Foundations of Finance (9th Edition) (Pearson Series in Finance)

9th Edition

ISBN: 9780134083285

Author: Arthur J. Keown, John D. Martin, J. William Petty

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 24SP

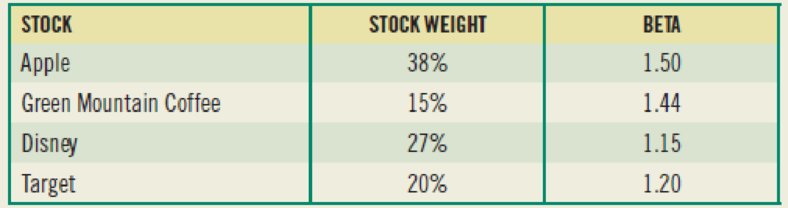

(Portfolio beta) Assume you have the following portfolio.

What is the portfolio’s beta?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Illustrate the formula for portfolio beta and portfolio expected return.

If a portfolio has a positive investment in every asset, can the standard deviation on the portfolio be less than that on every asset in the portfolio? What about the portfolio beta?

If a portfolio has a positive investment in every asset, can the beta of the portfolio be less than the sum of the individual asset's betas in the portfolio?

Chapter 6 Solutions

Foundations of Finance (9th Edition) (Pearson Series in Finance)

Ch. 6 - a. What is meant by the investors required rate of...Ch. 6 - Prob. 2RQCh. 6 - What is a beta? How is it used to calculate r, the...Ch. 6 - Prob. 4RQCh. 6 - Prob. 5RQCh. 6 - Prob. 6RQCh. 6 - Prob. 7RQCh. 6 - What effect will diversifying your portfolio have...Ch. 6 - (Expected return and risk) Universal Corporation...Ch. 6 - (Average expected return and risk) Given the...

Ch. 6 - (Expected rate of return and risk) Carter, Inc. is...Ch. 6 - (Expected rate of return and risk) Summerville,...Ch. 6 - Prob. 5SPCh. 6 - Prob. 9SPCh. 6 - Prob. 10SPCh. 6 - Prob. 11SPCh. 6 - Prob. 12SPCh. 6 - (Capital asset pricing model) Using the CAPM,...Ch. 6 - Prob. 16SPCh. 6 - Prob. 17SPCh. 6 - a. Compute an appropriate rate of return for Intel...Ch. 6 - (Estimating beta) From the graph in the right...Ch. 6 - Prob. 20SPCh. 6 - Prob. 21SPCh. 6 - (Capital asset pricing model) The expected return...Ch. 6 - (Portfolio beta and security market line) You own...Ch. 6 - (Portfolio beta) Assume you have the following...Ch. 6 - Prob. 1MCCh. 6 - Prob. 2MCCh. 6 - Prob. 3MCCh. 6 - Prob. 4MCCh. 6 - Prob. 5MCCh. 6 - Prob. 6MCCh. 6 - Prob. 7MCCh. 6 - Prob. 8MCCh. 6 - Prob. 9MCCh. 6 - Prob. 10MCCh. 6 - Prob. 11MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the following graph. According to Markowitz’ portfolio theory, which point on the graph represents optimal portfolio? C A B Darrow_forwardYou have a portfolio that is equally invested in Stock F with a beta of 1.15, Stock G with a beta of 1.52, and the risk-free asset. What is the beta of your portfolio? How do I solve this?arrow_forwardAccording the picture, Find:a) the expected return and standard deviation on this portfolio. b) the expected return on the market using portfolio beta if Rf=5%.arrow_forward

- What is the portfolio beta? (Format: XX.XX)arrow_forwardWhat is the equation for the Security Market Line? Define each term. If an asset has a beta of 2.0, what type of return should it realize compared to the market portfolio?arrow_forwardAs a portfolio manager, assume the following information: The beta of your portfolio 1.2 Your performance is exactly on target with the SML data under condition 1 Assume the true SML data is given under condition 2. Condition 1 RFR Rm(proxy) Condition 2 0.04 0.1 0.05 0.12 Rm(true) How much does your performance differ from the true SML?arrow_forward

- . Write out the equation for the Capital Market Line(CML), and draw it on the graph. Interpret theplotted CML. Now add a set of indifference curvesand illustrate how an investor’s optimal portfoliois some combination of the risky portfolio and therisk-free asset. What is the composition of the riskyportfolio?arrow_forwardCalculate Portfolio Returns with example?arrow_forwardwhich one is correct? QUESTION 6 Given a portfolio of stocks, the envelope curve containing the set of best possible combinations is known as the a. efficient frontier. b. utility curve. c. last frontier. d. efficient portfolio. e. capital asset pricing model.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Portfolio Management; Author: DevTechFinance;https://www.youtube.com/watch?v=Qmw15cG2Mv4;License: Standard YouTube License, CC-BY