Enterprise Fund

Required

- a. For fiscal year 2020, prepare general journal entries for the Water Utility Fund using the following information.

- 1. The amount in the Accrued Utility Revenue account was reversed.

- 2. Billings to customers for water usage during fiscal year 2020 totaled $2,982,557; $193,866 of the total was billed to the General Fund.

- 3. Cash in the amount of $260,000 was received. The cash was for interest earned on investments and $82,000 in accrued interest.

- 4. Expenses accrued for the period were management and administration, $360,408; maintenance and distribution, $689,103; and treatment plant, $695,237.

- 5. Cash receipts for customer deposits totaled $2,427.

- 6. Cash collections on customer accounts totaled $2,943,401, of which $209,531 was from the General Fund.

- 7. Cash payments for the period were as follows: Accounts Payable, $1,462,596; interest (which includes the interest payable), $395,917; bond principal, $400,000; machinery and equipment, $583,425; and return of customer deposits, $912.

- 8. A state grant amounting to $475,000 was received to help pay for new water treatment equipment.

- 9. Accounts written off as uncollectible totaled $10,013.

- 10. The utility fund transferred $800,000 in excess operating income to the General Fund.

- 11.

Adjusting entries for the period were recorded as follows:depreciation on buildings was $240,053 and on machinery and equipment was $360,079; the allowance for uncollectible accounts was increased by $14,913; an accrual for unbilled customer receivables was made for $700,000; accrued interest income was $15,849; and accrued interest expense was $61,406. - 12. The Revenue Bond Payable account was adjusted by $400,000 to record the current portion of the bond.

- 13. Closing entries and necessary adjustments were made to the net position accounts.

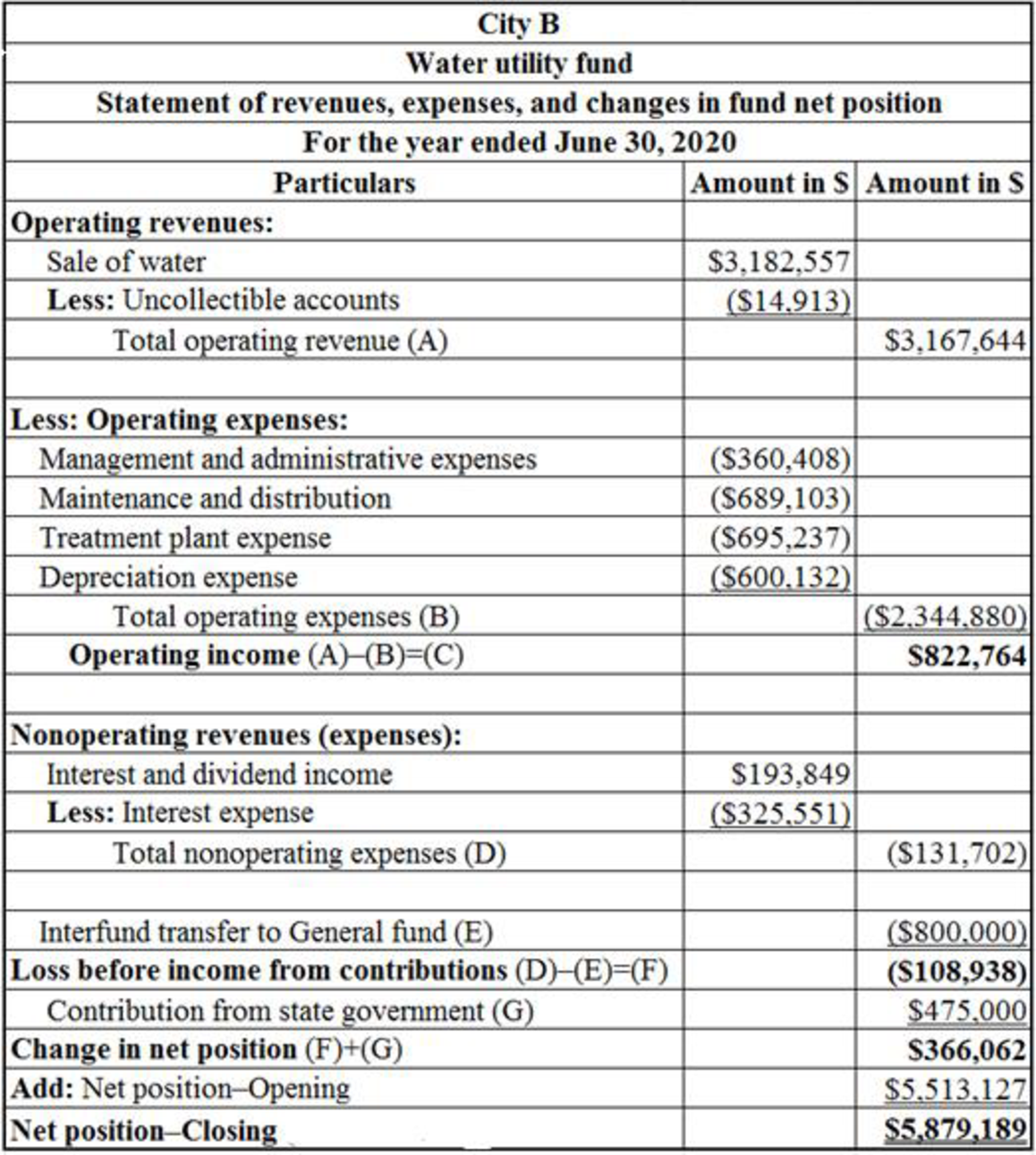

- b. Prepare a statement of revenues, expenses, and changes in fund net position for the Water Utility Fund for the year ended June 30, 2020.

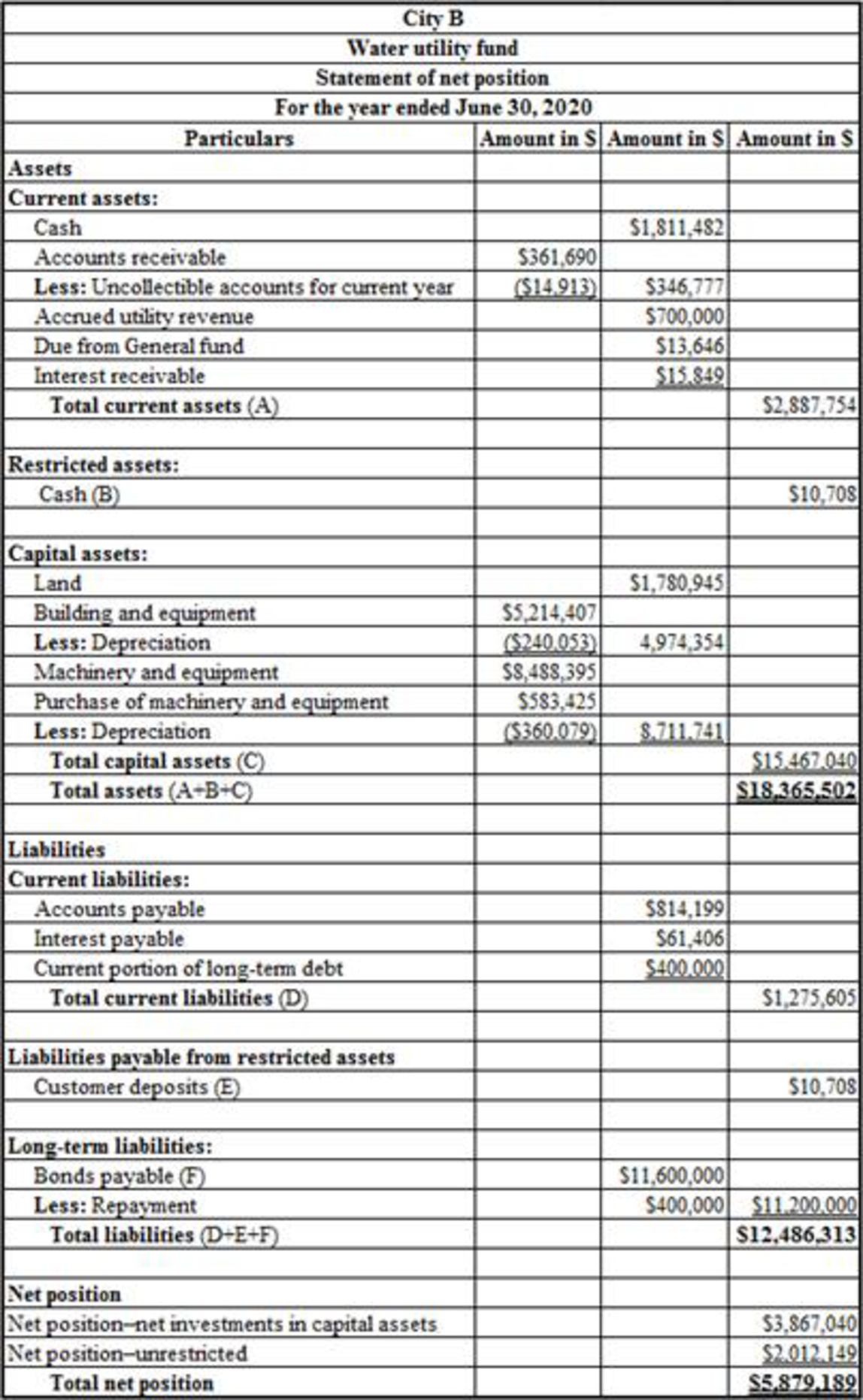

- c. Prepare a statement of net position for the Water Utility Fund as of June 30, 2020.

- d. Prepare a statement of cash flows for the Water Utility Fund as of June 30, 2020.

a.

Prepare journal entries to record the transactions of Water Utility Fund.

Explanation of Solution

Enterprise funds: The enterprise funds record the activities that provide goods or service to the public. The enterprise funds are treated similar to that of business organizations.

Journal: Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Prepare journal entry to reverse the “accrued utility revenue account”:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Sales of water | 500,000 | |||

| Accrued utility revenues | 500,000 | |||

| (To record the reverse of accrued utility revenue account) |

Table (1)

Prepare journal entry to record the accrual of revenue from the sale of water:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Accounts Receivable | 2,788,691 | |||

| Due from General fund | 193,866 | |||

| Sales of water | 2,982,557 | |||

| (To record the accrual of revenue from the sale of water) |

Table (2)

Prepare journal entry to record the interest income received and accrued:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Cash | 260,000 | |||

| Interest Income | 178,000 | |||

| Interest Receivable | 82,000 | |||

| (To record the interest income received and accrued) |

Table (3)

Prepare journal entry to record the accrual of expenses:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Management and administrative expense | 360,408 | |||

| Maintenance and Distribution | 689,103 | |||

| Treatment Plant Expense | 695,237 | |||

| Accounts Payable | 1,744,748 | |||

| (To record the accrual of expenses) |

Table (4)

Prepare journal entry to record the cash receipt for customer deposits:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Cash (restricted) | 2,427 | |||

| Customer deposits | 2,427 | |||

| (To record the cash receipts for customer deposits) |

Table (5)

Prepare journal entry to record the cash collected on customer account and general fund:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Cash | 2,943,401 | |||

| Accounts Receivable | 2,733,870 | |||

| Due from General Fund | 209,531 | |||

| (To record the cash collected on customer account and general fund) |

Table (6)

Prepare journal entry to record the payment of expenses and return of customer deposit:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Accounts Payable | 1,462,596 | |||

| Interest expense | 264,145 | |||

| Interest Payable | 131,772 | |||

| Current portion of long-term debt | 400,000 | |||

| Machinery and equipment | 583,425 | |||

| Customer deposits | 912 | |||

| Cash ($2,943,401-$209,531) | 2,841,938 | |||

| Cash (restricted) | 912 | |||

| (To record the payment of expenses and return of customer deposits) |

Table (7)

Prepare journal entry to record the receipt of state grant:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Cash | 475,000 | |||

| Contribution(capital grant) | 475,000 | |||

| (To record the receipt of grant from the state) |

Table (8)

Prepare journal entry to write off the uncollectible accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Allowance for uncollectible account | 10,013 | |||

| Accounts receivable | 10,013 | |||

| (To record the write off the uncollectible account) |

Table (9)

Prepare the journal entry to record the inter-fund fund transfer:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Interfund transfer- General fund | 800,000 | |||

| Cash | 800,000 | |||

| (To record the receipt of funds from general fund) |

Table (10)

Prepare journal entry to record the depreciation expense on building:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense - Building | 240,053 | |||

| Allowance for depreciation - Building | 240,053 | |||

| (To record the depreciation expense on building) |

Table (11)

Prepare journal entry to record the depreciation expense on machinery and equipment:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense – Machinery and equipment | 360,079 | |||

| Allowance for depreciation - Machinery and equipment | 360,079 | |||

| (To record the depreciation expense on machinery and equipment) |

Table (12)

Prepare journal entry to create provision for uncollectible accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Provision for uncollectible account | 14,913 | |||

| Allowance for uncollectible account | 14,913 | |||

| (To record the increase in uncollectible account) |

Table (13)

Prepare journal entry to record the accrual of utility revenues:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Accrued Utility Revenue | 700,000 | |||

| Sales of Water | 700,000 | |||

| (To record the increase in uncollectible account) |

Table (14)

Prepare journal entry to record the accrual of interest income:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Interest Receivable | 15,849 | |||

| Interest Income | 15,849 | |||

| (To record the accrual of interest income) |

Table (15)

Prepare journal entry to record the accrual of interest expense:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Interest Expense | 61,406 | |||

| Interest Payable | 61,406 | |||

| (To record the accrual of interest expense) |

Table (16)

Prepare journal entry to adjust the revenue bond payable and record the current portion of long-term debt:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Revenue bonds payable | 400,000 | |||

| Current portion of long-term debt | 400,000 | |||

| (To record the current portion of long-term debt) |

Table (17)

Prepare journal entry to close all the nominal accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Sales of water | 3,182,557 | |||

| Interest income | 193,849 | |||

| Contribution (capital grant) | 475,000 | |||

| Management and administrative expense | 360,408 | |||

| Maintenance and distribution | 689,103 | |||

| Treatment plant expense | 695,237 | |||

| Interfund transfer- general fund | 800,000 | |||

| Interest Expense | 325,551 | |||

| Depreciation expense-building | 240,053 | |||

| Depreciation expense- machinery and equipment | 360,079 | |||

| Uncollectible account | 14,913 | |||

| Net position-unrestricted (balancing figure) | 366,062 | |||

| (To record closing of nominal accounts) |

Table (18)

Prepare journal entry to allocate the increase in “net investment in capital assets” to the “unrestricted net position”:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Net position -Unrestricted | 383,293 | |||

| Net position-net investment in capital assets | 383,293 | |||

| (To record the increase in “net investment in capital assets” to the “unrestricted net position) |

Table (19)

Working note: Determine the amount of increase in the “net investments in capital assets”.

Step 1: Calculate the ending balance of “net investments in capital assets”.

Step 2: Calculate the amount of increase in the “net investments in capital assets”.

b.

Prepare a “statement of revenues, expenses, and changes in fund net position” for Central Station Fund.

Explanation of Solution

Statement of revenues, expenses and changes in net position: Statement of activities is the operating statement that reports revenues, expenses, and changes in net position during the year.

Prepare a “statement of revenues, expenses, and changes in fund net position” for Water utility fund.

Table (20)

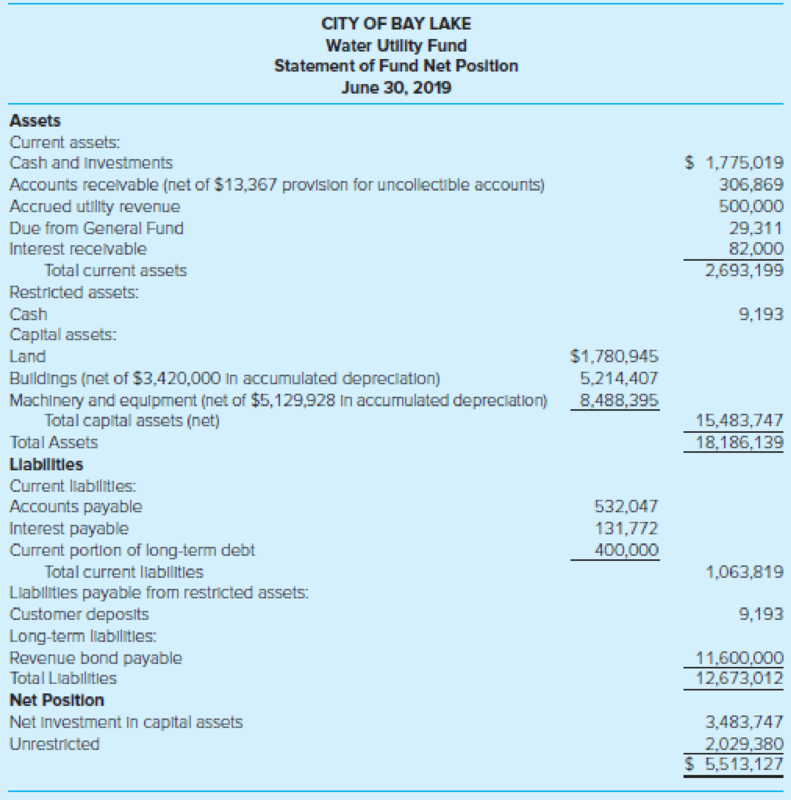

Working note: Determine the amount of net position-opening.

Before the fiscal year adjustment, the amount of unrestricted net position is $2,029,380 and the net position of “net investment is capital assets” calculated above is $3,483,747. Hence, the total net position-Opening is $5,513,127

(c)

Prepare a “statement of net position” for Water Utility Fund.

Explanation of Solution

Statement of net position: Statement of financial position is a balance sheet that reports the assets, deferred outflow of resources, liabilities, deferred inflow of resources and the residual amount or net position of the government at the end of the fiscal year.

Prepare a “statement of net position” for Water Utility Fund.

Table (21)

Working notes:

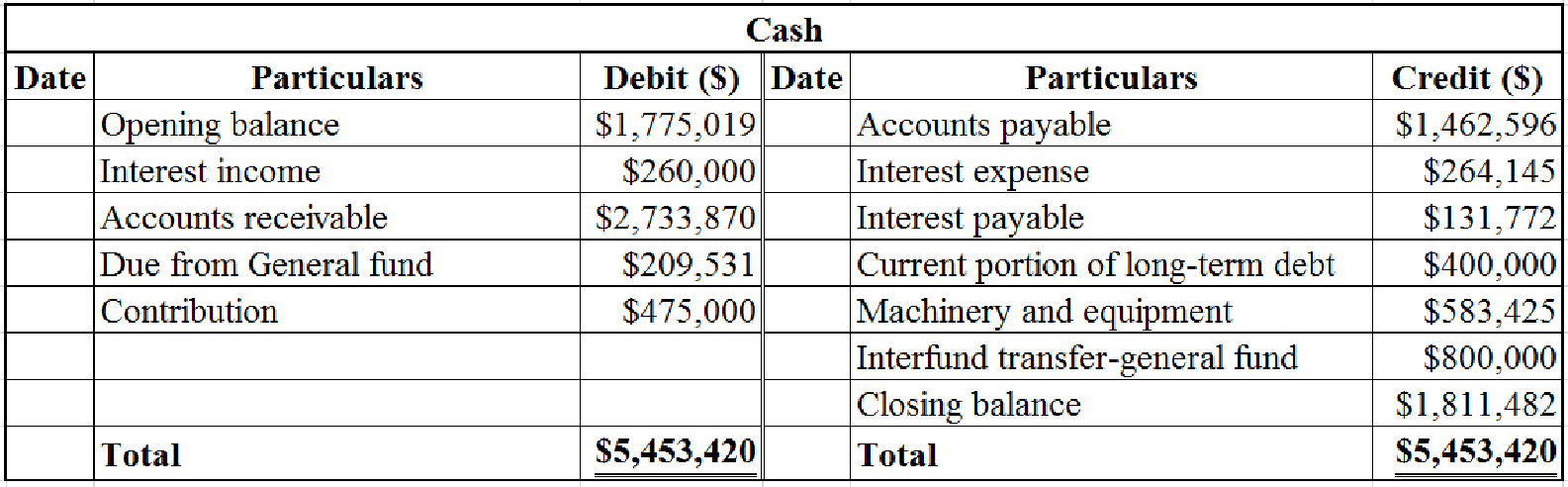

- Determine the closing balance of cash account.

Table (22)

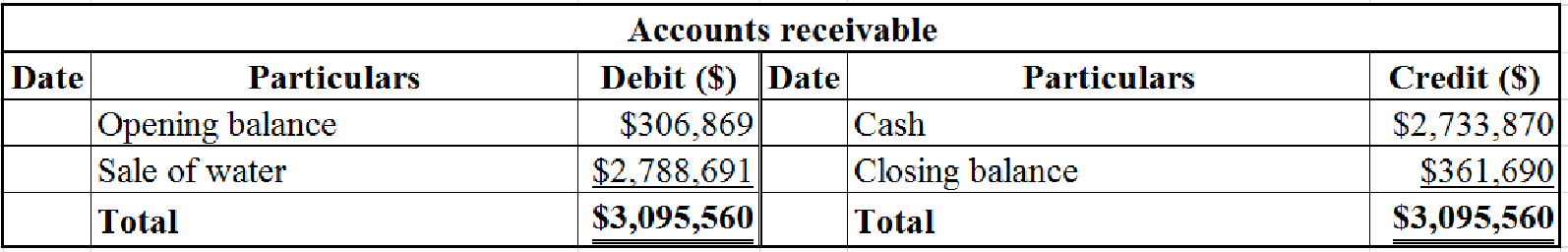

- Determine the closing balance of accounts receivable.

Table (23)

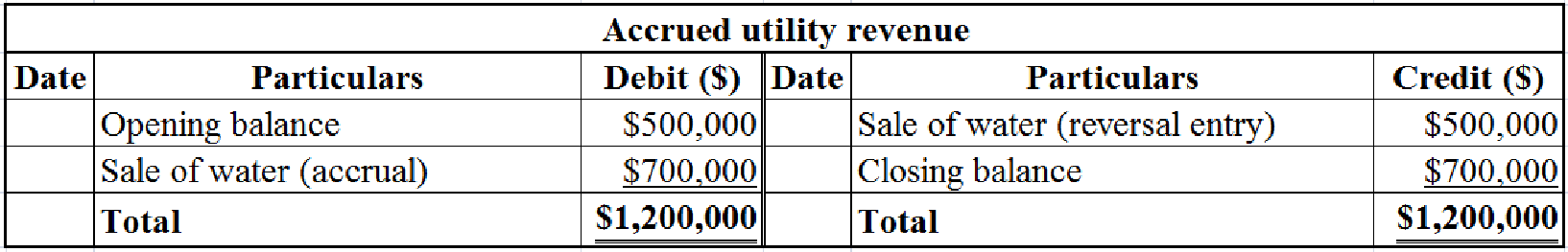

- Determine the closing balance of accrued utility revenue.

Table (24)

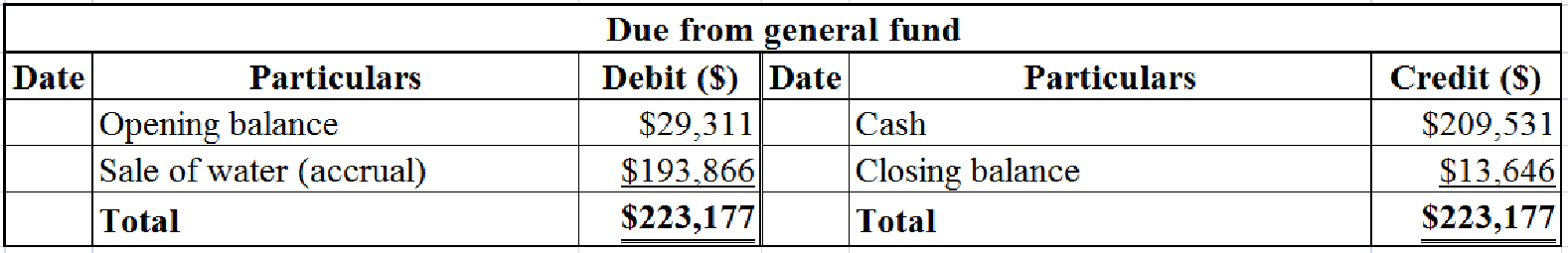

- Determine the closing balance of “due from general fund”.

Table (25)

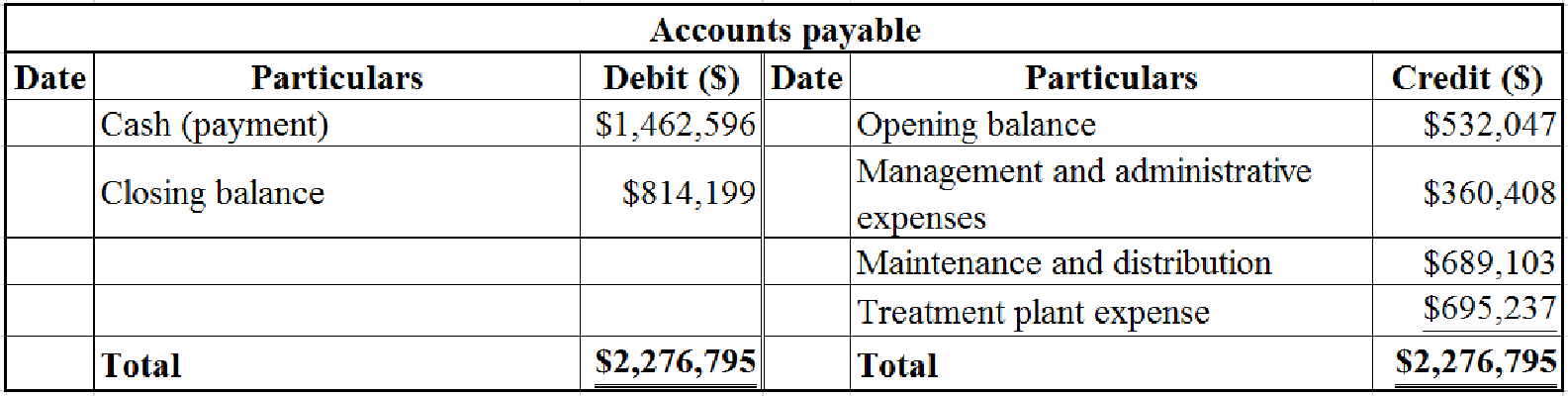

- Determine the closing balance of accounts payable.

Table (26)

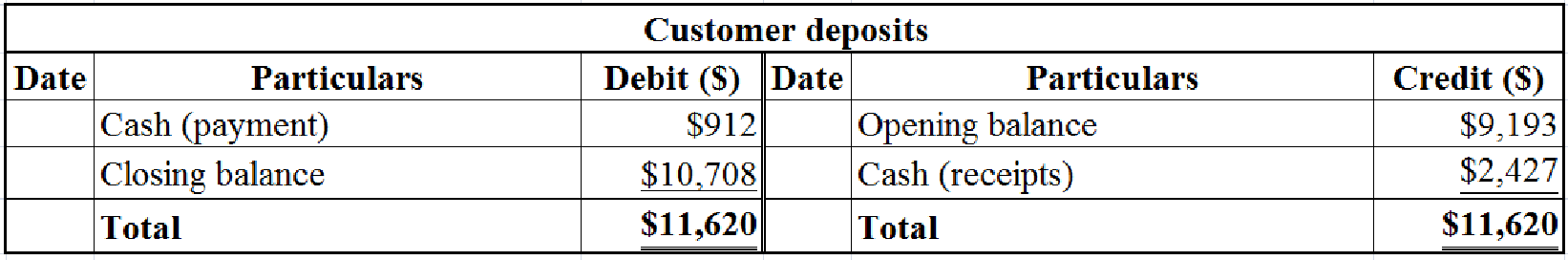

- Determine the closing balance of customer deposits.

Table (27)

- Determine the net position of unrestricted assets as on June 30, 2020.

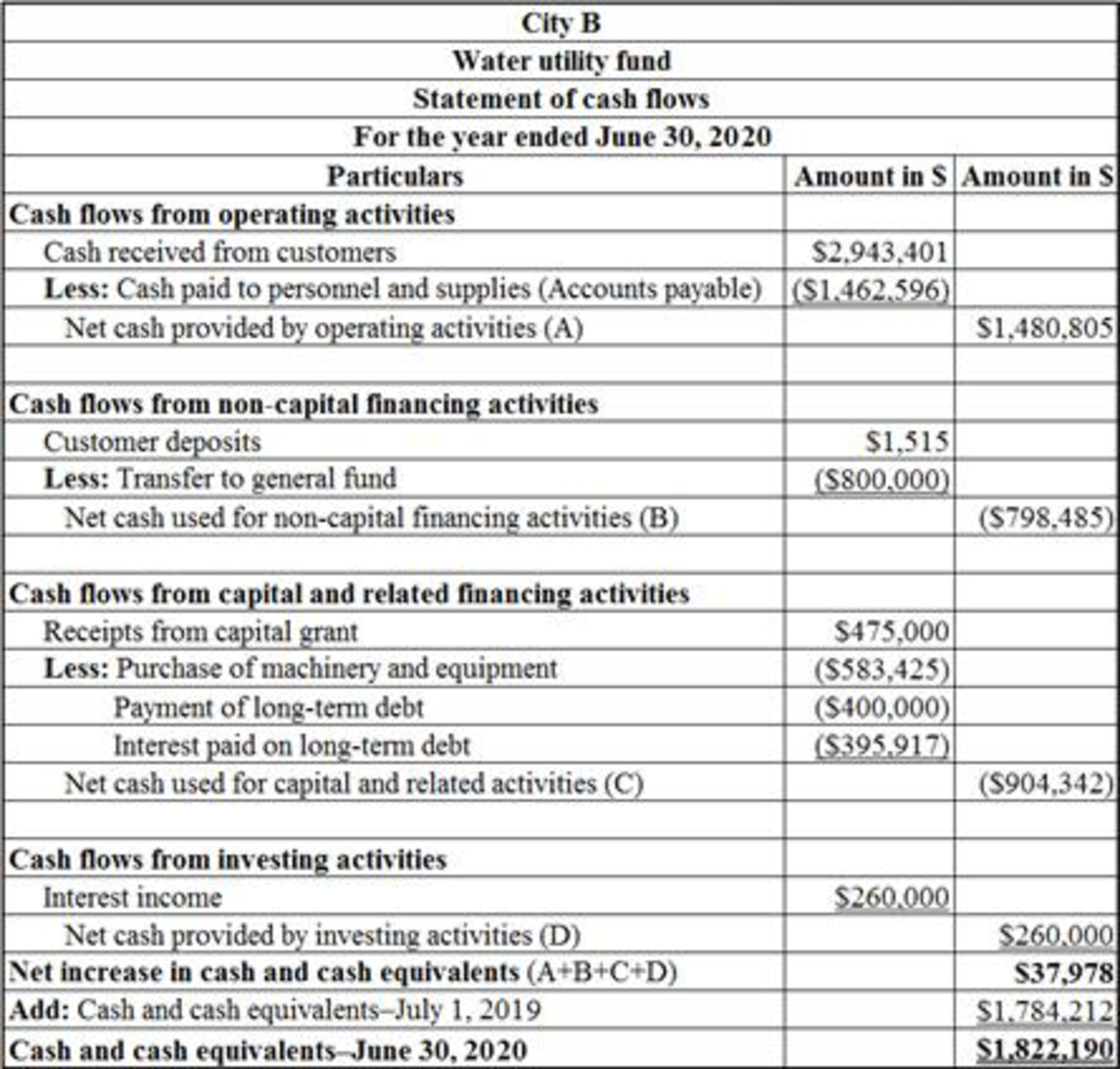

(d)

Prepare “a statement of cash flows” for water Utility Fund.

Explanation of Solution

Statement of cash flows: Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

Prepare “a statement of cash flows” for water Utility Fund.

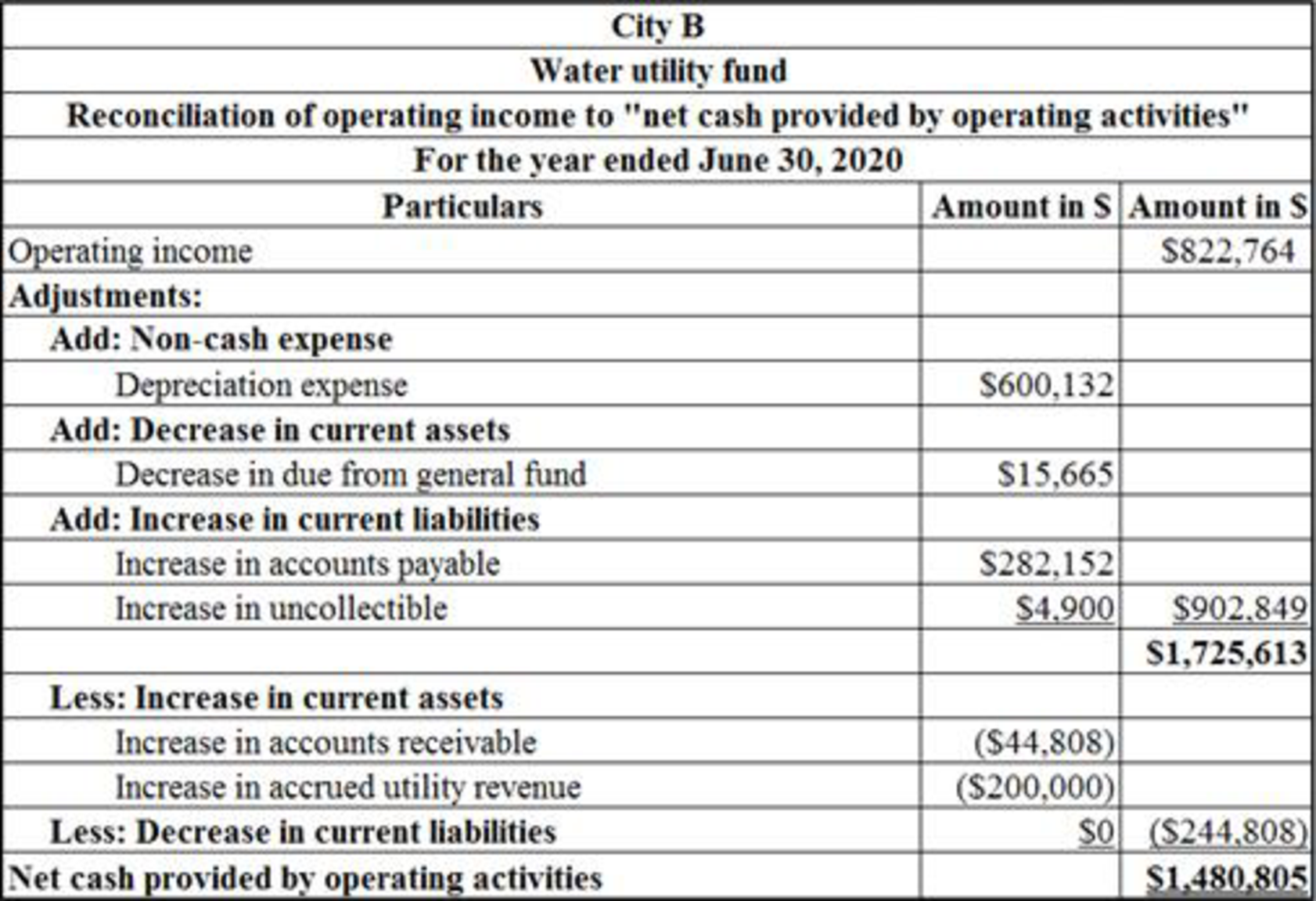

Step 1: Prepare the reconciliation statement to reconcile the operating loss with the “net cash used for operating activities”.

Table (28)

Working notes:

- Determine the increase in accounts payable.

The opening balance of accounts payable is $532,047 and the closing balance of accounts payable is $814,199. Hence, the accounts payable is increased by $282,152

- Determine the increase in “due from general fund”.

The opening balance of “due from general fund” is $29,311 and the closing balance of “due from general fund” is $13,646. Hence, the “due from general fund” is decreased by $15,665

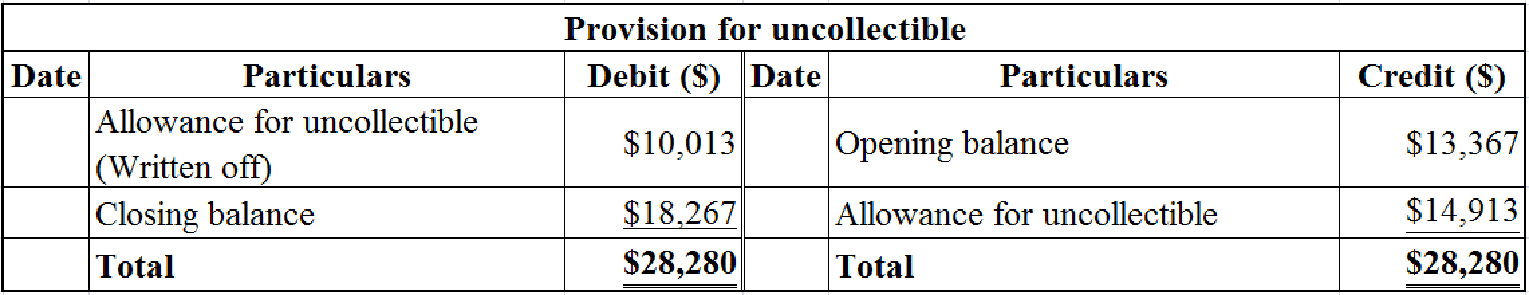

- Determine the balance in provision for uncollectible account.

Table (29)

- Determine the increase in uncollectible.

The opening balance of uncollectible is $13,367 and the closing balance of uncollectible is $18,267. Hence, the uncollectible is increased by $4,900

- Determine the increase in accounts receivable.

The opening balance of accounts receivable is $306,869. The closing balance of accounts receivable is $361,690. The written off portion of accounts receivable is $10,013. So, the net closing balance of accounts receivable is $351,677

- Determine the increase in accrued utility revenue.

The opening balance of accrued utility revenue is $500,000 and the closing balance of accrued utility revenue is $700,000. Hence, the accrued utility revenue is increased by $200,000

Step 2: Prepare “a statement of cash flows”.

Table (30)

Want to see more full solutions like this?

Chapter 7 Solutions

Accounting For Governmental & Nonprofit Entities

- E7-7 (Statement of Revenues, Expenditures, and Changes in Fund Balance) Prepare a statement of revenues, expenditures, and changes in fund balance for the Ahmed Village Park Improvement Capital Projects Fund for 20X7, given the following information: Fund balance, January 1, 20X7 .......................... $2,000,000 Intergovernmental grant revenue ........................ 850,000 Interest revenue ...................................... 30,000 Increase in fair value of investments ..................... 3,000 Construction costs incurred under contract with Builtwell Co. ................................... 2,400,000 Architect fees ........................................ 32,000 Engineering fees ...................................... 17,000 Bond proceeds (face amount was $1,000,000) ............. 1,008,000 Bond issuance costs ................................... 5,000 Purchase of land ...................................... 92,000 Repayment of bond anticipation notes treated as long-term…arrow_forwardThe following transactions relate to Al-Zafra MunicipalityGeneral Fund for the year ended December 31, 2020: (All figures are in 000 AED) The balance sheet as at 31/12/2019 was as follows: Assets: Liabilities & Fund Balances: Cash 200000 Accounts payable 70000 License receivable 150000 Wages payable 10000 Supplies 5000 Fund Balance: Reserved 275000 Total Assets 355000 Total Liabilities & FB. 355000 1. The budget was passed. Estimated revenues amounted to 1,450,000 and appropriations totaled 1,680,000, and estimated other uses $300,000. 2. Contracts were issued for contracted services in the amount of 20,000. 3. Collected 1,250,000 cash including last year license receivables and issued a bill of 100,000 for new license revenues. 4. Collected 200,000 for fines revenues. 5. Issued a contract of 300,000 to complete security and residency services in the West zone. 6. Contracted services of 200,000 were performed and supplies of 280,000 have been purchased on…arrow_forwardThe Balance Sheet of the Street and Highway Fund of the City of Monroe as of December 31, 2019, follow. CITY OF MONROE Street and Highway Fund Balance Sheet As of December 31, 2019 Assets Cash $ 19,000 Investments 63,000 Due from state government 107,000 Total assets $ 189,000 Liabilities and Fund Equity Liabilities: Accounts payable $ 10,000 Fund equity: Fund balance—assigned for streets and highways 179,000 Total liabilities and fund equity $ 189,000 3-C. This portion of the continuous problem continues the special revenue fund example by requiring the recording and posting of the budgetary entries. To reduce clerical effort required for the solution use control accounts for the budgetary accounts, revenues, expenditures and encumbrances. Subsidiary accounts are not required. Budget information for the City includes: (1) Also as of January 1, 2020, the City Council approved and the mayor signed a budget for the…arrow_forward

- Hi, I am in Advanced Acc. and I need to create a closing worksheet for a government fund. The following trial balance is taken form the General Fund of the City of Jennings for the year ending December 31, 2017. debit credit accounts payable $90,000 cash $30,000 contracts payable 90,000 unavailable revenues 40,000 due from capital projects fund 60,000 due to debt service funds 40,000 expenditures 530,000 fund…arrow_forwardPrepare the journal entries necessary for the following transactions. For each transaction you must identify the fund in which the entries are recorded. Make the entries only for the Fund-Based Financial Statements for the fiscal year ended 6/30/2021. 1. The board of commissioners of the Cosmo City adopted a General Fund budget for the year ending June 30, 2021, which indicated revenues of $5,100,000, bond proceeds of $620,000, appropriations of $1,900,000 for salaries, $800,000 for advertising, $400,000 for supplies, and $800,000 for utilities, and also operating transfers out of $980,000. 2. Cosmo City collected $22,000 from parking meters. 3. On March 12, 2021, Cosmo City ordered a new computer at an anticipated cost of $414,000. The computer was received on April 16 with an actual cost of $416,200. Payment was subsequently made on May 15, 2021. 4. Property taxes of 1,800,000 are levied for Cosmo City. The city expects that 5% will be uncollectible. Of the levied amount,…arrow_forwardThe Town of Weston has a Water Utility Fund with the following trial balance as of July 1, 2019, the first day of the fiscal year: During the year ended June 30, 2020, the following transactions and events occurred in the Town of Weston Water Utility Fund: Accrued expenses at July 1 were paid in cash. Billings to nongovernmental customers for water usage for the year amounted to $1,423,000; billings to the General Fund amounted to $118,000. Liabilities for the following were recorded during the year: Materials and supplies $ 202,000 Costs of sales and services 376,000 Administrative expenses 211,000 Construction work in progress 230,000 Materials and supplies were used in the amount of $294,000, all for costs of sales and services. After collection efforts were unsuccessful, $14,900 of old accounts receivable were written off. Accounts receivable collections totaled $1,518,000 from nongovernmental customers and $51,100 from the General Fund. $1,092,600 of accounts payable were paid…arrow_forward

- The City of Fox is evaluating which of its funds it will present as a major fund in its fund financial statements on December 31, Year 1. The city presents the following partial listing of asset data at December 31, Year 1: Total Governmental Fund Type Assets $ 3,000,000 Total Enterprise Fund Assets 2,000,000 General Fund Assets 280,000 Community Development Special Revenue Fund 290,000 Faberville River Bridge Capital Project Fund 100,000 Faberville Water & Sewer Utility Fund 1,800,000 Faberville Landfill 200,000 Based purely on assets, how many funds should be displayed as major funds? A.) Four B.) Five C.) TWO D.) Threearrow_forwardPrepare entries in general journal form to record the following transactions in the Roadway Fund general ledger accounts for City of Kettering for the fiscal year 2018. Use modified accrual accounting. At the beginning of the fiscal year, the fund $1,360,000 was offset by the assigned fund balance in the same amount. The city was awarded $4,200,000 for road inspections and repairs during the year. The award requires reimbursement for expenditures, not an allotment upfront. Work contracted for the year amounted to $4,175,000. Invoices received for the work performed totaled $4,150,000. $3,980,000 of that amount was paid in cash as of year-end. The state reimbursed the city $4,000,000 for the completed work before year-end. Prepare a statement of Revenues, Expenditures, and Changes in Fund Balance for the Roadway Fund.arrow_forwardThe preclosing trial balance of the general fund of Shorewood Village for fiscal year ended June 30, 2019, is as follows: Debit CreditCash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .90,000Receivables (net) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .120,000Vouchers Payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91,000Fund Balance—Assigned . . . . . . . . . . . . . . . . . . . . . 60,000Fund Balance—Unassigned . . . . . . . . . . . . . . . . . . 92,000Budgetary Fund Balance . . . . . . . . . . . . . . . . . . . . . 50,000Estimated Revenues . . . . . . . . . . . . . . . . . . . . . . . . . 600,000Estimated Other Financing Sources. . . . . . . . . . . 150,000Appropriations . . . . . . . . . . . . . . . . . . . . . . . . . . . . .…arrow_forward

- From the information given above, prepare a General Fund Statement of Revenues, Expenditures, and Changes in Fund Balances for the City of Eastern Shores General Fund for the year ended September 30, 2020. (Negative entries should be entered with a minus sign and will appear in parenthesis.)arrow_forwardIndicate (i) how each of the following transactions impacts the fund balance of the general fund, and its classifications, for fund financial statements and (ii) what impact each transaction has on the net position balance of the Government Activities on the government-wide financial statements.a. Issue a five-year bond for $6 million to finance general operations.b. Pay cash of $149,000 for a truck to be used by the police department.c. The fire department pays $17,000 to a government motor pool that services the vehicles of only the police and fire departments. Work was done on several department vehicles. d. Levy property taxes of $75,000 for the current year that will not be collected until four months into the subsequent year.e. Receive a grant for $7,000 that must be returned unless the money is spent according to the stipulations of the conveyance. That is expected to happen in the future.f. Businesses make sales of $20 million during the current year. The…arrow_forwardActivities of a county recreation center are reported in an enterprise fund. During 2019, $5,000,000 is spent on equipment and bonds are issued for $3,000,000. How are these two transactions reported on the enterprise fund’s operating statement? a. No effect b. Revenues, $3,000,000; expenditures, $5,000,000 c. Other financing sources, $3,000,000 d. Other financing sources, $3,000,000; expenditures, $5,000,000arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education