Concept explainers

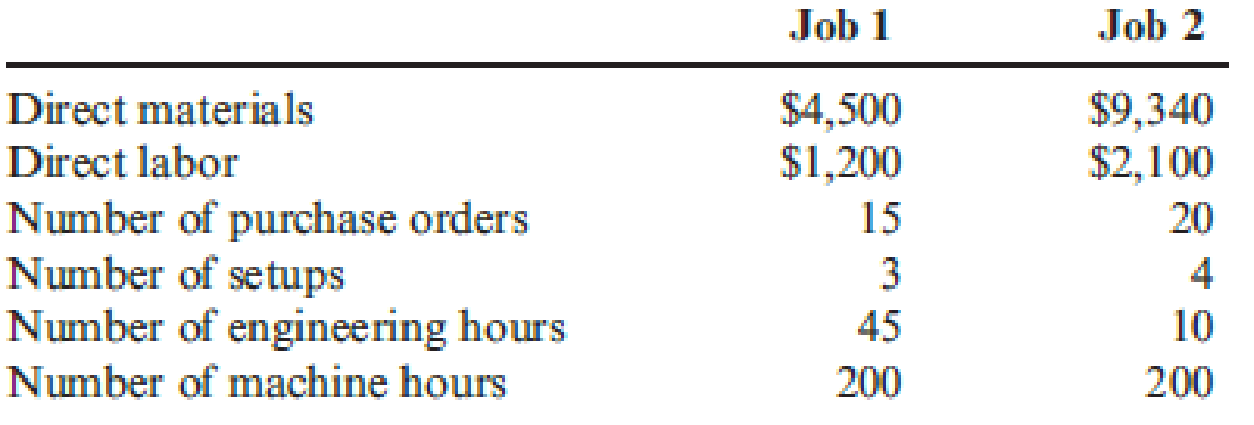

Firenza Company manufactures specialty tools to customer order. Budgeted

Previously, Sanjay Bhatt, Firenza Company’s controller, had applied overhead on the basis of machine hours. Expected machine hours for the coming year are 50,000. Sanjay has been reading about activity-based costing, and he wonders whether or not it might offer some advantages to his company. He decided that appropriate drivers for overhead activities are purchase orders for purchasing, number of setups for setup cost, engineering hours for engineering cost, and machine hours for other. Budgeted amounts for these drivers are 5,000 purchase orders, 500 setups, and 2,500 engineering hours.

Sanjay has been asked to prepare bids for two jobs with the following information:

The typical bid price includes a 40 percent markup over full

Required:

- 1. Calculate a plantwide rate for Firenza Company based on machine hours. What is the bid price of each job using this rate?

- 2. Calculate activity rates for the four overhead activities. What is the bid price of each job using these rates?

- 3. Which bids are more accurate? Why?

1.

Calculate the plant wide overhead rate for F Company based on machine hours and bid price for each job using plant wide overhead rate.

Explanation of Solution

Plant wide overhead rate: Plant wide overhead rate is the rate a company uses to allocate its manufacturing overhead costs to products and cost centers.

Calculate the overhead rate:

Working note:

- a) Calculate the budgeted overhead.

Calculate the bid price for job 1 and job 2.

| F company | ||

| Particulars | Job 1 | Job 2 |

| Direct materials | $4,500 | $9,340 |

| Direct labor | 1,200 | 2,100 |

| Overhead | $650 (b) | $650 (c) |

| Total manufacturing cost | $6,350 | $12,090 |

| Add: 40% markup | 2,540 (d) | 4,836 (e) |

| Bid price | $8,890 | $16,926 |

Table (1)

Working notes:

- b) Calculate the overhead for job 1.

- c) Calculate the overhead for job 2.

- d) Calculate the 40% markup for job 1.

- e) Calculate the 40% markup for job 2.

2.

Calculate the activity rate for all the overhead activities and bid price for both jobs using activity price.

Explanation of Solution

Calculate the purchasing rate per order.

Calculate the setup cost rate per setup.

Calculate the engineering rate per engineering hour.

Calculate the other cost rate per machine hour.

Calculate the bid price for job 1 and job 2.

| F company | ||

| Particulars | Job 1 | Job 2 |

| Direct materials | $4,500 | $9,340 |

| Direct labor | $1,200 | $2,100 |

| Overhead: | ||

| Purchasing | 120 (f) | 160 (g) |

| Setup | 225 (h) | 300 (i) |

| Engineering | 810 (j) | 180 (k) |

| Other | 160 (l) | 160 (m) |

| Total manufacturing cost | $7,015 | $12,240 |

| Add: 40% markup | 2,806 (n) | 4,896 (o) |

| Bid price | $9,281 | $17,136 |

Table (2)

Working notes:

- f) Calculate the purchasing overhead for job 1.

- g) Calculate the purchasing overhead for job 2.

- h) Calculate the setup overhead for job 1.

- i) Calculate the setup overhead for job 2.

- j) Calculate the engineering overhead for job 1.

- k) Calculate the engineering overhead for job 2.

- l) Calculate the other overhead for job 1.

- m) Calculate the other overhead for job 2.

- n) Calculate the 40% markup for job 1.

- o) Calculate the 40% markup for job 2.

3.

Identify the accurate bid price and explain the reason behind it.

Explanation of Solution

Assigning the overhead using activity based approach shows the accurate cost figure because most of the overheads are non-unit level and there is a variety of products.

Want to see more full solutions like this?

Chapter 5 Solutions

CengageNOWv2, 1 term Printed Access Card for Hansen/Mowen’s Cornerstones of Cost Management, 4th

- The controller for Muir Companys Salem plant is analyzing overhead in order to determine appropriate drivers for use in flexible budgeting. She decided to concentrate on the past 12 months since that time period was one in which there was little important change in technology, product lines, and so on. Data on overhead costs, number of machine hours, number of setups, and number of purchase orders are in the following table. Required: 1. Calculate an overhead rate based on machine hours using the total overhead cost and total machine hours. (Round the overhead rate to the nearest cent and predicted overhead to the nearest dollar.) Use this rate to predict overhead for each of the 12 months. 2. Run a regression equation using only machine hours as the independent variable. Prepare a flexible budget for overhead for the 12 months using the results of this regression equation. (Round the intercept and x-coefficient to the nearest cent and predicted overhead to the nearest dollar.) Is this flexible budget better than the budget in Requirement 1? Why or why not?arrow_forwardAdam Corporation manufactures computer tables and has the following budgeted indirect manufacturing cost information for the next year: If Adam uses the step-down (sequential) method, beginning with the Maintenance Department, to allocate support department costs to production departments, the total overhead (rounded to the nearest dollar) for the Machining Department to allocate to its products would be: a. 407,500. b. 422,750. c. 442,053. d. 445,000.arrow_forwardDouglas Davis, controller for Marston, Inc., prepared the following budget for manufacturing costs at two different levels of activity for 20X1: During 20X1, Marston worked a total of 80,000 direct labor hours, used 250,000 machine hours, made 32,000 moves, and performed 120 batch inspections. The following actual costs were incurred: Marston applies overhead using rates based on direct labor hours, machine hours, number of moves, and number of batches. The second level of activity (the right column in the preceding table) is the practical level of activity (the available activity for resources acquired in advance of usage) and is used to compute predetermined overhead pool rates. Required: 1. Prepare a performance report for Marstons manufacturing costs in the current year. 2. Assume that one of the products produced by Marston is budgeted to use 10,000 direct labor hours, 15,000 machine hours, and 500 moves and will be produced in five batches. A total of 10,000 units will be produced during the year. Calculate the budgeted unit manufacturing cost. 3. One of Marstons managers said the following: Budgeting at the activity level makes a lot of sense. It really helps us manage costs better. But the previous budget really needs to provide more detailed information. For example, I know that the moving materials activity involves the use of forklifts and operators, and this information is lost when only the total cost of the activity for various levels of output is reported. We have four forklifts, each capable of providing 10,000 moves per year. We lease these forklifts for five years, at 10,000 per year. Furthermore, for our two shifts, we need up to eight operators if we run all four forklifts. Each operator is paid a salary of 30,000 per year. Also, I know that fuel costs about 0.25 per move. Assuming that these are the only three items, expand the detail of the flexible budget for moving materials to reveal the cost of these three resource items for 20,000 moves and 40,000 moves, respectively. Based on these comments, explain how this additional information can help Marston better manage its costs. (Especially consider how activity-based budgeting may provide useful information for non-value-added activities.)arrow_forward

- Young Company is beginning operations and is considering three alternatives to allocate manufacturing overhead to individual units produced. Young can use a plantwide rate, departmental rates, or activity-based costing. Young will produce many types of products in its single plant, and not all products will be processed through all departments. In which one of the following independent situations would reported net income for the first year be the same regardless of which overhead allocation method had been selected? a. All production costs approach those costs that were budgeted. b. The sales mix does not vary from the mix that was budgeted. c. All manufacturing overhead is a fixed cost. d. All ending inventory balances are zero.arrow_forwardJohnston Company cleans and applies powder coat paint to metal items on a job-order basis. Johnston has budgeted the following amounts for various overhead categories in the coming year. In the coming year, Johnston expects to powder coat 120,000 units. Each unit takes 1.3 direct labor hours. Johnston has found that supplies and gas (used to run the drying ovensall units pass through the drying ovens after powder coat paint is applied) tend to vary with the number of units produced. All other overhead categories are considered to be fixed. (Round all overhead rates to the nearest cent.) Required: 1. Calculate the number of direct labor hours Johnston must budget for the coming year. Calculate the variable overhead rate. Calculate the total fixed overhead for the coming year. 2. Prepare an overhead budget for Johnston for the coming year. Show the total variable overhead, total fixed overhead, and total overhead. Calculate the fixed overhead rate and the total overhead rate (rounded to the nearest cent). 3. What if Johnston had expected to make 118,000 units next year? Assume that the variable overhead per unit does not change and the total fixed overhead amounts do not change. Calculate the new budgeted direct labor hours and prepare a new overhead budget. Calculate the fixed overhead rate and the total overhead rate (rounded to the nearest cent).arrow_forwardEclipse Motor Company manufactures two types of specialty electric motors, a commercial motor and a residential motor, through two production departments, Assembly and Testing. Presently, the company uses a single plantwide factory overhead rate for allocating factory overhead to the two products. However, management is considering using the multiple production department factory overhead rate method. The following factory overhead was budgeted for Eclipse: Direct machine hours were estimated as follows: In addition, the direct machine hours (dmh) used to produce a unit of each product in each department were determined from engineering records, as follows: a. Determine the per-unit factory overhead allocated to the commercial and residential motors under the single plantwide factory overhead rate method, using direct machine hours as the allocation base. b. Determine the per-unit factory overhead allocated to the commercial and residential motors under the multiple production department factory overhead rate method, using direct machine hours as the allocation base for each department. c. Recommend to management a product costing approach, based on your analyses in (a) and (b). Support your recommendation.arrow_forward

- Big Mikes, a large hardware store, has gathered data on its overhead activities and associated costs for the past 10 months. Nizam Sanjay, a member of the controllers department, believes that overhead activities and costs should be classified into groups that have the same driver. He has decided that unloading incoming goods, counting goods, and inspecting goods can be grouped together as a more general receiving activity, since these three activities are all driven by the number of receiving orders. The 10 months of data shown below have been gathered for the receiving activity. Required: 1. Prepare a scattergraph, plotting the receiving costs against the number of purchase orders. Use the vertical axis for costs and the horizontal axis for orders. 2. Select two points that make the best fit, and compute a cost formula for receiving costs. 3. Using the high-low method, prepare a cost formula for the receiving activity. 4. Using the method of least squares, prepare a cost formula for the receiving activity. What is the coefficient of determination?arrow_forwardKrouse Company produces two products, forged putter heads and laminated putter heads, which are sold through specialty golf shops. The company is in the process of developing itsoperating budget for the coming year. Selected data regarding the companys two products areas follows: Manufacturing overhead is applied to units using direct labor hours. Variable manufacturing overhead Ls projected to be 25,000, and fixed manufacturing overhead is expected to be15,000. The estimated cost to produce one unit of the laminated putter head is: a. 42. b. 46. c. 52. d. 62.arrow_forwardJoyT Company manufactures Maxi Dolls for sale in toy stores. In planning for this year, JoyT estimated variable factory overhead of 600,000 and fixed factory overhead of 400,000. JoyT uses a standard costing system, and factory overhead is allocated to units produced using standard direct labor hours. The level of activity budgeted for this year was 10,000 direct labor hours, and JoyT used 10,300 actual direct labor hours. Based on the output accomplished during this year, 9,900 standard direct labor hours should have been used. Actual variable factory overhead was 596,000, and actual fixed factory overhead was 410,000 for the year. Based on this information, the variable factory overhead controllable variance for JoyT for this year was: a. 24,000 unfavorable. b. 2,000 unfavorable. c. 4,000 favorable. d. 22,000 favorable.arrow_forward

- A local picnic table manufacturer has budgeted the following overhead costs: They are considering adapting ABC costing and have estimated the cost drivers for each pool as shown: Recent success has yielded an order for 1,500 tables. Determine how much the job would cost given the following activities, and assuming an hourly rate for direct labor of $25 per hour:arrow_forwardListed below are the budgeted factory overhead costs for 2011 for Moss Industries at a projected level of 2,000 units: Required: Prepare flexible budgets for factory overhead at the 1,000, 2,000, and 4,000 unit levels. (Hint: You must first decide which of the listed costs should be considered variable and which should be fixed.)arrow_forwardGreiner Company makes and sells high-quality glare filters for microcomputer monitors. John Craven, controller, is responsible for preparing Greiners master budget and has assembled the following data for the coming year. The direct labor rate includes wages, all employee-related benefits, and the employers share of FICA. Labor saving machinery will be fully operational by March. Also, as of March 1, the companys union contract calls for an increase in direct labor wages that is included in the direct labor rate. Greiner expects to have 5,600 glare filters in inventory on December 31 of the current year, and has a policy of carrying 35 percent of the following month's projected sales in inventory. Information on the first four months of the coming year is as follows: Required: 1. Prepare the following monthly budgets for Greiner Company for the first quarter of the coming year. Be sure to show supporting calculations. a. Production budget in units b. Direct labor budget in hours c. Direct materials cost budget d. Sales budget 2. Calculate the total budgeted contribution margin for Greiner Company by month and in total for the first quarter of the coming year. Be sure to show supporting calculations. (CMA adapted)arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College