total direct hours required to manufacture four (4) machines. ( Indicate both average time per unit as well as cumulative time per unit for all theunits) Calculate the total costs to manufacture 4 machinesarrow_forwardProfit Planning and Control This case is a manufacturer and could make specialty bikes, ski or outdoor equipment, computers, food like chocolates, saltwater taffy, cookies, or donuts, etc. Create the balance sheet, income statement, and statement of the cash flow from the following information. Use the following information for the learning experiences Sales volume units = 11,000 Sales price/unit = $100 Variable manufacturing costs/unit = $60 Fixed manufacturing costs = $210,000 Fixed sales & administration costs = $190,000 Business income tax rate = 25% Current assets = $250,000 (Cash $50,000, Accounts Receivables $100,000, Inventory $100,000) Fixed assets = $750,000 Current liabilities = $200,000 (Accounts Payable $100,000, Short Term Debt $100,000) Long Term Debt = $300,000 Owners' Equity = $500,000arrow_forward

- profile-image Student question Time to preview question: 00 : 08 : 51 The Epsilon Co. have a building, which houses three production department, Alpha, Beta and Gamma, and one service department Delta. The service department, Delta is wholly involved in working for the three production departments and it is estimated that department Alpa uses 50%, department Beta uses 30% and department Gamma uses 20% of the services of department Delta. The budgeted overhead for the four departments for a period were: REQUIRED: a. Apportion the costs to the departments on the most equitable bases and calculate the overhead absorption rate, based on labour hours, for all the production department.arrow_forwardDwyran Ltd also produce, the Menai, which has been in production for a number of years, and to date 497 units of the Menai have been produced. The budget for the next quarter is showing the production of 65 units of the Menai. If the 1st ever unit took 200 hours and an 80% learning curve applies: Calculate the total labours hours needed for the production of 65 units of the Menai Calculate the average labour time per unit Note: the learning co-efficient of 80% is -0.322arrow_forwardHarriman Industries manufactures engines for the aerospace industry. It has completed manufacturing the first unit of the new ZX-9 engine design. Management believes that the 1,000 labor hours required to complete this unit are reasonable and is prepared to go forward with the manufacture of additional units. An 80 percent cumulative average-time learning curve model for direct labor hours is assumed to be valid. Data on costs are as follows: Required: 1. Set up a table with columns for cumulative number of units, cumulative average time per unit in hours, and the cumulative total time in hours. Complete the table for 1, 2, 4, 8, 16, and 32 units. (Round hours to one significant digit.) 2. What are the total variable costs of producing 1, 2, 4, 8, 16, and 32 units? What is the variable cost per unit for 1, 2, 4, 8, 16, and 32 units?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning