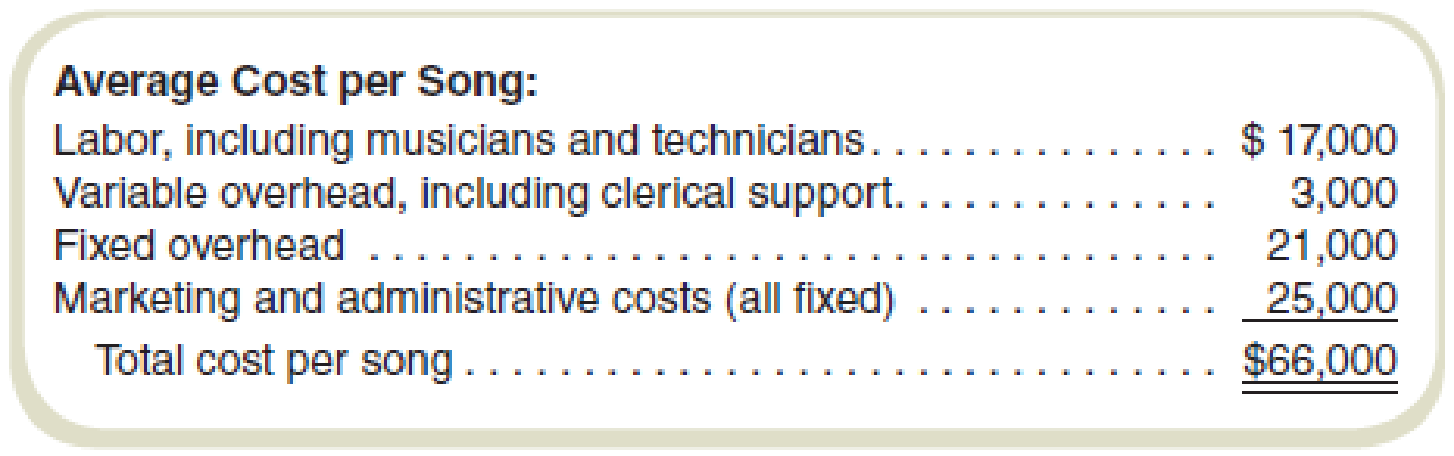

M. Anthony, LLP, produces music in a studio in London. The cost of producing one typical song follows:

The fixed costs allocated to each song are based on the assumption that the studio produces 60 songs per month.

Required

Treat each question independently. Unless stated otherwise, M. Anthony charges $80,000 per song produced.

- a. How many songs must the firm produce per month to break even?

- b.

Market research estimates that a price increase to $90,000 per song would decrease monthly volume to 52 songs. The accounting department estimates that fixed costs would remain unchanged in total, and variable costs per song would remain unchanged if the volume were to drop to 52 songs per month. How would a price increase affect profits? - c. Assume that M. Anthony’s studio is operating at its normal volume of 60 songs per month. It has received a special request from a university to produce 30 songs that will make up a two-CD set. M. Anthony must produce the music next month or the university will take its business elsewhere. M. Anthony would have to give up normal production of 10 songs because it has the capacity to produce only 80 songs per month. Because of the need to produce songs on a timely basis, M. Anthony could not make up the production of those songs in another month. Because the university would provide its own musicians, the total variable cost (labor plus overhead) would be cut to $15,000 per song on the special order for the university. The university wants a discounted price; it is prepared to pay only $40,000 per song and believes a fee reduction is in order. Total fixed costs will be the same whether or not M. Anthony accepts the special order. Should M. Anthony accept the special order?

- d. Refer to the situation presented in requirement (c) above. Instead of offering to pay $40,000 per song, suppose the university comes to M. Anthony with the following proposition. The university official says, “We want you to produce these 30 songs for us. We do not want you to be worse off financially because you have produced these songs. On the other hand, we want the lowest price we can get.” What is the lowest price that M. Anthony could charge and be no worse off for taking this order?

a.

Calculate the number of songs that are needed to be produced for the break-even.

Answer to Problem 56P

The break-even point is 46 songs.

Explanation of Solution

Break-even point:

The breakeven point or BEP is that level of output at which the total revenue is equal to the total cost. The BEP means there are no operating income and no operating losses. The management keeps an eye on the breakeven point in order to avoid the operating losses.

Calculate the break-even point:

Thus, the break-even point is 46 songs.

Working note 1:

Calculate the fixed costs:

Working note 2:

Calculate the fixed cost per unit:

Working note 3:

Calculate the contribution margin per unit:

Working note 4:

Calculate the variable cost (unit):

b.

Calculate the change in price affect the profit of the company.

Answer to Problem 56P

The change in profit is $40,000 in the case of the price increase.

Explanation of Solution

Operating profit:

The operating profit is the excess of total revenues over total expenses after adjusting for depreciation and taxes.

Calculate the change in the profit after the increase in price:

| Particulars |

Amount (60 songs) |

Amount (52 songs) | Change |

| Revenue | $4,800,000 | $4,680,000 | $120,000 lower |

| Less: variable costs | $1,200,000 | $1,040,000 | $160,000 lower |

| Contribution margin | $3,600,000 | $3,640,000 | $440,000 higher |

| Fixed costs | $2,760,000 | $2,760,000 | No change |

| Profit | $840,000 | $880,000 | $40,000 higher |

Table: (1)

Thus, the change in profit is $40,000 in the case of the price increase.

c.

Suggest whether Mr. M should accept the special offer or not.

Answer to Problem 56P

The change in profit is $150,000 in case of special order.

Explanation of Solution

Special order:

When the company gets a bigger order, then the usual order and the price of the unit is relatively lower than the price of normal units. Then this order is known as special order.

Calculate the change in profit:

| Particulars |

Amount (Status quo sales) |

Amount (alternate) | Change |

| Revenue | $4,800,000 | $5,200,000 | $400,000 lower |

| Less: variable costs | $1,200,000 | $1,450,000 | $250,000 lower |

| Contribution margin | $3,600,000 | $3,750,000 | $150,000 higher |

| Fixed costs | $2,760,000 | $2,760,000 | no change |

| Profit | $840,000 | $990,000 | $150,000 higher |

Table: (2)

Thus, the change in profit is $150,000 in case of special order.

d.

Calculate the change in case of special order.

Answer to Problem 56P

The change in price is $35,000.

Explanation of Solution

Special order:

When the company gets a bigger order, then the usual order and the price of the unit is relatively lower than the price of normal units. Then this order is known as special order.

Calculate the change in price:

Thus, the change in price is $35,000.

Working note 5:

Calculate the contribution margin per unit:

Working note 6:

Calculate the contribution margin foregone:

Mr. M has to foregone the contribution margin of 10 songs in order to produce the school’s songs. Contribution margin is calculated as follows:

Want to see more full solutions like this?

Chapter 4 Solutions

Gen Combo Fundamentals Of Cost Accounting; Connect Access Card

- Dimitri Designs has capacity to produce 30,000 desk chairs per year and is currently selling all 30,000 for $240 each. Country Enterprises has approached Dimitri to buy 800 chairs for $210 each. Dimitris normal variable cost is $165 per chair, including $50 per unit in direct labor per chair. Dimitri can produce the special order on an overtime shift, which means that direct labor would be paid overtime at 150% of the normal pay rate. The annual fixed costs will be unaffected by the special order and the contract will not disrupt any of Dimitris other operations. What will be the impact on profits of accepting the order?arrow_forwardVariety Artisans has a bottleneck in their production that occurs within the engraving department. Arjun Naipul, the COO, is considering hiring an extra worker, whose salary will be $45,000 per year, to solve the problem. With this extra worker, the company could produce and sell 3,500 more units per year. Currently, the selling price per unit is $18 and the cost per unit is $5.85. Using the information provided, calculate the annual financial impact of hiring the extra worker.arrow_forwardGent Designs requires three units of part A for every unit of Al that it produces. Currently, part A is made by Gent, with these per-unit costs in a month when 4.000 units were produced: Variable manufacturing overhead is applied at $1.00 per unit. The other $0.30 of overhead consists of allocated fixed costs. Gent will need 6,000 units of part A for the next years production. Cory Corporation has offered to supply 6,000 units of part A at a price of $7.00 per unit. It Gent accepts the offer, all of the variable costs and $1,200 of the fixed costs will be avoided. Should Gent Designs accept the offer from Cory Corporation?arrow_forward

- Remarkable Enterprises requires four units of part A for every unit of Al that it produces. Currently, part A is made by Remarkable, with these per-unit costs in a month when 4,000 units were produced: Variable manufacturing overhead is applied at $1.60 per unit. The other $0.50 of overhead consists of allocated fixed costs. Remarkable will need 8,000 units of part A for the next years production. Altoona Corporation has offered to supply 8,000 units of part A at a price of $8.00 per unit. If Remarkable accepts the offer, all of the variable costs and $2,000 of the fixed costs will be avoided. Should Remarkable accept the offer from Altoona Corporation?arrow_forwardCadre, Inc., sells a single product with a selling price of $120 and variable costs per unit of $90. The companys monthly fixed expenses are $180,000. What is the companys break-even point in units? What is the companys break-even point in dollars? Prepare a contribution margin income statement for the month of October when they will sell 10,000 units. How many units will Cadre need to sell in order to realize a target profit of $300,000? What dollar sales will Cadre need to generate in order to realize a target profit of $300,000? Construct a contribution margin income statement for the month of August that reflects $2,400,000 in sales revenue for Cadre, Inc.arrow_forwardArtisan Metalworks has a bottleneck in their production that occurs within the engraving department. Jamal Moore, the COO, is considering hiring an extra worker, whose salary will be $55,000 per year, to solve the problem. With this extra worker, the company could produce and sell 3,000 more units per year. Currently, the selling price per unit is $25 and the cost per unit is $7.85. Using the information provided, calculate the annual financial impact of hiring the extra worker.arrow_forward

- Markson and Sons leases a copy machine with terms that include a fixed fee each month of $500 plus a charge for each copy made. The company uses the high-low method to analyze costs. If Markson paid $360 for 5,000 copies and $280 for 3,000 copies, how much would Markson pay if it made 7,500 copies?arrow_forwardAt Stardust Gems, a faux gem and jewelry company, the setting department is a bottleneck. The company is considering hiring an extra worker, whose salary will be $67,000 per year, to ease the problem. Using the extra worker, the company will be able to produce and sell 9,000 more units per year. The selling price per unit is $20. The cost per unit currently is $15.85 as shown: What is the annual financial impact of hiring the extra worker for the bottleneck process?arrow_forwardMaple Enterprises sells a single product with a selling price of $75 and variable costs per unit of $30. The companys monthly fixed expenses are $22,500. What is the companys break-even point in units? What is the companys break-even point in dollars? Construct a contribution margin income statement for the month of September when they will sell 900 units. How many units will Maple need to sell in order to reach a target profit of $45,000? What dollar sales will Maple need in order to reach a target profit of $45,000? Construct a contribution margin income statement for Maple that reflects $150,000 in sales volume.arrow_forward

- Jansen Crafters has the capacity to produce 50,000 oak shelves per year and is currently selling 44,000 shelves for $32 each. Cutrate Furniture approached Jansen about buying 1,200 shelves for bookcases it is building and is willing to pay $26 for each shelf. No packaging will be required for the bulk order. Jansen usually packages shelves for Home Depot at a price of $1.50 per shell. The $1.50 per-shelf cost is included in the unit variable cost of $27, with annual fixed costs of $320.000. However, the $130 packaging cost will not apply in this case. The fixed costs will be unaffected by the special order and the company has the capacity to accept the order. Based on this information, what would be the profit if Jansen accepts the special order? A. Profits will decrease by $1,200. B. Profits will increase by $31,200. C. Profits will increase by $600. D. Profits will increase by $7,200.arrow_forwardOat Treats manufactures various types of cereal bars featuring oats. Simmons Cereal Company has approached Oat Treats with a proposal to sell the company its top selling oat cereal bar at a price of $27,500 for 20,000 bars. The costs shown are associated with production of 20,000 oat bars currently. The manufacturing overhead consists of $3,000 of variable costs with the balance being allocated to fixed costs. Should Oat Treats make or buy the oat bars?arrow_forwardEmerald Island Company is considering building a manufacturing plant in County Kerry. Predicting sales of 100,000 units, Emerald Isle estimates the following expenses: An Irish firm that specializes in marketing will be engaged to sell the manufactured product and will receive a commission of 10% of the sales price. None of the U.S. home office expense will be allocated to the Irish facility. Required: 1. If the unit sales price is 2, how many units must be sold to break even? (Hint: First compute the variable cost per unit.) 2. Calculate the margin of safety ratio. 3. Calculate the contribution margin ratio.arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT