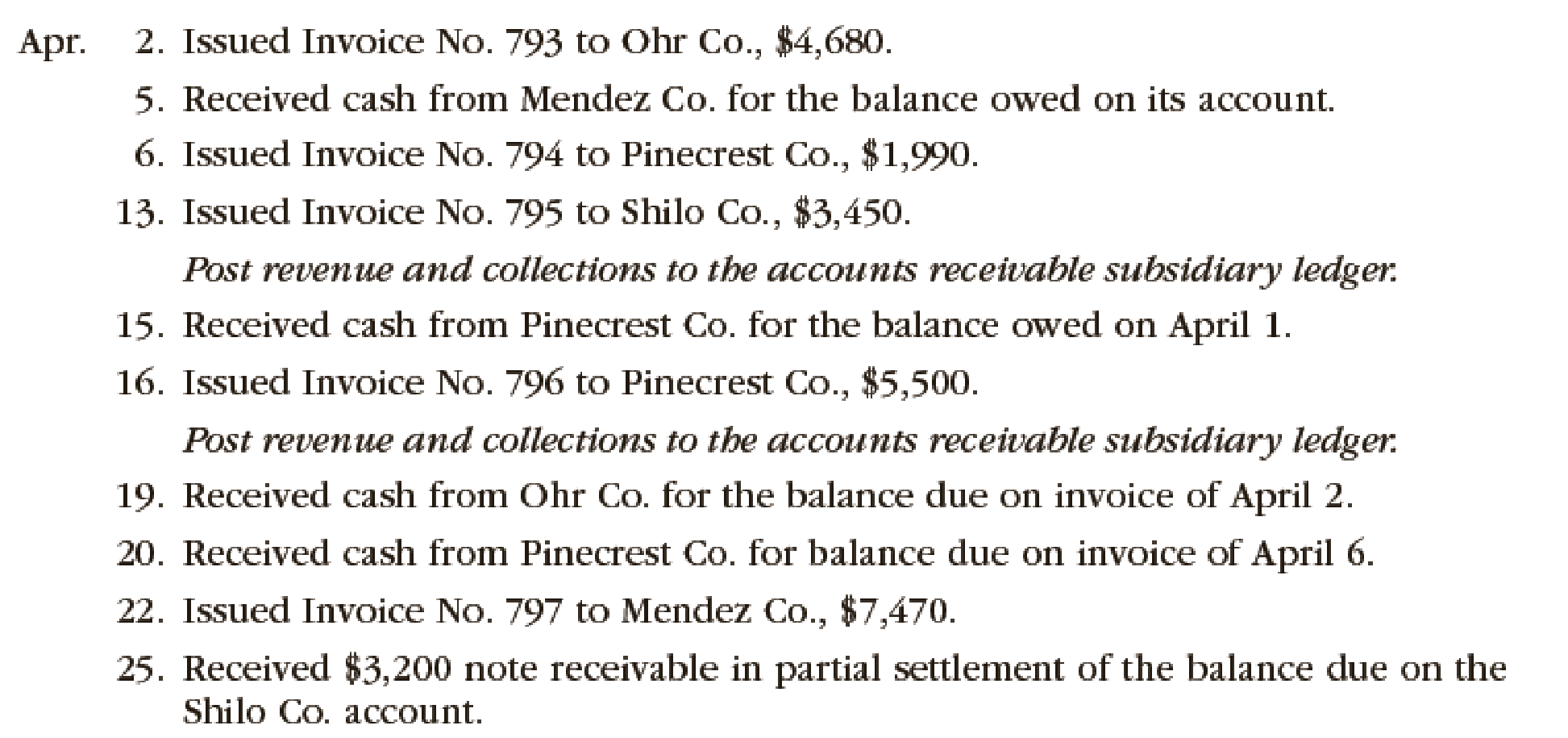

Transactions related to revenue and cash receipts completed by Crowne Business Services Co. during the period April 2–30 are as follows:

Post revenue and collections to the

Instructions

- 1. Insert the following balances in the general ledger as of April 1:

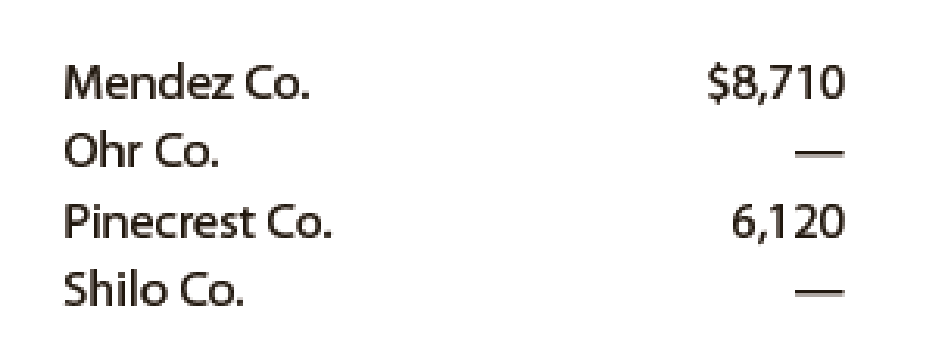

- 2. Insert the following balances in the accounts receivable subsidiary ledger as of April 1:

- 3. Prepare a single-column revenue journal (p. 40) and a cash receipts journal (p. 36). Use the following column headings for the cash receipts journal: Fees Earned Cr., Accounts Receivable Cr., and Cash Dr. The Fees Earned column is used to record cash fees. Insert a check mark (✓) in the Post. Ref. column when recording cash fees.

- 4. Using the two special journals and the two-column general journal (p. 1), journalize the transactions for April. Post to the accounts receivable subsidiary ledger, and insert the balances at the points indicated in the narrative of transactions. Determine the balance in the customer’s account before recording a cash receipt.

- 5. Total each of the columns of the special journals and

post the individual entries and totals to the general ledger. Insert account balances after the last posting. - 6. Determine that the sum of the customer balances agrees with the accounts receivable controlling account in the general ledger.

- 7. Why would an automated system omit postings to a controlling account as performed in step 5 for Accounts Receivable?

1. and 5.

Prepare general ledger for given accounts.

Explanation of Solution

General Ledger: General ledger refers to the ledger that records all the transactions of the business related to the company’s assets, liabilities, owners’ equities, revenues and expenses. Each subsidiary ledger is represented in the general ledger by summarizing the account.

Accounts receivable subsidiary ledger: Account receivable subsidiary ledger is the ledger which is used to post the customer transaction in one particular ledger account. It helps the business to locate the error in the customer ledger balance. After all transactions are posted, the balances in the accounts receivable subsidiary ledger should be totaled, and compared with the balance in the general ledger of accounts receivable. If both the balance does not agree, the error has to be located and corrected.

Revenue journal: Revenue journal refers to the journal that is used to record the fees earned on account. In the revenue journal, all revenue transactions are recorded only when the business renders service to customer on account (credit).

Cash receipts journal:Cash receipts journal refers to the journal that is used to record all the transaction that involves cash receipts. For example, the business received cash from customer (service performed in cash).

Prepare the general ledger for given accounts as follows:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 1 | Balance | ✓ | 11,350 | |||

| 30 | CR36 | 34,390 | 45,740 | ||||

Table (1)

| Account: Accounts Receivable Account no. 12 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 1 | Balance | ✓ | 14,830 | |||

| 25 | J1 | 3,200 | 11,630 | ||||

| 30 | R40 | 23,090 | 34,720 | ||||

| 30 | CR36 | 21,500 | 13,220 | ||||

Table (2)

| Account: Notes Receivable Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 1 | Balance | ✓ | 6,000 | |||

| 25 | J1 | 3,200 | 9,200 | ||||

Table (3)

| Account: Fees earned Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 30 | Balance | R40 | 23,090 | 23,090 | ||

| 30 | CR36 | 12,890 | 35,980 | ||||

Table (4)

| Journal Page 01 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| April | 25 | Notes receivable | 14 | 3,200 | |

| Accounts receivable | 12/ | 3,200 | |||

| (To record payable note raised against the accounts receivable from customer Company S) | |||||

Table (5)

2. and 4.

Prepare accounts receivable subsidiary ledger for given customers.

Explanation of Solution

The accounts receivable subsidiary ledger for given customers are as follows:

Accounts receivable subsidiary ledger

| Name: Company M | ||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) |

Balance ($) | |

| April | 1 | Balance | ✓ | 8,710 | ||

| 5 | R40 | 8,710 | - | |||

| 22 | CR36 | 7,470 | 7,470 | |||

Table (6)

| Name: Company O | ||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) |

Balance ($) | |

| April | 2 | R40 | 4,680 | 4,680 | ||

| 19 | CR36 | 4,680 | - | |||

Table (7)

| Name: Company P | ||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) |

Balance ($) | |

| April | 1 | Balance | ✓ | 6,120 | ||

| 6 | R40 | 1,990 | 8,110 | |||

| 15 | CR36 | 6,120 | 1,990 | |||

| 16 | R40 | 5,500 | 7,490 | |||

| 20 | CR36 | 1,990 | 5,500 | |||

Table (8)

| Name: Company S | ||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) |

Balance ($) | |

| April | 13 | R40 | 3,450 | 3,450 | ||

| 25 | J1 | 3,200 | 250 | |||

Table (9)

3.

Prepare single column revenue journal and cash receipt journal.

Explanation of Solution

Revenue journal: Revenue journal of C Business service in the month of April is as follows:

Revenue journal

Page 40

| Date | Invoice No. | Account debited | Post Ref. |

Account receivable Dr. Fees earned Cr. ($) | |

| April | 2 | 793 | Company O | ✓ | 4,680 |

| 6 | 794 | Company P | ✓ | 1,990 | |

| 13 | 795 | Company S | ✓ | 3,450 | |

| 16 | 796 | Company P | ✓ | 5,500 | |

| 22 | 797 | Company M | ✓ | 7,470 | |

| 30 | $23,090 | ||||

| (12) (41) | |||||

Table (10)

Cash receipt journal: Cash receipt journal of C Business service in the month of April is as follows:

Cash receipt journal

Page 36

| Date | Account Credited | Post Ref. | Fees earned Cr. | Accounts receivable Cr. | Cash Dr. | |

| April | 5 | Company M | ✓ | 8,710 | 8,710 | |

| 15 | Company P | ✓ | 6,120 | 6,120 | ||

| 19 | Company O | ✓ | 4,680 | 4,680 | ||

| 20 | Company P | ✓ | 1,990 | 1,990 | ||

| 30 | Fees earned | 12,890 | 12,890 | |||

| 30 | 12,890 | 21,500 | 34,390 | |||

| (41) | (12) | (11) | ||||

Table (11)

6.

Prepare accounts receivable customers balance, and verify that the total agrees with the ending balance of accounts receivable control account.

Explanation of Solution

Accounts receivable customer balance: Accounts receivable customers balance is as follows:

| C Business service | |

| Accounts receivable customers balances | |

| April 30 | |

| Particulars | Amount ($) |

| Company M | 7,740 |

| Company P | 5,500 |

| Company S | 250 |

| Total accounts receivable | 13,220 |

Table (12)

Accounts receivable controlling account: Ending balance of accounts receivable controlling account is as follows:

| C Business service | |

| Accounts receivable (Controlling account) | |

| April 30 | |

| Particulars | Amount ($) |

| Opening balance on April 1 | 14,830 |

| Add: | |

| Total debits (from revenue journal) | 23,090 |

| 11,210 | |

| Less: | |

| Total credits (from cash receipts journal and journal) (1) | (24,700) |

| Total accounts receivable | 13,220 |

Table (13)

Working note 1: Calculate the total credits in the accounts receivable

In this case, accounts receivable subsidiary ledger is used to identify and locate the error by way of cross checking the customer balance and accounts receivable controlling account. From the above calculation, we can understand that the both balance of accounts receivable is agreed, hence there is no error in the recording and posting of transactions.

7.

Explain the reasons for omitting the postings to a control account by an automated system.

Explanation of Solution

At the time of the original transactions are entered, the individual sales transactions are posted automatically in the computer system. So, there is no need to post the summary totals to the general ledger accounts.

Want to see more full solutions like this?

Chapter 5 Solutions

FINANCIAL ACCOUNTING

- Transactions related to revenue and cash receipts completed by Sterling Engineering Services during the period June 230 are as follows: Instructions 1. Insert the following balances in the general ledger as of June 1: 2. Insert the following balances in the accounts receivable subsidiary ledger as of June 1: 3. Prepare a single-column revenue journal (p. 40) and a cash receipts journal (p. 36). Use the following column headings for the cash receipts journal: Fees Earned Cr., Accounts Receivable Cr., and Cash Dr. The Fees Earned column is used to record cash fees. Insert a check mark () in the Post. Ref. column when recording cash fees. 4. Using the two special journals and the two-column general journal (p. 1), journalize the transactions for June. Post to the accounts receivable subsidiary ledger and insert the balances at the points indicated in the narrative of transactions. Determine the balance in the customers account before recording a cash receipt. 5. Total each of the columns of the special journals and post the individual entries and totals to the general ledger. Insert account balances after the last posting. 6. Determine that the sum of the customer accounts agrees with the accounts receivable controlling account in the general ledger. 7. Why would an automated system omit postings to a control account as performed in step 5 for Accounts Receivable?arrow_forwardTransactions related to revenue and cash receipts completed by Sycamore Inc. during the month of March 20Y8 are as follows: Prepare a single-column revenue journal and a cash receipts journal to record these transactions. Use the following column headings for the cash receipts journal: Fees Earned Cr., Accounts Receivable Cr., and Cash Dr. Place a check mark () in the Post. Ref. column to indicate when the accounts receivable subsidiary ledger should be posted.arrow_forwardTransactions related to revenue and cash receipts completed by Albany Architects Co. during the period November 230, 2016, are as follows: Instructions 1. Insert the following balances in the general ledger as of November 1: 2. Insert the following balances in the accounts receivable subsidiary ledger as of November 1: 3. Prepare a single-column revenue journal (p. 40) and a cash receipts journal (p. 36). Use the following column headings for the cash receipts journal: Fees Earned Cr., Accounts Receivable Cr., and Cash Dr. The Fees Earned column is used to record cash fees. Insert a check mark () in the Post. Ref. column when recording cash fees. 4. Using the two special journals and the two-column general journal (p. 1), journalize the transactions for November. Post to the accounts receivable subsidiary ledger, and insert the balances at the points indicated in the narrative of transactions. Determine the balance in the customers account before recording a cash receipt. 5. Total each of the columns of the special journals, and post the individual entries and totals to the general ledger. Insert account balances after the last posting. 6. Determine that the sum of the customer balances agrees with the accounts receivable controlling account in the general ledger. 7. Why would an automated system omit postings to a controlling account as performed in step 5 for Accounts Receivable?arrow_forward

- Transactions related to revenue and cash receipts completed by Sterling Engineering Services during the period June 230, 2016, are as follows: Instructions 1. Insert the following balances in the general ledger as of June 1: 2. Insert the following balances in the accounts receivable subsidiary ledger as of June 1: 3. Prepare a single-column revenue journal (p. 40) and a cash receipts journal (p. 36). Use the following column headings for the cash receipts journal: Fees Earned Cr., Accounts Receivable Cr., and Cash Dr. The Fees Earned column is used to record cash fees. Insert a check mark () in the Post. Ref. column when recording cash fees. 4. Using the two special journals and the two-column general journal (p. 1), journalize the transactions for June. Post to the accounts receivable subsidiary ledger, and insert the balances at the points indicated in the narrative of transactions. Determine the balance in the customers account before recording a cash receipt. 5. Total each of the columns of the special journals, and post the individual entries and totals to the general ledger. Insert account balances after the last posting. 6. Determine that the sum of the customer accounts agrees with the accounts receivable controlling account in the general ledger. 7. Why would an automated system omit postings to a control account as performed in step 5 for Accounts Receivable?arrow_forwardThe transactions completed by Revere Courier Company during December, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of December 1: 2. Journalize the transactions for December, using the following journals similar to those illustrated in this chapter: cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), single-column revenue journal (p. 35), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardTransactions related to revenue and cash receipts completed by Sycamore Inc. during the month of December 2016 are as follows: Prepare a single-column revenue journal and a cash receipts journal to record these transactions. Use the following column headings for the cash receipts journal: Fees Earned Cr., Accounts Receivable Cr., and Cash Dr. Place a check mark () in the Post. Ref. column to indicate when the accounts receivable subsidiary ledger should be posted.arrow_forward

- Transactions related to purchases and cash payments completed by Wisk Away Cleaning Services Inc. during the month of May 20Y5 are as follows: Prepare a purchases journal and a cash payments journal to record these transactions. The forms of the journals are similar to those illustrated in the text. Place a check mark () in the Post. Ref. column to indicate when the accounts payable subsidiary ledger should be posted. Wisk Away Cleaning Services Inc. uses the following accounts:arrow_forwardMaddie Inc. has the following transactions for its first month of business. A. What are the individual account balances, and the total balance, in the accounts receivable subsidiary ledger? B. What is the balance in the accounts receivable general ledger (control) account?arrow_forwardThe transactions completed by AM Express Company during March, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and twocolumn general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forward

- Happy Tails Inc. has a September 1, 20Y4, accounts payable balance of 620, which consists of 320 due Labradore Inc. and 300 due Meow Mart Inc. Transactions related to purchases and cash payments completed by Happy Tails Inc. during the month of September 20Y4 are as follows: a. Prepare a purchases journal and a cash payments journal to record these transactions. The forms of the journals are similar to those used in the text. Place a check mark () in the Post. Ref. column to indicate when the accounts payable subsidiary ledger should be posted. Happy Tails Inc. uses the following accounts: b. Prepare a listing of accounts payable creditor balances on September 30, 20Y4. Verify that the total of the accounts payable creditor balances equals the balance of the accounts payable controlling account on September 30, 20Y4. c. Why does Happy Tails Inc. use a subsidiary ledger for accounts payable?arrow_forwardSCHEDULE OF ACCOUNTS RECEIVABLE Based on the information provided in Problem 10-12A, prepare a schedule of accounts receivable for Sourk Distributors as of March 31, 20--. Verify that the accounts receivable account balance in the general ledger agrees with the schedule of accounts receivable total.arrow_forwardDuring the month of October 20--, The Pink Petal flower shop engaged in the following transactions: Selected account balances as of October 1 were as follows: The Pink Petal also had the following subsidiary ledger balances as of October 1: REQUIRED 1. Record the transactions in a sales journal (page 7), cash receipts journal (page 10), purchases journal (page 6), cash payments journal (page 11), and general journal (page 5). Total, verify, and rule the columns where appropriate at the end of the month. 2. Post from the journals to the general ledger, accounts receivable ledger, and accounts payable ledger accounts. Use account numbers as shown in the chapter.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage