Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

12th Edition

ISBN: 9781259144387

Author: Richard A Brealey, Stewart C Myers, Franklin Allen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 17PS

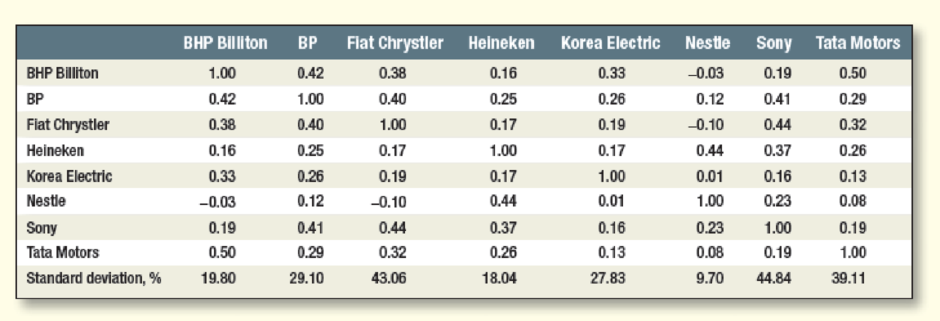

Portfolio risk Table 7.9 shows standard deviations and correlation coefficients for eight stocks from different countries. Calculate the variance of a portfolio with equal investments in each stock.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Calculate the correlation coefficient for the portfolio using the following information:

Variance of Stock X 0.08 Variance of Stock Y 0.06

Covariance is 0.05

a. 0.1042

b. 0.7217

c. 0.00024

d. 0.0693

Expected return of a portfolio using

beta.

The beta of four

stocks—P,

Q, R, and

S—are

0.49,

0.81,

1.19,

and

1.53,

respectively and the beta of portfolio 1 is

1.01,

the beta of portfolio 2 is

0.86,

and the beta of portfolio 3 is

1.15.

What are the expected returns of each of the four individual assets and the three portfolios if the current SML is plotted with an intercept of

4.5%

(risk-free rate) and a market premium of

12.0%

(slope of the line)?

What is the expected return of stock P?

(Round to two decimal places.)

What is the expected return of stock Q?

(Round to two decimal places.)

What is the expected return of stock R?

(Round to two decimal places.)

What is the expected return of stock S?

(Round to two decimal places.)

What is the expected return of portfolio 1?

(Round to two decimal places.)

What is the expected return of portfolio 2?

(Round to two decimal places.)

What is the expected return of portfolio 3?…

Expected return of a portfolio using

beta.

The beta of four

stocks—G,

H, I, and

J—are

0.44,

0.75,

1.21,

and

1.55,

respectively and the beta of portfolio 1 is

0.99,

the beta of portfolio 2 is

0.83,

and the beta of portfolio 3 is

1.14.

What are the expected returns of each of the four individual assets and the three portfolios if the current SML is plotted with an intercept of

3.5%

(risk-free rate) and a market premium of

10.0%

(slope of the line)?

What is the expected return of stock G?

(Round to two decimal places.)

What is the expected return of stock H?

(Round to two decimal places.)

What is the expected return of stock I?

(Round to two decimal places.)

What is the expected return of stock J?

(Round to two decimal places.)

What is the expected return of portfolio 1?

(Round to two decimal places.)

What is the expected return of portfolio 2?

(Round to two decimal places.)

What is the expected return of portfolio 3?…

Chapter 7 Solutions

Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Ch. 7 - Expected return and standard deviation A game of...Ch. 7 - Standard deviation of returns The following table...Ch. 7 - Average returns and standard deviation During the...Ch. 7 - Portfolio risk True or false? a. Investors prefer...Ch. 7 - Risk and diversification In which of the following...Ch. 7 - Portfolio risk To calculate the variance of a...Ch. 7 - Portfolio betas Suppose the standard deviation of...Ch. 7 - Portfolio betas A portfolio contains equal...Ch. 7 - Prob. 9PSCh. 7 - Prob. 10PS

Ch. 7 - Stocks vs. bonds Each of the following statements...Ch. 7 - Prob. 12PSCh. 7 - Prob. 13PSCh. 7 - Portfolio risk Hyacinth Macaw invests 60% of her...Ch. 7 - Portfolio risk a) How many variance terms and how...Ch. 7 - Portfolio risk Table 7.9 shows standard deviations...Ch. 7 - Portfolio risk Your eccentric Aunt Claudia has...Ch. 7 - Stock betas There are few, if any, real companies...Ch. 7 - Portfolio risk You can form a portfolio of two...Ch. 7 - Portfolio risk Here are some historical data on...Ch. 7 - Portfolio risk Suppose that Treasury bills offer a...Ch. 7 - Beta Calculate the beta of each of the stocks in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Expected return of a portfolio using beta. The beta of four stocks—G, H, I, and J—are 0.44, 0.75, 1.21, and 1.55, respectively and the beta of portfolio 1 is 0.99, the beta of portfolio 2 is 0.83, and the beta of portfolio 3 is 1.14. What are the expected returns of each of the four individual assets and the three portfolios if the current SML is plotted with an intercept of 3.5% (risk-free rate) and a market premium of 10.0% (slope of the line) What is the expected return of portfolio 1? (Round to two decimal places.) What is the expected return of portfolio 2? (Round to two decimal places.) What is the expected return of portfolio 3? (Round to two decimal places.)arrow_forwardHere are the returns on two stocks. A. Calculate the variance and standard deviation of each stock. Which stock is riskier if held on its own? B. Now calculate the returns in each month of a portfolio that invests an equal amount each month in the two stocks C. Is the variance more or less than halfway between the variance of the two Individual stocks?arrow_forwardConsider two stocks, Stock D, with an expected return of 13 percent and a standard deviation of 28 percent, and Stock I, an international company, with an expected return of 16 percent and a standard deviation of 38 percent. The correlation between the two stocks is -0.1. What is the weight of stock D in the minimum variance portfolio?arrow_forward

- Expected return of a portfolio using beta. The beta of four stocks-P, Q, R, and S-are 0.59, 0.89, 1.05, and 1.31, respectively and the beta of portfolio 1 is 0.96, the beta of portfolio 2 is 0.87, and the beta of portfolio 3 is 1.05. What are the expected returns of each of the four individual assets and the three portfolios if the current SML is plotted with an intercept of 4.5% (risk-free rate) and a market premium of 12.0% (slope of the line)? ..... What is the expected return of stock P? % (Round to two decimal places.)arrow_forwardQUESTION 1 Under which of the following scenarios, the minimum variance portfolio that contains two stocks has the smallest standard deviation? OA. The correlation between the two stock returns is -1 OB. The correlation between the two stock returns is -0.2 OC. The correlation between the two stock returns is 0.2 OD. The correlation between the two stock returns is 0.5arrow_forwardConsider two stocks, Stock D with an expected return of 21 percent and a standard deviation of 36 percent and Stock I, an international company, with an expected return of 9 percent and a standard deviation of 24 percent. The correlation between the two stocks is -22. What are the expected return and standard deviation of the minimum variance portfolio? (Round your answer to 2 decimal places. Omit the "%" sign in your response.) Expected return Standard deviation % %arrow_forward

- From the following information, calculate covariance between stocks A and B and expected return and risk of a portfolio in which A and B are equally weighted.Which stock would be recommend if investment in individual stock is to be made? Justify answer using numerical calculations. Stock A Stock B Expected return 24% 35% Standard deviation 12% 18% Coefficient of correlation 0.65 0.65arrow_forward3. Consider three stocks A, B and C and a market index M with the following prices: Year TO T1 T2 T3 A 85 108 110 125 B 12 14 13 15 C 50 60 70 75 M 1128 1435 1578 1786 The risk-free rate equals 4%. a. Compute the expected return and risk on each stock and the market index. b. Construct the matrix of variances and covariances between these assets. c. Construct the matrix of the correlation coefficients. d. Compute the beta coefficients of these companies and the expected return at equilibrium. e. Construct the minimum risk portfolio P1 composed of A and C. Compute the expected return and risk on this portfolio. f. Construct a portfolio P2 composed of A, B and C in proportions of 20%, 30% and 50%. Compute the expected return and risk on this portfolio. What is the contribution of each security to the return and risk pf this portfolio? g. Construct an equally weighted portfolio P3 composed of A, B, C and the risk-free rate. Compute the beta coefficient and position this portfolio with…arrow_forwardFrom the following information, calculate covariance between stocks A and B and expected return and risk of a portfolio in which A and B are equally weighted.Which stock would be best recommend if investment in individual stock is to be made? Justify the answer using numerical calculations. Stock A Stock B Expected return 24% 35% Standard deviation 12% 18% Coefficient of correlation 0.65arrow_forward

- Question 1. Calculate the variance and standard deviation of a portfolio of two stocks. Question 2. Suppose the volatility of stock 2 is 16%, but the weight of stock 2 in the portfolio is 15%, will there be any effect on the standard deviation of the portfolio?arrow_forwardFrom the information attached below, calculate: a. the average stock return from 20x1- 20x3. b. The standard deviation over the same period.arrow_forwardA portfolio is comprised of equal weights of two stocks labeled Stock X and Stock Y. The covariance between Stock X and Stock Y is 0.10. The standard deviation of Stock X is 0.50, and the standard deviation of Stock Y is 0.50. Which of the following comes closest to the correlation coefficient between Stock X and Stock Y? Select one: a. 0.60 b. 0.50 c. 1.00 d. 0.00 e. 0.40arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Investing For Beginners (Stock Market); Author: Daniel Pronk;https://www.youtube.com/watch?v=6Jkdpgc407M;License: Standard Youtube License