Cash flow analysis, sensitivity analysis. HealthMart is a retail store selling home oxygen equipment. HealthMart also services home oxygen equipment, for which the company bills customers monthly. HealthMart has budgeted for increases in service revenue of $200 each month due to a recent advertising

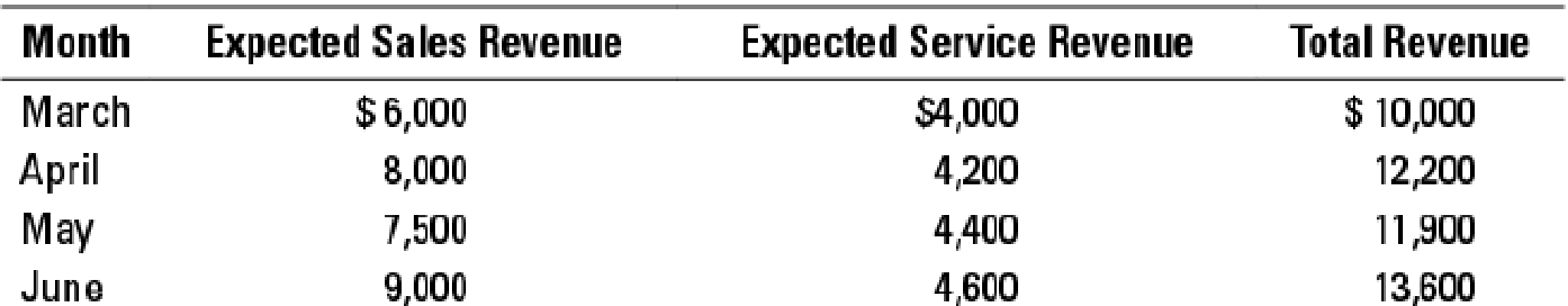

Sales and Service Revenues Budget March–-June 2018

Almost all of the sales revenues of the oxygen equipment are credit card sales; cash sales are negligible. The credit card company deposits 97% of the revenues recorded each day into HealthMart’s account overnight. For the servicing of home oxygen equipment, 60% of oxygen services billed each month is collected in the month of the service, and 40% is collected in the month following the service.

- 1. Calculate the cash that HealthMart expects to collect in April, May, and June 2018 from sales and service revenues. Show calculations for each month.

- 2. HealthMart has budgeted expenditures for May of $11,000 and requires a minimum cash balance of $250 at the end of each month. It has a cash balance on May 1 of $400.

- a. Given your answer to requirement 1, will HealthMart need to borrow cash to cover its payments for May and maintain a minimum cash balance of $250 at the end of May?

- b. Assume (independently for each situation) that (1) May total revenues might be 10% lower or that (2) total costs might be 5% higher. Under each of those two scenarios, show the total net cash for May and the amount HealthMart would have to borrow to cover its cash payments for May and maintain a minimum cash balance of $250 at the end of May. (Again, assume a balance of $400 on May 1.)

- 3. Why do HealthMart’s managers prepare a

cash budget in addition to the revenue, expenses, and operating income budget? Has preparing the cash budget been helpful? Explain briefly.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

REVEL for Horngren's Cost Accounting: A Managerial Emphasis -- Access Card (16th Edition) (What's New in Accounting)

- A bookstore is planning to purchase an automated inventory/remote marketing system, which includes an upgrade to a more sophisticated cash register system. The package has an initial investment cost of $360,000. It is expected to generate $144,000 of annual cash flows, reduce costs and provide incremental cash revenues of $326,000, and incur incremental cash expenses of $200,000 annually. What is the payback period and accounting rate of return (ARR)?arrow_forwardIn an attempt to better understand RR’s cash position, Johnson developed a cash budget for the first 2 months of the year. She has the figures for the other months, but they are not shown. After looking at the cash budget, answer the following questions: What does the cash budget show regarding the target cash level? Should depreciation expense be explicitly included in the cash budget? Why or why not? What are some other potential cash inflows besides collections? How can interest earned or paid on short-term securities or loans be incorporated in the cash budget? In her preliminary cash budget, Johnson has assumed that all sales are collected and thus that RR has no bad debts. Is this realistic? If not, how would bad debts be dealt with in a cash budgeting sense? (Hint: Bad debts will affect collections but not purchases.)arrow_forwardThe following four suggestions have been made to improve the company’s cash position. Evaluate the effect on cash flow for each of the four suggestions. After evaluating each suggestion, enter the projected cash balances in the spaces provided. Consider each suggestion separately. Reset cells to their initial values after each new suggestion. Seek agreement with suppliers to extend the credit period to 30 days. This would mean that all current monthly purchases would be paid for in the following month. Raise the unit price from $28 to $30. A price increase will reduce unit sales by 10% each month. Unit purchases will also be reduced by 10%. Put the company’s two salespeople on straight commission. This would reduce fixed marketing and administrative costs to $1,500 per month and raise variable marketing and administrative costs to $7 per unit. Increase the cash discount from 5% to 10%. It is anticipated that this would increase the percentage of customers paying within the discount period to 85%, and those paying the month after the discount period would drop to 8%. Five percent would pay in the following month and 2% would still be uncollectible. What are your recommendations for Sweet Pleasures, Inc.? Consider potential impact on profits as well as cash balances.arrow_forward

- Almost all of the sales revenues of the oxygen equipment are credit card sales; cash sales are negligible. The credit card company deposits 97% of the revenues recorded each day into HealthMart’s account overnight. For the servicing of home oxygen equipment, 60% of oxygen services billed each month is collected in the month of the service, and 40% is collected in the month following the service. Q. Why do HealthMart’s managers prepare a cash budget in addition to the revenue, expenses, and operating income budget? Has preparing the cash budget been helpful? Explain briefly.arrow_forwardBrighton, Inc., manufactures kitchen tiles. The company recently expanded, and the controller believes that it will need to borrow cash to continue operations. It began negotiating for a one-month bank loan of $600,000 starting May 1. The bank would charge interest at the rate of 1.25 percent per month and require the company to repay interest and principal on May 31. In considering the loan, the bank requested a projected income statement and cash budget for May. The following information is available: The company budgeted sales at 650,000 units per month in April, June, and July and at 500,000 units in May. The selling price is $4 per unit. The inventory of finished goods on April 1 was 162,500 units. The finished goods inventory at the end of each month equals 25 percent of sales anticipated for the following month. There is no work in process. The inventory of raw materials on April 1 was 61,250 pounds. At the end of each month, the raw materials inventory equals no less than…arrow_forwardLane Products manufactures a popular kitchen utensil. The company recently expanded, and the controller believes that it will need to borrow cash to continue operations. It opened negotiations with the local bank for a one-month loan of $40,000 starting March 1. The bank would charge interest at the rate of 0.5 percent per month and require the company to repay interest and principal on March 31. In considering the loan, the bank requested a projected income statement and cash budget for March. The following information is available: The company budgeted sales at 12,000 units per month in February, April, and May and at 9,000 units in March. The selling price is $60 per unit. The company offers a 2 percent discount for cash sales. The company's experience is that bad debts average 1 percent of credit sales. The inventory of finished goods on February 1 was 2,400 units. The desired finished goods inventory at the end of each month equals 25 percent of sales anticipated for the…arrow_forward

- From past experience, the company has learned that 20% of a month’s sales are collected in the month of sale, another 75% are collected in the month following sale, and the remaining 5% are collected in the second month following sale. Bad debts are negligible and can be ignored. February sales totaled $270,000, and March sales totaled $300,000. Required: 1. Prepare a schedule of expected cash collections from sales, by month and in total, for the second quarter. 2. What is the accounts receivable balance on June 30th?arrow_forwardThe accountant for Munoz’s Dress Shop prepared the following cash budget. Munoz’s desires to maintain a cash cushion of $24,000 at the end of each month. Funds are assumed to be borrowed and repaid on the last day of each month. Interest is charged at the rate of 3 percent per month. Required Complete the cash budget by filling in the missing amounts. Determine the amount of net cash flows from operating activities Munoz’s will report on the third quarter pro forma statement of cash flows. Determine the amount of net cash flows from financing activities Munoz’s will report on the third quarter pro forma statement of cash flows.arrow_forwardUpon receipt of the budget the team manager has now informed you that the management of Miller Merchandising & More have indicated a desire to maintain a minimum cash balance of $125,000 each month. Based on the budget prepared, will the business be achieving this desired target? Given that the management does not wish to borrow any funds from outside sources, suggest three (3) internal strategies that the business may employ in order to improve the organization’s monthly cash flow. Each strategy must be fully explained(in detailed).arrow_forward

- Upon receipt of the budget the team manager has now informed you that the management of Miller Merchandising & More have indicated a desire to maintain a minimum cash balance of $125,000 each month. Based on the budget prepared, will the business be achieving this desired target? Given that the management does not wish to borrow any funds from outside sources, suggest three (3) internal strategies that the business may employ in order to improve the organization’s monthly cash flow. Each strategy must be fully explained.arrow_forwardfrom the following data of nature’s herbs company, prepare a sales forecast and schedule of cash receipts for the company covering the last quarter of the year. based on past experience, 20% of sales are collected in the month of sales, 70% in the following month, and 10% are never collected. nature’s herbs company has forecast credit sales for the fourth quarter of the year: september (actual) p 100,000 fourth quarter: october 80,000 november 70,000 december 120,000arrow_forwardUsing the following data for for Rodriguez Art Studio to prepare a cash follow forecast. - Sales revenue: $10,000 March, $10,000 April, $9,000 May, $11,000 June. - Payment from customers is 50% paid in cash, 50% paid on one months credit - Direct Costs $5,500 April, $4,950 May, $6,060 June. - Opening Cash Balance in April $1,200 - Indirect Costs are $5,100 per month. What is the Total Cash inflow in May? Options -$4,500 -$11,200 -$10,000 -$9,500 What is the Net Cash flow in April? Options -$-600 -$660 -$-610 $600arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College