Concept explainers

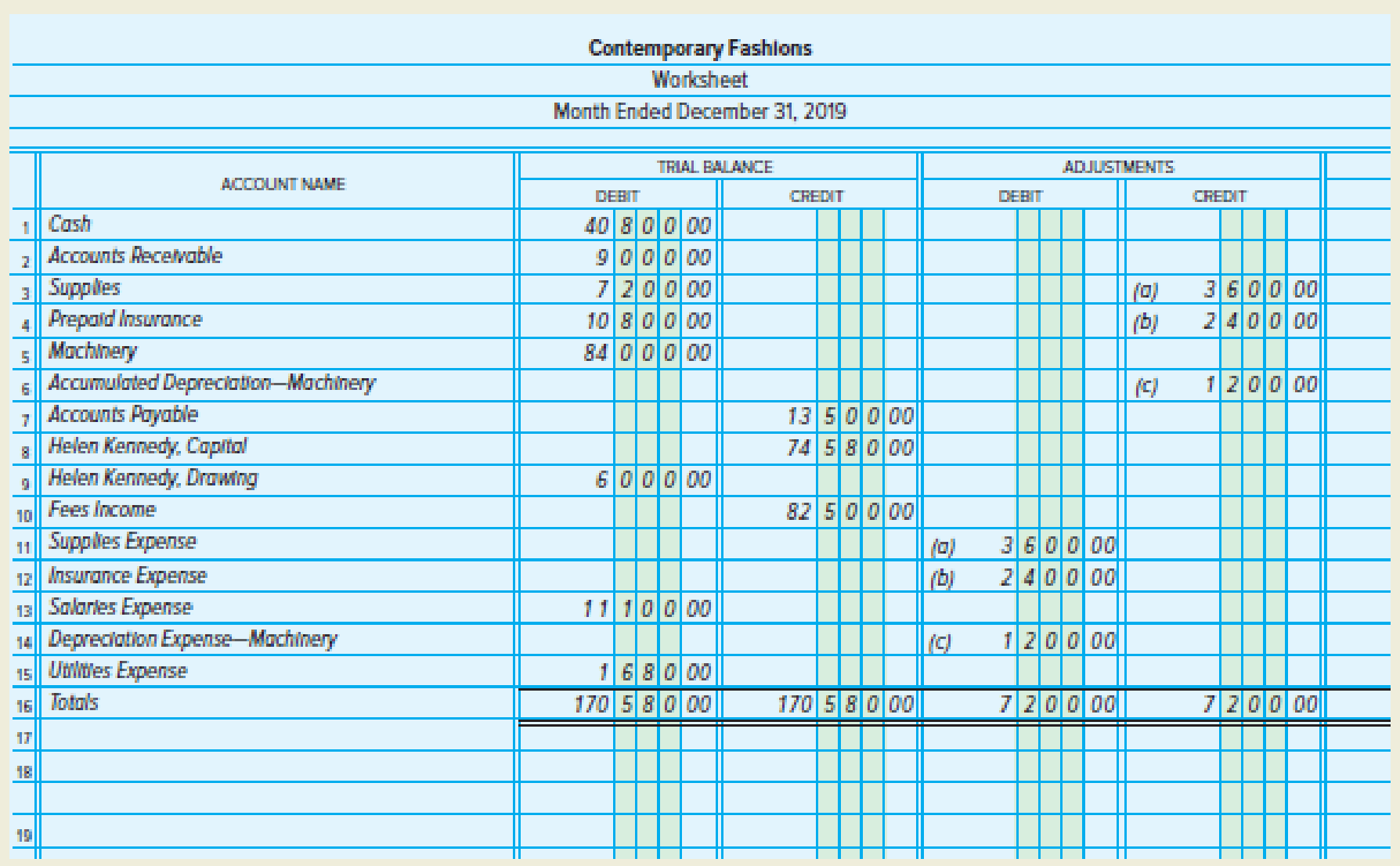

The

ADJUSTMENTS

- a. Supplies used, $3,600

- b. Expired insurance, $2,400

- c.

Depreciation expense for machinery, $1,200

INSTRUCTIONS

- 1. Complete the worksheet.

- 2. Prepare an income statement.

- 3. Prepare a statement of owner’s equity.

- 4. Prepare a

balance sheet . - 5. Journalize the

adjusting entries in the general journal, page 3. - 6. Journalize the closing entries in the general journal, page 4.

- 7. Prepare a postclosing trial balance.

Analyze: If the adjusting entry for expired insurance had been recorded in error as a credit to Insurance Expense and a debit to Prepaid Insurance for $2,400, what reported net income would have resulted?

1.

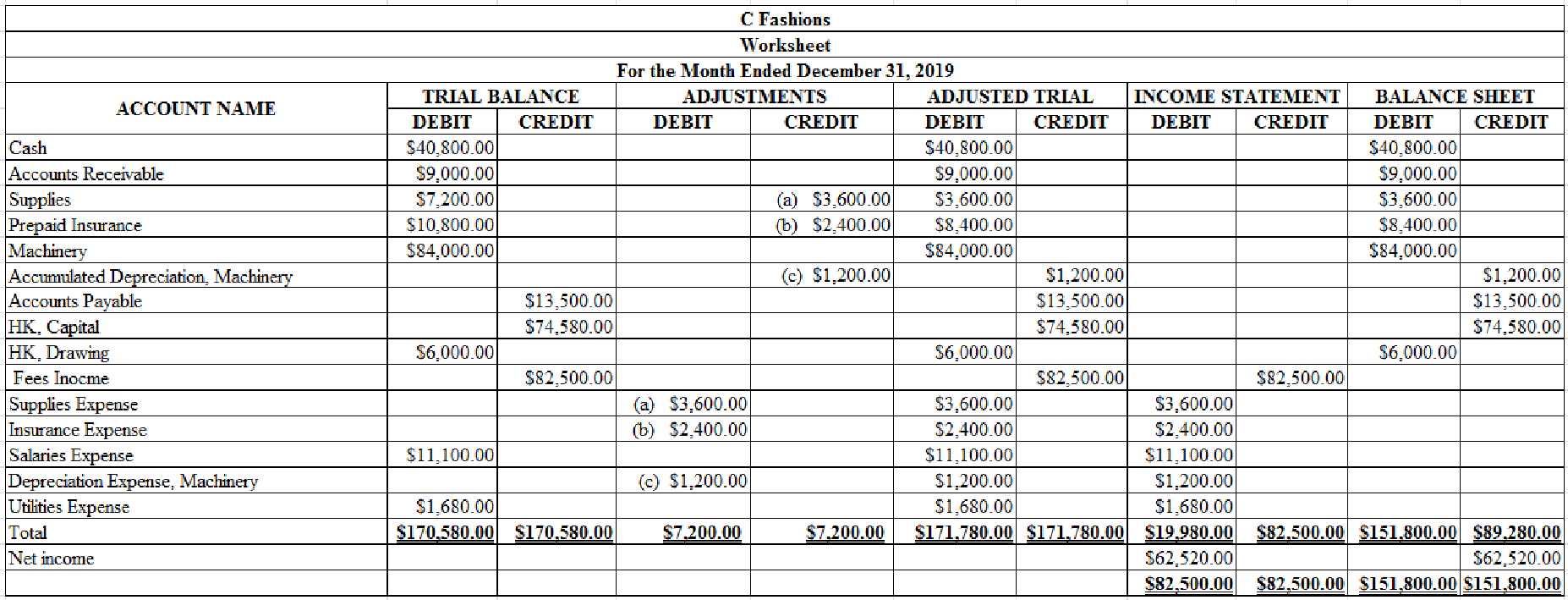

Complete the worksheet for C Fashions for the month ended December 31, 2019.

Explanation of Solution

Worksheet: Worksheet is an accounting tool that helps accountants to record adjustments and up-date balances required to prepare financial statements. Worksheet is a central place where trial balance, adjustments, adjusted trial balance, income statement, and balance sheet are presented.

Complete the worksheet for C Fashions for the month ended December 31, 2019.

Table (1)

2.

Prepare income statement for C Fashions for the month of December 31, 2019.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operation and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for C Fashions for the month ended December 31, 2019.

| C Fashions | ||

| Income Statement | ||

| For the Month Ended December 31, 2019 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues: | ||

| Fees Income | 82,500 | |

| Expenses: | ||

| Supplies Expense | 3,600 | |

| Insurance Expense | 2,400 | |

| Salaries Expense | 11,100 | |

| Depreciation Expense, Machinery | 1,200 | |

| Utilities Expense | 1,680 | |

| Total expenses | 19,980 | |

| Net income | $62,520 | |

Table (2)

3.

Prepare statement of owners’ equity for C Fashions for the month of December 31, 2019.

Explanation of Solution

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owners’ equity. Additional capital, net income from income statement is added to, and drawings are deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Prepare a statement of owners’ equity for C Fashions for the month ended December 31, 2019.

| C Fashions | ||

| Statement of Owners’ Equity | ||

| For the Month Ended December 31, 2019 | ||

| Particulars | Amount ($) | Amount ($) |

| HK, Capital, December 1, 2019 | $74,580 | |

| Net income for December | 62,520 | |

| Less: Withdrawals for December | 6,000 | |

| Increase in capital | 56,520 | |

| HK, Capital, December 31, 2019 | $131,100 | |

Table (3)

4.

Prepare balance sheet for C Fashions for the month of December 31, 2019.

Explanation of Solution

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and owners (owners’ equity) over those resources. The resources of the company are assets which include money contributed by owners and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and owners’ equity.

Prepare the balance sheet for C Fashions as at December 31, 2019.

| C Fashions | ||

| Balance Sheet | ||

| December 31, 2019 | ||

| Assets | Amount ($) | Amount ($) |

| Cash | $40,800 | |

| Accounts Receivable | 9,000 | |

| Supplies | 3,600 | |

| Prepaid Insurance | 8,400 | |

| Machinery | $84,000 | |

| Less: Accumulated Depreciation | 1,200 | 82,800 |

| Total Assets | $144,600 | |

| Liabilities and owner’s equity | ||

| Liabilities | ||

| Accounts Payable | 13,500 | |

| Owners’ Equity | ||

| HK, Capital | 131,100 | |

| Total Liabilities and Owners’ Equity | $144,600 | |

Table (4)

5.

Prepare adjusting entry for the given transactions in general ledger.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and owners’ or stockholders’ equity) to maintain the records according to accrual basis principle and matching concept.

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare adjusting entry for supplies.

| GENERAL JOURNAL | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2019 | Supplies expense | 3,600 | ||

| Supplies | 3,600 | |||

| (To record supplies used) | ||||

Table (5)

Description:

- Supplies Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Supplies are an asset account. Since amount of supplies is used, asset account decreased, and a decrease in asset is credited.

Prepare adjusting entry for insurance expense:

| GENERAL JOURNAL | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2019 | Insurance expense | 2,400 | ||

| Prepaid Insurance | 2,400 | |||

| (To record part of prepaid insurance expired) | ||||

Table (6)

Description:

- Insurance Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Prepaid Insurance is an asset account. Since amount of insurance is expired, asset account decreased, and a decrease in asset is credited.

Prepare adjusting entry for depreciation expense-Machinery:

| GENERAL JOURNAL | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2019 | Depreciation expense-Machinery | 1,200 | ||

| Accumulated depreciation-Machinery | 1,200 | |||

| (To record depreciation expense) | ||||

Table (7)

Description:

- Depreciation Expense, Machinery is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Machinery is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

6.

Prepare closing entries for the given transactions in general ledger.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to capital account are referred to as closing entries. The revenue, expense, and drawing accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Steps in closing procedure:

- 1. Close the revenue accounts to Income Summary account.

- 2. Close the expense accounts to Income Summary account.

- 3. Close the Income Summary account and transfer the net income or net loss balance to the Capital account.

- 4. Close the Drawing account to Capital account.

Close the revenue accounts to Income Summary account.

| GENERAL JOURNAL | Page 4 | |||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| 2019 | Fees Income | 82,500 | ||||

| December | 31 | Income Summary | 82,500 | |||

| (Record closing of revenue to Income Summary account) | ||||||

Table (8)

Description:

- Fees income is a revenue account. Revenue account has a normal credit balance. Since revenue is closed to Income Summary account, the account is debited.

- Income Summary is a clearing account which closes revenue, expense, drawings, and net of revenues and expenses to capital accounts. The account is credited to hold the transferred balance from revenue account.

Close the expense accounts to Income Summary account.

| GENERAL JOURNAL | Page 4 | |||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| 2019 | Income Summary | 19,980 | ||||

| December | 31 | Supplies Expense | 3,600 | |||

| Insurance Expense | 2,400 | |||||

| Salaries Expense | 11,100 | |||||

| Depreciation Expense, Machinery | 1,200 | |||||

| Utilities Expense | 1,680 | |||||

| (Record closing of expenses to Income Summary account) | ||||||

Table (9)

Description:

- Income Summary is a clearing account which closes revenue, expense, drawings, and net of revenues and expenses to capital accounts. The account is debited to hold the transferred balance from expense accounts.

- Supplies Expense, Insurance Expense, Salaries Expense, Depreciation Expense, and Utilities Expense are expense accounts. Expense account has a normal debit balance. Since expenses are closed to Income Summary account, the accounts are credited.

Close the net income to Income Summary account.

| GENERAL JOURNAL | Page 4 | |||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| 2019 | Income Summary | 62,520 | ||||

| December | 31 | HK, Capital | 62,520 | |||

| (Record closing of net income to capital account) | ||||||

Table (10)

Description:

- Income Summary is a clearing account which closes revenue, expense, drawings, and net of revenues and expenses to capital accounts. Since net income is closed, the account is reversed; hence, the Income Summary account is debited.

- HK, Capital is a capital account. Since net income is transferred to the account, the value increased, and an increase in capital is credited.

Working Note 1:

Compute net income.

Close the Drawing account to Capital account.

| GENERAL JOURNAL | Page 4 | |||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| 2019 | HK, Capital | 6,000 | ||||

| December | 31 | HK, Drawing | 6,000 | |||

| (Record closing of drawing to capital account) | ||||||

Table (11)

Description:

- HK, Capital is a capital account. Since drawings are transferred to the account, the value decreased, and a decrease in capital is debited.

- HK, Drawing is a capital account. Since drawings are transferred, the account is credited to reverse the previously debited effect.

7.

Prepare a post-closing trial balance for C Fashions at December 31, 2019.

Explanation of Solution

Post-closing trial balance: Post-closing trial balance is a summary of all the assets, liabilities, and capital accounts and their balances, after the closing entries are prepared. So, post-closing trial balance reports the balances of permanent accounts only.

Prepare a post-closing trial balance for C Fashions at December 31, 2019.

|

C Fashions Post- closing Trial Balance December 31, 2019 | ||

| Account Title |

Debit ($) |

Credit ($) |

| Cash | 40,800 | |

| Accounts Receivable | 9,000 | |

| Supplies | 3,600 | |

| Prepaid Insurance | 8,400 | |

| Machinery | 84,000 | |

| Accumulated Depreciation | 1,200 | |

| Accounts Payable | 13,500 | |

| HK, Capital | 131,100 | |

| Total | 145,800 | 145,800 |

Table (12)

Analyze: If expired insurance is wrongly adjusted as a credit to insurance expense and a debit to prepaid insurance for $2,400, then the net income would be increased by $4,800. The amount of net income would be reported as $67,320

Want to see more full solutions like this?

Chapter 6 Solutions

COLLEGE ACCOUNTING W/CONNECT

- The account balances of Bryan Company as of June 30, the end of the current fiscal year, are as follows: Required 1. Data for the adjustments are as follows: a. Expired or used up insurance, 495 b. Depreciation expense on equipment, 670. c. Depreciation expense on the van, 1,190. d. Salary accrued (earned) since the last payday, 540 (owed and to be paid on the next payday). e. Supplies used during the period, 97. Your instructor may want you to use a work sheet for these adjustments. 2. Journalize the adjusting entries. 3. Prepare an income statement. 4. Prepare a statement of owners equity. Assume that there was an additional investment of 2,000 on June 10. 5. Prepare a balance sheet. 6. Journalize the closing entries using the four steps in the correct sequence. Check Figure Net Income, 13,627arrow_forwardReece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services accounting clerk prepared the following unadjusted trial balance at July 31, 2019: The data needed to determine year-end adjustments are as follows: Depreciation of building for the year, 6,400. Depreciation of equipment for the year, 2,800. Accrued salaries and wages at July 31, 900. Unexpired insurance at July 31, 1,500. Fees earned but unbilled on July 31, 10,200. Supplies on hand at July 31, 615. Rent unearned at July 31, 300. Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable, Rent Revenue, Insurance Expense, Depreciation ExpenseBuilding, Depreciation ExpenseEquipment, and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted trial balance.arrow_forwardBased on the data presented in Exercise 6-25, journalize the closing entries. On March 31, 2019, the balances of the accounts appearing in the ledger of Racine Furnishings Company, a furniture wholesaler, are as follows: a. Prepare a multiple-step income statement for the year ended March 31, 2019. b. Compare the major advantages and disadvantages of the multiple-step and single-step forms of income statements.arrow_forward

- Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2019. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closingtrial balance as of April 30, 2019, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2019, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a twocolumn journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during May is 275. b. Supplies on hand on May 31 are 715. c. Depreciation of office equipment for May is 330. d. Accrued receptionist salary on May 31 is 325. e. Rent expired during May is 1,600. f. Unearned fees on May 31 are 3,210. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 10. Prepare a post-closing trial balance.arrow_forwardThe account balances of Miss Beverlys Tutoring Service as of June 30, the end of the current fiscal year, are as follows: Required 1. Data for the adjustments are as follows: a. Expired or used up insurance, 470. b. Depreciation expense on equipment, 948. c. Depreciation expense on the van, 1,490. d. Salary accrued (earned) since the last payday, 574 (owed and to be paid on the next payday). e. Supplies remaining as of June 30, 407. Your instructor may want you to use a work sheet for these adjustments. 2. Journalize the adjusting entries. 3. Prepare an income statement. 4. Prepare a statement of owners equity. Assume that there was an additional investment of 3,000 on June 10. 5. Prepare a balance sheet 6. Journalize the closing entries using the four steps in the proper sequence. Check Figure Net income, 19,567arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. amount due for employee salaries, $4,800 B. actual count of supplies inventory, $ 2,300 C. depreciation on equipment, $3,000arrow_forward

- The trial balance of Wikki Cleaners at December 31, 2012, the end of the current fiscal year, is as follows: Information for the adjusting entries is as follows: a. Cleaning supplies on hand on December 31, 2012, 18,750. b. Insurance premiums expired during the year, 1,800. c. Depreciation on equipment during the year, 21,600. d. Wages accrued but not paid at December 31, 2012, 1,830. As the accountant for Wikki Cleaners, you have been asked to prepare financial statements for the year. A file called F1WORK has been provided to assist you in this assignment. As you review this file, it should be noted that columns H and I will automatically change when you enter values in columns E or G.arrow_forwardValley Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on July 31, 2019, follows: The following business transactions were completed by Valley Realty during August 2019: Aug. 1. Purchased office supplies on account, 3,150. 2.Paid rent on office for month, 7,200. 3.Received cash from clients on account, 83,900. 5.Paid insurance premiums, 12,000. 9.Returned a portion of the office supplies purchased on August 1, receiving full credit for their cost, 400. Analyzing Transactions Aug. 17. Paid advertising expense, 8,000. 23.Paid creditors on account, 13,750. Enter the following transactions on Page 19 of the two-column journal: 29.Paid miscellaneous expenses, 1,700. 30.Paid automobile expense (including rental charges for an automobile), 2,500. 31.Discovered an error in computing a commission during July; received cash from the salesperson for the overpayment, 2,000. 31.Paid salaries and commissions for the month, 53,000. 31.Recorded revenue earned and billed to clients during the month, 183,500. 31.Purchased land for a future building site for 75,000, paying 7,500 in cash and giving a note payable for the remainder. 31.Withdrew cash for personal use, 1,000. 31.Rented land purchased on August 31 to a local university for use as a parking lot during football season (September, October, and November); received advance payment of 5,000. Instructions 1. Record the August 1 balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for August in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of August 31, 2019. 5. Assume that the August 31 transaction for Cindy Getmans cash withdrawal should have been 10,000. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?arrow_forwardWorksheet Victoria Company has the following account balances on December 31, 2019, prior to any adjustments: Additional adjustment information: (a) depreciation on buildings, 1,100; on equipment, 600; (b) bad debts expense, 240; (c) interest accumulated but not paid: on note payable, 50; on mortgage payable, 530 (this interest is due during the next accounting period); (d) insurance expired, 175; (e) salaries accrued but not paid 370; (f) rent was collected in advance and the performance obligation is now satisfied, 800; (g) office supplies cm hand at year-end, 230 (expensed when originally purchased earlier in the year); and (h) the income tax rate is 30% on current income and is payable in the first quarter of 2020. Required: 1. Transfer the account balances to a 10-column worksheet and prepare a trial balance. 2. Prepare the adjusting entries in the general journal and complete the worksheet. 3. Prepare the companys income statement, retained earnings statement, and balance sheet. 4. Prepare closing entries in the general journal.arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning