Concept explainers

Special Orders

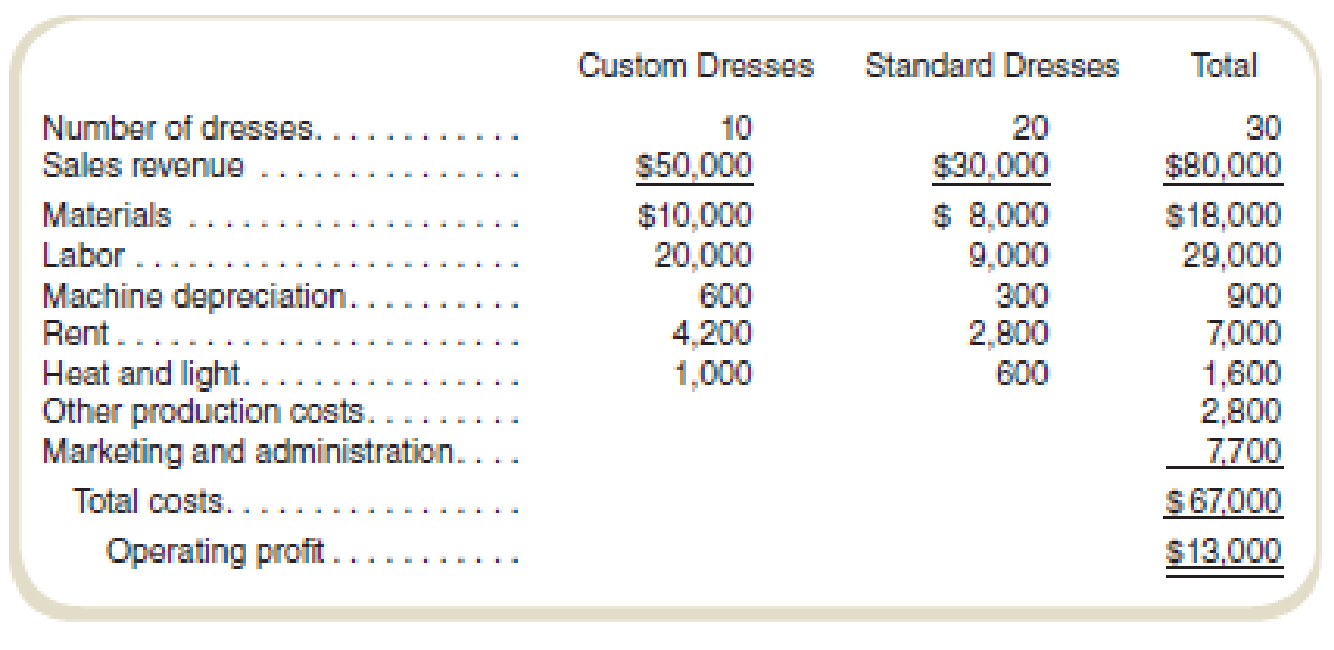

Sherene Nili manages a company that produces wedding gowns. She produces both a custom product that is made to order and a standard product that is sold in bridal salons. Her accountant prepared the following

Ms. Nili already has orders for the 10 custom dresses reflected in the March forecasted income statement. The depreciation charges are for machines used in the respective product lines. Machines

A valued customer, who is a wedding consultant, has asked Ms. Nili for a special favor. This customer has a client who wants to get married in early April. Ms. Nili’s company is working at capacity and would have to give up some other business to make this dress. She can’t renege on custom orders already agreed to, but she can reduce the number of standard dresses produced in March to 10. Ms. Nili would lose permanently the opportunity to make up the lost production of standard dresses because she has no unused capacity for the foreseeable future. The customer is willing to pay $24,000 for the special order. Materials and labor for the order will cost $6,000 and $10,000, respectively. The special order would require 140 hours of machine time. Ms. Nili’s company would save 150 hours of machine time from the standard dress business given up. Rent, heat and light, and other production costs would not be affected by the special order.

Required

- a. Should Ms. Nili take the order? Explain your answer.

- b. What is the minimum price Ms. Nili should accept to take the special order?

- c. What are the other factors, if any, besides price that she should consider?

a.

Determine whether Mr. N should take the order or not.

Answer to Problem 54P

Yes, Mr. N should take the order because of the operating profit increases by $1,510 in case of special order.

Explanation of Solution

Calculate the change in operating profit because of a special order:

| Particulars | Status Quo: without special dress | Alternative: with special dress | Difference |

| Sales | $80,000 | $89,000 (1) | $9,000 higher |

| Less: variable costs | |||

| Material cost | $18,000 | $20,000 (3) | $2,000 higher |

| Labor cost | $29,000 | $34,500 (5) | $5,500 higher |

| Machine depreciation | $900 | $890 (7) | $10 lower |

| Contribution margin | $32,100 | $33,610 | $1,510 higher |

| Less: fixed costs | |||

| Rent | $7,000 | $7,000 | $0 no change |

| Heat and light | $1,600 | $1,600 | $0 no change |

| Other production cost | $2,800 | $2,800 | $0 no change |

| Marketing and administration cost | $7,700 | $7,700 | $0 no change |

| Operating cost | $13,000 | $14,510 | $1,510 higher |

Table: (1)

Thus, the profit increases by $1,510 in case of special order.

Working note 1:

Calculate the sales revenue for special order:

Working note 2:

Calculate the loss of forcasted custome dress sales:

Working note 3:

Calculate the material cost for special order:

Working note 4:

Clculate the saving in cost of marterial of forcasted custom dress:

Working note 5:

Calculate the labor cost for special order:

Working note 6:

Clculate the saving in cost of laborl of forcasted custom dress:

Working note 7:

Calculate the machine depreciation:

Working note 8:

Clculate the saving in cost of laborl of forcasted custom dress:

b.

Calculate the minimum price to accept the offer.

Answer to Problem 54P

The minimum acceptable price for the special order is $22,490.

Explanation of Solution

Calculate the minimum acceptable price for the special order:

The minimum acceptable price will be where the business is neither making any profit nor any loss. Currently business is making the additional profit of $1,510 at the additional revenue of $24,000.

Ms. N can charge $22,490

Thus, the minimum acceptable price is $22,490.

c.

Suggest the factors that should be considered before accepting the special order other than price.

Explanation of Solution

Factors to consider before accepting the special order:

- • Ms. N should consider that the customers of 10 standard dresses will now go to her competitors.

- • Mr. N should also consider that she would get a consistent order of dresses in the future to maintain the sales and profit level

Thus, Ms. N should consider the consistent level of orders and loss of customers because of special order.

Want to see more full solutions like this?

Chapter 4 Solutions

Gen Combo Fundamentals Of Cost Accounting; Connect Access Card

- Lakeesha Barnett owns and operates a package mailing store in a college town. Her store, Send It Packing, helps customers wrap items and send them via UPS, FedEx, and the USPS. Send It Packing also rents mailboxes to customers by the month. In May, purchases of materials (stamps, cardboard boxes, tape, Styrofoam peanuts, bubble wrap, etc.) equaled 11,450; the beginning inventory of materials was 1,050, and the ending inventory of materials was 950. Payments for direct labor during the month totaled 25,570. Overhead incurred was 18,130 (including rent, utilities, and insurance, as well as payments of 14,050 to UPS and FedEx for the delivery services sold). Since Send It Packing is a franchise, Lakeesha owes a monthly franchise fee of 5 percent of sales. She spent 2,750 on advertising during the month. Other administrative costs (including accounting and legal services and a trip to Dallas for training) amounted to 3,650 for the month. Revenues for May were 102,100. Required: 1. What was the cost of materials used for packaging and mailing services during May? 2. What was the prime cost for May? 3. What was the conversion cost for May? 4. What was the total cost of services for May? 5. Prepare an income statement for May. 6. Of the overhead incurred, is any of it direct? Indirect? Explain.arrow_forwardTotal Pops data show the following information: New machinery will be added in April. This machine will reduce the labor required per unit and increase the labor rate for those employees qualified to operate the machinery. Finished goods inventory is required to be 20% of the next months requirements. Direct material requires 2 pounds per unit at a cost of $3 per pound. The ending inventory required for direct materials is 15% of the next months needs. In January, the beginning inventory is 3,000 units of finished goods and 4,470 pounds of material. Prepare a production budget, direct materials budget, and direct labor budget for the first quarter of the year.arrow_forwardMichelle’s Holiday Styles has been busy in the month of November! It seems Michelle’s marketing efforts have paid off, as she has answered many calls to help decorate homes for the upcoming holidays. The company carries an inventory of decorative items in its store and then installs them in creative and fun ways. The MOH costs are fairly low, since the company has just a small space to hold the inventory. The applied MOH rate is $10 per direct labor hour.As of November 30, the company carries the following balances in its inventory accounts. DM Inventory $7,600 WIP Inventory 9,350 FG Inventory 0 During December, the following events occurred. 1. Purchased direct materials costing $16,100 on account. 2. Used $20,700 of direct materials for jobs. 3. Paid direct labor wages for 141 hours of labor ($25/hr). 4. Applied MOH cost to jobs. 5. Actually incurred $3,500 in MOH costs. 6. Completed all jobs by the end of the month. 7. Billed clients…arrow_forward

- Heather’s Holiday Styles has been busy in the month of November! It seems Heather’s marketing efforts have paid off, as she has answered many calls to help decorate homes for the upcoming holidays. The company carries an inventory of decorative items in its store and then installs them in creative and fun ways. The MOH costs are fairly low, since the company has just a small space to hold the inventory. The applied MOH rate is $10 per direct labor hour. As of November 30, the company carries the following balances in its inventory accounts. DM Inventory $5,500 WIP Inventory 7,250 FG Inventory 0 During December, the following events occurred. Purchased direct materials costing $14,000 on account. Used $18,600 of direct materials for jobs. Paid direct labor wages for 120 hours of labor ($25/hr). Applied MOH cost to jobs. Actually incurred $1,400 in MOH costs. Completed all jobs by the end of the month. Billed clients $40,000 for jobs completed. Closed under- or overapplied MOH using the…arrow_forwardAngie March owns a catering company that stages banquets and parties for both individuals and companies. The business is seasonal, with heavy demand during the summer months and year-end holidays and light demand at other times. Angie has gathered the following cost information from the past year: Month Labor Hours Overhead Costs January 2,800 $51,840 February 2,100 49,120 March 2,200 50,120 April 3,300 53,640 May 3,600 56,520 June 4,800 60,040 July 7,100 68,120 August 6,800 65,240 September 5,700 60,680 October 3,800 57,440 November 2,400 52,000 December 5,800 61,640 Total 50,400 $686,400 (a) Correct answer icon Your answer is correct. Identify the high and low points. Activity Level $ High point…arrow_forwardABC Manufacturing is a producer of a local product used in house cleaning, called Agent C. The production manager isrequired to present a production report for the month August, however he got no idea on what information he neededfor the report, and what analysis could be made to help the top management on their decision-making.The production manager sought your expertise on the subject matter and gave to you the following information:Sales (in Pesos) 4,957,875.00Sales Volume 22,500.00Variable Costs:Cost of Direct Raw Materials 895,000.00Cost of Direct Labor 530,000.00Cost of Packaging Materials 124,200.00Fixed Costs:Monthly Depreciation 650,000.00Monthly Rent of Warehouse 100,000.00Fixed Monthly Allowance for Electricity 675,000.00Other Fixed Manufacturing Overhead 146,700.00Required:BREAKEVEN ANALYSIS1. Compute the selling price per unit of Agent C. _________________2. Compute the variable cost per unit of Agent C. _________________3. Compute the variable cost rate of Agent C.…arrow_forward

- Hello the question below: The Oak Rocking chair company manufactures and sells rockers to Walmart. The Seat & Arm Department produces the chair seats and arms and transfers the parts to the Assembly Department where the chairs are assembled. This problem focuses on the Assembly Department. During February, the firm's Assembly Department had 15,000 chairs in beginning inventory on Feb 1 and started production of 75,000 chairs during February. During the month, the firm completed 80,000 chairs. The Assembly department had 10,000 chairs in ending inventory on Feb 28. Direct materials (screws, glue, etc) are added when the chairs are 50% complete and conversion costs are added uniformly throughout the production process. Beginning work in process was 30% complete as to conversion costs, while ending work in process was 80% complete as to conversion costs. The FIFO method of process costing is used. What is the TOTAL Equivalent Units for Transferred In (TI)? What is the TOTAL…arrow_forwardPrepare a direct materials purchasing plan for January, February, and March, based on the following facts: Lana Gonzales owns a business that assembles ceiling fan units. Each fan requires one motor system and four blades. Motors cost $40 each, and blades are $3.50 each. Lana is able to reliably obtain motors as needed, and does not maintain them in inventory. However, blades are stocked in inventory sufficient to produce 30% of the following month's expected production. Planned production is as follows: January 10,000 February 12,000 March 15,000 April 11,000 In accordance with the stocking plan, January's beginning inventory included 12,000 blades. Direct materials purchasing plan: Raw materials needed: Motors (1 per unit) Estimated cost per motor Total estimated motor cost Fan Blades (4 per unit) Plus: Target ending raw material * Fan blades needed Less: Target beginning raw material * Fan blade purchases Estimated cost per blade Total estimated…arrow_forwardJerry Thomas is the manger for the storeroom for Classic Manufacturing. He was asked to estimate the future monthly purchase costs for part number 782. Jerry collected the cost and quantity data for the past nine months as provided below. Month Purchase cost Quantity Purchased January $ 12,925 2,762 February $ 13,250 2,862 March $ 17,903 4,212 April $ 16,075 3,818 May $ 13,375 2,966 June $ 14,064 3,447 July $ 15,550 3,685 August $ 10,483 2,356 September $ 15,200 3,636 Estimated monthly purchases of part 782 for the following three months are: October 3,590 November 3,960 December 3,290 Required: (a) Use…arrow_forward

- One Stop Invitations & More does customize, hand-crafted wedding memorabilia, in which each batch of items is a job. The company has a highly labour-intensive production process, so it allocates manufacturing overhead based on direct labour hours. The business expects to incur $2,400,000 of manufacturing overhead costs and to use 40,000 direct labour hours during 20X9. At the end of May June 20X9, One Stop Invitations & More reported the following inventories:Raw Materials Inventory $200,000Work-in-Progress Inventory $170,000Finished Goods Inventory $110,000During July 20X9, One Stop Invitations & More actually used 3,000 direct labour hours and recorded the following transactions.i) Purchased materials on account $310,000ii) Manufacturing wages incurred $400,000iii) Materials requisitioned (includes $30,000 of indirect materials) $420,000iv) Assigned manufacturing wages, 90% direct labour, 10% indirect labour v) Other manufacturing overhead incurred $130,000vi) Allocated…arrow_forwardTami Tyler opened Novelty Creations, Inc., a small manufacturing company, at the beginning of 2021. Getting the company through its first two-quarters of operations placed considerable stress on Ms. Bridgton’s personal finances. The following income statement was prepared for the second quarter by a friend who has just completed a course in managerial accounting at a local community college. Novelty Creations, Inc.Income StatementFor the Quarter Ended June 30, 2021 Sales (28,000 units) $1,120,000 Variable expenses: Variable cost of goods sold $462,000 Variable selling and administrative 168,000 630,000 Contribution margin 490,000 Fixed expenses: Fixed manufacturing overhead 300,000 Fixed selling and administrative 200,000 500,000 Net operating loss $(10,000) Ms. Tyler was very unhappy over the loss shown for the quarter, particularly because she had planned to use the statement as support for a…arrow_forwardTami Tyler opened Novelty Creations, Inc., a small manufacturing company, at the beginning of 2021. Getting the company through its first two-quarters of operations placed considerable stress on Ms. Bridgton’s personal finances. The following income statement was prepared for the second quarter by a friend who has just completed a course in managerial accounting at a local community college. Novelty Creations, Inc.Income StatementFor the Quarter Ended June 30, 2021 Sales (28,000 units) $1,120,000 Variable expenses: Variable cost of goods sold $462,000 Variable selling and administrative 168,000 630,000 Contribution margin 490,000 Fixed expenses: Fixed manufacturing overhead 300,000 Fixed selling and administrative 200,000 500,000 Net operating loss $(10,000) Ms. Tyler was very unhappy over the loss shown for the quarter, particularly because she had planned to use the statement as support for a…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,