Concept explainers

ABC, product costing at banks, cross-subsidization. United Savings Bank (USB) is examining the profitability of its Premier Account, a combined savings and checking account. Depositors receive a 2% annual interest rate on their average deposit. USB earns an interest rate spread of 3% (the difference between the rate at which it lends money and the rate it pays depositors) by lending money for home-loan purposes at 5%. Thus. USB would gain $60 on the interest spread if a depositor had an average Premier Account balance of $2,000 in 2017 ($2, 000 × 3% = $60).

The Premier Account allows depositors unlimited use of services such as deposits, withdrawals, checking accounts, and foreign currency drafts.

Depositors with Premier Account balances of $1,000 or more receive unlimited free use of services. Depositors with minimum balances of less than $1,000 pay a $22-a-month service fee for their Premier Account.

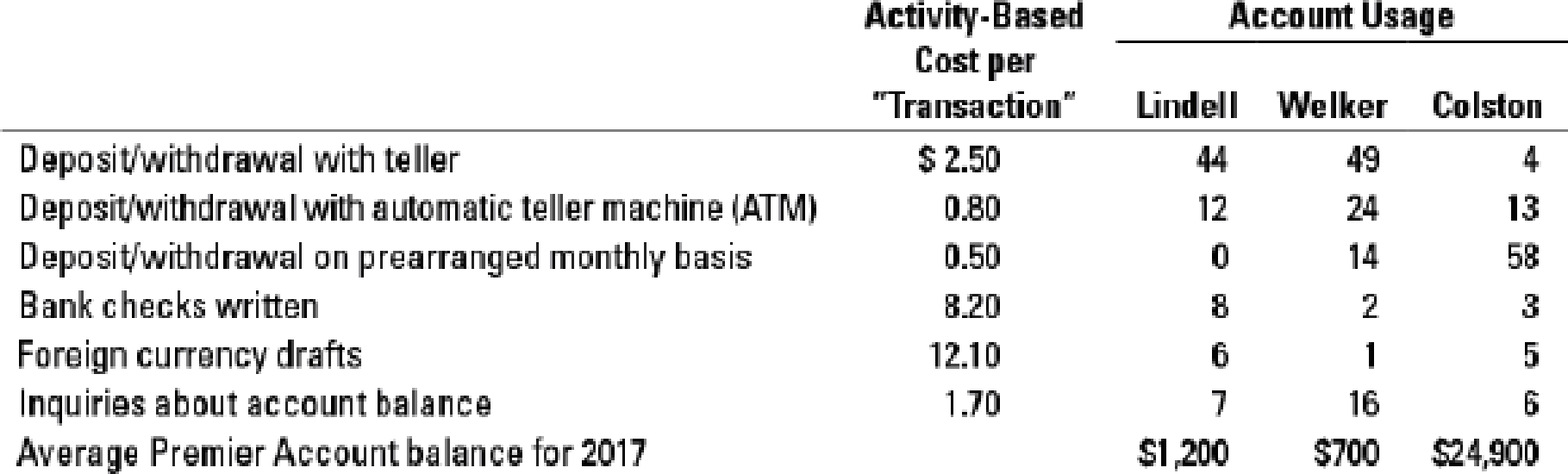

USB recently conducted an activity-based costing study of its services. It assessed the following costs for six individual services. The use of these services in 2017 by three customers is as follows:

Assume Lindell and Colston always maintain a balance above $1,000, whereas Welker always has a balance below $1,000.

- 1. Compute the 2017 profitability of the Lindell, Welker, and Colston Premier Accounts at USB.

Required

- 2. Why might USB worry about the profitability of Individual customers if the Premier Account product offering is profitable as a whole?

- 3. What changes would you recommend for USB’s Premier Account?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Horngren's Cost Accounting, Student Value Edition (16th Edition)

- Contribution Margin Ratio, Break-Even Sales, Operating Leverage Elgart Company produces plastic mailboxes. The projected income statement for the coming year follows: Required: 1. Compute the contribution margin ratio for the mailboxes. 2. How much revenue must Elgart earn in order to break even? 3. What is the effect on the contribution margin ratio if the unit selling price and unit variable cost each increase by 15%? 4. CONCEPTUAL CONNECTION Suppose that management has decided to give a 4% commission on all sales. The projected income statement does not reflect this commission. Recompute the contribution margin ratio, assuming that the commission will be paid. What effect does this have on the break-even point? 5. CONCEPTUAL CONNECTION If the commission is paid as described in Requirement 4, management expects sales revenues to increase by 80,000. How will this affect operating leverage? Is it a sound decision to implement the commission? Support your answer with appropriate computations.arrow_forwardKlamath Company produces a single product. The projected income statement for the coming year is as follows: Required: 1. Compute the unit contribution margin and the units that must be sold to break even. 2. Suppose 10,000 units are sold above break-even. What is the operating income? 3. Compute the contribution margin ratio. Use the contribution margin ratio to compute the break-even point in sales revenue. (Note: Round the contribution margin ratio to four decimal places, and round the sales revenue to the nearest dollar.) Suppose that revenues are 200,000 more than expected for the coming year. What would the total operating income be?arrow_forwardSchylar Pharmaceuticals, Inc., plans to sell 130,000 units of antibiotic at an average price of 22 each in the coming year. Total variable costs equal 1,086,800. Total fixed costs equal 8,000,000. (Round all ratios to four significant digits, and round all dollar amounts to the nearest dollar.) Required: 1. What is the contribution margin per unit? What is the contribution margin ratio? 2. Calculate the sales revenue needed to break even. 3. Calculate the sales revenue needed to achieve a target profit of 245,000. 4. What if the average price per unit increased to 23.50? Recalculate: a. Contribution margin per unit b. Contribution margin ratio (rounded to four decimal places) c. Sales revenue needed to break even d. Sales revenue needed to achieve a target profit of 245,000arrow_forward

- Sales Needed to Earn Target Income Chillmax Company plans to sell 3,500 pairs of shoes at 60 each in the coming year. Variable cost is 35% of the sales price; contribution margin is 65% of the sales price. Total fixed cost equals 78,000 (includes fixed factory overhead and fixed selling and administrative expense). Required: 1. Calculate the sales revenue that Chillmax must make to earn operating income of 81,900 by using the point in sales equation. 2. Check your answer by preparing a contribution margin income statement based on the sales dollars calculated in Requirement 1.arrow_forwardRefer to Cornerstone Exercise 3.4 for data on Dohini Manufacturing Companys purchasing cost and number of purchase orders. The controller for Dohini Manufacturing ran regression on the data, and the coefficients shown by the regression program are: Required: 1. Construct the cost formula for the purchasing activity showing the fixed cost and the variable rate. 2. If Dohini Manufacturing Company estimates that next month will have 430 purchase orders, what is the total estimated purchasing cost for that month? (Round your answer to the nearest dollar.) 3. What if Dohini Manufacturing wants to estimate purchasing cost for the coming year and expects 5,340 purchase orders? What will estimated total purchasing cost be? (Round your answer to the nearest dollar.) What is the total fixed purchasing cost? Why doesnt it equal the fixed cost calculated in Requirement 1?arrow_forwardHammond Company runs a driving range and golf shop. The budgeted income statement for the coming year is as follows. Required: 1. What is Hammonds variable cost ratio? Its contribution margin ratio? 2. Suppose Hammonds actual revenues are 200,000 greater than budgeted. By how much will before-tax profits increase? Give the answer without preparing a new income statement. 3. How much sales revenue must Hammond earn in order to break even? What is the expected margin of safety? (Round your answers to the nearest dollar.) 4. How much sales revenue must Hammond generate to earn a before-tax profit of 130,000? An after-tax profit of 90,000? (Round your answers to the nearest dollar.) Prepare a contribution margin income statement to verify the accuracy of your last answer.arrow_forward

- Mauro Products distributes a single product, a woven basket whose selling price is $15 and whose variable expense is $12 per unit. The company’s monthly fi xed expense is $4,200. Required: a)Solve for the company’s break-even point in unit sales using the formula method. b) Solve for the company’s break-even point in sales dollars using the formula method and the CM ratioarrow_forwardCustomers as a Cost ObjectMorrisom National Bank has requested an analysis of checking account profitability by customer type. Customers are categorized according to the size of their account: low balances, mediumbalances, and high balances. The activities associated with the three different customer categories and their associated annual costs are as follows: Required:(Note: Round answers to two decimal places.)1. Calculate a cost per account per year by dividing the total cost of processing andmaintaining checking accounts by the total number of accounts. What is the average feeper month that the bank should charge to cover the costs incurred because of checkingaccounts?2. Calculate a cost per account by customer category by using activity rates.3. Currently, the bank offers free checking to all of its customers. The interest revenuesaverage $90 per account; however, the interest revenues earned per account by categoryare $80, $100, and $165 for the low-, medium-, and high-balance…arrow_forwardPosters.com is a small Internet retailer of high-quality posters. The company has $810,000 in operating assets and fixed expenses of $162,000 per year. With this level of operating assets and fixed expenses, the company can support sales of up to $4,600,000 per year. The company’s contribution margin ratio is 10%, which means that an additional dollar of sales results in additional contribution margin, and net operating income, of 10 cents. Required: Complete the following table showing the relation between sales and return on investment (ROI). What happens to the company’s return on investment (ROI) as sales increase? req 1 Complete the following table showing the relation between sales and return on investment (ROI). (Round your percentage answers to 2 decimal places.) Sales Net Operating Income Average Operating Assets ROI $4,100,000 $248,000 $810,000 % $4,200,000 $810,000 % $4,300,000 $810,000 % $4,400,000…arrow_forward

- Projected financial results for the university's cafeteria for next year are shown. Answer each of the following independent questions. Sales $944,000 Fixed Cost $597,000 Total Variable Cost $235, 470 Total Cost $832, 470 Net Income $111,530 (a) How much is the contribution margin and the contribution rate?(b) How much does the business need to sell to break even?(c) If the business was to spend $24,000 to upgrade their processes, how much does the business need to sell to break even?(d) If 9% more meals were sold, what would be the resulting net income?arrow_forwardPosters.com is a small Internet retailer of high-quality posters. The company has $890,000 in operating assets and fixed expenses of $150,000 per year. With this level of operating assets and fixed expenses, the company can support sales of up to $5,300,000 per year. The company’s contribution margin ratio is 10%, which means that an additional dollar of sales results in additional contribution margin, and net operating income, of 10 cents. Required: 1. Complete the following table showing the relation between sales and return on investment (ROI). 2. What happens to the company’s return on investment (ROI) as sales increase? Complete this question by entrying your answers in the tab attachedarrow_forwardWildhorse Cash, Ltd. operates a chain of exclusive ski hat boutiques in the western United States. The stores purchase several hat styles from a single distributor at $13 each. All other costs incurred by the company are fixed. Wildhorse Cash, Ltd. sells the hats for $49 each. (a) If fixed costs total $630,000 per year, what is the breakeven point in units? In sales dollars? (Use your answer of breakeven units to calculate the breakeven point in dollars.) The breakeven point hats The breakeven sales $arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub