Global Services is considering a promotional campaign that will increase annual credit sales by

All

a. Compute the investments in accounts receivable, inventory, and plant and equipment based on the turnover ratios. Add the three together.

b. Compute the accounts receivable collection costs and production and selling costs and add the two figures together.

c. Compute the costs of carrying inventory.

d. Compute the depreciation expense on new plant and equipment.

e. Add together all the costs in parts b, c, and d.

f. Subtract the answer from part e from the sales figure of

g. Divide the aftertax return figure in part f by the total investment figure in part a. If the firm has a required return on investment of 8 percent, should it undertake the promotional campaign described throughout this problem?

a.

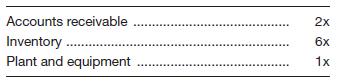

To calculate: Investments in accounts receivable, inventory, and plant & equipment based on the turnover ratios.

Introduction:

Accounts receivable:

It is the amount that the company has not received yet for the services already rendered by it or the goods already sold. Accounts receivable is mentioned under the head assets in the balance sheet.

Inventory:

It is the goods including raw materials which are kept in store either for the selling or for further usage in production purpose. The inventory includes raw materials, unfinished as well as finished goods.

Answer to Problem 21P

For Global Services, the investments in accounts receivable should be $225,000, in inventory should be $75,000, and plant & equipment is $450,000 . The total investment should be $750,000.

Explanation of Solution

The calculation of investment to be made in accounts receivables:

The calculation of investment to be made in inventory:

The calculation of investments to be made in plant and equipment:

The calculation of total investment:

b.

To calculate: The cost of Accounts receivable collection, production, and selling. Also, find the total cost.

Introduction:

Accounts receivable:

Accounts receivable is the amount that the company has not received yet for already rendered services or goods sold. Accounts receivable is mentioned under the head assets in the balance sheet.

Production and selling cost:

The cost which is incurred for the production and distribution is referred to as production and selling cost. This cost is considered as variable, as it keeps on varying with the level of production.

Answer to Problem 21P

The collection cost of Global Services is $27,000 and its production and selling costs is $319,500.

Explanation of Solution

The calculation of collection cost:

The calculation of production and selling costs:

The calculation of total cost related to accounts receivables:

c.

To calculate: The cost of carrying inventory.

Introduction:

Inventory carrying cost:

All the expenses related to the holding or storing the inventory is referred to as inventory carrying cost. This varying cost determines the level of inventory to be held by a company.

Answer to Problem 21P

The inventory carrying cost of Global Services is $3,000.

Explanation of Solution

The calculation of the inventory carrying cost of Global Services:

d.

To calculate: Depreciation expense charged on new plant and equipment.

Introduction:

Depreciation:

The non-cash expense referred to as depreciation, which is gradual decrease in the value of fixed assets due to the wear and tear or continuous usage. Depreciation is calculated either through straight line or diminishing balance method.

Answer to Problem 21P

The depreciation expense of Global services is $22,500.

Explanation of Solution

The calculation of depreciation expense:

e.

To calculate: The sum of all the costs in parts b, c, and d.

Introduction:

Production and selling cost:

The cost which is incurred for the production and distribution is referred to as production and selling cost.

Inventory carrying cost:

All the expenses related to the holding or storing the inventory is referred to as inventory carrying cost. This varying cost determines the level of inventory to be held by a company.

Depreciation:

The non-cash expense referred to as depreciation, which is gradual decrease in the value of fixed assets due to the wear and tear or continuous usage. Depreciation is calculated either through straight line or diminishing balance method.

Answer to Problem 21P

Total costs of Global Services are $372,000.

Explanation of Solution

The calculation of the sum of costs in part b, c, and d:

f.

To calculate: The income before taxes.

Introduction:

Income before taxes:

The income before taxes is the measure of the company’s fiscal performance, which is computed by subtracting expenses from the revenue of the company.

Answer to Problem 21P

The income before taxes of Global Services is $78,000 and its income after taxes is $54,600.

Explanation of Solution

The calculation of income before tax:

The calculation of income after tax:

g.

To calculate: The result after division of the after-tax return figure by total investment and further determine whether it should undertake the promotional campaign.

Introduction:

After-tax return:

After-tax return is the measure of a company’s performance. It is calculated by subtracting the tax from the revenue of the company. This after tax return is considered for distribution amongst the shareholders.

Answer to Problem 21P

The figure obtained after dividing income after taxes by the total investment is 7.28%.

No, the company should not undertake the promotional campaign.

Explanation of Solution

The calculation of percentage of income after taxes to total investment:

As the figure obtained is not more than 8 %, the company should not undertake the campaign.

Want to see more full solutions like this?

Chapter 7 Solutions

Foundations of Financial Management

- Halifax Shoes has 30% of its sales in cash and the remainder on credit. Of the credit sales, 65% is collected in the month of sale, 25% is collected the month after the sale, and 5% is collected the second month after the sale. How much cash will be collected in August if sales are estimated as $75,000 in June, $65,000 in July, and $90,000 in August?arrow_forwardBig Toy, Inc. annually sells 115,000 units of Big Blobs. Currently, inventory is financed through the use of commercial bank loans. Big Toy pays $11.80 per Big Blob. The cost of carrying this inventory is $3.40 per unit while the cost of placing an order involves expenses of $500 per order. Since Big Blobs are imported, delivery is generally 25 days but may be as long as 30 days. To manage inventory more efficiently, the management of Big Toy, Inc. has decided to use the EOQ model plus a safety stock to determine inventory levels. What is the economic order quantity? Round your answer to the nearest whole number. units Today is January 1 and the current level of inventory is 11,500 units; when should the first order be placed based on the economic order quantity? Assume 365 days in a year. Round your answer to the nearest whole number. The first order based on the EOQ model would be placed on the th day. Management always wants sufficient Big Blobs so that they never are out…arrow_forwardThe Milton Company currently purchases an average of $18,000 per day in raw materials on credit terms of "net 25." The company expects sales to increase substantially next year and anticipates that its raw material purchases will increase to an average of $22,000 per day. Milton feels that it may need to finance part of this sales expansion by stretching accounts payable. Round your answers to the nearest dollar. Assuming that Milton currently waits until the end of the credit period to pay its raw material suppliers, what is its current level of trade credit? $ If Milton stretches its accounts payable an extra 5 days beyond the due date next year, how much additional short-term funds (that is, trade credit) will be generated? $ solution is incorrectarrow_forward

- To increase sales, management is considering reducing its credit standards. This action is expected to increase sales by $120,000. Unfortunately, it is anticipated that 7 percent of the sales will be uncollectible. Accounts receivable turnover is expected to be seven times a year, and it costs the firm 11 percent to carry its receivables. Collection costs will be 4 percent of sales, and the cost of the additional goods sold is $62,000. Will earnings increase? Round your answer to the nearest dollar. Net in earnings is $ .arrow_forwardDinshaw Company is considering the purchase of a new machine. The invoice price of the machine is $58,027, freight charges are estimated to be $2,910, and installation costs are expected to be $7,320. The annual cost savings are expected to be $14,660 for 11 years. The firm requires a 21% rate of return. Ignore income taxes. What is the internal rate of return on this investment?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College