Concept explainers

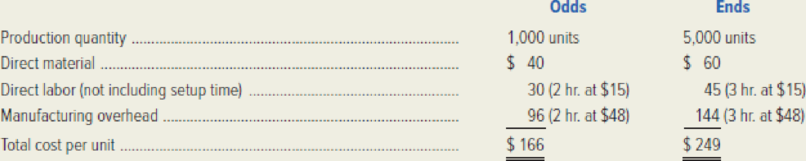

Knickknack, Inc. manufactures two products: Odds and Ends. The firm uses a single, plantwide overhead rate based on direct-labor hours. Production and product-costing data are as follows:

Calculation of predetermined overhead rate:

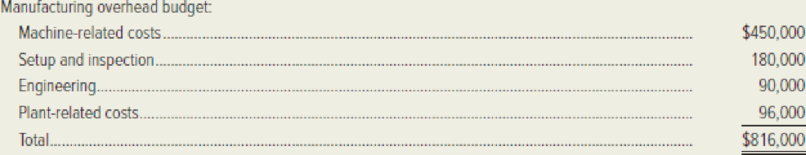

Manufacturing overhead budget:

Predetermined overhead rate:

Knickknack, Inc. prices its products at 120 percent of cost, which yields target prices of $199.20 for Odds and $298.80 for Ends. Recently, however, Knickknack has been challenged in the market for Ends by a European competitor, Bricabrac Corporation. A new entrant in this market, Bricabrac has been selling Ends for $220 each. Knickknack’s president is puzzled by Bricabrac’s ability to sell Ends at such a low cost. She has asked you (the controller) to look into the matter. You have decided that Knickknack’s traditional, volume-based product-costing system may be causing cost distortion between the firm’s two products. Ends are a high-volume, relatively simple product. Odds, on the other hand, are quite complex and exhibit a much lower volume. As a result, you have begun work on an activity-based costing system.

Required:

- 1. Let each of the overhead categories in the budget represent an activity cost pool. Categorize each in terms of the type of activity (e.g., unit-level activity).

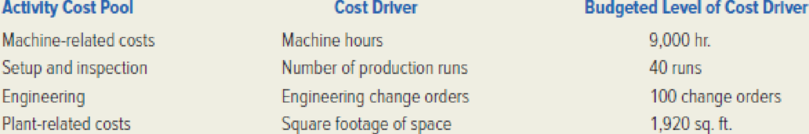

- 2. The following cost drivers have been identified for the four activity cost pools.

You have gathered the following additional information:

- Each Odd requires 4 machine hours, whereas each End requires 1 machine hour.

- Odds are manufactured in production runs of 50 units each. Ends are manufactured in 250-unit batches.

- Three-quarters of the engineering activity, as measured in terms of change orders, is related to Odds.

- The plant has 1,920 square feet of space, 80 percent of which is used in the production of Odds.

For each activity cost pool, compute a pool rate. (Hint: Regarding the pool rate refer to Exhibit 5–6.)

- 3. Determine the unit cost, for each activity cost pool, for Odds and Ends.

- 4. Compute the new product cost per unit for Odds and Ends, using the ABC system.

- 5. Using the same pricing policy as in the past, compute prices for Odds and Ends. Use the product costs determined by the ABC system.

- 6. Show that the ABC system fully assigns the total budgeted

manufacturing overhead costs of $816,000. - 7. Show how Knickknack’s traditional, volume-based costing system distorted its product costs. (Refer to Exhibit 5–10 for guidance.)

1.

Categorize each in terms of the type of activity.

Explanation of Solution

Activity-based costing: It is a method that helps in finding the activities performed by a company and it tracks the indirect costs to the activities of the company that consumes resources.

Categorize each in terms of the type of activity are shown below:

| Activity Cost Pool | Type of Activity |

| I: Machine related costs | Unit-level |

| II: Setup and inspection | Batch- level |

| III: Engineering | Product-sustaining-level |

| IV: Plant-related costs | Facility-level |

Table (1)

2.

Calculate pool rate of each activity cost pool.

Explanation of Solution

| Activity Cost Pool | Cost (A) | Cost drivers (B) | Pool rate (A ÷ B) |

| I: Machine related costs | $450,000 | 9,000 machine hours | $50 per machine hour |

| II: Setup and inspection | $180,000 | 40 runs | $4,500 per run |

| III: Engineering | $90,000 | 100 change orders | $900 per change order |

| IV: Plant-related costs | $96,000 | 1,920 square feet | $50 square feet |

Table (2)

3.

Calculate unit cost for each activity cost pool for odds and ends.

Explanation of Solution

Calculate unit cost for machine related costs for odds.

Calculate unit cost for machine related costs for ends.

Calculate unit cost for setup and inspection costs for odds.

Calculate unit cost for setup and inspection cost for ends.

Calculate unit cost for engineering for odds.

Calculate unit cost for engineering for ends.

Calculate unit cost for plant related costs of Odds.

Calculate unit cost for plant related cost of ends.

4.

Calculate the new product cost per unit for odds and ends using activity based costing.

Explanation of Solution

Calculate the new product cost per unit for odds and ends using activity based costing are given below:

| Particulars | Odds | Ends |

| Direct materials | $40 | $60 |

| Direct labor | $30 | $45 |

| Manufacturing overhead: | ||

| Machine related | $200 | $50 |

| Setup and inspection | $90 | $18 |

| Engineering | $67.50 | $4.50 |

| Plant related | $76.80 | $3.84 |

| Total cost per unit | $504.30 | $181.34 |

Table (3)

5.

Calculate the product costs using the same pricing policy as in the past for odds and ends.

Explanation of Solution

Calculate the product costs using the same pricing policy as in the past for odds and ends.

| Particulars | Odds | Ends |

| New product cost (ABC) (A) | $504.30 | $181.34 |

| Pricing policy (B) | 120% | 120% |

| New target price (A × B) | $605.16 | $217.61 |

Table (4)

6.

Display that the activity based costing system fully assigns the total budgeted manufacturing overhead costs of $816,000.

Explanation of Solution

| Particulars | Odds | Ends | Total |

| Manufacturing overhead costs: | |||

| Machine related | $200 | $50 | |

| Setup and inspection | $90 | $18 | |

| Engineering | $67.50 | $4.50 | |

| Plant-related | $76.80 | $3.84 | |

| Total overhead cost per unit (A) | $434.30 | $76.34 | |

| Production volume (B) | 1,000 | 5,000 | |

| Total overhead cost assigned | $434,300 | $381,700 | $816,000 |

Table (5)

7.

Prepare a table showing traditional based product costing system distorts the product costs of odds and evens.

Explanation of Solution

Prepare a table showing traditional based product costing system distorts the product costs of odds and evens.

| Particulars | Product G | Product T |

| Traditional based costing system - reported cost system | $166.00 | $249.00 |

| Less: Activity based costing system - Reported cost system | $504.30 | $181.34 |

| Traditional system Over costs (Under costs) per unit (A) | ($338.30) | $67.66 |

| Product volume (B) | 1,000 | 5,000 |

| Total amount of cost distortion for entire product line (A × B) | ($338,300) | $338,300 |

Table (1)

Traditional system overcosts ends by $67.66 per unit, and traditional system undercosts odds by $338.30 per unit.

Want to see more full solutions like this?

Chapter 5 Solutions

MANAGERIAL ACCOUNTING-ACCESS

- Douglas Davis, controller for Marston, Inc., prepared the following budget for manufacturing costs at two different levels of activity for 20X1: During 20X1, Marston worked a total of 80,000 direct labor hours, used 250,000 machine hours, made 32,000 moves, and performed 120 batch inspections. The following actual costs were incurred: Marston applies overhead using rates based on direct labor hours, machine hours, number of moves, and number of batches. The second level of activity (the right column in the preceding table) is the practical level of activity (the available activity for resources acquired in advance of usage) and is used to compute predetermined overhead pool rates. Required: 1. Prepare a performance report for Marstons manufacturing costs in the current year. 2. Assume that one of the products produced by Marston is budgeted to use 10,000 direct labor hours, 15,000 machine hours, and 500 moves and will be produced in five batches. A total of 10,000 units will be produced during the year. Calculate the budgeted unit manufacturing cost. 3. One of Marstons managers said the following: Budgeting at the activity level makes a lot of sense. It really helps us manage costs better. But the previous budget really needs to provide more detailed information. For example, I know that the moving materials activity involves the use of forklifts and operators, and this information is lost when only the total cost of the activity for various levels of output is reported. We have four forklifts, each capable of providing 10,000 moves per year. We lease these forklifts for five years, at 10,000 per year. Furthermore, for our two shifts, we need up to eight operators if we run all four forklifts. Each operator is paid a salary of 30,000 per year. Also, I know that fuel costs about 0.25 per move. Assuming that these are the only three items, expand the detail of the flexible budget for moving materials to reveal the cost of these three resource items for 20,000 moves and 40,000 moves, respectively. Based on these comments, explain how this additional information can help Marston better manage its costs. (Especially consider how activity-based budgeting may provide useful information for non-value-added activities.)arrow_forwardBusiness Specialty, Inc., manufactures two staplers: small and regular. The standard quantities of direct labor and direct materials per unit for the year are as follows: The standard price paid per pound of direct materials is 1.60. The standard rate for labor is 8.00. Overhead is applied on the basis of direct labor hours. A plantwide rate is used. Budgeted overhead for the year is as follows: The company expects to work 12,000 direct labor hours during the year; standard overhead rates are computed using this activity level. For every small stapler produced, the company produces two regular staplers. Actual operating data for the year are as follows: a. Units produced: small staplers, 35,000; regular staplers, 70,000. b. Direct materials purchased and used: 56,000 pounds at 1.5513,000 for the small stapler and 43,000 for the regular stapler. There were no beginning or ending direct materials inventories. c. Direct labor: 14,800 hours3,600 hours for the small stapler and 11,200 hours for the regular stapler. Total cost of direct labor: 114,700. d. Variable overhead: 607,500. e. Fixed overhead: 350,000. Required: 1. Prepare a standard cost sheet showing the unit cost for each product. 2. Compute the direct materials price and usage variances for each product. Prepare journal entries to record direct materials activity. 3. Compute the direct labor rate and efficiency variances for each product. Prepare journal entries to record direct labor activity. 4. Compute the variances for fixed and variable overhead. Prepare journal entries to record overhead activity. All variances are closed to Cost of Goods Sold. 5. Assume that you know only the total direct materials used for both products and the total direct labor hours used for both products. Can you compute the total direct materials and direct labor usage variances? Explain.arrow_forwardJohn Sheng, a cost accountant at Starlet Company, is developing departmental factory overhead application rates for the companys Tooling and Fabricating departments. The budgeted overhead for each department and the data for one job are as follows: Using the departmental overhead application rates, total overhead applied to Job 231 in the Tooling and Fabricating departments will be: a. 225. b. 303. c. 537. d. 671.arrow_forward

- Lansing. Inc., provided the following data for its two producing departments: Machine hours are used to assign the overhead of the Molding Department, and direct labor hours are used to assign the overhead of the Polishing Department. There are 30,000 units of Form A produced and sold and 50,000 of Form B. Required: 1. Calculate the overhead rates for each department. 2. Using departmental rates, assign overhead to live two products and calculate the overhead cost per unit. How does this compare with the plantwide rate unit cost, using direct labor hours? 3. What if the machine hours in Molding were 1,200 for Form A and 3,800 for Form B and the direct labor hours used in Polishing were 5,000 and 15,000, respectively? Calculate the overhead cost per unit for each product using departmental rates, and compare with the plantwide rate unit costs calculated in Requirement 2. What can you conclude from this outcome?arrow_forwardMinor Co. has a job order cost system and applies overhead based on departmental rates. Service Department 1 has total budgeted costs of 168,000 for next year. Service Department 2 has total budgeted costs of 280,000 for next year. Minor allocates service department costs solely to the producing departments. Service Department 1 cost is allocated to producing departments on the basis of machine hours. Service Department 2 cost is allocated to producing departments on the basis of direct labor hours. Producing Department 1 has budgeted 8,000 machine hours and 12,000 direct labor hours. Producing Department 2 has budgeted 2,000 machine hours and 12,000 direct labor hours. What is the total cost allocation from the two service departments to Producing Department 1? a. 173,600 b. 140,000 c. 134,400 d. 274,400arrow_forwardMoleno Company produces a single product and uses a standard cost system. The normal production volume is 120,000 units; each unit requires 5 direct labor hours at standard. Overhead is applied on the basis of direct labor hours. The budgeted overhead for the coming year is as follows: At normal volume. During the year, Moleno produced 118,600 units, worked 592,300 direct labor hours, and incurred actual fixed overhead costs of 2,150,400 and actual variable overhead costs of 1,422,800. Required: 1. Calculate the standard fixed overhead rate and the standard variable overhead rate. 2. Compute the applied fixed overhead and the applied variable overhead. What is the total fixed overhead variance? Total variable overhead variance? 3. CONCEPTUAL CONNECTION Break down the total fixed overhead variance into a spending variance and a volume variance. Discuss the significance of each. 4. CONCEPTUAL CONNECTION Compute the variable overhead spending and efficiency variances. Discuss the significance of each.arrow_forward

- Shinto Corp. uses a standard cost system and manufactures one product. The variable costs per product follow: Budgeted fixed overhead costs for the month are $4,000, and Shinto expected to manufacture 2,000 units. Actual production, however, was only 1,800 units. Materials prices were 10% over standard, and labor rates were 5% over standard. Of the factory overhead expense, only 80% was used, and fixed overhead was $100 over budget. The actual variable overhead cost was $4,800. In materials usage, 8% more parts were used than were allowed for actual production by the standard, and 6% more labor hours were used than were allowed. Required: Calculate the materials and labor variances. Calculate the variances for overhead by the four-variance method. (Hint: First compute the fixed and variable overhead rates per hour.)arrow_forwardFlaherty, Inc., has just completed its first year of operations. The unit costs on a normal costing basis are as follows: During the year, the company had the following activity: Actual fixed overhead was 12,000 less than budgeted fixed overhead. Budgeted variable overhead was 5,000 less than the actual variable overhead. The company used an expected actual activity level of 12,000 direct labor hours to compute the predetermined overhead rates. Any overhead variances are closed to Cost of Goods Sold. Required: 1. Compute the unit cost using (a) absorption costing and (b) variable costing. 2. Prepare an absorption-costing income statement. 3. Prepare a variable-costing income statement. 4. Reconcile the difference between the two income statements.arrow_forwardEclipse Motor Company manufactures two types of specialty electric motors, a commercial motor and a residential motor, through two production departments, Assembly and Testing. Presently, the company uses a single plantwide factory overhead rate for allocating factory overhead to the two products. However, management is considering using the multiple production department factory overhead rate method. The following factory overhead was budgeted for Eclipse: Direct machine hours were estimated as follows: In addition, the direct machine hours (dmh) used to produce a unit of each product in each department were determined from engineering records, as follows: a. Determine the per-unit factory overhead allocated to the commercial and residential motors under the single plantwide factory overhead rate method, using direct machine hours as the allocation base. b. Determine the per-unit factory overhead allocated to the commercial and residential motors under the multiple production department factory overhead rate method, using direct machine hours as the allocation base for each department. c. Recommend to management a product costing approach, based on your analyses in (a) and (b). Support your recommendation.arrow_forward

- Bach Instruments Inc. makes three musical instruments: flutes, clarinets, and oboes. The budgeted factory overhead cost is 2,948,125. Overhead is allocated to the three products on the basis of direct labor hours. The products have the following budgeted production volume and direct labor hours per unit: a. Determine the single plant wide overhead rate. b. Use the overhead rate in (a) to determine the amount of total and per-unit overhead allocated to each of the three products, rounded to the nearest dollar.arrow_forwardJillian Manufacturing Inc. manufactures a single product and uses a standard cost system. The factory overhead is applied on the basis of direct labor hours. A condensed version of the company’s flexible budget follows: The product requires 3 lb of materials at a standard cost of $5 per pound and 2 hours of direct labor at a standard cost of $10 per hour. For the current year, the company planned to operate at the level of 6,250 direct labor hours and to produce 3,125 units of product. Actual production and costs for the year follow: Required: For the current year, compute the factory overhead rate that will be used for production. Show the variable and fixed components that make up the total predetermined rate to be used. Prepare a standard cost card for the product. Show the individual elements of the overhead rate as well as the total rate. Compute (a) standard hours allowed for production and (b) under- or overapplied factory overhead for the year. Determine the reason for any under- or overapplied factory overhead for the year by computing all variances, using each of the following methods: Two-variance method Three-variance method (appendix) Four-variance method (appendix)arrow_forwardYoung Company is beginning operations and is considering three alternatives to allocate manufacturing overhead to individual units produced. Young can use a plantwide rate, departmental rates, or activity-based costing. Young will produce many types of products in its single plant, and not all products will be processed through all departments. In which one of the following independent situations would reported net income for the first year be the same regardless of which overhead allocation method had been selected? a. All production costs approach those costs that were budgeted. b. The sales mix does not vary from the mix that was budgeted. c. All manufacturing overhead is a fixed cost. d. All ending inventory balances are zero.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning