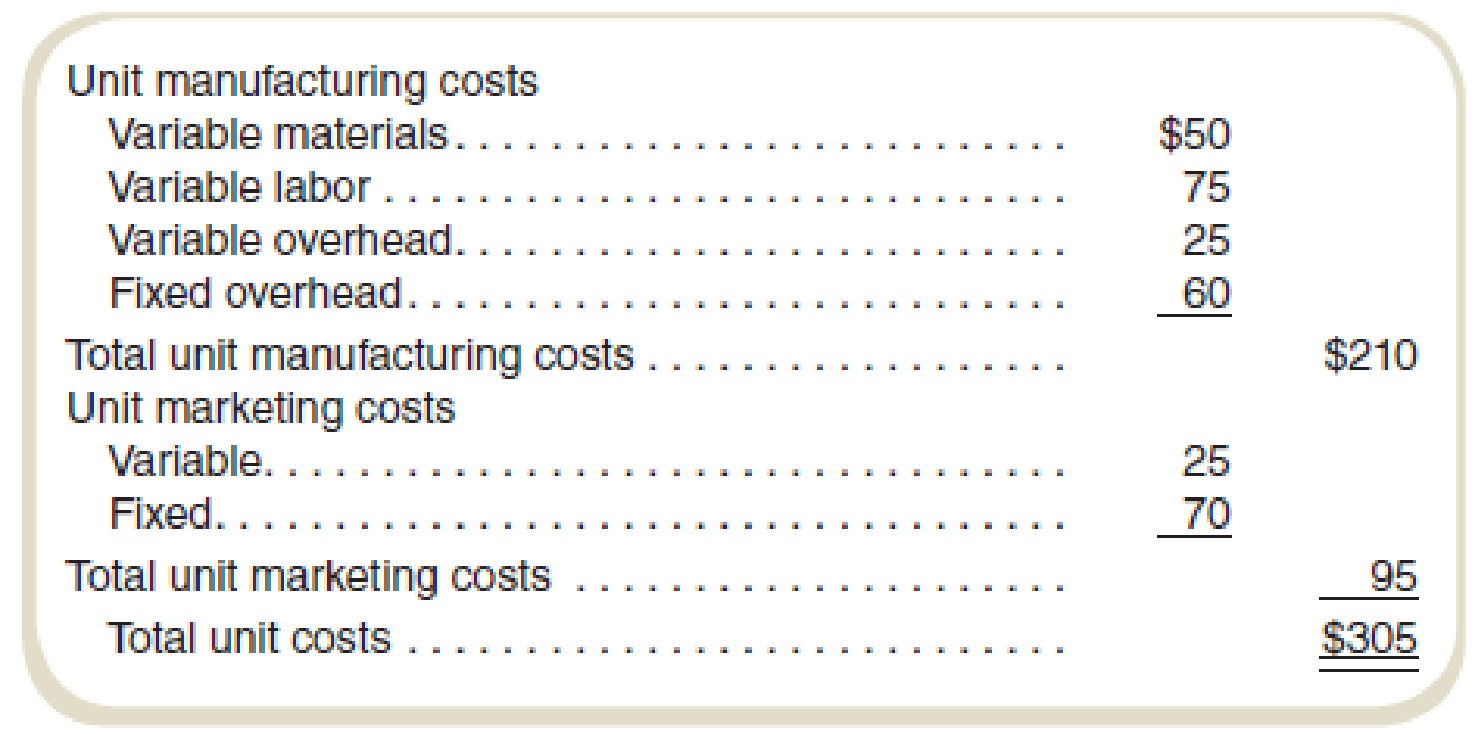

Davis Kitchen Supply produces stoves for commercial kitchens. The costs to manufacture and market the stoves at the company’s normal volume of 6,000 units per month are shown in the following table:

Unless otherwise stated, assume that no connection exists between the situation described in each question; each is independent. Unless otherwise stated, assume a regular selling price of $370 per unit. Ignore income taxes and other costs that are not mentioned in the table or in the question itself.

Required

- a.

Market research estimates that volume could be increased to 7,000 units, which is well within production capacity limitations if the price were cut from $370 to $325 per unit. Assuming that the cost behavior patterns implied by the data in the table are correct, would you recommend taking this action? What would be the impact on monthly sales, costs, and income? - b. On March 1, the federal government offers Davis a contract to supply 1,000 units to military bases for a March 31 delivery. Because of an unusually large number of rush orders from its regular customers, Davis plans to produce 8,000 units during March, which will use all available capacity. If it accepts the government order, it would lose 1,000 units normally sold to regular customers to a competitor. The government contract would reimburse its “share of March

manufacturing costs ” plus pay a $50,000 fixed fee (profit). (No variable marketing costs would be incurred on the government’s units.) What impact would accepting the government contract have on March income? (Part of your problem is to figure out the meaning of “share of March manufacturing costs.”) - c. Davis has an opportunity to enter a highly competitive foreign market. An attraction of the foreign market is that its demand is greatest when the domestic market’s demand is quite low; thus, idle production facilities could be used without affecting domestic business. An order for 2,000 units is being sought at a below-normal price to enter this market. For this order, shipping costs will total $40 per unit; total (marketing) costs to obtain the contract will be $4,000. No other variable marketing costs would be required on this order, and it would not affect domestic business. What is the minimum unit price that Davis should consider for this order of 2,000 units?

- d. An inventory of 460 units of an obsolete model of the stove remains in the stockroom. These must be sold through regular channels (thus incurring variable marketing costs) at reduced prices or the inventory will soon be valueless. What is the minimum acceptable selling price for these units?

- e. A proposal is received from an outside contractor who will make and ship 2,000 stoves per month directly to Davis’s customers as orders are received from Davis’s sales force. Davis’s fixed marketing costs would be unaffected, but its variable marketing costs would be cut by 20 percent for these 2,000 units produced by the contractor. Davis’s plant would operate at two-thirds of its normal level, and total fixed manufacturing costs would be cut by 30 percent. What in-house unit cost should be used to compare with the quotation received from the supplier? Should the proposal be accepted for a price (that is, payment to the outside contractor) of $215 per unit?

- f. Assume the same facts as in requirement (e) except that the idle facilities would be used to produce 1,600 modified stoves per month for use in extreme climates. These modified stoves could be sold for $450 each, while the costs of production would be $275 per unit variable manufacturing expense. Variable marketing costs would be $50 per unit. Fixed marketing and manufacturing costs would be unchanged whether the original 6,000 regular stoves were manufactured or the mix of 4,000 regular stoves plus 1,600 modified stoves were produced. Should the proposal be accepted for a price of $215 per unit to the outside contractor?

a.

Explain whether the action should be taken or not on the basis of the given situation. Also, identify the impact on monthly sales, costs, and income.

Explanation of Solution

Differential cost:

The cost difference of two alternatives is differential cost. Before taking any decision, the management of the business has to check for various options to make sure the reliability of the alternative.

| Particulars | Before Price Reduction | After price reduction | Impact | Increase/decrease |

| Sales price | $370 | $325 | ||

| Quantity | 6000 | 7000 | ||

| Revenue | $2,220,000 | $2,275,000 | $55,000 | Increase |

| Variable manufacturing cost | $900,000 | $1,050,000 | $150,000 | Increase |

| Variable marketing costs | $150,000 | $175,000 | $25,000 | Increase |

| Contribution margin | $1,170,000 | $1,050,000 | ($120,000) | Decrease |

| Fixed manufacturing costs | $360,000 | $360,000 | ||

| Fixed marketing costs | $420,000 | $420,000 | ||

| Income | $390,000 | $270,000 | ($120,000) | Decrease |

Table: (1)

Thus, the price should not be lowered because it results in a decrease in operating profit. However, the market share and other points can be taken into consideration.

b.

Identify the impact of the increase in price on profit.

Explanation of Solution

The impact of the increase in price on profit:

| Particulars | Without Government Contract | With Government Contract | Impact | Increase/decrease | ||

| Regular | Government | Total | ||||

| Revenue | $2,960,000 | $2,590,000 | $245,000 (1) | $2,835,000 | ($125,000) | Decrease |

| Variable manufacturing costs | $1,200,000 | $1,050,000 | $150,000 | $1,200,000 | $0 | |

| Variable marketing costs | $200,000 | $175,000 | $0 | $175,000 | ($25,000) | Decrease |

| Contribution margin | $1,560,000 | $1,365,000 | $95,000 | $1,460,000 | ($100,000) | Decrease |

| Fixed manufacturing costs | $360,000 | $360,000 | $0 | |||

| Fixed marketing costs | $420,000 | $420,000 | $0 | |||

| Income | $780,000 | $680,000 | ($100,000) | Decrease | ||

Table: (2)

Thus, the contact should not be accepted because it results in decrease in income to the company.

Working note 1:

Compute the government revenue:

c.

Find the minimum unit price that Mr. D should consider for this order of 2,000 units.

Explanation of Solution

Compute the minimum unit price that Mr. D should consider for this order of 2,000 units:

Thus, the minimum unit price that Mr. D should consider for this order of 2,000 units is $192.

d.

Determine the minimum acceptable selling price for the given units.

Explanation of Solution

Determine the minimum acceptable selling price for the given units:

The minimum acceptable selling price will be the differential costs which involve the marketing costs of $25 per unit. The minimum price is the differential marketing costs because the variable costs must be recovered for selling the product. The additional price if charged will add to the income.

e.

Calculate the in-house unit cost which should be used to compare with the quotation received from the supplier. Also, decide whether the proposal should be accepted for a price of $215 per unit.

Explanation of Solution

Calculate the in-house unit cost which should be used to compare with the quotation received from the supplier:

| Particulars | All Production In-house | 2,000 Units Contracted |

| Total revenue | $ 2,220,000 | $ 2,220,000 |

| Total variable manufacturing costs | $ 900,000 | $ 1,030,000 (2) |

| Total variable marketing costs | $ 150,000 | $ 140,000 (3) |

| Total contribution margin | $ 1,170,000 | $ 1,050,000 |

| Total fixed manufacturing costs | $ 360,000 | $ 252,000 (4) |

| Total fixed marketing costs | $ 420,000 | $ 420,000 |

| Income | $ 390,000 | $ 378,000 |

Table: (3)

The proposed price of $215 should not be accepted by the management because it would result in a decrease in net income by $12,000. Thus, price of $215 is not an acceptable price.

Working note 2:

Compute the total variable manufacturing costs when 2,000 units are being contracted:

Working note 3:

Compute the total variable marketing costs when 2,000 units are being contracted:

Working note 4:

Compute the total fixed marketing costs when 2,000 units are being contracted:

f.

Determine whether the proposal should be accepted for a price of $215 per unit to the outside contractor.

Explanation of Solution

Determine the income for a price of $215 per unit to the outside contractor:

| Particulars | 6,000 Regular Stoves Produced | Contract 2,000 Regular stoves; Produce 1,600 Modified stoves and 4,000 Regular Stoves | |||

| In-house | Regular (In) | Regular (Out) | Modified | Total | |

| Revenue | $2,220,000 | $1,480,000 | $740,000 | $720,000 | $2,940,000 (5) |

| Variable manufacturing costs | $900,000 | $600,000 | $430,000 | $440,000 | $1,470,000 (6) |

| Variable marketing costs | $150,000 | $100,000 | $40,000 | $80,000 | $220,000 (7) |

| Contribution margin | $1,170,000 | $780,000 | $270,000 | $200,000 | $1,250,000 |

| Fixed manufacturing costs | $360,000 | $360,000 | |||

| Fixed marketing costs | $420,000 | $420,000 | |||

| Income | $390,000 | $470,000 | |||

Table: (4)

Compute the in-house cost savings from the contract:

| Particulars | Amount (per unit) |

| Variable manufacturing cost saved | $ 150 |

| Variable marketing saved | $ 5 |

| Contribution from freed-up capacity | $ 100 |

| In-house cost savings | $ 255 |

Table: (5)

The proposed price of $215 should be accepted now. The deal made with the subcontractor is more profitable as there is a cost saving of $255 per unit.

Working note 5:

Compute the total revenue when 2,000 units are being contracted:

Working note 6:

Compute the total variable manufacturing costs when 2,000 units are being contracted:

Working note 7:

Compute the total variable marketing costs when 2,000 units are being contracted:

Want to see more full solutions like this?

Chapter 4 Solutions

FUNDAMENTALS OF COST ACCOUNTING

- Oat Treats manufactures various types of cereal bars featuring oats. Simmons Cereal Company has approached Oat Treats with a proposal to sell the company its top selling oat cereal bar at a price of $27,500 for 20,000 bars. The costs shown are associated with production of 20,000 oat bars currently. The manufacturing overhead consists of $3,000 of variable costs with the balance being allocated to fixed costs. Should Oat Treats make or buy the oat bars?arrow_forwardMarkson and Sons leases a copy machine with terms that include a fixed fee each month plus acharge for each copy made. Markson made 9,000 copies and paid a total of $480 in January. In April, they paid $320 for 5,000 copies. What is the variable cost per copy if Markson uses the high-low method to analyze costs?arrow_forwardDeuce Sporting Goods manufactures a high-end model tennis racket. The company’s forecasted income statement for the year, before any special orders, is as follows: Fixed costs included in the forecasted income statement are $400,000 in manufacturing cost of goods sold and $200,000 in selling expenses. A new client placed a special order with Deuce, offering to buy 1,000 tennis rackets for $100.00 each. The company will incur no additional selling expenses if it accepts the special order. Assuming that Deuce has sufficient capacity to manufacture 1,000 more tennis rackets, by what amount would differential income increase (decrease) as a result of accepting the special order? (Hint: First compute the variable cost per unit relevant to this decision.)arrow_forward

- Almond Treats manufactures various types of cereals that feature almonds. Acme Cereal Company has approached Almond Treats with a proposal to sell the company its top selling cereal at a price of $22,000 for 20,000 pounds. The costs shown are associated with production of 20,000 pounds of almond cereal: The manufacturing overhead consists of $2,000 of variable costs with the balance being allocated to fixed costs. Should Almond Treats make or buy the almond cereal?arrow_forwardBoston Executive. Inc., produces executive limousines and currently manufactures the mini-bar inset at these costs: The company received an offer from Elite Mini-Bars to produce the insets for $2,100 per Unit and supply 1,000 mini-bars for the coming years estimated production. If the company accepts this offer and shuts down production of this part of the business, production workers and supervisors will be reassigned to other areas. Assume that for the short-term decision-making process demonstrated in this problem, the companys total labor costs (direct labor and supervisor salaries) will remain the same if the bar inserts are purchased. The specialized equipment cannot be used and has no market value. However, the space occupied by the mini bar production can be used by a different production group that will lease it for $55,000 per year. Should the company make or buy the mini-bar insert?arrow_forwardAble Transport operates a tour bus that they lease with terms that involve a fixed fee each month plus a charge for each mile driven. Able Transport drove the tour bus 4,000 miles and paid a total of $1,250 in March. In April, they paid $970 for 3.000 miles. What is the variable cost per mile if Able Transport uses the high-low method to analyze costs?arrow_forward

- Reubens Deli currently makes rolls for deli sandwiches it produces. It uses 30,000 rolls annually in the production of deli sandwiches. The costs to make the rolls are: A potential supplier has offered to sell Reuben the rolls for $0.90 each. If the rolls are purchased, 30% of the fixed overhead could be avoided, If Reuben accepts the offer, what will the effect on profit be?arrow_forwardCinnamon Depot bakes and sells cinnamon rolls for $1.75 each. The cost of producing 500,000 rolls in the prior year was: At the start of the current year, Cinnamon Depot received a special order for 18,000 rolls to be sold for $1.50 per roll. The company estimates it will incur an additional $1,000 in total fixed costs in order to lease a special machine that forms the rolls in the shape of a heart per the customers request. This order will not affect any of its other operations. Should the company accept the special order? (Show your work.)arrow_forwardDimitri Designs has capacity to produce 30,000 desk chairs per year and is currently selling all 30,000 for $240 each. Country Enterprises has approached Dimitri to buy 800 chairs for $210 each. Dimitris normal variable cost is $165 per chair, including $50 per unit in direct labor per chair. Dimitri can produce the special order on an overtime shift, which means that direct labor would be paid overtime at 150% of the normal pay rate. The annual fixed costs will be unaffected by the special order and the contract will not disrupt any of Dimitris other operations. What will be the impact on profits of accepting the order?arrow_forward

- Ottis, Inc., uses 640,000 plastic housing units each year in its production of paper shredders. The cost of placing an order is 30. The cost of holding one unit of inventory for one year is 15.00. Currently, Ottis places 160 orders of 4,000 plastic housing units per year. Required: 1. Compute the economic order quantity. 2. Compute the ordering, carrying, and total costs for the EOQ. 3. How much money does using the EOQ policy save the company over the policy of purchasing 4,000 plastic housing units per order?arrow_forwardRegal Executive, Inc., produces executive motor coaches and currently manufactures the cent awnings that accompany them at these costs: The company received an offer from Saied Tents to produce the awnings for $3,200 per unit and supply 1,000 awnings for the coming years estimated production. If the company accepts this offer and shuts down production of this part of the business, production workers and supervisors will be reassigned to other areas. Assume that for the short-term decision-making process demonstrated in this problem, the companys total labor costs (direct labor and supervisor salaries) will remain the same if the bar inserts are purchased. The specialized equipment cannot be used and has no market value. However, the space occupied by the awning production can be used by a different production group that will lease it for $60,000 per year. Should the company make or buy the awnings?arrow_forwardUsing the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,