REVEL for Horngren's Cost Accounting: A Managerial Emphasis -- Access Card (16th Edition) (What's New in Accounting)

16th Edition

ISBN: 9780134789705

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 4.42P

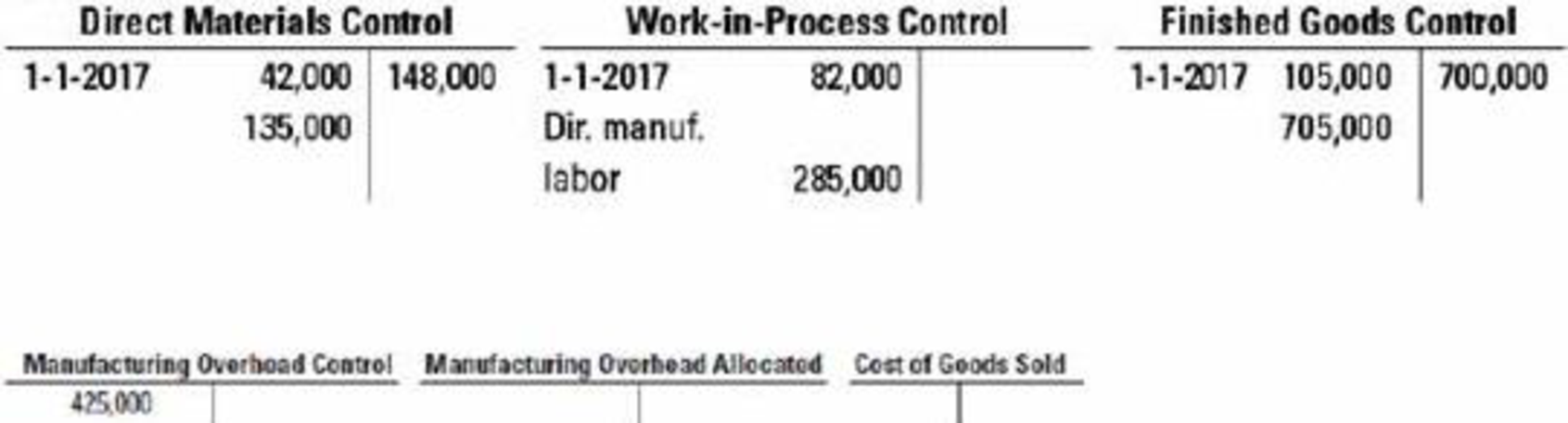

General ledger relationships, under- and overallocation. (S. Sridhar adapted) Keezel Company uses normal costing in its

Additional information follows:

- a. Direct manufacturing labor wage rate was $15 per hour.

- b. Manufacturing

overhead was allocated at $20 per direct manufacturing labor-hour. - c. During the year sales revenues were $1,550,000, and marketing and distribution costs were $810,000.

- 1. What was the amount of direct materials issued to production during 2017?

Required

- 2. What was the amount of manufacturing overhead allocated to jobs during 2017?

- 3. What was the total cost of jobs completed during 2017?

- 4. What was the balance of work-in-process inventory on December 31, 2017?

- 5. What was the cost of goods sold before proration of under- or overallocated overhead?

- 6. What was the under- or overallocated manufacturing overhead in 2017?

- 7. Dispose of the under- or overallocated manufacturing overhead using the following:

- a. Write-off to Cost of Goods Sold

- b. Proration based on ending balances (before proration) in Work-in-Process Control, Finished Goods Control, and Cost of Goods Sold

- 8. Using each of the approaches in requirement 7, calculate Keezel’s operating income for 2017.

- 9. Which approach in requirement 7 do you recommend Keezel use? Explain your answer briefly.

Expert Solution & Answer

Learn your wayIncludes step-by-step video

schedule07:21

Students have asked these similar questions

Keezel Company uses normal costing in its job-costing system. Partially completed T-accounts and additional information for Keezel for 2017 are as follows:

a.

Direct manufacturing labor wage rate was

$15

per hour.

b.

Manufacturing overhead was allocated at

$20

per direct manufacturing labor-hour.

c.

During the year, sales revenues were

$1,550,000,

and marketing and distribution costs were

$810,000.

Question

1.

What was the amount of direct materials issued to production during

2017?

2.

What was the amount of manufacturing overhead allocated to jobs during

2017?

3.

What was the total cost of jobs completed during

2017?

4.

What was the balance of work-in-process inventory on December 31,

2017?

5.

What was the cost of goods sold before proration of under- or overallocated overhead?

6.

What was the under- or overallocated manufacturing overhead in

2017?

7.

Dispose of the under- or overallocated…

What is the adjusted cost of goods sold?Gitano Products operates a job-order costing system and applies overhead cost to jobs on the basis of direct materials used in production (not on the basis of raw materials purchased). Its predetermined overhead rate was based on a cost formula that estimated $120,400 of manufacturing overhead for an estimated allocation base of $86,000 direct material dollars to be used in production. The company has provided the following data for the just completed year:Purchase of raw materials $ 133,000Direct labor cost $ 82,000Manufacturing overhead costs:Indirect labor $ 118,600Property taxes $ 8,000Depreciation of equipment $ 18,000Maintenance $ 15,000Insurance $ 9,700Rent, building $ 39,000Beginning EndingRaw Materials $ 26,000 $ 13,000Work in Process $ 44,000 $ 40,000Finished Goods $ 71,000 $ 60,000

SMC Inc. employs Just-in-Time and Backflush Costing Systems for the production of goods for the year ended December 31, 2016. The following transactions summarize the major steps in SMC's production during the year of 2016:a. Raw materials received from suppliers amounted to P4,000.b. Direct labor costs of P10,400 and overhead costs of P7,800 were incurred and applied, respectively, during the year of 2016.c. The cost of work-in-process at December 31, 2016 was P3,600, This cost was determined through the production report and is composed of the following elements of costDirect materials 1,500 Direct labor 1,200 Overhead 900d. In addition, the finished goods inventory at December 31, 2016 was P6,500 consisting ofDirect materials 1.500 Direct labor 2,850 Overhead 2,150Requirements:1. What is the amount of direct materials backflushed from raw and in process account to finished goods?2. What is the amount of direct materials backflushed from finished goods to cost of goods sold?3. What…

Chapter 4 Solutions

REVEL for Horngren's Cost Accounting: A Managerial Emphasis -- Access Card (16th Edition) (What's New in Accounting)

Ch. 4 - Define cost pool, cost tracing, cost allocation,...Ch. 4 - How does a job-costing system differ from a...Ch. 4 - Why might an advertising agency use job costing...Ch. 4 - Describe the seven steps in job costing.Ch. 4 - Give examples of two cost objects in companies...Ch. 4 - Describe three major source documents used in...Ch. 4 - What is the advantage of using computerized source...Ch. 4 - Give two reasons why most organizations use an...Ch. 4 - Distinguish between actual costing and normal...Ch. 4 - Describe two ways in which a house-construction...

Ch. 4 - Comment on the following statement: In a...Ch. 4 - Describe three different debit entries to the...Ch. 4 - Describe three alternative ways to dispose of...Ch. 4 - When might a company use budgeted costs rather...Ch. 4 - Prob. 4.15QCh. 4 - Which of the following does not accurately...Ch. 4 - Sturdy Manufacturing Co. assembled the following...Ch. 4 - For which of the following industries would...Ch. 4 - ABC Company uses job-order costing and has...Ch. 4 - Under Stanford Corporations job costing system,...Ch. 4 - (10 min) Job costing, process costing. In each of...Ch. 4 - Actual costing, normal costing, accounting for...Ch. 4 - Job costing, normal and actual costing. Atkinson...Ch. 4 - Budgeted manufacturing overhead rate, allocated...Ch. 4 - Job costing, accounting for manufacturing...Ch. 4 - Job costing, consulting firm. Frontier Partners, a...Ch. 4 - Time period used to compute indirect cost rates....Ch. 4 - Accounting for manufacturing overhead. Creative...Ch. 4 - Job costing, journal entries. The University of...Ch. 4 - Journal entries, T-accounts, and source documents....Ch. 4 - Job costing, journal entries. Donald Transport...Ch. 4 - Job costing, unit cost, ending work in process....Ch. 4 - Job costing; actual, normal, and variation from...Ch. 4 - Job costing; variation on actual, normal, and...Ch. 4 - Proration of overhead. The Ride-On-Wave Company...Ch. 4 - Job costing, accounting for manufacturing...Ch. 4 - Service industry, job costing, law firm. Kidman ...Ch. 4 - Service industry, job costing, two direct- and two...Ch. 4 - Proration of overhead. (Z. Iqbal, adapted) The Zaf...Ch. 4 - Normal costing, overhead allocation, working...Ch. 4 - Proration of overhead with two indirect cost...Ch. 4 - General ledger relationships, under- and...Ch. 4 - Overview of general ledger relationships. Estevez...Ch. 4 - Allocation and proration of overhead. Resource...Ch. 4 - (2530 min.) Job costing, ethics. Joseph Underwood...Ch. 4 - Job costingservice industry. Market Pulse performs...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Would treasury stock be considered authorized, issued, or outstanding? Explain your answer.

Financial Accounting

Discussion Questions 1. What characteristics of the product or manufacturing process would lead a company to us...

Managerial Accounting (4th Edition)

Small Business Analysis Purpose: To help you understand the importance of cash flows in the operation of a smal...

Financial Accounting, Student Value Edition (4th Edition)

How is activity-based costing useful for pricing decisions?

Cost Accounting (15th Edition)

Sykes Corporations comparative balance sheets at December 31, Year 2 and Year 1, reported accumulated depreciat...

Intermediate Accounting

Compute Cost of Goods Manufactured and Cost of Goods Sold (Learning Objective 5) Compute the Cost of Goods Manu...

Managerial Accounting (5th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Davis Co. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 70,000. b. Requisitioned raw materials to production, 70,000. c. Distributed direct labor costs, 15,000. d. Factory overhead costs incurred, 45,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 195,000, on account. (Hint: Use a single account for raw materials and work in process.)arrow_forwardRipley, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. Required: 1. What was the predetermined overhead rate? 2. What was the applied overhead for last year? 3. Was overhead over- or underapplied, and by how much? 4. What was the total cost per unit produced (carry your answer to four significant digits)?arrow_forwardOReilly Manufacturing Co.s cost of goods sold for the month ended July 31 was 345,000. The ending work in process inventory was 90% of the beginning work in process inventory. Factory overhead was 50% of the direct labor cost. No indirect materials were used during the period. Other information pertaining to OReillys inventories and production for July is as follows: Required: 1. Prepare a statement of cost of goods manufactured for the month of July. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information. Start by using cost of goods sold to solve for the cost of goods manufactured.) 2. Prepare a schedule to compute the prime cost incurred during July. 3. Prepare a schedule to compute the conversion cost charged to Work in Process during July.arrow_forward

- Leen Production Co. uses the job order cost system of accounting. The following information was taken from the companys books after all posting had been completed at the end of May: a. Compute the total production cost of each job. b. Prepare the journal entry to transfer the cost of jobs completed to Finished Goods. c. Compute the selling price per unit for each job, assuming a mark-on percentage of 40%. d. Prepare the journal entries to record the sale of Job 1065.arrow_forwardFor E2-17, prepare any journal entries that would have been different if the only trigger points had been the purchase of materials and the sale of finished goods. Davis Co. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 70,000. b. Requisitioned raw materials to production, 70,000. c. Distributed direct labor costs, 15,000. d. Factory overhead costs incurred, 45,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 195,000, on account. (Hint: Use a single account for raw materials and work in process.)arrow_forwardCushing, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. What was last years per unit product cost? a. 1.39 b. 4.40 c. 4.43 d. 3.01arrow_forward

- Lavender Manufacturing Company began business in the current year. The company uses the simplified method to allocate mixed services costs to production. The companys costs and expenses for the year were as follows. a. Determine Lavenders total production costs for the year. b. Assume that the hourly pay for direct labor is much lower than the hourly pay for employees in general administration and that the employee turnover is much higher for production employees than for general administration employees. How should these facts affect the companys decision to use the simplified mixed services method to allocate mixed services costs to production?arrow_forwardGlasson Manufacturing Co. produces only one product. You have obtained the following information from the corporations books and records for the current year ended December 31, 2016: a. Total manufacturing cost during the year was 1,000,000, including direct materials, direct labor, and factory overhead. b. Cost of goods manufactured during the year was 970,000. c. Factory Overhead charged to Work in Process was 75% of direct labor cost and 27% of the total manufacturing cost. d. The beginning Work in Process inventory, on January 1, was 40% of the ending Work in Process inventory, on December 31. e. Material purchases were 400,000 and the ending balance in Materials inventory was 60,000. No indirect materials were used in production. Required: Prepare a statement of cost of goods manufactured for the year ended December 31 for Glasson Manufacturing. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information.)arrow_forwardDuring March, the following costs were charged to the manufacturing department: $14886 for materials; $14,656 for labor; and $13,820 for manufacturing overhead. The records show that 30,680 units were completed and transferred, while 2,400 remained in ending inventory. There were 33,080 equivalent units of material and 31,640 of conversion costs. Using the weighted-average method, what is the cost of inventory transferred and the balance in work in process inventory?arrow_forward

- Kenkel, Ltd. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 80,000. b. Requisitioned raw materials to production, 80,000. c. Distributed direct labor costs, 10,000. d. Factory overhead costs incurred, 60,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 225,000, on account.arrow_forwardThe books of Petry Products Co. revealed that the following general journal entry had been made at the end of the current accounting period: The total direct materials cost for the period was $40,000. The total direct labor cost, at an average rate of $10 per hour for direct labor, was one and one-half times the direct materials cost. Factory overhead was applied on the basis of $4 per direct labor hour. What was the total actual factory overhead incurred for the period? (Hint: First solve for direct labor cost and then for direct labor hours.)arrow_forwardThe cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY