EBK CONTEMPORARY ENGINEERING ECONOMICS

6th Edition

ISBN: 9780134123950

Author: Park

Publisher: PEARSON CUSTOM PUB.(CONSIGNMENT)

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 15P

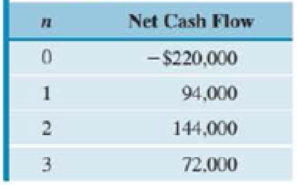

Consider an investment project with the cash flows given in Table P7.15.

- (a) Find the

IRR for this investment. - (b) Plot the present worth of the cash flow as a function of i.

- (c) On the basis of the IRR criterion, should the project be accepted at MARR = 15%?

TABLE P7.15

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A certain fluidized-bed combustion vessel has an investment cost of $100,000, a life of 10 years, and negligible market (resale) value. Annual costs of materials, maintenance, and electric power for the vessel are expected to total $10,000. A major relining of the combustion vessel will occur during the fifth year at a cost of $30,000. If the interest rate is 15% per year, what is the lump-sum equivalent cost of this project at the present time?

On a land worth P800,000, an investor constructs a building worth P3,000,000. The owner estimates that the annual receipts from rentals will be P720,000 and annual expenses to cover taxes, insurance and maintenance of the building will be P80,000. The investor estimates that the land can be sold for P1,200,000, the building for P2,000,000 at the end of 20 years. If his money is now earning 15%, compute the rate of return.

A project has a service of five years with the initial investment outlay of$180,000. If the discounted payback period occurs at the end of project service life (say five years) at an interest rate of 8%, what can you say about the NFW of the project?

Chapter 7 Solutions

EBK CONTEMPORARY ENGINEERING ECONOMICS

Ch. 7 - Prob. 1PCh. 7 - Prob. 2PCh. 7 - Prob. 3PCh. 7 - Prob. 4PCh. 7 - Prob. 5PCh. 7 - Prob. 6PCh. 7 - Prob. 7PCh. 7 - Prob. 8PCh. 7 - Prob. 9PCh. 7 - Prob. 10P

Ch. 7 - Prob. 11PCh. 7 - Prob. 12PCh. 7 - Prob. 13PCh. 7 - Prob. 14PCh. 7 - Consider an investment project with the cash flows...Ch. 7 - Consider the investment projects given in Table...Ch. 7 - Prob. 17PCh. 7 - Prob. 18PCh. 7 - Consider the investment projects given in Table...Ch. 7 - Consider the investment projects given in Table...Ch. 7 - Prob. 21PCh. 7 - Prob. 22PCh. 7 - Consider the investment projects given in Table...Ch. 7 - Prob. 24PCh. 7 - Prob. 25PCh. 7 - Prob. 26PCh. 7 - Prob. 27PCh. 7 - Prob. 28PCh. 7 - Prob. 29PCh. 7 - Prob. 30PCh. 7 - Prob. 31PCh. 7 - Prob. 32PCh. 7 - Prob. 33PCh. 7 - Prob. 34PCh. 7 - Prob. 35PCh. 7 - Prob. 36PCh. 7 - Prob. 37PCh. 7 - Prob. 38PCh. 7 - Prob. 39PCh. 7 - Prob. 40PCh. 7 - Prob. 41PCh. 7 - Prob. 42PCh. 7 - Consider the two mutually exclusive investment...Ch. 7 - You are considering two types of automobiles....Ch. 7 - Prob. 45PCh. 7 - Prob. 46PCh. 7 - Fulton National Hospital is reviewing ways of...Ch. 7 - Prob. 48PCh. 7 - Consider the investment projects given in Table...Ch. 7 - Prob. 50PCh. 7 - Prob. 51PCh. 7 - Prob. 52PCh. 7 - Prob. 53PCh. 7 - Prob. 54PCh. 7 - Prob. 55PCh. 7 - Prob. 56PCh. 7 - Prob. 57PCh. 7 - Prob. 1STCh. 7 - Prob. 2STCh. 7 - Prob. 3STCh. 7 - Prob. 4STCh. 7 - Prob. 5ST

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- On land worth P800,000 an investor constructs a building worth P3,000,000 containing a theater , a bank, stores and offices. The owner estimates that the annual receipts from rentals will be P720,000, and annual expenses to cover taxes, insurance and maintenance of the building will be P80,000. He also estimates that the land can be sold for P1,200,000, the building for P2,000,000 at the end of 20 years. If his money is now earning 15% before taxes, what is the rate of return to justify this investment?arrow_forwardA syndicate wishes to purchase an oil well which estimates indicate, will produce a net income of P2M per year for 30 years. What should be the syndicate pay for the well if out of this net income, a return of 10% of the investment is desired and a sinking fund is to established at 3% interest to recover this investment.arrow_forwardDetermine to the nearest percent the IRR of the following projects: a. An initial outlay of $10,000 resulting in a free cash flow of $2.000 at the end of year 1, $5,000 at the end of year 2, and $8,000 at the end of year 3. b. an initial outlay of $10,000 resulting in a free cash flow of $8,000 at the end of year 1, $5,000 at the end of year 2, and $2,000 at the end of year 3. c. an initial outlay of $10,000 resulting in the free cash flow of $2,000 at the end of years 1 through 5 and $5,000 at the end of year 6.arrow_forward

- You are considering a luxury apartment building project that requires an investment of $14,500,000. The building has 60 units. You expect the maintenance cost for the apartment building to be $450,000 the first year and $490,000 the second year. The maintenance cost will continue to increase by $40,000 in subsequent years. The cost to hire a manager for the building is estimated to be $100,000 per year. After five years of operation, the apartment building can be sold for $18,000,000. What is the annual rent per apartment unit that will provide a return on investment of 17%? Assume that the building will remain fully occupied during its five years of operation. The annual rent per apartment unit should be $ ______thousand. (Round to one decimal place.).arrow_forwardConsider three investment plans at an annual rate of 9.38%. • Investor A: Invest $2000 per year for the first 10 years of your career. At the end of 10 years, make no further investments, but reinvest the amount accumulated at the end of 10 years for the next 31 years. • Investor B: Do nothing for the first 10 years. Then start investing $2000 per year for the next 31 years. • Investor C: Invest $2000 per year for the entire 41 years. Note that all investments are made at the beginning of each year, the first deposit will be .made at the beginning of age 25 (n=0), and you want to calculate the balance at age of 65 (n=41).arrow_forwardYou have found an investment that pays 0.5% each week. What is the effective annual rate of return for this investment? Question 15.8%24.7% 26% 29.6%arrow_forward

- A piece of new equipment has been proposed by engineers to increase theproductivity of a certain manual welding operation. The investment cost is $25,000, and the equipment will have a market value of $5,000 at the end of a study period of five years. Increased productivity attributable to the equipment will amount to $8,000 per year after extra operating costs have been subtracted from the revenue generated by the additional production. A cash-flow diagram for this investment opportunity is given below. If the firm’s MARR is 20% per year, is this proposal a sound one? Use the PW method.arrow_forwardYou invest in a piece of equipment costing $40,000. The equipment will be used for two years, and it will be worth $15,000 at the end of two years. The machine will be used for 4,000 hours during the first year and 6,000 hours during the second year. The expected savings associated with the use of the piece of equipment will be $28,000 during the first year and $40,000 during the second year. Your interest rate is 10%.(a) What is the capital recovery cost?(b) What is the annual equivalent worth?(c) What is net savings generated per machine-hour?arrow_forwardA new municipal refuse-collection truck can be purchased for $84,000. Its expected useful life is six years, at which time its market value will be zero. Annual receipts less expenses will be approximately $18,000 per year over the six-year study period. At MARR of 19%, calculate the internal rate of return of the project a. 7% b. 8% c. 9% d. none of the abovearrow_forward

- A bridge that was constructed at a cost of P500,000 is expected to last 20 years, at the end of which time its renewal cost will be P100,000. Annual repairs and maintenance are P45,000. What is the capitalized cost of the bridge at an interest of 6%? A. 1,295,307.60 B. 1,925,307.60 C. 2,592,307.60 D. 2,195,307.60arrow_forwardYou are being asked to evaluate the worthiness of an investment that requires you to spend $100,000 today in return for receiving $30,000 each year for seven years, beginning four years from now. Which of the following statements is TRUE If the MARR = 10%, I would conclude that this is a profitable investment. Present Worth = $30,000 X 7 - $100,000. If the MARR = 10%, I would conclude that this is not a profitable investment.arrow_forwardAnnual maintenance costs for a machine are P1,500 this year and are estimated to increase 10% each year every year. What is the present worth of the maintenance cost for six years? a) if i = 8% b) if i = 10% c) if i = 12%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education

Valuation Analysis in Project Finance Models - DCF & IRR; Author: Financial modeling;https://www.youtube.com/watch?v=xDlQPJaFtCw;License: Standard Youtube License