Foundations of Finance (9th Edition) (Pearson Series in Finance)

9th Edition

ISBN: 9780134083285

Author: Arthur J. Keown, John D. Martin, J. William Petty

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 15SP

(

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Suppose you are given the following inputs for the Fama-Frech-3-Factor model. Required Return for Stock i: bi=0.8, kRF=8%, the market risk premium is 6%, ci=-0.6, the expected value for the size factor is 5%, di=-0.4, and the expected value for the book-to-market factor is 4%.

Task: Estimate the required rate of return of this asset using the Capital asset pricing model and compare it with the Fama-French-3-factor model.

Assume for parts (a) to (h) that the Capital Asset Pricing Model holds. The marketportfolio has an expected return of 5%. Stock A’s return has a market beta of 1.5, anexpected value of 7% and a standard deviation of 10%. Stock B’s return has amarket beta of 0.5 and a standard deviation of 20%. The correlation between stockA’s and stock B’s return is 0.5.Required:a) Explain the term ‘capital asset pricing model.’b) What is the risk-free rate?c) What is the expected return on stock B?d) Draw a graph with expected return on the y-axis and beta on the x-axis. Indicate the approximate position of the risk-free asset, the market portfolio and stocks A and B on this graph. Draw the line, which connects these four points.e) Explain the term ‘Securities Market Line’, and what is the slope of the SML for this economy?f) Consider a portfolio with a weight of 50% in stock A and 50% in stock B. What are its variance and expected return?g) Where would under-priced and over-priced securities plot on…

Consider an economy where Capital Asset Pricing Model holds. In this economy,

stocks A and B have the following characteristics:

Stock A has and expected return of 22% and a beta of 2.

Stock B has an expected return of 15% and a beta of 0.8.

The standard deviation of the market portfolio’s return is 18%.

Q: Assuming that stocks A and B are correctly priced according to the CAPM, compute the risk-free rate and the market risk premium.

Chapter 6 Solutions

Foundations of Finance (9th Edition) (Pearson Series in Finance)

Ch. 6 - a. What is meant by the investors required rate of...Ch. 6 - Prob. 2RQCh. 6 - What is a beta? How is it used to calculate r, the...Ch. 6 - Prob. 4RQCh. 6 - Prob. 5RQCh. 6 - Prob. 6RQCh. 6 - Prob. 7RQCh. 6 - What effect will diversifying your portfolio have...Ch. 6 - (Expected return and risk) Universal Corporation...Ch. 6 - (Average expected return and risk) Given the...

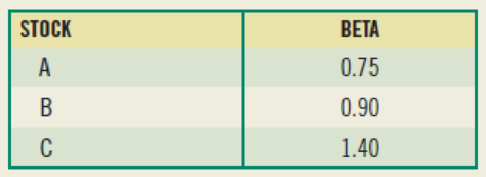

Ch. 6 - (Expected rate of return and risk) Carter, Inc. is...Ch. 6 - (Expected rate of return and risk) Summerville,...Ch. 6 - Prob. 5SPCh. 6 - Prob. 9SPCh. 6 - Prob. 10SPCh. 6 - Prob. 11SPCh. 6 - Prob. 12SPCh. 6 - (Capital asset pricing model) Using the CAPM,...Ch. 6 - Prob. 16SPCh. 6 - Prob. 17SPCh. 6 - a. Compute an appropriate rate of return for Intel...Ch. 6 - (Estimating beta) From the graph in the right...Ch. 6 - Prob. 20SPCh. 6 - Prob. 21SPCh. 6 - (Capital asset pricing model) The expected return...Ch. 6 - (Portfolio beta and security market line) You own...Ch. 6 - (Portfolio beta) Assume you have the following...Ch. 6 - Prob. 1MCCh. 6 - Prob. 2MCCh. 6 - Prob. 3MCCh. 6 - Prob. 4MCCh. 6 - Prob. 5MCCh. 6 - Prob. 6MCCh. 6 - Prob. 7MCCh. 6 - Prob. 8MCCh. 6 - Prob. 9MCCh. 6 - Prob. 10MCCh. 6 - Prob. 11MC

Additional Business Textbook Solutions

Find more solutions based on key concepts

The change in equity cost of capital, debt cost of capital, and the weighted average cost of capital when a fir...

Corporate Finance

The meaning for float and its three components.

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

The present value of bankruptcy costs and the delta of the firm’s assets. Introduction: A delta is characterize...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

The benefits of risk, costs and risk of aggressive funding strategy and of a conservatinve funding strategy.

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

What research would you want to conduct prior to making a decision to invest in new presses?

Principles of Management

S3-5 Identifying types of adjusting entries

Learning Objective 3

A select list of transactions for Anuradh...

Horngren's Accounting (11th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An analyst has modeled the stock of a company using the Fama-French three-factor model. The market return is 10%, the return on the SMB portfolio (rSMB) is 3.2%, and the return on the HML portfolio (rHML) is 4.8%. If ai = 0, bi = 1.2, ci = 20.4, and di = 1.3, what is the stock’s predicted return?arrow_forwardThe risk-free rate is 1.45% and the market risk premium is 5.21%According to the Capital Asset Pricing Model (CAPM ), a stock with a beta of 1.13 will have an expected return of %.arrow_forwardSuppose the risk-free rate is 6 percent and the market portfolio has an expected return of 12 percent. The market portfolio has a standard deviation of 7 percent. Portfolio Z has a correlation coefficient with the market of 0.35 and standard deviation of 6 percent. According to the capital asset pricing model, what is the expected return on portfolio Z a. 12.6 percent b. 7.8 percent c. 9.87 percent d. 12.05 percentarrow_forward

- . Assume that the Capital Asset Pricing Model holds. The market portfolio has an expected return of 5%. Stock A’s return has a market beta of 1.5, an expected value of 7% and a standard deviation of 10%. Stock B’s return has a market beta of 0.5 and a standard deviation of 20%. The correlation coefficient between stock A’s and stock B’s returns is 0.5. What is the risk-free rate? What is the expected return on stock B?arrow_forwardConsider two types of assets: market portfolio (M) and stock A. The expected return is 8% and standard deviation of the market portfolio is 15%. The risk-free rate is 2%. The standard deviation of market portfolio returns is 15%. The standard deviation of stock A is 30%, and the beta coefficient is 1. Draw the capital market line and show the position of stock A.arrow_forwardConsider an economy where Capital Asset Pricing Model holds. In this economy, stocks A and B have the following characteristics: • Stock A has and expected return of 22% and a beta of 2. • Stock B has an expected return of 15% and a beta of 0.8. The standard deviation of the market portfolio’s return is 18%. (a) Assuming that stocks A and B are correctly priced according to the CAPM, compute the risk-free rate and the market risk premium. (b) Draw the security market line, showing the positions of stocks A and B, as well as the risk-free rate and the market portfolio on the plot. You are not required to draw the security market line to scale. (c) Consider stock C that has an expected return of 30%, a beta of 2.3, and a standard deviation of returns of 20%. According to the CAPM, calculated in part (a) above, is stock C overpriced, underpriced, or correctly priced? What would you recommend to investors? (d) Briefly explain the definition of market portfolio in a CAPM economyarrow_forward

- The Treasury bill rate is 4.9%, and the expected return on the market portfolio is 11.1%. Use the capital asset pricing model. What is the risk premium on the market? (Enter your answer as a percent rounded to 1 decimal place.) What is the required return on an investment with a beta of 1.2? (Enter your answer as a percent rounded to 2 decimal places.) If an investment with a beta of 0.46 offers an expected return of 8.7%, does it have a positive NPV? If the market expects a return of 12.2% from stock X, what is its beta? (Round your answer to 2 decimal places.)arrow_forwardUse the basic equation for the capital asset pricing model (CAPM) to work each of the following problems. a. Find the required return for an asset with a beta of 1.65 when the risk-free rate and market return are 8% and 14%, respectively. b. Find the risk-free rate for a firm with a required return of 11.366% and a beta of 1.29 when the market return is 10%. c. Find the market return for an asset with a required return of 7.711% and a beta of 0.89 when the risk-free rate is 4%. d. Find the beta for an asset with a required return of 6.552% when the risk-free rate and market return are 6% and 8.4%, respectively.arrow_forwardAssume that the Collins Company has a beta of 1.8 and that the risk-free rate of return is 2.5 percent. If the equity-risk premium is six percent, calculate the cost of equity for the Collins Company using the capital asset pricing model.arrow_forward

- For each of the cases shown in the following table, use the capital asset pricing model to find the required return. case risk free rate market return beta A 5% 8% 1.30 B 8% 13% 0.90 C 9% 12% -0.20 D 10% 15% 1.00 E 6% 10% 0.60 (solve using excel)arrow_forwardWhat is required return using the capital asset pricing model if a stock's beta is 1.2 and the individual, who expects the market to rise by 11.2%, can earn 4.4% invested in a risk-free Treasury Bill?arrow_forwardThe data on the expected return of 2 stocks (M and C) along with the economic conditions and their probabilities is attached below Questions : Calculate the expected return for asset M and asset C. Calculate the standard deviation for asset M and asset C. c) If asset M is a market portfolio, while the beta (β) for asset C is 1.25 and the risk-free asset is 6%. What is the required rate of return for asset C according to the CAPM method ?. .arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Portfolio return, variance, standard deviation; Author: MyFinanceTeacher;https://www.youtube.com/watch?v=RWT0kx36vZE;License: Standard YouTube License, CC-BY